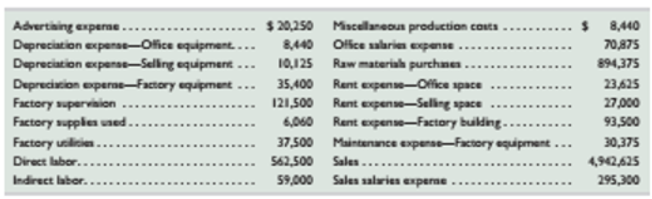

The following calendar year-end information is taken from December 31, 2015, adjust

Required

- Identity and classify each of the costs above as either a product or period cost.

- Classify each of the product costs as either direct materials, direct labor, or factory

overhead. - Classify each of the period costs as either selling or general and administrative expenses.

Concept introduction:

Product cost:

The costs are incurred when the product is acquired or produced and are considered in the inventory valuation. It includes costs of direct materials, direct labor and manufacturing overheads. Rents on factory building, factory maintenance, and depreciation on factory equipment are some of its examples.

Period cost:

These costs are associated with the passage of time, i.e. when the business has no production or inventory purchasing activities, this cost would still be incurred. Mostly, these costs are associated with selling or general and administrative activities. Depreciation on office equipment, advertising expense and office manager salaries are some of its examples.

Requirement 1:

Identification and classification of costs of Best Bikes as either product or period.

Answer to Problem 2PSB

Classification of costs of Best Bikes (Amount in $):

| Particulars | Product cost | Period cost |

| Advertising expense | 20, 250 | |

| Depreciation expense- Office equipment | 8, 440 | |

| Depreciation expense- Selling equipment | 10, 125 | |

| Depreciation expense- Factory equipment | 35, 400 | |

| Factory supervision | 1, 21, 500 | |

| Factory supplies used | 6, 060 | |

| Factory utilities | 37, 500 | |

| Direct labor | 5, 62, 500 | |

| Indirect labor | 59, 000 | |

| Miscellaneous production costs | 8, 440 | |

| Office salaries expense | 70, 875 | |

| Raw materials purchases | 8, 94, 375 | |

| Rent expense- Office space | 23, 625 | |

| Rent expense- Selling space | 27, 000 | |

| Rent expense- Factory building | 93, 500 | |

| Maintenance expense- Factory equipment | 30, 375 | |

| Sales salaries expense | 2, 95, 300 |

Explanation of Solution

The costs of Best Bikes can be classified into product or period based on their nature as explained below:

Product costs are incurred when the product is acquired or produced and are considered in the inventory valuation. It includes costs of direct materials, direct labor and manufacturing overheads. Therefore, following costs would be classified as Product:

- Depreciation expense- Factory equipment: as it relates to manufacturing overheads

- Factory supervision: as it relates to manufacturing overheads

- Factory supplies used: as it relates to manufacturing overheads

- Factory utilities: as it relates to manufacturing overheads

- Direct labor: as it is cost of direct labor

- Indirect labor: as it relates to manufacturing overheads

- Miscellaneous production costs: as it relates to manufacturing overheads

- Raw material purchases: as it relates to direct materials

- Rent expense- Factory building: as it relates to manufacturing overheads

- Maintenance expense- Factory equipment: as it relates to manufacturing overheads

Period costs are associated with the passage of time, i.e. when the business has no production or inventory purchasing activities, this cost would still be incurred. Mostly, these costs are associated with selling or general and administrative activities. Following would be classified as Period costs:

- Advertising expense: : as it relates to selling activity

- Depreciation expense- Office equipment: as it relates to general and administrative activity

- Depreciation expense- Selling equipment: as it relates to selling activity

- Office salaries expense: as it relates to general and administrative activity

- Rent expense- Office space: as it relates to general and administrative activity

- Rent expense- Selling space: as it relates to selling activity

- Sales salaries expense: as it relates to selling activity

Therefore, identification and classification of costs of Best Bikes, as asked in the given problem is shown below:

Classification of costs of Best Bikes (Amount in $):

| Particulars | Product cost | Period cost |

| Advertising expense | 20, 250 | |

| Depreciation expense- Office equipment | 8, 440 | |

| Depreciation expense- Selling equipment | 10, 125 | |

| Depreciation expense- Factory equipment | 35, 400 | |

| Factory supervision | 1, 21, 500 | |

| Factory supplies used | 6, 060 | |

| Factory utilities | 37, 500 | |

| Direct labor | 5, 62, 500 | |

| Indirect labor | 59, 000 | |

| Miscellaneous production costs | 8, 440 | |

| Office salaries expense | 70, 875 | |

| Raw materials purchases | 8, 94, 375 | |

| Rent expense- Office space | 23, 625 | |

| Rent expense- Selling space | 27, 000 | |

| Rent expense- Factory building | 93, 500 | |

| Maintenance expense- Factory equipment | 30, 375 | |

| Sales salaries expense | 2, 95, 300 |

Concept introduction:

Product cost:

The costs are incurred when the product is acquired or produced and are considered in the inventory valuation. It includes costs of direct materials, direct labor and manufacturing overheads. Rents on factory building, factory maintenance, and depreciation on factory equipment are some of its examples.

Direct materials:

These are the cost of materials used for production of the product. The cost of all the materials integral to finished product and having a physical presence that is readily traced to that finished product is included in direct materials.

Direct labor:

These consist of wages paid to labor who have physically and directly work on the goods being produced other than administrative and selling activities.

Factory overheads:

All other costs remaining other than direct materials and direct labor relating to factory comes under Factory overheads.

Requirement 2:

Identification and classification of product costs of Best Bikes as direct materials, direct labor and factory overheads.

Answer to Problem 2PSB

Classification of product costs of Best Bikes (Amount in $):

| Particulars | Direct materials | Direct labor | Factory overheads |

| Depreciation expense- Factory equipment | 35, 400 | ||

| Factory supervision | 1, 21, 500 | ||

| Factory supplies used | 6, 060 | ||

| Factory utilities | 37, 500 | ||

| Direct labor | 5, 62, 500 | ||

| Indirect labor | 59, 000 | ||

| Miscellaneous production costs | 8, 440 | ||

| Raw materials purchases | 8, 94, 375 | ||

| Rent expense- Factory building | 93, 500 | ||

| Maintenance expense- Factory equipment | 30, 375 |

Explanation of Solution

The product costs of Best Bikes can be classified into direct materials, direct labor and factory overheads based on their nature as explained below:

Direct materials are the cost of materials used for production of the product. Therefore, costs of Raw material purchases would be classified under direct materials.

Direct labor includes wages paid to labor who have physically and directly work on the goods being produced other than administrative and selling activities. Only cost of direct labor would be covered under direct labor.

All other costs remaining other than direct materials and direct labor relating to factory comes under Factory overheads. Therefore, following costs would factory overheads:

- Depreciation expense- Factory equipment

- Factory supervision

- Factory supplies used

- Factory utilities

- Indirect labor

- Miscellaneous production costs

- Rent expense- Factory building

- Maintenance expense- Factory equipment

Therefore, identification and classification of product costs of Best Bikes, as asked in the given problem is shown below:

Classification of product costs of Best Bikes (Amount in $):

| Particulars | Direct materials | Direct labor | Factory overheads |

| Depreciation expense- Factory equipment | 35, 400 | ||

| Factory supervision | 1, 21, 500 | ||

| Factory supplies used | 6, 060 | ||

| Factory utilities | 37, 500 | ||

| Direct labor | 5, 62, 500 | ||

| Indirect labor | 59, 000 | ||

| Miscellaneous production costs | 8, 440 | ||

| Raw materials purchases | 8, 94, 375 | ||

| Rent expense- Factory building | 93, 500 | ||

| Maintenance expense- Factory equipment | 30, 375 |

Concept introduction:

Period cost:

These costs are associated with the passage of time, i.e. when the business has no production or inventory purchasing activities, this cost would still be incurred. Mostly, these costs are associated with selling or general and administration activities. Depreciation on office equipment, advertising expense and office manager salaries are some of its examples.

Selling expenses:

These are the expenses incurred for making sales. These include direct and indirect cost associated with selling a product.

General or administrative expenses:

These are basically the overheads of the company. These are the costs a company incurs to keep its business operational.

Requirement 3:

Identification and classification of period costs of Best Bikes as either selling or general and administration expenses.

Answer to Problem 2PSB

Classification of period costs of Best Bikes (Amount in $):

| Particulars | Selling expenses | General or administration expenses |

| Advertising expense | 20, 250 | |

| Depreciation expense- Office equipment | 8, 440 | |

| Depreciation expense- Selling equipment | 10, 125 | |

| Office salaries expense | 70, 875 | |

| Rent expense- Office space | 23, 625 | |

| Rent expense- Selling space | 27, 000 | |

| Sales salaries expense | 2, 95, 300 |

Explanation of Solution

The period costs of Best Bikes can be classified into product or period based on their nature as explained below:

Period costs are associated with the passage of time and are associated with selling and general or administration activities.

Selling expenses are incurred for making sales and include direct and indirect cost associated with selling a product. Following would be covered under selling expenses:

- Advertising expense:

- Depreciation expense- Selling equipment

- Rent expense- Selling space

- Sales salaries expense

General or administrative expenses are the overheads a company incurs to keep its business operational. Following are classified under them:

- Depreciation expense- Office equipment

- Office salaries expense

- Rent expense- Office space

Therefore, identification and classification of period costs of Best Bikes, as asked in the given problem is shown below:

Classification of period costs of Best Bikes (Amount in $):

| Particulars | Selling expenses | General or administration expenses |

| Advertising expense | 20, 250 | |

| Depreciation expense- Office equipment | 8, 440 | |

| Depreciation expense- Selling equipment | 10, 125 | |

| Office salaries expense | 70, 875 | |

| Rent expense- Office space | 23, 625 | |

| Rent expense- Selling space | 27, 000 | |

| Sales salaries expense | 2, 95, 300 |

Want to see more full solutions like this?

Chapter 1 Solutions

MANAGERIAL ACCOUNTING ACCT 2302 >IC<

- The following information is available for the first year of operations of Creston Inc., a manufacturer of fabricating equipment: Determine the following amounts: a. Cost of goods sold b. Direct materials cost c. Direct labor costarrow_forwardThis information was collected for the first year of manufacturing for Appliance Apps: Prepare an income statement under variable costing, and prepare a reconciliation to the income under the absorption method.arrow_forwardGunnison Company had the following equivalent units schedule and cost information for its Sewing Department for the month of December: Required: 1. Calculate the unit cost for December, using the FIFO method. 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for. 3. What if you were asked for the unit cost from the month of November? Calculate Novembers unit cost and explain why this might be of interest to management.arrow_forward

- Statement of cost of goods manufactured for a manufacturing company Cost data for Johnstone Manufacturing Company for the month ended March 31 are as follows: a. Prepare a cost of goods manufactured statement for March. b. Determine the cost of goods sold for March.arrow_forwardDaytona Beverages Inc. uses the FIFO cost method and adds all materials, labor, and factory overhead evenly to production. A record of the factory operations for October follows: Required: Prepare a cost of production summary for the month.arrow_forwardSummary information from a companys job cost sheets shows the following information: What are the balances in the work in process inventory, finished goods Inventory, and cost of goods sold for April, May, and June?arrow_forward

- The adjusted trial balance for Appleton Appliances, Ltd. on June 30, the end of its first month of operation, is as follows: The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were 23,000. c. Direct labor cost was 18,500. d. Factory overhead costs were as follows: Required: 1. Prepare a statement of cost of goods manufactured for June. 2. Prepare an income statement for June. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.) 3. Prepare a balance sheet as of June 30. (Hint: Do not forget Retained Earnings.)arrow_forwardCost flow relationships The following information is available for the first month of operations of Bahadir Company, a manufacturer of mechanical pencils: Using the information given, determine the following missing amounts: A. Cost of goods sold B. Finished goods inventory at the end of the month C. Direct materials cost D. Direct labor cost E. Work in process inventory at the end of the montharrow_forwardMonterrey Products Co. uses the process cost system. A record of the factory operations for the month of October follows: Required: Prepare a cost of production summary, assuming that the production losses are considered to be normal.arrow_forward

- Freeman Furnishings has summarized its data as shown: Compute the cost of goods manufactured, assuming that the overhead is allocated based on direct labor hoursarrow_forwardFor E2-17, prepare any journal entries that would have been different if the only trigger points had been the purchase of materials and the sale of finished goods. Davis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forwardAero Aluminum Inc. uses a process cost system. The records for May show the following information: Using the data in P5-9, draft the journal entries to record: 1. The cost of goods received from Rolling during the month. 2. The production costs incurred in Converting during the month. 3. The cost of goods completed and transferred to finished goods during the month.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning