Concept explainers

a.

The total product cost and average cost per unit.

a.

Explanation of Solution

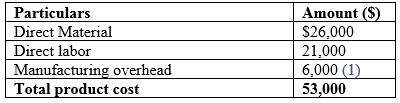

Product cost:

It is the cost incurred by the company during the process of manufacturing the product.

Given information:

- The raw material is $26,000.

- The wages for production workers are $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000, and an expected life is 6 years.

- The completed production of Company S is 10,000 units.

The calculation of total product cost for the year 2018 is as follows:

Hence, the total cost of the product for the year 2018 is $53,000.

The calculation average cost per unit for the year 2018 is as follows:

Hence, the average cost per unit for the year 2018 is $5.30.

Working notes:

The calculation of manufacturing overheads is as follows:

Hence, the manufacturing overheads are $6,000.

(1)

b.

The cost of goods sold that appears in 2018 income statement.

b.

Explanation of Solution

Cost of goods sold

The cost of goods sold is the accumulation of all the direct costs incurred in the process of producing a product. It excludes the indirect expenses.

Given information:

- The total number of units sold by Company S is 8,000 units.

The calculation of total cost of goods sold for the year 2018 is as follows:

Hence, the total cost of goods sold is $41,400.

c.

The cost of ending inventory that appears on 31st December 2018 balance sheet.

c.

Explanation of Solution

Inventory:

It is the term for products that are ready for sale and raw materials that are used in the making of the final product.

Given information:

- The total number of units sold by Company S is 8,000 units.

- The completed production of Company S is 10,000 units.

The calculation of ending inventory for the year 2018 is as follows:

Hence, the ending inventory for the year 2018 is $10,600.

d.

The total amount of net income for the year 2018.

d.

Explanation of Solution

Financial statement:

The financial statement which reports the revenues and expenses from business operations and the result of those operations as the net income or net loss for a particular time period is referred to as an income statement.

Given information:

- The raw material is $26,000.

- The wages for production workers is $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000, and an expected life is 6years.

- The total number of units sold by Company S is 8,000 units at cost of $9 per unit.

- The completed production of Company S is 10,000 units.

- The common stock of the Company S is $89,000.

- The purchased furniture for office at $32,000 and an expected life is 8years.

- The Company pays $12,000 as salary and $21,000 as wages for the production purpose.

- Company S pays 26,000 for the raw materials.

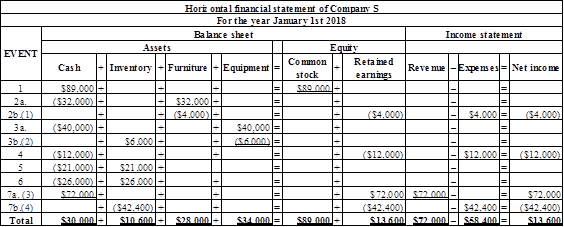

The calculation of net income of the Company S for the year 2018 is as follows:

Table (2)

Hence, the net income of the Company for the year 2018 is $13,600.

Working note:

The calculation of depreciation value for furniture:

Hence, the depreciation value of furniture is $4,000.

(1)

The calculation of depreciation value for manufacturing equipment’s:

Hence, the depreciation value of the manufacturing equipment is $6,000.

(2)

The calculation of total units sold at the rate of $9 per unit.

The total units sold by the Company S are 72,000.

(3)

The calculation of total inventory at the average cost per unit.

The total inventory at the average cost is 42,400.

(4)

e.

The total amount of net income for the year 2018.

e.

Explanation of Solution

Financial statement:

The financial statement which reports the revenues and expenses from the business operations and the result of those operations as net income or net loss for a particular time period is referred to as an income statement.

Given information:

- The raw material is 26,000.

- The wages for production workers is $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000, and an expected life is 6years.

- The total number of units sold by Company S is 8,000 units at cost of $9 per unit.

- The completed production of Company S is 10,000 units.

- The common stock of the Company S is $89,000.

- The purchased furniture for office at $32,000 and an expected life is 8 years.

- The Company pays $12,000 as salary and $21,000 as wages for the production purpose.

- Company S pays 26,000 for raw materials.

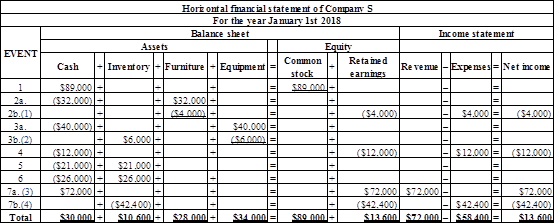

The calculation of

Table (3)

Hence, the net income of the Company for the year 2018 is $13,600.

Working note:

The calculation of depreciation value for furniture:

Hence, the depreciation value of furniture is $4,000.

(1)

The calculation of depreciation value for manufacturing equipment’s:

Hence, the depreciation value of manufacturing equipment is $6,000.

(2)

The calculation of total units sold at the rate of $9 per unit.

The total units sold by the Company S are 72,000.

(3)

The calculation of total inventory at the average cost per unit.

The total inventory at the average cost is 42,400.

(4)

f.

The total assets that appears on the balance sheet.

f.

Explanation of Solution

Financial statement:

The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as an income statement.

Given information:

- The raw material is $26,000.

- The wages for production workers is $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000 and an expected life is 6years.

- The total number of units sold by Company S is 8,000 units at cost of $9 per unit.

- The completed production of Company S is 10,000 units.

- The common stock of the Company S is $89,000.

- The purchased furniture for office at $32,000 and an expected life is 8 years.

- The Company pays $12,000 as salary and $21,000 as wages for the production purpose.

- Company S pays 26,000 for raw materials.

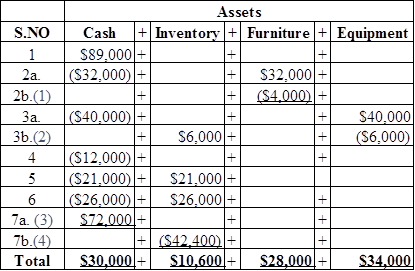

The table showing calculation of assets:

Table (4)

The calculation of total assets is as follows:

Hence, the total amount of assets of the Company for the year 2018 is $102,600.

Working note:

The calculation of depreciation value for furniture:

Hence, the depreciation value of furniture is $4,000.

(1)

The calculation of depreciation value for manufacturing equipment’s:

Hence, the depreciation value of manufacturing equipment is $6,000.

(2)

The calculation of total units sold at the rate of $9 per unit.

The total units sold by the Company S are 72,000.

(3)

The calculation of total inventory at the average cost per unit.

The total inventory at the average cost is 42,400.

(4)

Want to see more full solutions like this?

Chapter 10 Solutions

GEN COMBO LOOSELEAF SURVEY OF ACCOUNTING; CONNECT ACCESS CARD

- Communication Godwin Co. owns three delivery trucks. Details for each truck at the end of the most recent year follow: Age Expected Useful Life Initial Cost Accumulated Depreciation Truck 1 3 6 22,500 11,250 Truck 2 5 6 26,250 21,875 Truck 3 2 6 28,500 9,500 At the beginning of the year, a hydraulic lift is added to Truck 1 at a cost of 4,500. The addition of the hydraulic lift will allow the company to deliver much larger objects than could previously be delivered. At the beginning of the year, the engine of Truck 2 is overhauled at a cost of 5,000. The engine overhaul will extend the trucks useful life by three years. Write a short memo to Godwins chief financial officer explaining the financial statement effects of the expenditures associated with Trucks 1 and 2.arrow_forwardAsset turnover The Home Depot reported the following data (in millions) in its recent financial statements: Year 2 Year 1 Sales 83,176 78,812 Total assets at the end of the year 39,946 40,518 Total assets at the beginning of the year 40,518 41,084 a. Determine the asset turnover for The Home Depot for Year 2 and Year 1. Round to two decimal places. b. What conclusions can be drawn concerning the trend in the ability of The Home Depot to effectively use its assets to generate sales?arrow_forwardQUESTION 1The following trial balance relates to Golden Ltd at 30th September 2018 GHS'000 GHS'000Sales (a) 760,000Material purchases (b) 128,000Production labour (b) 248,000Factory overheads (b) 160,000Distribution costs 28,400Administrative expenses (c) 92,800Finance costs 700Investment income 1,600Leased property - at cost (b) 100,000Plant and equipment - at cost (b) 89,000Accumulated amortisation/depreciation at 1/10/2017- leased property 20,000- plant and equipment…arrow_forward

- Brief Exercise 9-08 Pharoah Company sells office equipment on July 31, 2022, for $23,160 cash. The office equipment originally cost $78,110 and as of January 1, 2022, had accumulated depreciation of $38,300. Depreciation for the first 7 months of 2022 is $3,500.Prepare the journal entries to (a) update depreciation to July 31, 2022, and (b) record the sale of the equipment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation Debit Credit (a) Enter an account title to update depreciation to July 31 Enter a debit amount Enter a credit amount enter an account title to update depreciation to July 31 Enter a debit amount Enter a credit amount (b) Enter an account title to record the sale of the equipment Enter a debit amount Enter a…arrow_forwardASSIGNMENT 05: JOURNAL ENTRIES FOR MERCHANDISING BUSINESS Transactions for the 1st year 200x:Jan 1 Owner invested P1,000,000 cash Feb 1 Purchased furniture worth P120,000 with 8 years useful life and no salvage value Feb 12 Purchases on account, P600,000; terms: 2/20; n/30. FOB shipping point, freight prepaid, P2,000. Mar 2 Sold merchandise on account, P900,000; terms 10; 5/15, n/30. FOB shipping point, freight prepaid, P25,000 Mar 7 Collected 80% of receivable on March 2 Mar 12 Paid purchases made on Feb. 12 Mar 23 Received sales returns, P25,000 from sales on Mar 2 Apr 2 Collected remaining receivables on Mar 2. Dec. 30 Paid Rent, P80,000 and utilities, P16,000 Dec. 31 Accrued salary, P120,000 and merchandise inventory per count P60,000 Transactions for the 2nd year 200y: Jan. 15 Paid accrued salary of 200x Apr 27 Purchased goods on account P480,000. FOB destination, freight prepaid P14,000 May 22 Sold goods for cash to…arrow_forwardDd6). Required information Skip to question [The following information applies to the questions displayed below.] On January 1, Super Saver Groceries purchased store equipment for $29,500. Super Saver estimates that at the end of its 10-year service life, the equipment will be worth $3,500. During the 10-year period, the company expects to use the equipment for a total of 13,000 hours. Super Saver used the equipment for 1,700 hours the first year. Required:arrow_forward

- Question 6 a) Ibu Mertuaku Berhad manufactures paper boxes. The company closes its accounts annually on 31 May, and in its year ended 31 May 2022, the company acquired the following assets: A lorry was acquired under a hire purchase scheme and the relevant details are as follows: A heavy machine was acquired for RM3,000 and used in the company. A reconditioned van was acquired for RM130,000 to transport their management team. The van was not licensed as a commercial vehicle. On 3 October 2022, the company bought a folding machine for RM120,000. Required: a)Compute the total capital allowances claimable by Ibu Mertuaku Berhad for the above assets for the year of assessment 2022.arrow_forwardAssignment 1 The following is the Trial Balance of Sonia HR Enterprises, a dealer in HR Software, as at 31stDecember, 2021. GHS GHS Capital 240,000 Receivables and Payables 159,000 51,000 Inventory 99,000 Motor vehicles: (cost) 72,500 Accumulated depreciation (31 December 2020) 32,500 Office equipment: (cost) 90,000 Accumulated depreciation (31 December 2020) 30,000 Administrative expenses 26,000 Purchases and sales…arrow_forwardB 23 Brown Company constructed a building for its own use. Construction started on January 3, 2021 and the building was completed on December 31, 2021. Costs incurred during the year were as follows: January 1 - P400,000 April 1 - 500,000 August 1 - 480,000 December 1 - 180,000 To help finance the construction of the building, the company obtained a two-year, 10% loan of P800,000. Prior to the disbursement of the loan proceeds, it was temporarily invested and earned interest income of P12,000. During the year 2021, the company has also general borrowings as follows: 10% Notes Payable, due March 1, 2023 - P1,000,000 12% Notes Payable, due Dec. 31, 2024 - 1,500,000 How much interest is capitalized?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning