(a)

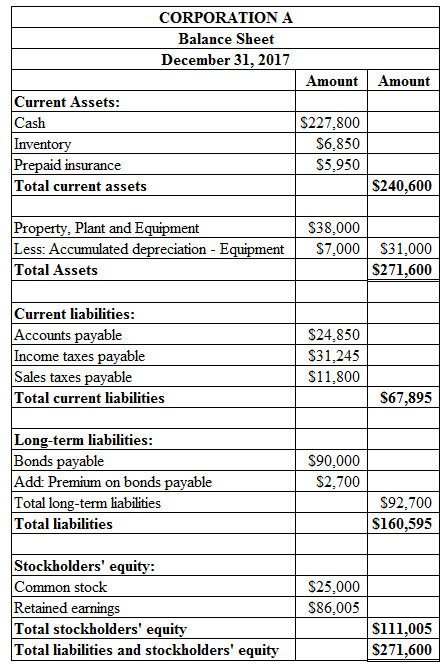

Balance Sheet

This is a financial statement that shows the assets owned, and the liabilities owed to the creditors and the owners (

To Prepare: The

(a)

Explanation of Solution

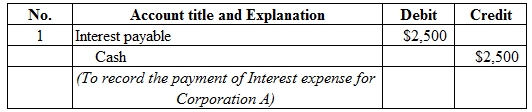

Figure (1)

Description:

- Interest payable is a current liability, and decreased. Therefore, debit interest payable account for $2,500.

- Cash is a current asset, and decreased. Therefore, credit cash account for $2,500.

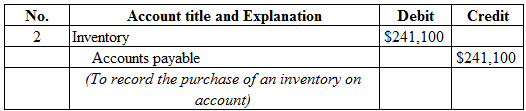

Figure (2)

Description:

- Inventory is a current asset, and increased. Therefore, debit inventory account for $241,100.

- Accounts payable is a current liability, and increased. Therefore, credit accounts payable account for $241,100.

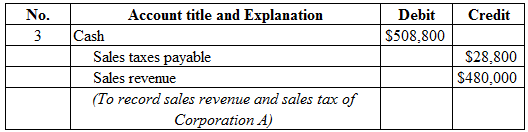

Figure (3)

Description:

- Cash is a current asset, and increased. Therefore, debit cash is a current asset account for $508,800.

- Sales taxes payable is a current liability, and increased. Therefore, credit sales taxes payable account for $28,800.

- Sales revenue is a component of stockholders’ equity, and increased it. Therefore, credit sales revenue account for $480,000.

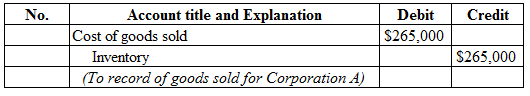

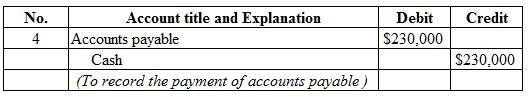

Figure (4)

Description:

- Cost of goods sold is a component of stockholders’ equity, and decreased it. Therefore, debit cost of goods sold account for $265,000.

- Inventory is a current asset, and decreased. Therefore, credit inventory account for $265,000.

Figure (5)

Description:

- Accounts payable is a current liability, and decreased. Therefore, debit accounts payable account for $230,000.

- Cash is a current asset, and decreased. Therefore, credit cash account for $230,000.

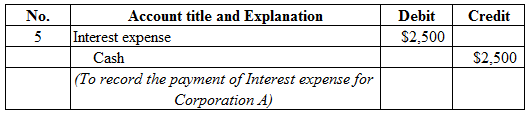

Figure (6)

Description:

- Interest expense is a component of stockholders’ equity, and decreased it. Therefore, debit interest expense account for $2,500.

- Cash is a current asset, and decreased. Therefore, credit cash account for $2,500.

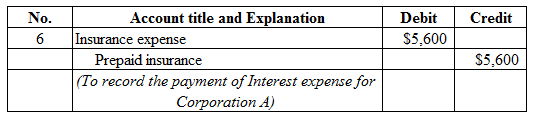

Figure (7)

Description:

- Insurance expense is a component of stockholders’ equity, and decreased it. Therefore, debit insurance expense account for $5,600.

- Cash is a current asset, and decreased. Therefore, credit cash account for $5,600.

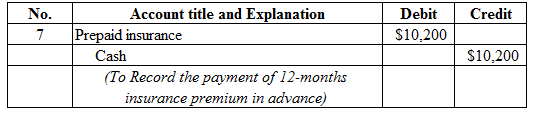

Figure (8)

Description:

- Prepaid insurance is a current asset, and increased. Therefore, debit prepaid insurance account for $10,200.

- Cash is a current asset, and decreased. Therefore, credit cash account for $10,200.

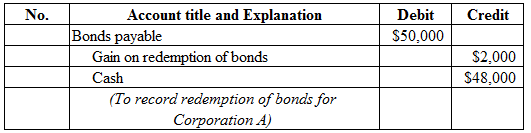

Figure (9)

Description:

- Sales taxes payable is a current liability, and decreased. Therefore, debit sales taxes payable account for $17,000.

- Cash is a current asset, and decreased. Therefore, credit cash account for $17,000.

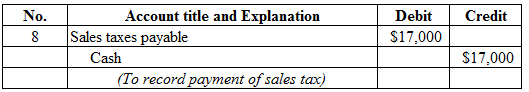

Figure (10)

Description:

- Other operating expenses are a component of stockholders’ equity, and decreased it. Therefore, debit other operating expenses account for $91,000.

- Cash is a current asset, and decreased. Therefore, credit cash account for $91,000.

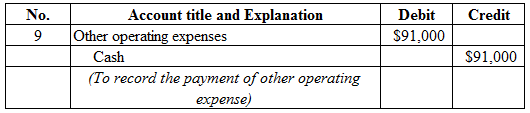

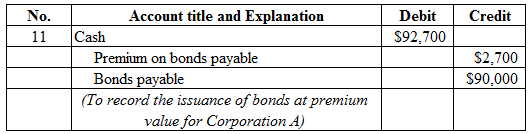

Figure (11)

Description:

- Interest expense is a component of stockholders’ equity, and decreased it. Therefore, debit interest expense account for $2,500.

- Cash is a current asset, and decreased. Therefore, credit cash account for $2,500.

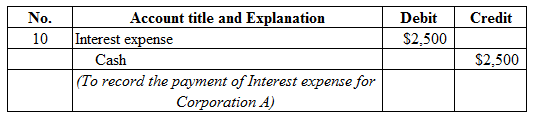

Figure (12)

Description:

- Bonds payable is a liability, and decreased. Therefore, debit bonds payable account for $50,000.

- Gain on redemption of bonds is a component of stockholders’ equity, and increased it. Therefore, credit gain on redemption of bonds account for $2,000.

- Cash is a current asset, and decreased. Therefore, credit cash account for $48,000.

Figure (13)

Description:

- Cash is a current asset, and increased. Therefore, debit cash account for $92,700.

- Premium on bonds payable is a contra liability, and increased. Therefore, credit premium on bonds payable for $2,700.

- Bonds payable is a long-term liability, and increased. Therefore, credit bonds payable account for $90,000.

To Prepare: The

Explanation of Solution

Prepare the adjustment entries of Corporation as shown below:

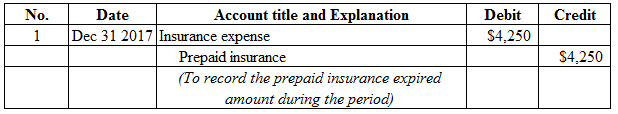

Figure (14)

Working note:

Calculate interest expense as shown below:

Description:

Insurance expense is a component of stockholders’ equity, and decreased it. Therefore, debit insurance expense account for $4,250.

Prepaid insurance is a current asset, and decreased. Therefore, credit cash account for $4,250.

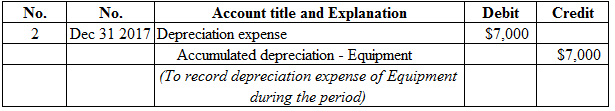

Figure (15)

Description:

Depreciation expense is a component of stockholders’ equity, and decreased it. Therefore, debit depreciation expense account for $7,000.Accumulated depreciation – equipment is a contra asset, and increased. Therefore, credit accumulated depreciation - equipment account for $7,000.

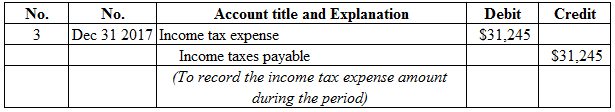

Figure (16)

Working note:

Calculate income tax expense as shown below:

Description:

- Income tax expense is a component of stockholders’ equity, and decreased it. Therefore, debit income tax expense account for $31,245.

- Income taxes payable is a current liability, and increased. Therefore, credit income taxes payable account for $31,245.

To Prepare: The T-Accounts of Corporation A.

Answer to Problem 10.1CACR

| Cash | |||

| Bal. | $30,000 | $2,500 | |

| $508,800 | $230,000 | ||

| $92,700 | $2,500 | ||

| $10,200 | |||

| $17,000 | |||

| $91,000 | |||

| $2,500 | |||

| $48,000 | |||

| Bal. | $227,800 | ||

Table (1)

| Inventory | |||

| Bal. | $30,750 | $265,000 | |

| $241,100 | |||

| Bal. | $6,850 | ||

Table (2)

| Prepaid Insurance | |||

| Bal. | $5,600 | $5,600 | |

| $10,200 | $4,250 | ||

| Bal. | $5,950 | ||

Table (3)

| Equipment | |||

| Bal. | $38,000 | ||

Table (4)

| Accumulated Depreciation - Equipment | |||

| $7,000 | |||

Table (5)

| Accounts Payable | |||

| $230,000 | Bal. | $13,750 | |

| $241,100 | |||

| Bal. | $24,850 | ||

Table (6)

| Other Operating Expenses | |||

| $91,000 | |||

Table (7)

| Interest Expense | |||

| $2,500 | |||

| $2,500 | |||

| Bal. | $5,000 | ||

Table (8)

| Income Tax Expense | |||

| $31,245 | |||

Table (9)

| Interest Payable | |||

| $2,500 | Bal. | $2,500 | |

| Bal. | $0 | ||

Table (10)

| Sales Taxes Payable | |||

| $17,000 | $28,800 | ||

| Bal. | $11,800 | ||

Table (11)

| Income Taxes Payable | |||

| $31,245 | |||

Table (12)

| Bonds Payable | |||

| $50,000 | Bal. | $50,000 | |

| $90,000 | |||

| Bal. | $90,000 | ||

Table (13)

| Premium on Bonds Payable | |||

| $2,700 | |||

Table (14)

| Common Stock | |||

| Bal. | $25,000 | ||

Table (15)

| Bal. | $13,100 | ||

Table (16)

| Sales Revenue | |||

| $480,000 | |||

Table (17)

| Cost of Goods sold | |||

| $265,000 | |||

Table (18)

| Depreciation Expense | |||

| $7,000 | |||

Table (19)

| Insurance Expense | |||

| $5,600 | |||

| $4,250 | |||

| Bal. | $9,850 | ||

Table (20)

| Gain on Redemption of Bonds | |||

| Bal. | $2,000 | ||

Table (21)

Explanation of Solution

Normal balance of assets account, expenses, losses account is debit balance. Hence, a debit increases these accounts and credit decreases these accounts.

Normal balance of liabilities account, capital account, revenue account and gains is credit balance. Hence, a debit decreases these accounts and credit increases these accounts.

(b)

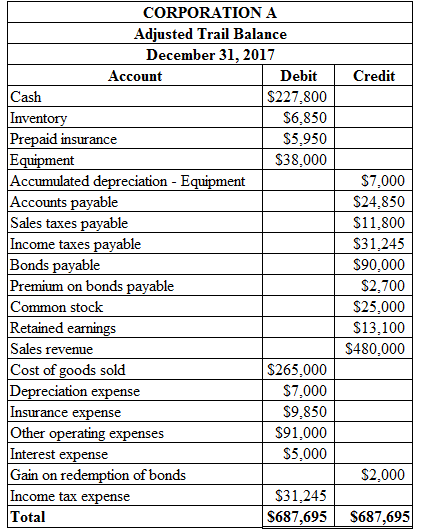

To Prepare: The adjusted trail balance of Corporation A on December 31, 2017.

(b)

Explanation of Solution

Prepare the adjusted trail balance of Corporation A on December 31, 2017 as shown below:

Figure (17)

(c)

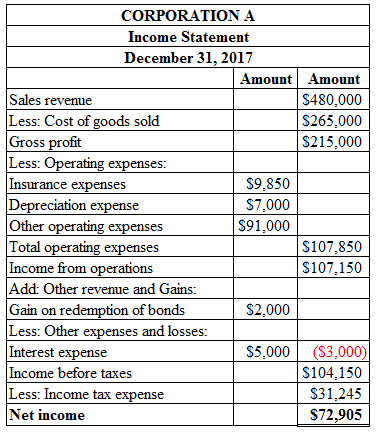

To Prepare: The income statement of Corporation A on December 31, 2017.

(c)

Answer to Problem 10.1CACR

Prepare the income statement of Corporation A on December 31, 2017 as shown below:

Figure (18)

Explanation of Solution

Gross profit is calculated by deducting cost of goods sold from sales revenue. Total operating expenses are calculated by adding insurance expense, depreciation expense, and other operating expenses. Income from operations is calculated by deducting total operating expenses from gross profit. Income before taxes is calculated by deducting interest expenses and adding gain on redemption of bonds from income from operations. Income tax expense is calculated by multiplying income from operations with tax rate. Net income is calculated by deducting income tax expense from income before taxes.

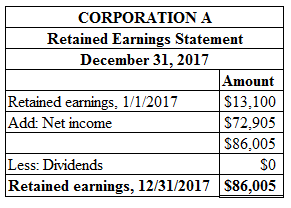

To Prepare: The retained earnings statement of Corporation A on December 31, 2017.

Answer to Problem 10.1CACR

Prepare retained earnings statement of Corporation A on December 31, 2017 as shown below:

Figure (19)

Explanation of Solution

Ending retained earnings is calculated by adding opening retained earnings and net income and then deducting the dividends. Therefore, ending retained earnings is $86,005.

To Prepare: The classified balance sheet statement of Corporation A on December 31, 2017.

Explanation of Solution

Prepare classified balance sheet statement of Corporation A on December 31, 2017 as shown below:

Figure (20)

Want to see more full solutions like this?

Chapter 10 Solutions

FINANCIAL ACCOUNTING: TOOLS WP ACCESS

- Saverin, Inc. produces and sells outdoor equipment. On July 1, 2016, Saverin, Inc. issued 62,500,000 of 10-year, 9% bonds at a market (effective) interest rate of 8%, receiving cash of 66,747,178. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Instructions 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds. 2. Journalize the entries to record the following: a. The first semiannual interest payment on December 31, 2016, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) b. The interest payment on June 30, 2017, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) 3. Determine the total interest expense for 2016.arrow_forwardReal-world annual report The financial statements for Nike, Inc. (NKE), are presented in Appendix E at the end of the text. The following additional information is available (in thousands): Instructions 1. Determine the following measures for the fiscal years ended May 31, 2017, and May 31, 2016. Round ratios and percentages to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory' h. Ratio of liabilities to stockholders equity i. Asset turnover j. Return on total assets, assuming interest expense is 82 million for the year ending May 31. 2017, and 33 million for the year ending May 31, 2016. k. k. Return on common stockholders equity l. Price-eamings ratio, assuming that the market price was 52.81 per share on May 31, 2017, and 54.35 per share on May 31, 2016. m. m. Percentage relationship of net income to sales 2. What conclusions can be drawn from these analyses?arrow_forwardComprehensive: Income Statement and Supporting Schedules The following s a partial list of the account balances, after adjustments, of Silvoso Company on December 31, 2019: The following information is also available: 1. The company declared and paid a 0.60 per share cash dividend on its common stock. The stock was outstanding the entire year. 2. A physical count determined that the December 31, 2019, ending inventory is 34,100. 3. A tornado destroyed a warehouse, resulting in a pretax loss of 12,000. The last tornado in this area had occurred 10 years earlier. 4. On May 1, 2019, the company sold an unprofitable division (R). From January through April, Division R (a major component of the company) had incurred a pretax operating loss of 8,700. Division R was sold at a pretax gain of 10,000. 5. The company is subject to a 30% income tax rate. Its income tax expense for 2019 totals 4,230. The breakdown is as follows: 6. The company had average shareholders equity of 150,000 during 2019. Required: 1. As supporting documents for Requirement 2, prepare separate supporting schedules for cost of goods sold, selling expenses, general and administrative expenses, and depreciation expense. 2. Prepare a 2019 multiple-step income statement for Silvoso. Include any related note to the financial statements. 3. Prepare a 2019 retained earnings statement. 4. Next Level What was Silvosos return on common equity for 2019? What is your evaluation of Silvosos return on common equity if last year it was 10%?arrow_forward

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)arrow_forwardComprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.arrow_forwardFrost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.arrow_forward

- Recording Various Liabilities Glenview Hardware had the following transactions that produced liabilities during 2020: a. Purchased merchandise on credit for $30,000. ( Note: Assume a periodic inventory system.) b. Year-end wages of $10,000 were incurred, but not paid. Related federal income taxes of $1,200, Social Security of $620 (employee portion), and Medicare taxes of $145 were with-held from employees. c. Year-end estimated income taxes payable, but unpaid, for the year were $42,850. d. Sold merchandise on account for $1,262, including state sales taxes of S48. ( Note: Assume a periodic inventory system.) e. Employers share of Social Security and Medicare taxes for the period were $620 and $145, respectively. f. Borrowed cash under a 90-day, 9%, $25,000 note. Required: Prepare the entry to record each of these transactions (treat each transaction independently).arrow_forwardFinancial statement analysis The financial statements for Nike, Inc., are presented in Appendix D at the end of the text. Use the following additional information (in thousands): Instructions 1. Determine the following measures for the fiscal years ended May 31, 2016, and May 31, 2015. Round ratios and percentages to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory h. Ratio of liabilities to stockholders equity i. Asset turnover j. Return on total assets. k. Return on common stockholders equity l. Price-earnings ratio, assuming that the market price was 54.90 per share on May 29, 2016, and 52.81 per share on May 30, 2015 m. Percentage relationship of net income to sales 2. What conclusions can be drawn from these analyses?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub