a.

The

a.

Answer to Problem 30P

Option 1

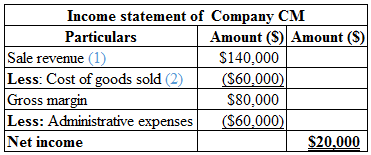

Calculation of income statement of Company CM is as follows:

Table (1)

Hence, the net income of Company CM is $20,000.

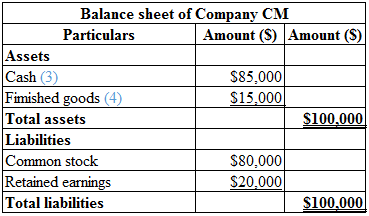

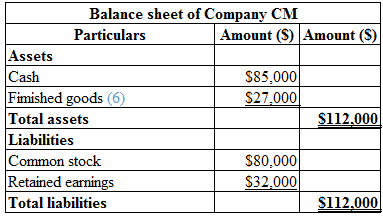

Calculation of balance sheet of Company CM is as follows:

Table (2)

Option 2

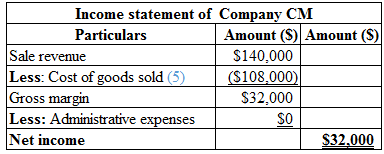

Calculation of income statement of Company CM is as follows:

Table (3)

Hence, the net income of Company CM is $32,000.

Calculation of balance sheet of Company CM is as follows:

Table (4)

Explanation of Solution

Income statement:

It is the financial statement of a company that shows all the incomes earned and expenditures incurred by the company for a particular period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarizes the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

Calculate the sale revenue:

Hence, the sales revenue is $140,000.

(1)

Calculate the cost per unit:

Hence, the cost per unit is $15.

Calculate the cost of goods sold:

Hence, the cost of goods sold is $60,000.

(2)

Calculate the total cash:

Hence, the total cash is $85,000.

(3)

Calculate the total finished goods:

Hence, the finished goods is $15,000.

(4)

Calculate the cost per unit:

Hence, the cost per unit is $27.

Calculate the cost of goods sold:

Hence, the cost of goods sold is $108,000.

(5)

Calculate the total finished goods:

Hence, the finished goods is $27,000.

(6)

b.

The option in the financial statement that gives a favourable image to the creditors and investors.

b.

Answer to Problem 30P

Option 2 is the financial statement that gives a favorable impression to creditors and investors with a greater net income of $12,000 than option 1’s net income.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the incomes gained and expenditures incurred by the company for a time period.

Balance sheet:

Balance sheet is one of the financial statements that summarizes the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

The option that gives the favorable image to the creditors and investors is as follows:

Option 2 provides the financial statement that gives a favorable image to the creditors and investors because the net income in option 2 is greater than the net income in option 1.

c.

The amount of bonus under each option and recognize the option that provides a higher bonus.

c.

Answer to Problem 30P

Option 2 provides the president with a higher bonus of $6,400.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarizes the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Calculation of bonus under option 1 is as follows:

Hence, the bonus received by the president under option 1 is $4,000.

Calculation of bonus under option 2 is as follows:

Hence, the bonus received by the president under option 2 is $6,400.

d.

The amount of tax rate under each option and recognize which option pays less tax.

d.

Answer to Problem 30P

Option 1 minimizes the cost of income tax expenses for the company by $6,000.

Explanation of Solution

Calculation of income tax under option 1 is as follows:

Hence, the income tax expenses under option 1 is $6,000.

Calculation of income tax under option 2 is as follows:

Hence, the bonus received by the president under option 2 is $9,600

e.

Comment on the conflict among the company’s president as determined in requirement c and the owner-based requirement d, and define an incentive compensation plan that will neglect the conflict.

e.

Explanation of Solution

The conflicts between the owner and the president are as follows:

Option 2 provides the president with a higher bonus of $6,400. Option 1 minimizes the cost of income tax expenses for the company by $6,000. These are the two conflicts between the owner and the president.

The reasons to avoid these conflicts are as follows:

- The bonus plans of the company can be tied up with the company’s stock price, instead of net income.

Market efficiency increases; as a result, the performance of the company increases, which creates a value to the company’s stock price.

Want to see more full solutions like this?

Chapter 10 Solutions

GEN COMBO LOOSELEAF SURVEY OF ACCOUNTING; CONNECT ACCESS CARD

- Question 2 The Anthony Company, a sole proprietorship, reports the following information pertaining to its operating activities: During the year, the company purchased $40,000 of direct materials and incurred $21,000 of direct labor costs. Total manufacturing overhead costs for the year amounted to $18,000. Selling and administrative expenses amounted to $60,000, and the company’s annual sales amounted to $250,000. Prepare Anthony’s schedule of the cost of finished goods manufactured. Prepare Anthony’s income statement (ignore income taxes).arrow_forwardQ1) A company has the following accounts’ balances at the end of the year: Building (Net) 20 year life left $ 4,000,000. The replacement cost for the Building is 4,500,000 USD. Inventory 40,000 unit at $20 each with a replacement cost $22. And cost of goods sold of $500,000 with a replacement cost of 520,000. Required: Indicate how the above information would affect the financial statements of the company when adopting the current cost accounting model. You need to determine the realized and unrealized profit.arrow_forwardQUESTION 1: Schedule of Cost of Goods Manufactured: Income Statement. Richmond Chocolates Limited, a manufacturing Company, produces a single product. The following information has been taken from the company’s production, sales and cost records for the year ended December 31, 2021. Sales $ 450,000 Indirect Labour 12,000 Utilities 15,000 Direct Labour 70,000 Depreciation, factory equipment 21,000 Raw materials purchased 165,000 Depreciation, sales equipment 18,000 Insurance expired during the year 4,000 Rent on facilities 50,000 Selling and administrative salaries 32,000 Advertising 75,000 Additional information about the company follows: Some 60 percent of the utilities costs and 75 percent of the expired insurance apply to factory operations. The remaining amounts apply to selling and administrative activities Only 80 percent of the rent on facilities apply to factory operations: the remainder applies to…arrow_forward

- QUESTION 1: Schedule of Cost of Goods Manufactured: Income Statement. Richmond Chocolates Limited, a manufacturing Company, produces a single product. The following information has been taken from the company’s production, sales and cost records for the year ended December 31, 2021. Sales $ 450,000 Indirect Labour 12,000 Utilities 15,000 Direct Labour 70,000 Depreciation, factory equipment 21,000 Raw materials purchased 165,000 Depreciation, sales equipment 18,000 Insurance expired during the year 4,000 Rent on facilities 50,000 Selling and administrative salaries 32,000 Advertising 75,000 Additional information about the company follows: Some 60 percent of the utilities costs and 75 percent of the expired insurance apply to factory operations. The remaining amounts apply to selling and administrative activities Only 80 percent of the rent on facilities apply to factory operations: the remainder applies to…arrow_forwardQUESTION 1: Schedule of Cost of Goods Manufactured: Income Statement. Richmond Chocolates Limited, a manufacturing Company, produces a single product. The following information has been taken from the company’s production, sales and cost records for the year ended December 31, 2021. Sales $ 450,000 Indirect Labour 12,000 Utilities 15,000 Direct Labour 70,000 Depreciation, factory equipment 21,000 Raw materials purchased 165,000 Depreciation, sales equipment 18,000 Insurance expired during the year 4,000 Rent on facilities 50,000 Selling and administrative salaries 32,000 Advertising 75,000 Additional information about the company follows: Some 60 percent of the utilities costs and 75 percent of the expired insurance apply to factory operations. The remaining amounts apply to selling and administrative activities Only 80 percent of the rent on facilities apply to factory operations: the remainder…arrow_forwardExercise 2-27 Statement of comprehensive Income and schedule of cost of goods manufactured. The Howell Corporation has the following account balances (all in millions): For Specific Date Direct Materials, January 01, 2019 $18 Work in process, January 01, 2019 12 Finished Goods, January 01, 2019 84 Direct Materials, December 31, 2019 24 Work in Process, December 31, 2019 6 Finished Goods, December 31, 2019 66 For the Year 2019 Purchased of Direct Materials $390 Direct Manufacturing Labour 120 Depreciation, - Plant, Building, and Equipment 96 Plant Supervisory Salaries 6 Miscellaneous Plant Overhead 42 Revenues 1140 Marketing, Distribution and Customer Service Cost 288 Plant Supplies Used 12 Plant Utilities 36 Indirect Manufacturing Labour 72 Required: Prepare a statement of Comprehensive Income and a supporting schedule of goods manufactured for…arrow_forward

- Problem 3. The following costs are obtained regarding the restructuring of one of the businessoperations of DIP Inc. as of December 31, 2014:Direct expenditures arising from restructuring P1,000,000Salaries of employees to be incurred after operations cease 2,000,000Employee benefits associated with the closure of operations 3,000,000Future operating losses 4,000,000Cost of retraining or relocating continuing staff 5,000,000Marketing or advertising program to promote the new company image 6,000,000Investment in new system and distribution network 7,000,000What is the total amount to be recognized as restructuring provision as of December 31,2014?arrow_forwardGibson Manufacturing Company (CMC) was started when it acquired $92,000 by issuing common stock. During the first year of operations, the company incurred specifically identifiable product costs (materials, labor, and overhead) amounting to $53,300. CMC also incurred $77,900 of engineering design and planning costs. There was a debate regarding how the design and planning costs should be classified. Advocates of Option 1 believe that the costs should be classified as general, selling, and administrative costs. Advocates of Option 2 believe it is more appropriate to classify the design and planning costs as product costs. During the year, CMC made 4,100 units of product and sold 3,300 units at a price of $35.00 each. All transactions were cash transactions. Prepare a GAAP-based income statement for Option 1arrow_forwardGibson Manufacturing Company (CMC) was started when it acquired $92,000 by issuing common stock. During the first year of operations, the company incurred specifically identifiable product costs (materials, labor, and overhead) amounting to $53,300. CMC also incurred $77,900 of engineering design and planning costs. There was a debate regarding how the design and planning costs should be classified. Advocates of Option 1 believe that the costs should be classified as general, selling, and administrative costs. Advocates of Option 2 believe it is more appropriate to classify the design and planning costs as product costs. During the year, CMC made 4,100 units of product and sold 3,300 units at a price of $35.00 each. All transactions were cash transactions. d. Assume a 40 percent income tax rate. Determine the amount of income tax expense under each of the two options. Identify the option that minimizes the amount of the company’s income tax expense.arrow_forward

- Gibson Manufacturing Company (CMC) was started when it acquired $92,000 by issuing common stock. During the first year of operations, the company incurred specifically identifiable product costs (materials, labor, and overhead) amounting to $53,300. CMC also incurred $77,900 of engineering design and planning costs. There was a debate regarding how the design and planning costs should be classified. Advocates of Option 1 believe that the costs should be classified as general, selling, and administrative costs. Advocates of Option 2 believe it is more appropriate to classify the design and planning costs as product costs. During the year, CMC made 4,100 units of product and sold 3,300 units at a price of $35.00 each. All transactions were cash transactions. Prepare a Balance Sheet for Option 1.arrow_forwardGibson Manufacturing Company (CMC) was started when it acquired $92,000 by issuing common stock. During the first year of operations, the company incurred specifically identifiable product costs (materials, labor, and overhead) amounting to $53,300. CMC also incurred $77,900 of engineering design and planning costs. There was a debate regarding how the design and planning costs should be classified. Advocates of Option 1 believe that the costs should be classified as general, selling, and administrative costs. Advocates of Option 2 believe it is more appropriate to classify the design and planning costs as product costs. During the year, CMC made 4,100 units of product and sold 3,300 units at a price of $35.00 each. All transactions were cash transactions. What is the Cost of Goods Sold for Option 1?arrow_forwardQuestion 3 A Lighting industry manufactures and sells a single product, heavy-duty battery operated standby lamp. The financial controller has prepared the following income statement for the most recent year: An Industry Income Statement under Absorption costing, for the year ended December 31. Sales Revenue RM2,450,000 Less: Cost of Goods Sold RM1,140,000 Gross Profit RM1,310,000 Less: Operating Expenses RM 750,000 Operating Income RM 560,000 The company produced 40,000 units and sold 30,000 units during the ear ending Dec 31. Fixed manufacturing overhead (MOH) for the year was RM320,000, while fixed operating expenses were RM450,000. Assume per unit cost of Direct Material and direct labor is RM15 and RM12 respectively. The company had no beginning inventory. Requirements Will the company’s operating income under variable costing be higher, lower or the same as operating income under absorption costing? Why? Project the company’s operating income…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning