Concept explainers

a.

Introduction:

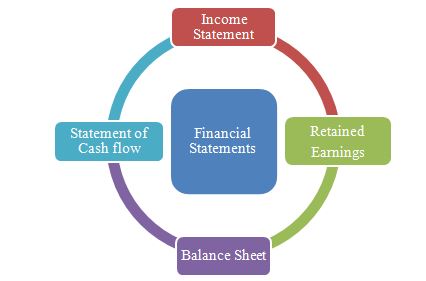

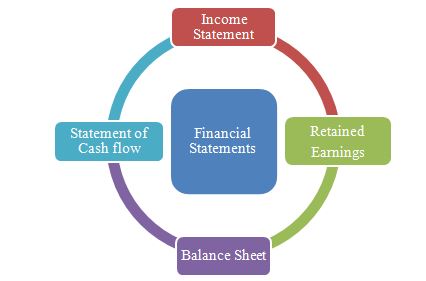

Financial statements are a complete record of the financial transactions that takes place in a company at a particular point of time. It provides important financial information like assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company. There are four basic financial statements as shown in the figure below:

Basic Financial Statements

Figure (1)

To Compute: Net income for the year ended December 31, 2017.

a.

Introduction:

Financial statements are a complete record of the financial transactions that takes place in a company at a particular point of time. It provides important financial information like assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company. There are four basic financial statements as shown in the figure below:

Basic Financial Statements

Figure (1)

Answer to Problem 1.10E

Determine net income for the year 2017.

Introduction:

Income statement is a financial statement that shows the net income earned or net loss suffered by a company through reporting all the revenues earned and expenses incurred by the company over a specific period of time.

Income statement is also known as operations statement, earnings statement, revenue statement, or

Prepare the income statement of the company for the year ended December 31st , 2017 as below.

|

O Park Income Statement For the year ended December 31 st, 2017. | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | 132,000 | |

| Service Revenue | 25,000 | 157,000 |

| Less: Expenses | 126,000 | |

| Net income | 31,000 | |

Table (1)

Explanation of Solution

Income statement is used to determine the net income / net loss of the company. It is calculated by finding out the difference between the net revenues and expenses. Net income for the year ended December 31 st, 2017 is $31,000.

Thus, the net income for the year ended December 31st, 2017 is $31,000.

b.

i.

Introduction:

Use the following formula to determine the retained earnings for the year ending December 31, 2017.

Prepare retained earnings statement for the year ending December 31, 2017.

b.

i.

Answer to Problem 1.10E

Prepare the retained earnings statement of O Park for the year ended December 31st, 2017 as below.

|

O Park Retained Earnings Statement For the year ended December 31 st, 2017. | |

| Particulars | Amount ($) |

| Retained earnings, January 1 | 5,000 |

| Add: Net income (From requirement a) | 31,000 |

| 36,000 | |

| Less: Dividends | 9,000 |

| Retained earnings, December 31 | 27,000 |

Table (2)

Explanation of Solution

Ending retained earnings is determined by adding the net income and deducting the dividends to beginning retained earnings. Thus, above table shows the determination of the retained earnings, December 31.

Thus, the ending retained earnings is $27,000.

ii.

Introduction:

Balance sheet is a financial statement that shows the available assets (owner’s equity and outsider’s equity) and owed liabilities from investing and financial activities of a company. This statement reveals the financial health of company. So, this statement is also called as

Use the formula to prepare balance sheet.

Prepare balance sheet for O Park as of December 31, 2017.

ii.

Answer to Problem 1.10E

Prepare the balance sheet for O Park as of December 31, 2017 as below.

|

O Park Balance Sheet December 31, 2017 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Cash | 8,500 | |

| Supplies | 5,500 | |

| Equipment | 114,000 | |

| Total assets | 128,000 | |

| Liabilities and Stockholders’ equity | ||

| Notes payable | 50,000 | |

| Accounts payable | 11,000 | |

| Total liabilities | 61,000 | |

| Stockholders’ equity | ||

| Common stock | 40,000 | |

| Retained earnings | 27,000 | 67,000 |

| Total liabilities and stockholders’ equity | 128,000 | |

Table (3)

Explanation of Solution

Balance sheet includes the items of assets, liabilities, and stockholders’ equity. The total assets of the company are the sum of cash, supplies, and equipment. The total liabilities are the sum of notes payable and accounts payable. The stockholders’ equity is the sum of common stock and retained earnings.

Thus, assets are equal to liabilities and stockholders’ equity.

c.

To Comment: On the company’s growth.

c.

Explanation of Solution

The income statement is prepared to determine the net income. The revenues from the G store are only 16% out of total revenues. In order to know whether the company is in more trouble than worth, it is necessary to know the expenses that are attributable to the G store.

In this income statement, expenses amount is shown in the single category instead of showing it separately for both the companies. Thus, when there is a breakdown of categories, it helps the company to generate profit or loss for the company.

Thus, there should be breakdown of the categories with respect to two companies.

Want to see more full solutions like this?

Chapter 1 Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

- Krespy Corp. has a cash balance of $7,500 before the following transactions occur: A. received customer payments of $965 B. supplies purchased on account $435 C. services worth $850 performed, 25% is paid in cash the rest will be billed D. corporation pays $275 for an ad in the newspaper E. bill is received for electricity used $235. F. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?arrow_forwardQuality Service Inc. has the following accounts balances in their charts of accounts balances as at June 1, 2020: Cash $138,000; Accounts receivable $0; Land $ 30,000; Building $0; Supplies $0; Accounts payable $0; Notes payable $0; Quality-capital $70,000; Service revenue $98,000; Utilities, salary expense $0. The company also presented the following transactions for the month: June 1. Purchased supplies for $1000 on account June 4. Purchased a building for, $62,100 cash June 6. Performed service for a client on account, $12,000 June 10. Borrowed $7,000 cash, signing a note payable June 13. Paid the liability from June 1 June 17. Sold for $15,000 land that had cost this same amount June 21. Received $8000 cash from June 10 transaction June 30. Paid utilities expense of $600 and salary expense $2,500 Requirements: State the effect each transaction from June 1st -30th will have on the…arrow_forwardQuality Service Inc.has the following accounts balances in their charts of accounts balances as at June 1, 2020: Cash $138,000; Accounts receivable $0; Land $ 30,000; Building $0;Supplies $0; Accounts payable $0; Notes payable $0; Quality-capital $70,000; Service revenue $98,000; Utilities, salary expense $0. The company also presented the following transactions for the month: June 1. Purchased supplies for $1000 on account June 4. Purchased a building for, $62,100 cash June 6. Performed service for a client on account, $12,000 June 10. Borrowed $7,000 cash, signing a note payable June 13. Paid the liability from June 1 June 17. Sold for $15,000 landthat had cost this same amount June 21. Received $8000 cash from June 6 transaction June 30. Paid utilities expense of $600 and salary expense $2,500 Requirements: State the effect each transaction from June 1st -30th will have on the accounting…arrow_forward

- Quality Service Inc. has the following accounts balances in their charts of accounts balances as at June 1, 2020: Cash $138,000; Accounts receivable $0; Land $ 30,000; Building $0; Supplies $0; Accounts payable $0; Notes payable $0; Quality-capital $70,000; Service revenue $98,000; Utilities, salary expense $0. The company also presented the following transactions for the month: June 1. Purchased supplies for $1000 on account June 4. Purchased a building for, $62,100 cash June 6. Performed service for a client on account, $12,000 June 10. Borrowed $7,000 cash, signing a note payable June 13. Paid the liability from June 1 June 17. Sold for $15,000 land that had cost this same amount June 21. Received $8000 cash from June 10 transaction June 30. Paid utilities expense of $600 and salary expense $2,500 Requirements: State the effect each transaction from June 1st -30th will have on the…arrow_forwardThe accountant of Mamba Sports Club has extracted the following information from the books of account for the year ended 31 March 2016: Receipts Payments Sh. Sh. Balance brought forward 288,000 Salaries and wages 254,000 Subscriptions: New equipment 565,000 Year 2014 - 2015 249,000 Repairs & maintenance 124,000 2015 - 2016 2,050,000 Office expenses 415,000 2016- 2017 194,000 Printing and stationery 168,000 Dinner dance 723,000 Purchase of Beverages 197,000 Beverage sales 657,000 Dinner dance expenses 315,000 Investments income 400,000 Refund of subscriptions…arrow_forwardOn January 1, 2021, Red Flash Photography had the following balances: Cash, $25,000; Supplies, $9,300; Land, $73,000; Deferred Revenue, $6,300; Common Stock $63,000; and Retained Earnings, $38,000. During 2021, the company had the following transactions: 1. February 15 Issue additional shares of common stock, $33,000. 2. May 20 Provide services to customers for cash, $48,000, and on account, $43,000. 3. August 31 Pay salaries to employees for work in 2021, $36,000. 4. October 1 Purchase rental space for one year, $25,000. 5. November 17 Purchase supplies on account, $35,000. 6. December 30 Pay dividends, $3,300. The following information is available on December 31, 2021: Employees are owed an additional $5,300 in salaries. Three months of the rental space has expired. Supplies of $6,300 remain on hand. All of the services associated with the beginning deferred revenue have been performed. part 1.please do the journal entry…arrow_forward

- Please see below. I have included pictures to show which parts I got wrong on this specific problem. During 2017, its first year of operations as a delivery service, Bramble Corp. entered into the following transactions. 1. Issued shares of common stock to investors in exchange for $145,000 in cash. 2. Borrowed $48,000 by issuing bonds. 3. Purchased delivery trucks for $54,000 cash. 4. Received $16,000 from customers for services performed. 5. Purchased supplies for $4,300 on account. 6. Paid rent of $4,800. 7. Performed services on account for $11,600. 8. Paid salaries of $27,200. 9. Paid a dividend of $10,000 to shareholders. Using the following tabular analysis, show the effect of each transaction on the accounting equation. Put explanations for changes to Stockholders’ Equity in the far right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the…arrow_forwardDuring 2017, its first year of operations as a delivery service, Bramble Corp. entered into the following transactions. 1. Issued shares of common stock to investors in exchange for $119,000 in cash. 2. Borrowed $38,000 by issuing bonds. 3. Purchased delivery trucks for $64,000 cash. 4. Received $15,000 from customers for services performed. 5. Purchased supplies for $6,000 on account. 6. Paid rent of $4,300. 7. Performed services on account for $11,300. 8. Paid salaries of $26,700. 9. Paid a dividend of $10,800 to shareholders. Using the following tabular analysis, show the effect of each transaction on the accounting equation. Put explanations for changes to Stockholders’ Equity in the far right column.arrow_forwardThe accountant for Polo's Pet Shop prepared the following list of account balances from the entity's records for the financial year ended June 30, 2021: Sales Revenue $196,000 Cash $25,000 Accounts Receivable 14,500 Cost of Goods Sold 45,000 Equipment 56,000 Polo, Capital-1 July 2020 22,000 Accounts Payable 17,000 Notes Payable 15,000 General & Admin Expense 32,000 Inventory 1,500 Selling Expense 6,000 Accumulated Depreciation 12,000 Mortgage Payable 5,000 Land 66,000 Interest Expense 21,000 What will be Polo's capital at the end of financial year 30 June 2021 if there was no withdrawal from Polo, but he contributed $10,000 more capital to the business? a. $135,000 b. $124,000 c. $132,000 d. $110,000 e. None on these answers are correctarrow_forward

- The accountant for Polo's Pet Shop prepared the following list of account balances from the entity's records for the financial year ended June 30, 2021: Sales Revenue $196,000 Cash $25,000 Accounts Receivable 14,500 Cost of Goods Sold 45,000 Equipment 56,000 Polo, Capital-1 July 2020 22,000 Accounts Payable 17,000 Notes Payable 15,000 General & Admin Expense 32,000 Inventory 1,500 Selling Expense 6,000 Accumulated Depreciation 12,000 Mortgage Payable 5,000 Land 66,000 Interest Expense 21,000 1. What is the amount of Gross profit presented in the income statement? 2. What is the amount of operating income (EBIT) in the income statement? 3. What is the amount of net profit for the financial year 2021? 4. What will be Polo's capital at the end of financial year 30 June 2021 if there was no withdrawal from Polo, but he contributed $10,000 more capital to the…arrow_forwardTraf Enterprises incorporated on May 3, 2011. The company engaged in the following transactionsduring its first month of operations:May 3 Issued capital stock in exchange for $800,000 cash.May 4 Paid May office rent expense of $1,000.May 5 Purchased office supplies for $400 cash.May 15 Purchased office equipment for $8,000 on account.May 18 Purchased a company car for $27,000. Paid $7,000 cash and issued a note payable forthe remaining amount owed.May 20 Billed clients $32,000 on account.May 26 Declared a $5,000 dividend; distributed to shareholders on June 26.May 29 Paid May utilities of $200.May 30 Received $30,000 from clients billed on May 20.May 31 Recorded and paid salary expense of $14,000.Apply concept of financial accounting :a. Prepare journal entries, including explanations, for the above transactions.b. Post each entry to the appropriate ledger accounts (T accounts).c. Prepare a trial balance dated May 31, 2011.arrow_forwardOn May 1, Nimbus Flying School, a company that provides flying lessons, was started with an investment of $45,000 cash in the business. Following are the assets and liabilities of the company on May 31, 2017, and the revenues and expenses for the month of May. Cash $ 4,650 Notes Payable $28,000 Accounts Receivable 7,400 Rent Expense 900 Equipment 64,000 Maintenance and Repairs Expense 350 Service Revenue 6,800 Gasoline Expense 2,500 Advertising Expense 500 Utilities Expense 400 Accounts Payable 1,400 No additional investments were made in May, but the company paid dividends of $500 during the month. 1.- Prepare a balance sheet at May 31. (List Assets in order of liquidity.) 2.- Prepare an income statement for May assuming the following data are not included above: (1) $900 worth of services were performed and billed but not collected at May 31, and (2) $1,500 of gasoline expense was incurred but not paid.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College