Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 1PA

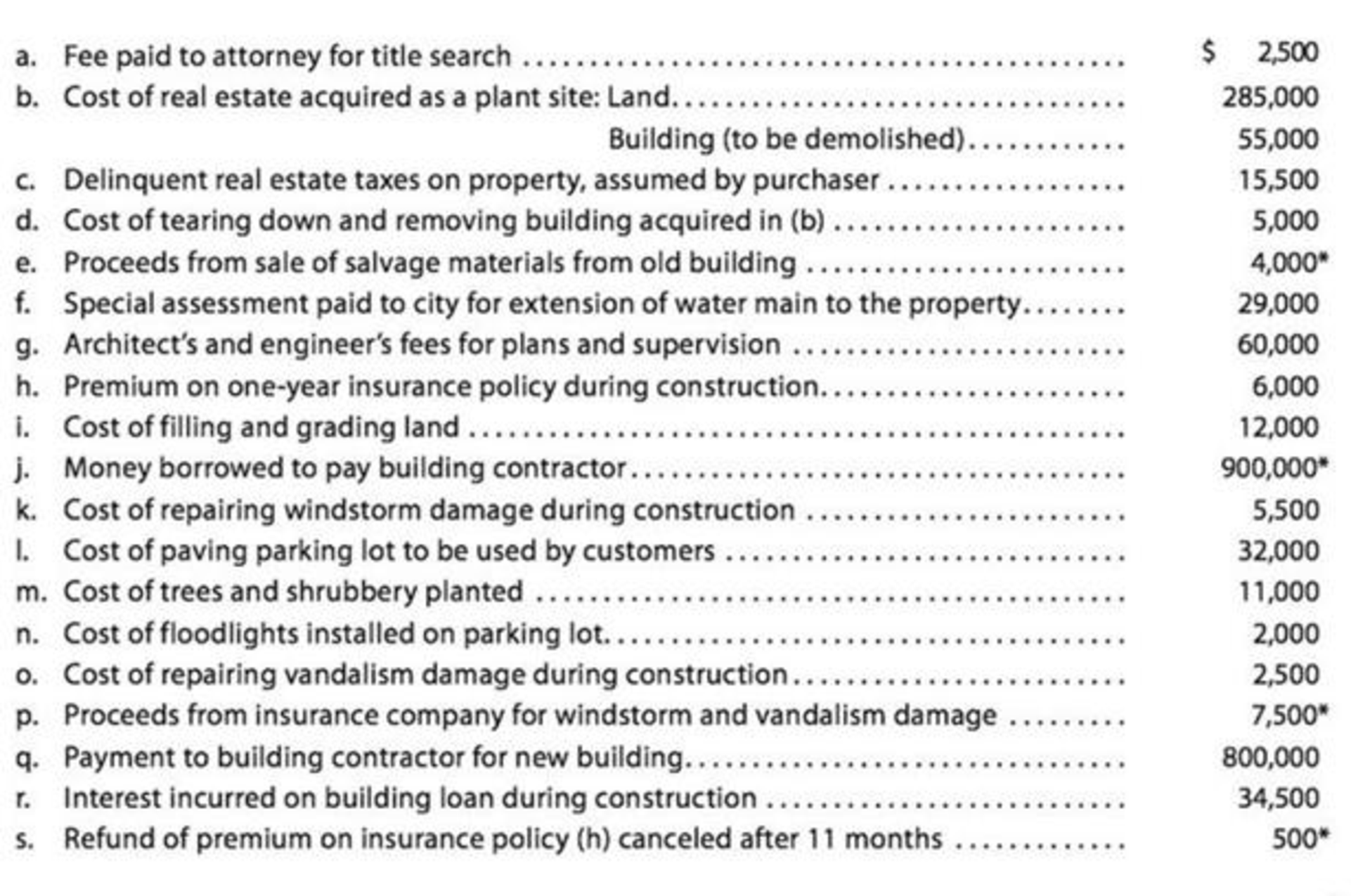

The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk.

Instructions

- 1. Assign each payment and receipt to Land (unlimited life), Land Improvements (limited life), Building, or Other Accounts. Indicate receipts by an asterisk. Identify each item by letter and list the amounts in columnar form, as follows:

- 2. Determine the amount debited to Land, Land Improvements, and Building.

- 3.

The costs assigned to the land, which is used as a plant site, will not be

The costs assigned to the land, which is used as a plant site, will not be depreciated , while the costs assigned to land improvements will be depreciated. Explain this seemingly contradictory application of the concept of depreciation. - 4. What would be the effect on the current year’s income statement and balance sheet if the cost of filling and grading land of $12,000 [payment (i)] was incorrectly classified as Land Improvements rather than Land? Assume that Land Improvements are depreciated over a 20-year life using the double-declining-balance method.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses.

(a)

Money borrowed to pay building contractor (signed a note)

$(294,600

)

(b)

Payment for construction from note proceeds

294,600

(c)

Cost of land fill and clearing

10,250

(d)

Delinquent real estate taxes on property assumed by purchaser

7,170

(e)

Premium on 6-month insurance policy during construction

11,100

(f)

Refund of 1-month insurance premium because construction completed early

(1,850

)

(g)

Architect’s fee on building

26,350

(h)

Cost of real estate purchased as a plant site (land $208,600 and building $51,900)

260,500

(i)

Commission fee paid to real estate agency

9,500

(j)

Installation of fences around property

4,120

(k)

Cost of razing and removing building

10,230

(l)

Proceeds from salvage of…

The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses.

(a)

Money borrowed to pay building contractor (signed a note)

$(294,600

)

(b)

Payment for construction from note proceeds

294,600

(c)

Cost of land fill and clearing

10,250

(d)

Delinquent real estate taxes on property assumed by purchaser

7,170

(e)

Premium on 6-month insurance policy during construction

11,100

(f)

Refund of 1-month insurance premium because construction completed early

(1,850

)

(g)

Architect’s fee on building

26,350

(h)

Cost of real estate purchased as a plant site (land $208,600 and building $51,900)

260,500

(i)

Commission fee paid to real estate agency

9,500

(j)

Installation of fences around property

4,120

(k)

Cost of razing and removing building

10,230

(l)

Proceeds from salvage of…

The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses.

(a)

Money borrowed to pay building contractor (signed a note)

$(290,400

)

(b)

Payment for construction from note proceeds

290,400

(c)

Cost of land fill and clearing

11,780

(d)

Delinquent real estate taxes on property assumed by purchaser

7,360

(e)

Premium on 6-month insurance policy during construction

11,340

(f)

Refund of 1-month insurance premium because construction completed early

(1,890

)

(g)

Architect’s fee on building

25,930

(h)

Cost of real estate purchased as a plant site (land $207,300 and building $57,700)

265,000

(i)

Commission fee paid to real estate agency

9,860

(j)

Installation of fences around property

3,860

(k)

Cost of razing and removing building

10,800

(l)

Proceeds from salvage of…

Chapter 10 Solutions

Financial Accounting

Ch. 10 - ONeil Office Supplies has a fleet of automobiles...Ch. 10 - Prob. 2DQCh. 10 - Prob. 3DQCh. 10 - Prob. 4DQCh. 10 - Immediately after a used truck is acquired, a new...Ch. 10 - Keyser Company purchased a machine that has a...Ch. 10 - Is it necessary for a business to use the same...Ch. 10 - Prob. 8DQCh. 10 - Prob. 9DQCh. 10 - Prob. 10DQ

Ch. 10 - A building acquired at the beginning of the year...Ch. 10 - Equipment acquired at the beginning of the year at...Ch. 10 - A truck acquired at a cost of 69,000 has an...Ch. 10 - A tractor acquired at a cost of 420,000 has an...Ch. 10 - A building acquired at the beginning of the year...Ch. 10 - A building acquired at the beginning of the year...Ch. 10 - Equipment with a cost of 180,000 has an estimated...Ch. 10 - A truck with a cost of 82,000 has an estimated...Ch. 10 - On February 14, Garcia Associates Co. paid 2,300...Ch. 10 - On August 7, Green River Inflatables Co. paid...Ch. 10 - Equipment was acquired at the beginning of the...Ch. 10 - Equipment was acquired at the beginning of the...Ch. 10 - Prob. 7PEACh. 10 - Prob. 7PEBCh. 10 - On December 31, it was estimated that goodwill of...Ch. 10 - On December 31, it was estimated that goodwill of...Ch. 10 - Prob. 9PEACh. 10 - Prob. 9PEBCh. 10 - Prob. 1ECh. 10 - Prob. 2ECh. 10 - Northwest Delivery Company acquired an adjacent...Ch. 10 - Warner Freight Lines Co. incurred the following...Ch. 10 - Jackie Fox owns and operates Platinum Transport...Ch. 10 - Quality Move Company made the following...Ch. 10 - Tri-City Ironworks Co. reported 44,500,000 for...Ch. 10 - Convert each of the following estimates of useful...Ch. 10 - A refrigerator used by a meat processor has a cost...Ch. 10 - A diesel-powered tractor with a cost of 180,000...Ch. 10 - Prior to adjustment at the end of the year, the...Ch. 10 - A John Deere tractor acquired on January 4 at a...Ch. 10 - A storage tank acquired at the beginning of the...Ch. 10 - Sandblasting equipment acquired at a cost of...Ch. 10 - A building with a cost of 1,200,000 has an...Ch. 10 - Willow Creek Company purchased and installed...Ch. 10 - Equipment acquired on January 8, 2013, at a cost...Ch. 10 - Equipment acquired on January 6, 2013, at a cost...Ch. 10 - Prob. 19ECh. 10 - Prob. 20ECh. 10 - Apple Inc. designs, manufactures, and markets...Ch. 10 - Prob. 22ECh. 10 - Prob. 23ECh. 10 - The following table shows the revenue and average...Ch. 10 - Prob. 25ECh. 10 - Prob. 26ECh. 10 - Prob. 27ECh. 10 - On October 1, Bentley Delivery Services acquired a...Ch. 10 - The following payments and receipts are related to...Ch. 10 - Montes Coffee Company purchased packaging...Ch. 10 - Perdue Company purchased equipment on April 1,...Ch. 10 - New lithographic equipment, acquired at a cost of...Ch. 10 - The following transactions, adjusting entries, and...Ch. 10 - Prob. 6PACh. 10 - Prob. 1PBCh. 10 - Waylander Coatings Company purchased waterproofing...Ch. 10 - Prob. 3PBCh. 10 - New tire retreading equipment, acquired at a cost...Ch. 10 - The following transactions, adjusting entries, and...Ch. 10 - Prob. 6PBCh. 10 - Prob. 1CPCh. 10 - The following is an excerpt from a conversation...Ch. 10 - Tuttle Construction Co. specializes in building...Ch. 10 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Allocate payments and receipts to fixed asset accounts The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale apparel business. The receipts are identified by an asterisk. Instructions Determine the increases to Land, Lind Improvements. and Building.arrow_forwardIdentify the letter for the principle or assumption from A through F in the blank space next to situation that it best explains or justifies: _________If $51,000 cash is paid to buy land, the land is reported on the buyer’s balance sheet at $51,000.arrow_forwardThe following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(282,600) (b) Payment for construction from note proceeds 282,600 (c) Cost of land fill and clearing 11,200 (d) Delinquent real estate taxes on property assumed by purchaser 8,870 (e) Premium on 6-month insurance policy during construction 10,260 (f) Refund of 1-month insurance premium because construction completed early (1,710) (g) Architect’s fee on building 25,770 (h) Cost of real estate purchased as a plant site (land $207,200 and building $52,900) 260,100 (i) Commission fee paid to real estate agency 9,490 (j) Installation of fences around property 4,130 (k) Cost of razing and removing building 9,910 (l) Proceeds from salvage…arrow_forward

- The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(282,600 ) (b) Payment for construction from note proceeds 282,600 (c) Cost of land fill and clearing 11,200 (d) Delinquent real estate taxes on property assumed by purchaser 8,870 (e) Premium on 6-month insurance policy during construction 10,260 (f) Refund of 1-month insurance premium because construction completed early (1,710 ) (g) Architect’s fee on building 25,770 (h) Cost of real estate purchased as a plant site (land $207,200 and building $52,900) 260,100 (i) Commission fee paid to real estate agency 9,490 (j) Installation of fences around property 4,130 (k) Cost of razing and removing building 9,910 (l) Proceeds from salvage of…arrow_forwardThe following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk next to the item letter. a. Fee paid to attorney for title search $ 2,500 b. Cost of real estate acquired as a plant site: Land 285,000 Cost of real estate acquired as a plant site: Building (to be demolished) 55,000 c. Delinquent real estate taxes on property, assumed by purchaser 15,500 d. Cost of razing and removing building acquired in B 5,000 e.* Proceeds from sale of salvage materials from old building 4,000 f. Special assessment paid to city for extension of water main to the property 29,000 g. Architect’s and engineer’s fees for plans and supervision 60,000 h. Premium on one-year insurance policy during construction 6,000 i. Cost of filling and grading land 12,000 j.* Money borrowed to pay building contractor 900,000 k. Cost of repairing windstorm damage during…arrow_forwardThe following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk next to the item letter. a. Fee paid to attorney for title search $ 2,500 b. Cost of real estate acquired as a plant site: Land 285,000 Cost of real estate acquired as a plant site: Building (to be demolished) 55,000 c. Delinquent real estate taxes on property, assumed by purchaser 15,500 d. Cost of razing and removing building acquired in B 5,000 e.* Proceeds from sale of salvage materials from old building 4,000 f. Special assessment paid to city for extension of water main to the property 29,000 g. Architect’s and engineer’s fees for plans and supervision 60,000 h. Premium on one-year insurance policy during construction 6,000 i. Cost of filling and grading land 12,000 j.* Money borrowed to pay building contractor 900,000 k. Cost of repairing windstorm damage during…arrow_forward

- The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(280,800 ) (b) Payment for construction from note proceeds 280,800 (c) Cost of land fill and clearing 12,020 (d) Delinquent real estate taxes on property assumed by purchaser 7,470 (e) Premium on 6-month insurance policy during construction 12,360 (f) Refund of 1-month insurance premium because construction completed early (2,060 ) (g) Architect’s fee on building 28,020 (h) Cost of real estate purchased as a plant site (land $208,600 and building $50,000) 258,600 (i) Commission fee paid to real estate agency 8,480 (j) Installation of fences around property 3,960 (k) Cost of razing and removing building 10,190 (l) Proceeds from salvage of…arrow_forwardFor each of the following situations write the principle, assumption, or concept that justifies or explains what occurred. A) Land is purchased for $205,000 cash; the land is reported on the balance sheet of the purchaser at $205,000.B)A company records the expenses incurred to generate the revenues reported. C)When preparing financials for a company, the owner makes sure that the expense transactions are kept separate from expenses of the other company that he owns. *arrow_forwardThe following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(294,000 ) (b) Payment for construction from note proceeds 294,000 (c) Cost of land fill and clearing 10,230 (d) Delinquent real estate taxes on property assumed by purchaser 7,990 (e) Premium on 6-month insurance policy during construction 11,280 (f) Refund of 1-month insurance premium because construction completed early (1,880 ) (g) Architect’s fee on building 26,210 (h) Cost of real estate purchased as a plant site (land $201,800 and building $54,800) 256,600 (i) Commission fee paid to real estate agency 8,660 (j) Installation of fences around property 3,810 (k) Cost of razing and removing building 11,840 (l) Proceeds from salvage of…arrow_forward

- The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. a. Money borrowed to pay building contractor (signed a note) $(275,000) b. Payment for construction from note proceeds 275,000 c. Cost of land fill and clearing 8,000 d. Delinquent real estate taxes on property assumed by purchaser 7,000 e. Premium on 6-month insurance policy during construction 6,000 f. Refund of 1-month insurance premium because construction completed early (1,000) g. Architect’s fee on building 22,000 h. Cost of real estate purchased as a plant site (land $200,000 and building $50,000) 250,000 i. Commission fee paid to real estate agency 9,000 j. Installation of fences around property 4,000 k. Cost of razing and removing building 11,000 l. Proceeds from salvage of demolished…arrow_forwardWhich of the following is correct when land costing $23,000 is sold for $31,000? The land was a component of property and equipment on the balance sheet.arrow_forwardHow should the following expenditures and receipts related to land, land improvements, and buildings acquired for use in a business enterprise be classified? 1. Money borrowed to pay building contractor 2. Payment for construction from note proceeds 3. Cost of land fill and clearing 4. Delinquent real estate taxes on property assumed AUDPRO2 32 Exercise 1 5. Premium on 6-month insurance policy during construction 6. Architect’s fee on building 7. Cost of real estate purchased as a plant site (land, P2,000,000; building, P500,000) 8. Commission fee paid to real estate agency 9. Installation of fences around property 10. Cost of razing and removing buildingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Property, Plant and Equipment (PP&E) - Introduction to PPE; Author: Gleim Accounting;https://www.youtube.com/watch?v=e_Hx-e-h9M4;License: Standard Youtube License