Concept explainers

Variable and Fixed Costs; Subtleties of Direct and Indirect Costs

Madison Seniors Care Centreis a non-profit organization that provides a variety of health services to the elderly. The centre is organized into a

number of departments, one of which is the Meals-On-Vhee1s program that delivers hot meals to seniors in their homes on a daily basis.

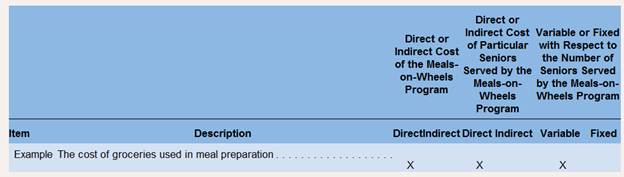

Below are listed a number of costs of the centre and the Meals-On-Wheels program.

Examplethe cost of groceries used in meal preparation.

a. The cost of leasing the Meals-On-Wheels van.

b. The cost of incidental supplies such as salt, pepper, napkins, and so on.

c. The cost of gasoline consumed by the Meals-On-Wheels van.

d. The rent on the facility that houses Madison Seniors Care Centre, including the Meals-On-Wheels program.

e. The salary of the part-time manager of the Meals-On-Wheels program.

f.

g. The hourly wages of the caregiver who drives the van and delivers the meals.

h. The costs of complying with health safety regulations in the kitchen.

i. The costs of mailing letters soliciting donations to the Meals-On-Wheels program.

Required:

For each cost listed above, indicate whether it is a direct or indirect cost of the Meals-On-Wheels program, whether it is a direct or indirect cost of particular seniors served by the program, and whether it is variable or fixed with respect to the number of seniors served. Use the form below for your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Introduction To Managerial Accounting

- The Two Cost Systems Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service linesthe Emergency Room (ER) and the Operating Room (OR). SHHs current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal 300,000. The table below shows expected patient volume for both lines. After discussion with several experienced nurses, Jack Bauer (SHHs accountant) decided that assigning nursing costs to the two service lines based on the number of times that nurses must check patients vital signs might more closely match the underlying use of costly hospital resources. Therefore, for comparative purposes, Jack decided to develop a second cost system that assigns total nursing costs to the ER and OR based on the number of times nurses check patients vital signs. This system is referred to as the vital-signs costing system. The earlier table also shows data for vital signs checks for lines. Calculate the amount of nursing costs that the vital-signs costing system assigns to the ER and to the OR.arrow_forwardThe Two Cost Systems Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service linesthe Emergency Room (ER) and the Operating Room (OR). SHHs current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal 300,000. The table below shows expected patient volume for both lines. Calculate the amount of nursing costs that the current cost system assigns to the ER and to the OR.arrow_forwardSacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service linesthe Emergency Room (ER) and the Operating Room (OR). SHHs current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal 300,000. The table below shows expected patient volume for both lines. After discussion with several experienced nurses, Jack Bauer (SHHs accountant) decided that assigning nursing costs to the two service lines based on the number of times that nurses must check patients vital signs might more closely match the underlying use of costly hospital resources. Therefore, for comparative purposes, Jack decided to develop a second cost system that assigns total nursing costs to the ER and OR based on the number of times nurses check patients vital signs. This system is referred to as the vital-signs costing system. The earlier table also shows data for vital signs checks for lines. In an effort to better plan for and control OR costs, SHH management asked Jack to calculate the flexible budget variance (i.e., flexible budget costs - actual costs) for OR nursing costs, including the price variance and efficiency variance. Given that Jack is interested in comparing the reported costs of both systems, he decided to prepare the requested OR variance analysis for both the current cost system and the vital-signs costing system. In addition, Jack chose to use each cost systems estimate of the cost per OR nursing hour as the standard cost per OR nursing hour. Jack collected the following additional information for use in preparing the flexible budget variance for both systems: Actual number of surgeries performed = 950 Standard number of nursing hours allowed for each OR surgery = 5 Actual number of OR nursing hours used = 5,000 Actual OR nursing costs = 190,000 What does each of the calculated variances suggest to Jack regarding actions that he should or should not take with respect to investigating and improving each variance? Also, briefly explain why the variances differ between the two cost systems.arrow_forward

- ABC, Resource Drivers, Service Industry Glencoe Medical Clinic operates a cardiology care unit and a maternity care unit. Colby Hepworth, the clinic’s administrator, is investigating the charges assigned to cardiology patients. Currently, all cardiology patients are charged the same rate per patient day for daily care services. Daily care services are broadly defined as occupancy, feeding, and nursing care. A recent study, however, revealed several interesting outcomes. First, the demands patients place on daily care services vary with the severity of the case being treated. Second, the occupancy activity is a combination of two activities: lodging and use of monitoring equipment. Since some patients require more monitoring than others, these activities should be separated. Third, the daily rate should reflect the difference in demands resulting from differences in patient type. Separating the occupancy activity into two separate activities also required the determination of the cost…arrow_forwardAn assisted-living facility provides services in the form of residential space, meals, and other occupant assistance (OOA) to its occupants. The facility currently uses a traditional cost accounting system that charges each occupant a daily rate equal to the facility’s annual cost of providing residential space, meals, and OOA divided by total occupant days. However, an activity-based costing (ABC) analysis has revealed that occupants’ use of OOA varies substantially. This analysis determined that occupants could be grouped into three categories (low, moderate, and high usage of OOA) and that the activity driver of OOA should be nursing hours. The driver of the residential space and meals is occupant days. The following quantitative information was also provided: OccupantCategory AnnualOccupantDays AnnualNursingHours Low usage 36,000 90,000 Medium usage 18,000 90,000 High usage 6,000 120,000…arrow_forwardObjectives of Cost Allocation Dr. Fred Poston,"Dermatologist to the Stars," has a practice in southern California. The practice includes three dermatologists, three medical assistants, an office manager, and a receptionist. The office space, which is rented for $5,000 per month, is large enough to accommodate four dermatologists, but Dr. Poston has not yet found the right physician to fill the fourth spot. Dr. Poston developed a skin cleanser for his patients that is nongreasy and does not irritate skin that is still recovering from the effects of chemical peels and dermabrasion. The cleanser requires $0.50 worth of ingredients per eight-ounce bottle. A medical assistant mixes up several bottles at a time during lulls in her schedule. She waits until she has about 15 minutes free and then mixes 10 bottles of cleanser. She is paid $2,250 per month. Dr. Poston charges $5.00 per bottle and sells approximately 5,000 bottles annually. His accountant is considering various ways of costing…arrow_forward

- Comprehensive Care Nursing Home is required by statute and regulation to maintain a minimum 3 to 1 ratio of direct service staff to residents to maintain the licensure associated with the Nursing Home beds. The salary expense associated with direct service staff for the Comprehensive Care Nursing Home would most likely be classified as: Variable cost. Fixed cost. Overhead costs. Inventoriable costs.arrow_forwardIdentify each responsibility center in the list below as either a service center, cost center (clinical or administrative), profit center (capitated or administrative), or investment center. Explain your choices. Radiology department that must control its own costs: Admitting department of a hospital: HMO: Stand‐alone outpatient clinic that must earn a 10 percent return on investment (ROI): Volunteer department with no budget: Development office:arrow_forwardFerdinand Construction (FC) manages the design and construction of hospitals. Ferdinand has developed several formulas that it uses to quote jobs. These include costs of basic construction but exclude equipment and furniture. These estimates are also dependent on the purpose of the hospital (teaching hospitals are more costly to build) and location (downtown hospitals are more costly to build). Both of these are based on the building costs. The estimated costs also depend on whether the hospital has few or many stories (high-rise buildings are more expensive). The following are the cost estimates for one region in the Northeast: Design costs $ 15,000,000 Building costs – per square foot (low-rise) 300 Building costs – per square foot (high-rise) 360 Downtown premium 60% Teaching hospital premium 20% Required: A local university medical school has asked Ferdinand Construction to provide a quote on a high-rise teaching hospital located in the city center downtown. The…arrow_forward

- Need help using ABC product costing model. Grand Haven is a senior living community that offers a full range of services including independent living, assisted living, and skilled nursing care. The asssited living division provides residential space, meals, and medical services (MS) to its residents. The current costing system adds the cost of all of these services (space, meals, and MS) and divides by total resident days to get a cost per resident day for each month. Recognizing that MS tends to vary significantly among the residents, Grant Haven's accountant recommended that an ABC system be designed to calculate more accurated the cost of MS provided to residents. She decided that residents should be classified into four categories (A, B, C, D) based on the level of services received, with group A representing the lowest level of services and D representing the highest level of service. Two cost drivers being considered for measuring MS costs are number of assistance calls…arrow_forwardHoodys for Good manufactures and sells hooded sweatshirts. The company locates its manufacturing facilities in areas with high unemployment rates and provides on-site day care and education for its employees’ children. The company recently started a “one for one” program where, for each sweatshirt sold, it will donate one sweatshirt to an international charity to provide to a child in need. The customer pays the shipping cost for items purchased, but the company pays to ship to the international charities.Cost information is summarized below:Variable Costs Direct Materials $ 3.00 per unit produced Direct Labor $ 2.50 per unit produced Variable Manufacturing Overhead $ 0.50 per unit produced Shipping $ 3.00 per unit donated Fixed Costs Salaries $ 20,000 per month Advertising $ 60,000 per month Production Equipment $ 40,000 per monthRequired: Answer each of the following independent questions.1.Assume that the price of each sweatshirt sold is $30.a.How much contribution margin is earned…arrow_forwardThe Housekeeping Services Department of Ruger Clinic, had $100,000 in direct costs during the year. Department Revenue HK Hours Adult Services $3,000,000 1,500 Pediatric Services $1,500,000 3,000 Other Services $ 500,000 500 Total $5,000,000 5,000 What is the value of the cost pool? Which of the two cost drivers is better? Patient service revenue or housekeeping hours? Why?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub