a.

The total amount of upstream cost.

a.

Explanation of Solution

Upstream cost: This cost is incurred before starting the manufacturing process such as research and development, and product design.

The given information:

- Fashion design cost is $20,000.

- Research and development cost is $30,000.

The calculation of upstream cost is as follows:

Hence, the upstream cost is $50,000.

b.

The total amount of downstream cost.

b.

Explanation of Solution

Downstream: This cost is incurred after starting the manufacturing process such as marketing, distribution, and customer service

The given information:

- Advertisement cost is $25,000.

- Administrative cost is $45,000.

The calculation of downstream cost is as follows:

Hence, the downstream cost is $70,000.

c.

The total amount of midstream cost.

c.

Explanation of Solution

Mid-stream: It is a cost incurred in making a product. It includes direct labor, direct materials, and manufacturing

The given information:

- Direct materials are $15.

- Direct labor is $17

- Manufacturing overheads are $8.

- Total production is 4,000 units.

The calculation of midstream cost is as follows:

Hence, the midstream cost is $160,000.

d.

The total amount of sales price.

d.

Explanation of Solution

The given information:

- Direct materials are $15.

- Direct labor is $17

- Manufacturing overheads are $8.

- Total production is 4,000 units.

- 150% on GAPP defined product.

The calculation of sales price is as follows:

Hence, the sales price is $60.

e.

The income statement based on GAPP.

e.

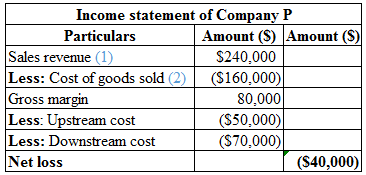

Answer to Problem 25P

The calculation of income statement of Company D is as follows:

Hence, the company has a net loss of $40,000.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

The given information:

- Direct materials are $15.

- Direct labor is $17

- Manufacturing overheads are $8.

- Total production is 4,000 units.

- Fashion design cost is $20,000.

- Research and development cost is $30,000.

- Advertisement cost is $25,000.

- Administrative cost is $45,000.

The sales revenue is calculated as follows:

Hence, the sales revenue is $240,000.

(1)

The cost of goods sold is calculated as follows:

Hence, the cost of goods sold is $160,000.

(2)

f.

Explain the reason for the net loss.

f.

Explanation of Solution

The management failed to consider the cost of downstream and upstream while pricing the product. Only the cost of GAPP based prices were considered. The selling price of the product is $60 and the total cost price of the product is $70 (3). Therefore, the selling price is less than the cost per unit and this explains why the company is facing loss.

Working notes:

The total cost per unit is calculated as follows:

Hence, the total cost per unit is $70.

Want to see more full solutions like this?

Chapter 10 Solutions

GEN COMBO LOOSELEAF SURVEY OF ACCOUNTING; CONNECT ACCESS CARD

- Case 1: The Lexington Company produces gas grills. This year’s expected production is 20,000 units. Currently, Lexington makes the side burners for its grills. Each grill includes two side burners. Lexington’s management accountant reports the following costs for making the 40,000 burners: Cost per Unit Cost for 40,000 units Direct materials $8.00 $320,000 Direct manufacturing labor 4.00 160,000 Variable manufacturing overhead 2.00 80,000 Inspection, setup, materials handling 8,000 Machine rent 12,000 Allocated fixed costs of plant administration, taxes, and insurance 80,000 Total costs $660,000 Lexington has received an offer from an outside vendor to supply any number of burners Lexington requires at $14.80 per burner. The following additional information is available: Inspection, setup, and materials-handling costs vary with the number of batches in which the burners are produced. Lexington produces…arrow_forwardQuestion 3 Part II The Advent Corporation also manufactures chairs and tables at one of their divisions. The following isdata for its chair manufacturing department for the month of February.Actual Sales 4,500 ChairsSelling Price $60.00 per chairVariable Costs $15.00 per chairFixed Costs $72,000 Required:a. Calculate the Contribution Margin per chair. b. Compute the Contribution Margin Ratio. c. Determine the break-even point in revenue dollars. d. Calculate the Margin of Safety in revenue dollars. e. If the company wishes to increase its total dollar contribution margin by 50% in March, by how muchwill it have to increase sales, in units, if all factors remain the same?arrow_forwardQuestion 6: Your company currently produces a range of three products, D, E, and F to which the following details relate for Period 2. D E F Production (units) 1,500 2,500 14,000 Material cost per unit Br. 18 Br. 10 Br. 20 Labor hours per unit 1 3 2 Machine hours per unit 3 2 6 Labor costs are Br. 8 per hour and production overheads are currently absorbed in the conventional system by reference to machine hours. Total production overheads for Period 2 have been analyzed as follows: Set-up cost 327,250 Handling cost 187,000 Machine cost 140,250 Inspection cost 280,500 935,000 Calculate the cost per unit for each product using conventional The introduction of an ABC is being considered and to that end the following volume…arrow_forward

- MA2. Barley Brindle produces a single product, Product B. One unit of product B has a prime cost of £6.20, which included one hour of direct labour at £6.20, and each unit uses 0.5 hours of machine time. Estimated production of Product B in 2013 is 60,000 units. Total production overheads are estimated at £218,000. Calculate the overhead recovery rates and total cost of production, based on: a)Direct labour hours b)Machine hours c)Units of productionarrow_forwardQuestion Content Area Strait Co. manufactures office furniture. During the most productive month of the year, 3,600 desks were manufactured at a total cost of $82,000. In the month of lowest production, the company made 1,180 desks at a cost of $61,400. Using the high-low method of cost estimation, total fixed costs are a. $61,400 b. $82,000 c. $51,364 d. $20,600arrow_forwardQuestion Q1Moona Inc. produces Mobile phones. Information of the company's operations last year appear below: Fixed cost:Fixed Manufacturing overhead Rs 40,000Fixed Selling & Administrative Rs 60,000Selling Price per unit Rs 100Variable cost per unit:Direct Materials Rs 30Direct labor Rs 10Variable Manufacturing overhead Rs 5Variable Selling & Administrative Rs 2Units In beginning Inventory 0Units Produced 2000Units Sold 1900 Required: a. Compute the unit product cost under both absorption and variable costing.b. Prepare an income statement for the year using absorption costing.c. Prepare a contribution format income statement for the year using variable costing. d. Prepare a report reconciling the difference in net operating income between absorption and variable costing for the year.arrow_forward

- Question 2 Mika Sdn Bhd manufacture vase branded as Flora for local market. The following is the information on production cost and other expenses related to July 2021. Details of cost elements 2000 Units of Vases (RM) Fixed Administration expenses 4,500 Indirect labour 9,500 Power 1,000 Fixed Rental 1,400 Selling and Distribution 6,500 Direct labour 25,000 Factory supplies 2,500 Direct materials 50,000 Total cost 64,200 The averages selling price of the vase is RM50.20 per unit. The maximum capacity of the production is 10,000 vase per month. Required: (a). Calculate the break even point (in unit and RM) for Mika Sdn Bhd. (b). What should be the new selling price for the company to break even if it can only sell 1,500 vases per month? (c). Based on (a) above, calculate the expected net profit at a sales level of 3,000 vases when an additional commission of RM1 per vase is incurred after the…arrow_forwardChapter 10 C1 Cullumber produces and sells two products—aluminum and vinyl. Each of these products is made in a dedicated manufacturing facility, and the product line managers are evaluated based on the product line’s return on investment. The following data is from the most recent year of operations. Aluminum Vinyl Sales $4,800,000 $4,200,000 Variable costs 2,304,000 2,355,000 Direct fixed costs 1,728,000 1,530,000 Average assets 3,200,000 1,500,000arrow_forwardQuestion 1.1 Bichette Soda Company operates many bottling plants around the globe. At its Mississauga plant, where nine different brands are bottled, the following costs were incurred in the current year to produce 15,000,000 cans of soft drink: Development costs of adding the new product "Pop Plus" amounted to $614,000. Material handling costs of inspecting and handling concentrate, bottles, packages, and so forth amounted to $433,500. These costs are allocated to each production run. Incoming materials purchase costs that can be directly traced to individual products being canned and packaged. These costs are purely variable with output level and amounted to $2,213,000. Executive salaries and other central administration overhead amounted to $423,000. Plant overhead including costs related to: supervision, safety, energy and plant insurance amounted to $623,000. The cost of cleaning and calibrating equipment for each production run amounted to $171,500. Required…arrow_forward

- H6. Broduer Aquatics manufactures swimming pool equipment. Broduer estimates total manufacturing overhead costs next year to be $2,500,000 The company also estimates it will use 50,000 direct labour hours and incur $1,000,000 of direct labour cost next year. In addition, the machines are expected to be run for 30,000 hours. Compute the predetermined manufacturing overhead rate for next year under the following independent situations: 1. Assume that Brodeur uses direct labour hours as its manufacturing overhead allocation base. 2. Assume that Brodeur suses direct labour cost as its manufacturing overhead allocation base. 3. Assume that Brodeur uses machine hours as its manufacturing allocation basearrow_forwardQ-5. A company manufactures three products A, B, and C using the same equipment and processes. Data for the period is given below. C B A 20000 25000 2000 Production (units) $20 $20 $20 Sales price (per unit) $5 S10 $10 Material cost per unit hour Labour hours per unit hours hour Labour is paid at the rate of S5 per hour Overheads for the period were as follows: 90000 Set up costs 30000 Receiving 15000 Dispatch Machining 55000 $190000 Cost driver data: B Machine hours per unit 10 13 2 Number of set ups Number of deliveries received 2 20 20 20 Number of orders dispatched Required: 1.Calculate the cost per unit, absorbing all the overheads on the basis of labour hours. (5) 2. Calculate the cost per unit, absorbing the overheads on the basis of Activity based costing approach. (5)arrow_forwardComprehensive Problem 5Part A: Note: You must complete part A before completing parts B and C. Genuine Spice Inc. began operations on January 1 of the current year. The company produces eight- ounce bottles of hand and body lotion called Eternal Beauty. The lotion is sold wholesale in 12-bottle cases for $100 per case. There is a selling commission of $20 per case. The January direct materials, direct labor, and factory overhead costs are as follows: DIRECT MATERIALS Cost Behavior Units per Case Cost per Unit Direct Materials Cost per Case Cream base Variable 100 ozs. $0.02 $2.00 Natural oils Variable 30 ozs. 0.30 9.00 Bottle (8-oz.) Variable 12 bottles 0.50 6.00 $17.00 DIRECT LABOR Department Cost Behavior Time per Case Labor Rate per Hour Direct Labor Cost per Case Mixing Variable 20 min. $18.00 $6.00 Filling Variable 5 14.40 1.20 25 min. $7.20 FACTORY OVERHEAD Cost Behavior Total Cost…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education