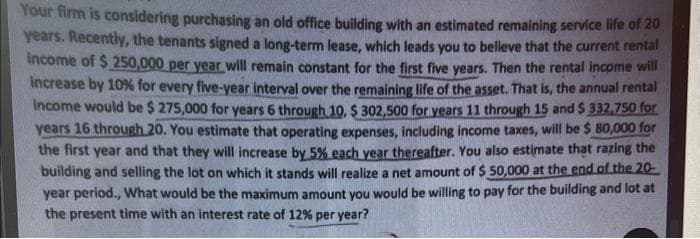

Your firm is considering purchasing an old office building with an estimated remaining service life of 20 years. Recently, the tenants signed a long-term lease, which leads you to believe that the current rental Income of $ 250,000 per year will remain constant for the first five years. Then the rental income will increase by 10% for every five-year interval over the remaining life of the asset. That is, the annual rental Income would be $ 275,000 for years 6 through 10, $ 302,500 for years 11 through 15 and $ 332,750 for years 16 through 20. You estimate that operating expenses, including income taxes, will be $ 80,000 for the first year and that they will increase by 5% each year thereafter. You also estimate that razing the building and selling the lot on which it stands will realize a net amount of $ 50,000 at the end of the 20- year period., What would be the maximum amount you would be willing to pay for the building and lot at the present time with an interest rate of 12% per year?

Your firm is considering purchasing an old office building with an estimated remaining service life of 20 years. Recently, the tenants signed a long-term lease, which leads you to believe that the current rental Income of $ 250,000 per year will remain constant for the first five years. Then the rental income will increase by 10% for every five-year interval over the remaining life of the asset. That is, the annual rental Income would be $ 275,000 for years 6 through 10, $ 302,500 for years 11 through 15 and $ 332,750 for years 16 through 20. You estimate that operating expenses, including income taxes, will be $ 80,000 for the first year and that they will increase by 5% each year thereafter. You also estimate that razing the building and selling the lot on which it stands will realize a net amount of $ 50,000 at the end of the 20- year period., What would be the maximum amount you would be willing to pay for the building and lot at the present time with an interest rate of 12% per year?

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter21: Costs And The Supply Of Goods

Section: Chapter Questions

Problem 17CQ

Related questions

Question

Transcribed Image Text:Your firm is considering purchasing an old office building with an estimated remaining service life of 20

years. Recently, the tenants signed a long-term lease, which leads you to believe that the current rental

Income of $ 250,000 per year will remain constant for the first five years. Then the rental income will

increase by 10% for every five-year interval over the remaining life of the asset. That is, the annual rental

Income would be $ 275,000 for years 6 through 10, $ 302,500 for years 11 through 15 and $ 332,750 for

years 16 through 20. You estimate that operating expenses, including income taxes, will be $ 80,000 for

the first year and that they will increase by 5% each year thereafter. You also estimate that razing the

building and selling the lot on which it stands will realize a net amount of $ 50,000 at the end of the 20-

year period., What would be the maximum amount you would be willing to pay for the building and lot at

the present time with an interest rate of 12% per year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning