Concept explainers

Classifying Variable and Fixed Costs and Product and Period Costs

Below are listed various costs that are found in organizations.

1. Hamburger buns in a Wendy’s restaurant.

2. Advertising by a dental office.

3. Apples processed and canned by Del Monte.

4. Shipping canned apples from a Del Monte plant to customers.

5. Insurance on a Bausch & Lomb factory producing contact lenses.

6. Insurance on IBMs corporate headquarters.

7. Salary of a supervisor overseeing production of printers at Hewlett-Packard.

8. Commissions paid to automobile salespersons.

9.

10. Steering wheels installed in BMWs.

Required:

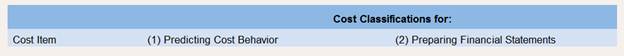

Using the table shown below, describe each of the costs mentioned above in two ways. In termsof cost classifications for predicting cost behaviour (column 1), indicate whether the cost is fixed or variable with respect to the number of units produced and sold. With respect to costclassifications for preparing financial statements (column 2), indicate whether the item is a product cost or period cost (selling and administrative cost).

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Introduction To Managerial Accounting

- Identifying Fixed, Variable, Mixed, and Step Costs Consider each of the following independent situations: a. A computer service agreement in which a company pays 150 per month and 15 per hour of technical time b. Fuel cost of the companys fleet of motor vehicles c. The cost of beer for a bar d. The cost of computer printers and copiers at your college e. Rent for a dental office f. The salary of a receptionist in a law firm g. The wages of counter help in a fast-food restaurant h. The salaries of dental hygienists in a three-dentist office. One hygienist can take care of 120 cleanings per month. i. Electricity cost which includes a 15 per month billing charge and an additional amount depending on the number of kilowatt-hours used Required: 1. For each situation, describe the cost as one of the following: fixed cost, variable cost, mixed cost, or step cost. (Hint: First, consider what the driver or output measure is. If additional assumptions are necessary to support your cost type decision, be sure to write them down.) Example: Raw materials used in productionVariable cost 2. CONCEPTUAL CONNECTION Change your assumption(s) for each situation so that the cost type changes to a different cost type. List the new cost type and the changed assumption(s) that gave rise to it. Example: Raw materials used in production. Changed assumptionthe materials are difficult to obtain, and a years worth must be contracted for in advance. Now, this is a fixed cost. (This is the case with diamond sales by DeBeers Inc. to its sightholders. See the following website for information: www.keyguide.net/sightholders/.)arrow_forwardVentana Window and Wall Treatments Company provides draperies, shades, and various window treatments. Ventana works with the customer to design the appropriate window treatment, places the order, and installs the finished product. Direct materials and direct labor costs are easy to trace to the jobs. Ventanas income statement for last year is as follows: Ventana wants to find a markup on cost of goods sold that will allow them to earn about the same amount of profit on each job as was earned last year. Required: 1. What is the markup on cost of goods sold (COGS) that will maintain the same profit as last year? (Round the percentage to two significant digits.) 2. A customer orders draperies and shades for a remodeling job. The job will have the following costs: What is the price that Ventana will quote given the markup percentage calculated in Requirement 1? (Round the price to the nearest dollar.) 3. What if Ventana wants to calculate a markup on direct materials cost, since it is the largest cost of doing business? What is the markup on direct materials cost that will maintain the same profit as last year? (Round the percentage to two significant digits.) What is the bid price Ventana will use for the job given in Requirement 2 if the markup percentage is calculated on the basis of direct materials cost? (Round to the nearest dollar.)arrow_forwardFor apparel manufacturer Abercrombie Fitch, Inc. (ANF), classify each of the following costs as either a product cost or a period cost: a. Advertising expenses b. Chief financial officers salary c. Depreciation on office equipment d. Depreciation on sewing machines e. Fabric used during production f. Factory janitorial supplies g. Factory supervisors salaries h. Property taxes on factory building and equipment i. Oil used to lubricate sewing machines j. Repairs and maintenance costs for sewing machines k. Research and development costs l. Sales commissions m. Salaries of distribution center personnel n. Salaries of production quality control supervisors o. Travel costs of media relations employees p. Utility costs for office building q. Wages of sewing machine operatorsarrow_forward

- Listed as follows are various costs found in businesses. Classify each cost as a fixed or variable cost, and as a product and/or period cost. Wages of administrative staff Shipping costs on merchandise sold Wages of workers assembling computers Cost of lease on factory equipment Insurance on factory Direct materials used in production of lamps Supervisor salary, factory Advertising costs Property taxes, factory Health insurance cost for company executives Rent on factoryarrow_forwardMott Company recently implemented a JIT manufacturing system. After one year of operation, Heidi Burrows, president of the company, wanted to compare product cost under the JIT system with product cost under the old system. Motts two products are weed eaters and lawn edgers. The unit prime costs under the old system are as follows: Under the old manufacturing system, the company operated three service centers and two production departments. Overhead was applied using departmental overhead rates. The direct overhead costs associated with each department for the year preceding the installation of JIT are as follows: Under the old system, the overhead costs of the service departments were allocated directly to the producing departments and then to the products passing through them. (Both products passed through each producing department.) The overhead rate for the Machining Department was based on machine hours, and the overhead rate for assembly was based on direct labor hours. During the last year of operations for the old system, the Machining Department used 80,000 machine hours, and the Assembly Department used 20,000 direct labor hours. Each weed eater required 1.0 machine hour in Machining and 0.25 direct labor hour in Assembly. Each lawn edger required 2.0 machine hours in Machining and 0.5 hour in Assembly. Bases for allocation of the service costs are as follows: Upon implementing JIT, a manufacturing cell for each product was created to replace the departmental structure. Each cell occupied 40,000 square feet. Maintenance and materials handling were both decentralized to the cell level. Essentially, cell workers were trained to operate the machines in each cell, assemble the components, maintain the machines, and move the partially completed units from one point to the next within the cell. During the first year of the JIT system, the company produced and sold 20,000 weed eaters and 30,000 lawn edgers. This output was identical to that for the last year of operations under the old system. The following costs have been assigned to the manufacturing cells: Required: 1. Compute the unit cost for each product under the old manufacturing system. 2. Compute the unit cost for each product under the JIT system. 3. Which of the unit costs is more accurate? Explain. Include in your explanation a discussion of how the computational approaches differ. 4. Calculate the decrease in overhead costs under JIT, and provide some possible reasons that explain the decrease.arrow_forwardHicks Contracting collects and analyzes cost data in order to track the cost of installing decks on new home construction jobs. The following are some of the costs that they incur. Classify these costs as fixed or variable costs and as product or period costs. Lumber used to construct decks ($12.00 per square foot) Carpenter labor used to construct decks ($10 per hour) Construction supervisor salary ($45,000 per year) Depreciation on tools and equipment ($6,000 per year) Selling and administrative expenses ($35,000 per year) Rent on corporate office space ($34,000 per year) Nails, glue, and other materials required to construct deck (varies per job)arrow_forward

- Variable and Fixed Costs What follows are a number of resources that are used by a manufacturer of futons. Assume that the output measure or cost driver is the number of futons produced. All direct labor is paid on an hourly basis, and hours worked can be easily changed by management. All other factory workers are salaried. a. Power to operate a drill (to drill holes in the wooden frames of the futons) b. Cloth to cover the futon mattress c. Salary of the factory receptionist d. Cost of food and decorations for the annual Fourth of July party for all factory employees e. Fuel for a forklift used to move materials in a factory f. Depreciation on the factory g. Depreciation on a forklift used to move partially completed goods h. Wages paid to workers who assemble the futon frame i. Wages paid to workers who maintain the factory equipment j. Cloth rags used to wipe the excess stain off the wooden frames Required: Classify the resource costs as variable or fixed.arrow_forwardA manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardStan is opening a coffee shop next to Big State University. He knows that controlling his costs will be important to the success of the shop. He will not be able to work all the hours the shop is open, so the employees will need some guidelines to perform their jobs correctly. After talking to an accounting professor, he decides he needs a standard cost system for his shop. Describe the process Stan should follow in setting his standards for materials and labor.arrow_forward

- Below are listed various costs that are found in organizations.1. Hamburger buns in a Wendy’s restaurant.2. Advertising by a dental office.3. Apples processed and canned by Del Monte.4. Shipping canned apples from a Del Monte plant to customers.5. Insurance on a Bausch & Lomb factory producing contact lenses.6. Insurance on IBM’s corporate headquarters.7. Salary of a supervisor overseeing production of printers at Hewlett-Packard.8. Commissions paid to automobile salespersons.9. Depreciation of factory lunchroom facilities at a General Electric plant.10. Steering wheels installed in BMWs.Required:Using the table shown below, describe each of the costs mentioned above in two ways. In terms of cost classifications for predicting cost behavior (column 1), indicate whether the cost is fixed or variable with respect to the number of units produced and sold. With respect to cost classificationsfor preparing financial statements (column 2), indicate whether the item is a product cost or…arrow_forwardThe following is a list of costs incurred by several businesses:a. Salary of quality control supervisorb. Packing supplies for products sold. These supplies are a very small portion of the total cost of the product.c. Factory operating suppliesd. Depreciation of factory equipmente. Hourly wages of warehouse laborersf. Wages of company controller’s secretaryg. Maintenance and repair costs for factory equipmenth. Paper used by commercial printeri. Entertainment expenses for sales representativesj. Protective glasses for factory machine operatorsk. Sales commissionsl. Cost of hogs for meat processorm. Cost of telephone operators for a toll-free hotline to help customers operate productsn. Hard drives for a microcomputer manufacturero. Lumber used by furniture manufacturerp. Wages of a machine operator on the production lineq. First-aid supplies for factory workersr. Tires for an automobile manufacturers. Paper used by Computer Department in processing various managerial reportst. Seed for…arrow_forwardClassifying costsThe following is a list of costs incurred by several businesses:a. Salary of quality control supervisor b. Packing supplies for products sold. These supplies are a verysmall portion of the total cost of the product.c. Factory operating suppliesd. Depreciation of factory equipmente. Hourly wages of warehouse laborers f. Wages of company controller's secretaryg. Maintenance and repair costs for factory equipmenth. Paper used by commercial printeri. Entertainment expenses for sales representativesj. Protective glasses for factory machine operators k. Sales commissionsl. Cost of hogs for meat processorm. Cost of telephone operators for a toll-free hotline to helpcustomers operate productsn. Hard drives for a microcomputer manufacturer o. Lumber used by furniture manufacturerp. Wages of a machine operator on the production lineq. First-aid supplies for factory workersr. Tires for an automobile manufacturers. Paper used by Computer Department in processing variousmanagerial…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning