Concept explainers

Problem 1-21A Effect of product versus period costs on financial statements

Sinclair Manufacturing Company experienced the following accounting events during its first year of operation. With the exception of the

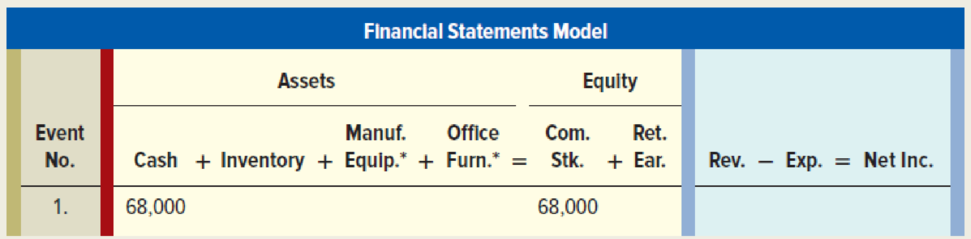

1. Acquired $68,000 cash by issuing common stock.

2. Paid $8,700 for the materials used to make its products, all of which were started and completed during the year.

3. Paid salaries of $4,500 to selling and administrative employees.

4. Paid wages of $10,000 to production workers.

5. Paid $9,600 for furniture used in selling and administrative offices. The furniture was acquired on January 1. It had a $1,600 estimated salvage value and a four-year useful life.

6. Paid $16,000 for manufacturing equipment. The equipment was acquired on January 1. It had a $1,000 estimated salvage value and a five-year useful life.

7. Sold inventory to customers for $35,000 that had cost $14,000 to make.

Required

Explain how these events would affect the balance sheet and income statement by recording them in a horizontal financial statements model as indicated here. The first event is recorded as an example.

*Record

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

SURVEY OF ACCOUNTING 360DAY CONNECT CAR

- Problem 3.7 The Oakland Mills Company has disclosed the following financial information in its annual reports for the period ending March 31, 2011: sales of $1,438,049, costs of goods sold of $658,116.42, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has a tax rate of 35 percent. What is the company's net income? Set up an income statement to answer the question. (Round answers to 2 decimal places, e.g. 15.25)arrow_forwardExercise 3-2 (Static) Prepare T-Accounts [LO3-2, LO3-4] Jurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a recent month is shown below. $94,000 in raw materials were purchased for cash. $89,000 in raw materials were used in production. Of this amount, $78,000 was for direct materials and the remainder was for indirect materials. Total labor wages of $132,000 were incurred and paid. Of this amount, $112,000 was for direct labor and the remainder was for indirect labor. Additional manufacturing overhead costs of $143,000 were incurred and paid. Manufacturing overhead of $152,000 was applied to production using the company’s predetermined overhead rate. All of the jobs in process at the end of the month were completed. All of the completed jobs were shipped to customers. Any underapplied or overapplied overhead for the period was closed to Cost of Goods Sold. Required: 1. Post the above transactions…arrow_forwardExercise One: The data presented below are related to Gamma Company and has been gathered at June 30, 2020. Gamma Company prepares its financial statements Quarterly. 1. Salaries $1,300 were incurred but unpaid at June 30, 2020. 2. $2,000 of the unearned revenues has been earned prior to June 30, 2020. 3. The equipment of the Company has a cost of $10,000 with a 5 years useful life and no salvage value. It was purchased on January 1, 2020. 4. Services provided to customers totaling $5,000 were not yet billed or recorded on June 30, 2020. 5. The 6-month insurance policy was purchased on May 1, 2020 for $3,000. 6. Utilities expenses of $500 were incurred but unpaid at June 30, 2020. 7. Supplies totaling $600 were used in the last three months. Instructions: Journalize the adjusting entries for Gamma Company at June 30, 2020. Date Accounts Ref Debit Creditarrow_forward

- Exercise One: The data presented below are related to Gamma Company and has been gathered at June 30, 2020. Gamma Company prepares its financial statements Quarterly. 1. Salaries $1,300 were incurred but unpaid at June 30, 2020. 2. $2,000 of the unearned revenues has been earned prior to June 30, 2020. 3. The equipment of the Company has a cost of $10,000 with a 5 years useful life and no salvage value. It was purchased on January 1, 2020. 4. Services provided to customers totaling $5,000 were not yet billed or recorded on June 30, 2020. 5. The 6-month insurance policy was purchased on May 1, 2020 for $3,000. 6. Utilities expenses of $500 were incurred but unpaid at June 30, 2020. 7. Supplies totaling $600 were used in the last three months. Instructions: Journalize the adjusting entries for Gamma Company at June 30, 2020. Date Accounts Refarrow_forwardIntermediate Accounting 105 Please use GAAP concepts and explanations provided with examples. New machinery, which replaced a number of employees, was installed and put in operation in the last month of the fiscal year. The employees had been dismissed after payment of an extra month’s wages, and this amount was added to the cost of the machinery. Discuss the proprietary of the charge. If it was improper, describe the proper treatment.arrow_forwardQuestion 2: - The following is the trial balance of Falcon Manufacturing Company as at March 31, 2018 Particular Rs. Particular Rs. Cash at Bank 38, 100 Indirect Labor 18, 400 Acc Receivables (net) 9, 420 Sales 496, 000 Dir Material Inv – April 1 30, 000 Sales Returns 16, 000 Work-in-process April 1 35, 725 Purchases of Material 48, 000 Fin Goods Inv April 1 19, 430 Carriage on Purchases 5, 000 Machine – Factory 600, 000 Purchases Returns 3, 000 Salary Expense 40, 500 Purchases Discount 1, 500 Machine – Office 200, 000 Direct Labor 86, 450 Acc Dep – Office machine 143, 700 Electricity 200, 000 Salary Payable 15, 500 Rent 75, 000 Indirect Material 25, 600 Depreciation (machine) 45, 000 The inventories as at March 31, 2018 are as…arrow_forward

- Question 2: - The following is the trial balance of Falcon Manufacturing Company as at March 31, 2018 Particular Rs. Particular Rs. Cash at Bank 38, 100 Indirect Labor 18, 400 Acc Receivables (net) 9, 420 Sales 496, 000 Dir Material Inv – April 1 30, 000 Sales Returns 16, 000 Work-in-process April 1 35, 725 Purchases of Material 48, 000 Fin Goods Inv April 1 19, 430 Carriage on Purchases 5, 000 Machine – Factory 600, 000 Purchases Returns 3, 000 Salary Expense 40, 500 Purchases Discount 1, 500 Machine – Office 200, 000 Direct Labor 86, 450 Acc Dep – Office machine 143, 700 Electricity 200, 000 Salary Payable 15, 500 Rent 75, 000 Indirect Material 25, 600 Depreciation (machine) 45, 000 The inventories as at March 31, 2018 are as…arrow_forwardProblem 1: During the first year of operations, a calendar year company received $14,400 in cash for rent on a portion of its building. Analysis indicates that of this amount $4,800 applies to next year. Assuming the $14,400 was recorded initially in an income statement account (revenue), record all necessary entries. Assuming the $14,400 was recorded initially in a balance sheet account (liability), record all necessary entries. Problem 2: Prior to adjustment at April 30, the end of the fiscal year, Salary Expense has a debit balance of $372,750. Salaries owed but not paid as of the same date total $5,275. On May 2, $6,000 is paid. Present all necessary entries assuming a reversing entry is used. Present all necessary entries assuming NO reversing entry is used.arrow_forwardExercise 5-9 (Part Level Submission) Suppose in its income statement for the year ended June 30, 2017, The Clorox Company reported the following condensed data (dollars in millions). Salaries and wages expenses $ 450 Research and development expense $ 110 Depreciation expense 80 Income tax expense 224 Sales revenue 5,785 Loss on disposal of plant assets 50 Interest expense 165 Cost of goods sold 3,315 Advertising expense 535 Rent expense 110 Sales returns and allowances 260 Utilities expense 50 Assume a tax rate of 34%. (a) Prepare a multiple-step income statement. (Round answers to 0 decimal places, e.g. 15,222.)arrow_forward

- Exercises Exercise 4-1 Construction accounting The Gagliano Construction Company contracted to build an office building for $2,000,000. Construc tion began in 1997 and was completed in 1998. Data relating to the contract are summarized below: percentage-of-completion and completed contract methods Costs incurred during the year Estimated costs to complete as of 12/31 Billings during the year Cash collections during the year 1997 1998 $1,575,000 $ 300,000 1,200,000 360,000 250,000 1,640,000 1,750,000 Required: 1. Compute the amount of gross profit or loss to be recognized in 1997 and 1998 using the percentage-of-completion method. 2. Compute the amount of gross profit or loss to be recognized in 1997 and 1998 using the completed contract method. 3. Prepare a partial balance sheet to show how the information related to this contract would be presented at the end of 1997 using the percentage-of completion method. 4. Prepare a partial balance sheet to show how the information related to…arrow_forwardAssignment 1 The following is the Trial Balance of Sonia HR Enterprises, a dealer in HR Software, as at 31stDecember, 2021. GHS GHSCapital 240,000Receivables and Payables 159,000 51,000Inventory 99,000Motor vehicles: (cost) 72,500Accumulated depreciation (31 December 2020) 32,500Office equipment: (cost)…arrow_forwardQuestion 2. Underwritten profit.From company records you ascertain that at the end of the year, you are given thefollowing data.1. the accounting department had unpaid claims amounting to K 4, 000.00,2. claims amounting to K 10,000.00 was paid the accounting department during theperiod.3. in the claims underwriting department, the monthly report for the final month of theaccounting period shows that the claims that were waiting for claims to be settledamounted to K 2,400.00 of which claims amounting to K 1,400 had not beenagreed with loss adjusters and clients.4. The Claims Manager had included a contingent amount of expected loss notbrought to the attention of the Insurer amounting to K 2, 100.00.5. You are further informed that underwriting expense reserves for unearnedpremium which stood at K6, 0006. Written premiums were 15% higher than Earned Premiums.7. Earned premiums (are those premiums for which the service for which thepremiums were paid (insurance protection) has been…arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning