Concept explainers

a.

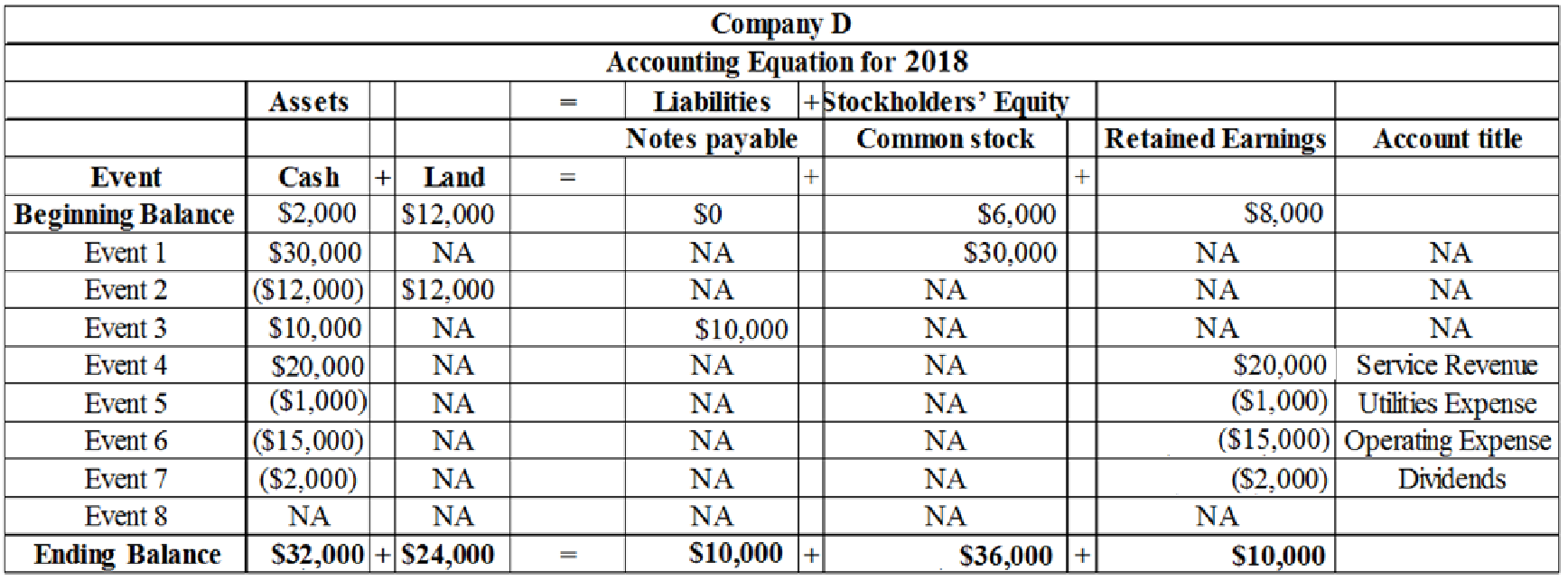

Record the eight events in the

a.

Explanation of Solution

The eight events are recorded using

Table (1)

b.

Prepare an income statement, statement of changes in equity, year-end balance sheet, and statement of cash flows for the 2018.

b.

Explanation of Solution

Income statement: Income statement is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Income statement for the Year 2018 is prepared as follows:

| Company D | |

| Income Statement | |

| For the Year Ended December 31, 2018 | |

| Particulars | Amount ($) |

| Service Revenue | $20,000 |

| Utilities Expense | (1,000) |

| Operating Expense | ($15,000) |

| Net Income | 4,000 |

Table (2)

Statement of changes in stockholders' equity: Statement of changes in stockholders' equity records the changes in the

Statement of changes in equity for the Year 2018 is prepared is as follows:

| Company D | ||

| Statement of Changes in Stockholders’ Equity | ||

| For the Year Ended December 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Beginning Common Stock | 6,000 | |

| Add: Common Stock Issued | 30,000 | |

| Ending Common Stock | 36,000 | |

| Beginning | 8,000 | |

| Add: Net Income | 4,000 | |

| Less: Dividends | (2,000) | |

| Ending Retained Earnings | 10,000 | |

| Total Stockholders’ Equity | $46,000 | |

Table (3)

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Balance sheet for the Year 2018 is prepared as follows:

| Company D | ||

| Balance Sheet | ||

| As of December 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets: | ||

| Cash | 32,000 | |

| Land | 24,000 | |

| Total Assets | $56,000 | |

| Liabilities: | ||

| Notes Payable | 10,000 | |

| Total Liabilities | 10,000 | |

| Stockholders’ Equity: | ||

| Common Stock | 36,000 | |

| Retained Earnings | 10,000 | |

| Total Stockholders’ Equity | 46,000 | |

| Total Liabilities and Stockholders’ Equity | $56,000 | |

Table (4)

Statement of cash flows: Statement of cash flows is one among the financial statement of a Company statement that shows aggregate data of all

Statement of cash flows for the Year 2018 is prepared as follows:

| Company D | ||

| Statement of Cash Flows | ||

| For the Year Ended December 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash Flows From Operating Activities: | ||

| Cash Receipts from Customers | 20,000 | |

| Cash Payment for Utilities Expense | (1,000) | |

| Cash Payments for Other Operating Expense | (15,000) | |

| Net Cash Flow from Operating Activities | 4,000 | |

| Cash Flows From Investing Activities: | ||

| Cash Paid to Purchase Land | (12,000) | |

| Net Cash Flow from Investing Activities | (12,000) | |

| Cash Flows From Financing Activities: | ||

| Cash Receipts from Stock Issue | 30,000 | |

| Cash Receipts from Loan | 10,000 | |

| Cash Payments for Dividends | (2,000) | |

| Net Cash Flow from Financing Activities | 38,000 | |

| Net Increase in Cash | 30,000 | |

| Add: Beginning Cash Balance | 2,000 | |

| Ending Cash Balance | $32,000 | |

Table (5)

c.

Ascertain the percentage of assets provided by the retained earnings and find out the amount of cash in the retained earnings account.

c.

Explanation of Solution

Retained earnings: Retained earnings are the portion of earnings kept by the business for the purpose of reinvestments, payment of debts, or for future growth.

Calculate the percentage of assets provided by retained earnings:

Retained earnings are used to purchase assets or to pay liabilities and therefore, the amount of cash in the retained earnings accounts cannot be determined.

Therefore, the percentage of assets provided by retained earnings is 17.9%.

Want to see more full solutions like this?

Chapter 1 Solutions

SURVEY OF ACCOUNTING 360DAY CONNECT CAR

- Analyzing Transactions. Using the analytical framework, indicate the effect of the following related transactions of a firm. a. January 1: Issued 10,000 shares of common stock for 50,000. b. January 1: Acquired a building costing 35,000, paying 5,000 in cash and borrowing the remainder from a bank. c. During the year: Acquired inventory costing 40,000 on account from various suppliers. d. During the year: Sold inventory costing 30,000 for 65,000 on account. e. During the year: Paid employees 15,000 as compensation for services rendered during the year. f. During the year: Collected 45,000 from customers related to sales on account. g. During the year: Paid merchandise suppliers 28,000 related to purchases on account. h. December 31: Recognized depreciation on the building of 7,000 for financial reporting. Depreciation expense for income tax purposes was 10,000. i. December 31: Recognized compensation for services rendered during the last week in December but not paid by year-end of 4,000. j. December 31: Recognized and paid interest on the bank loan in Part b of 2,400 for the year. k. Recognized income taxes on the net effect of the preceding transactions at an income tax rate of 40%. Assume that the firm pays cash immediately for any taxes currently due to the government.arrow_forwardAssume that as of January 1, 20Y8, Sylvester Con- suiting has total assets of $500,000 and total assets of $150,000. As of December 31, 20Y8, Sylvester has total liabilities of $200,000 and total stockholders’ equity of $400,000. (a) What was Sylvester’s stockholders’ equity as of January 1, 20Y8? (b) Assume that Sylvester did not pay any dividends during 20Y8. What was the amount of net income for 20Y8?arrow_forwardProvide journal entries to record each of the following transactions. For each, identify whether the transaction represents a source of cash (S), a use of cash (U), or neither (N). A. Paid $22,000 cash on bonds payable. B. Collected $12,600 cash for a note receivable. C. Declared a dividend to shareholders for $16,000, to be paid in the future. D. Paid $26,500 to suppliers for purchases on account. E. Purchased treasury stock for $18,000 cash.arrow_forward

- Provide journal entries to record each of the following transactions. For each, also identify *the appropriate section of the statement of cash flows, and s utility bill, $1,500arrow_forwardVisual Inspection Noble Companys accounting records provided the following changes in account balances and other information for 2019: Additional information: Net income was 9,900. Dividends were declared and paid. Land was sold for 1,700. No land was purchased. A building was purchased for 23,000. No buildings and equipment were sold. Bonds payable were issued at the end of the year. Two hundred shares of stock were issued for 15 per share. The beginning cash balance was 4,800. Required: Using visual inspection, prepare a 2019 statement of cash flows for Noble.arrow_forwardIn which section of the statement of cash flows would each of the following transactions be included? For each, identify the appropriate section of the statement of cash flows as operating (O), investing (I), financing (F), or none (N). (Note: some transactions might involve two sections.) A. borrowed from the bank for business loan B. declared dividends, to be paid next year C. purchased treasury stock D. purchased a two-year insurance policy E. purchased plant assetsarrow_forward

- Discuss how each of the following transactions for Watson, International, will affect assets, liabilities, and stockholders equity, and prove the companys accounts will still be in balance. A. An investor invests an additional $25,000 into a company receiving stock in exchange. B. Services are performed for customers for a total of $4,500. Sixty percent was paid in cash, and the remaining customers asked to be billed. C. An electric bill was received for $35. Payment is due in thirty days. D. Part-time workers earned $750 and were paid. E. The electric bill in C is paid.arrow_forwardComprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)arrow_forwardComprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College