Concept explainers

a.

The

a.

Answer to Problem 26P

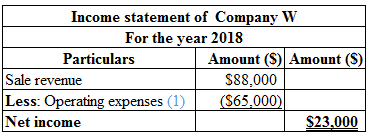

The calculation of income statement of Company W is as follows:

Table (1)

Hence, the net income of Company W is $23,000.

The calculation of balance sheet of Company W is as follows:

Table (2)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The entire $65,000 is treated as operating expenses.

(1)

The total cash is calculated as follows:

Hence, the total cash is $93,000.

(2)

b.

The balance sheet and income statement of Company W according to GAAP.

b.

Answer to Problem 26P

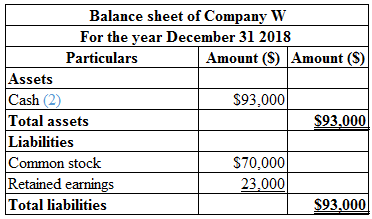

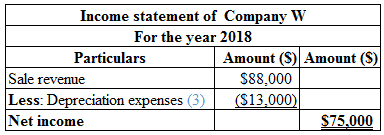

The calculation of income statement of Company W is as follows:

Table (3)

Hence, the net income of Company W is $75,000.

The calculation of balance sheet of Company W is as follows:

Table (4)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The

Hence, the depreciation is $13,000.

(3)

The depreciation amount $13,000 must be adjusted in the balance sheet as

(4)

c.

The balance sheet and income statement of Company W according to GAAP.

c.

Answer to Problem 26P

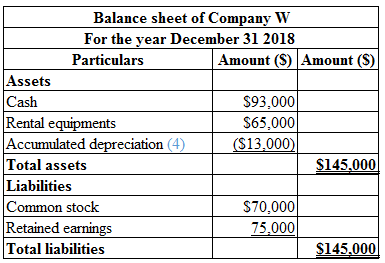

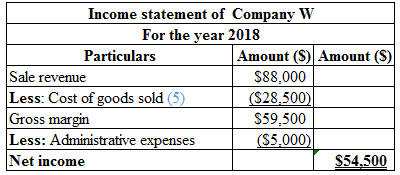

The calculation of income statement of Company W is as follows:

Table (5)

Hence, the net income of Company W is $54,500.

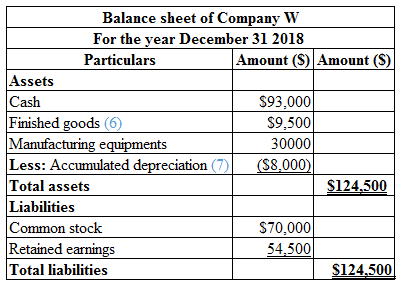

The calculation of balance sheet of Company W is as follows:

Table (6)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The depreciation on the manufacturing equipment is calculated as follows:

Hence, the depreciation cost is $8,000.

The cost per unit is calculated as follows:

Hence, the cost per unit is $19.

Calculate the cost of goods sold:

Hence, the cost of goods sold is $28,500.

(5)

The total finished goods are calculated as follows:

Hence, the finished goods are $9,500.

(6)

The depreciation on the manufacturing equipment is calculated as follows:

Hence, the accumulated depreciation cost is $8,000.

(7)

d.

Explain the reason why management might be more interested in average cost than the actual cost.

d.

Explanation of Solution

The exact cost of the product cannot be determined because the labor and material usage will differ among the same products. Cost average is an element that smoothens these differences.

Want to see more full solutions like this?

Chapter 10 Solutions

SURVEY OF ACCOUNTING 360DAY CONNECT CAR

- Exercise 3-44 Revenue Expense and Recognition Carrico Advertising Inc. performs advertising services for several Fortune 500 companies. The following information describes Carricos activities during 2019. At the beginning of 2019, customers owed Carrico $45,800 for advertising services formed during 2018. During 2019, Carrico performed an additional $695,100 of advertising services on account. Carrico collected $708,700 cash from customers during 2019. At the beginning of 2019, Carrico had $13,350 of supplies on hand for which it owed suppliers SS, 150. During 2019, Carrico purchased an additional $14,600 of supplies on account. Carrico also paid $19,300 cash owed to suppliers for goods previously purchased on credit. Carrico had of supplies on hand at the end of 2019. Carricos 2019 operating and interest were $437 and $133,400, respectively. Required: Calculate Carricos 2019 income before taxes. Calculate the ending balance of receivable, the supplies used, and the ending balance of accounts payable. CONCEPTUAL CONNECTION Explain the underlying principles behind why the three accounts computed in Requirement 2 exist.arrow_forwardExercise 1-38 Identifying Current Assets and Liabilities Dunn Sporting Goods sells athletic clothing and footwear 10 retail customers. Dunns accountant indicates that the firms operating cycle averages 6 months. At December 31, 2019, Dunn has the following assets and liabilities: Prepaid rent in the amount of 58,500. Dunns rent is $500 per month. A $9,700 account payable due in 45 days. Inventory in the amount of $46,230. Dunn expects to sell $38,000 of the inventory within 3 months. The remainder will be placed in storage until September 2020. The items placed in storage should be sold by November 2020. An investment in marketable securities in the amount of $1,900. Dunn expects to sell $700 of the marketable securities in 6 months. The remainder are not expected to be sold until 2022. Cash in the amount of $1,050. An equipment loan in the amount of $60,000 due in March 2024. Interest of $4,500 is due in March 2020 ($3,750 of the interest relates to 2019. with the remainder relating to the first 3 months of 2020). An account receivable from a local university in the amount of $2,850. The university has promised to pay the full amount in 3 months. Store equipment at a cost of $9,200. Accumulated depreciation has been recorded on the store equipment in the amount of 51,250. Required: Prepare the current asset and current liability portions of Dunns December 31, 20191 balance-sheet. Compute Dunns working capital and current ratio at December 31, 2019. CONCEPTUAL CONNECTION As in investor or creditor. what do these ratios tell you about Dunns liquidity?arrow_forwardBrief Exercise 2-30 Transaction Analysis Galle Inc. entered into the following transactions during January. Borrowed $50,000 from First Street Bank by signing a new payable. Purchased $25,000 of equipment for cash. (Continued) Paid $500 to landlord for rent for January. Performed services for customers on account, $10,000. Collected $31000 from customers for services performed in Transaction d. Paid salaries of $2,500 for the current month. Required: Show the effect of each transaction using the following model.arrow_forward

- Problem 2-62B Comprehensive Problem Mulberry Services sells electronic data processing services to firms too Email to own their own computing equipment. Mulberry had the following amounts and amount balances as of January 1, 2019: During 2019, the following transactions occurred (the events described below are aggregations of many individual events): During 2019, Mulberry sold $690,000 of computing services, all on credit. Mulberry collected $570,000 from the credit sales in Transaction a and an additional $129,000 from the accounts receivable outstanding at the beginning of the year. Mulberry paid the interest payable of $8,000. A Wages of $379,000 were paid in cash. Repairs and maintenance of $9,000 were incurred and paid. The prepaid rent at the beginning of the year was used in 2019. In addition, $28,000 of computer rental costs were incurred and paid. There is no prepaid rent or rent payable at year-end. Mulberry purchased computer paper for $13,000 cash in late December. None of the paper was used by year-end. Advertising expense of $26,000 was incurred and paid. Income tax of $10,300 was incurred and paid in 2019. Interest of $5,000 was paid on the long-term loan. (Continued) Required: Establish a T-account for the accounts listed above and enter the beginning balances. Use a chart of accounts to order the T-accounts. Analyze each transaction; Journalize as appropriate. (Note: Ignore the date because these events are aggregations of individual events.) Post your journal entries to the T-accounts. Add additional T-accounts when needed. Use the ending balances in the T-accounts to prepare a trial balance.arrow_forwardExercise 3-38 Accrual- and Cash-Basis Expense Recognition The following information is taken from the accrual accounting records of Kroger Sales Company: During January, Kroger paid $9,150 for supplies to in sales to customers during the next 2 months (February and March). The supplies will be used evenly over the next 2 months. Kroger pays its employees at the end of each month for salaries earned during that month. Salaries paid at the end of February and March amounted to $4,925 and $5,100, respectively. Kroger placed an advertisement in the local newspaper during March at a cost of $850. The ad promoted the pre-spring sale during the last week in March. Kroger did not pay for the newspaper ad until mid-April. Required: Under cash-basis accounting, how much exvxn.se should Kroger report for February and March? Under accrual-basis accounting, how much expense should Kroger report for February and March? CONCEPTUAL CONNECTION Which basis of accounting provides the most useful information for decision-makers? Why?arrow_forwardJournal Entries Overnight Delivery Inc. is incorporated on February 1 and enters into the following transactions during its first month of operations: February 15: Received $8,000 cash from customer accounts. February 26: Provided $16,800 of services on account during the month. February 27: Received a $3,400 bill from the local service station for gas and oil used during February. February 28: Paid $400 for wages earned by employees for the month. February 28: Paid $3,230 for February advertising. February 28: Declared and paid $2,000 cash dividends to stockholders. Required Prepare journal entries on the books of Overnight to record the transactions entered into during February. Explain why you agree or disagree with the following: The transactions on February 28 all represent expenses for the month of February because cash was paid. The transaction on February 27 does not represent an expense in February because cash has not yet been paid.arrow_forward

- Cornerstone Exercise 2-22 Transaction Analysis The Mendholm Company entered into the following transactions: Performed services on account, 521,500. Collected $9,500 from client related to services performed in Item a. Find $500 dividend to stockholders. Paid salaries of $4,000 for the current month. (Continued) Required: Show the effect of each transaction using the following model:arrow_forwardCornerstone Exercise 1-18 Balance Sheet An analysis of the transactions of Cavernous Homes Inc. yields the following totals at December 31, 2019: cash, $3,200; accounts receivable, $4,500; notes payable, $5,000; supplies, $8,100; common stock, $7,000; and retained earnings, 9,800. Required: Prepare a balance sheet for Cavernous Homes Inc. at December 31 , 2019.arrow_forwardExercise 3-47 Revenue Adjustments Sentry Transport Inc. of Atlanta provides in-town parcel delivery services in addition to a full range of passenger services. Sentry engaged in the following activities during the current year: Sentry received $5,000 cash in advance from Richs Department Store for an estimated 250 deliveries during December 2019 and January and February of 2020. The entire amount was recorded as unearned revenue when received. During December 2019, 110 deliveries were made for Richs. Sentry operates several small buses that take commuters from suburban communities to the central downtown area of Atlanta. The commuters purchase, in advance, tickets for 50 one-way rides. Each So-ride ticket costs S500. At the time of purchase, Sentry credits the cash received to unearned revenue. At year end, Sentry determines that 10,160 one-way rides have been taken. Sentry operates buses that provide transportation for the clients of a social agency in Atlanta. Sentry bills the agency quarterly at the end of January, April, July, and October for the that quarter. The contract price is S7,500 per quarter. Sentry follows the practice of recognizing revenue from this contract in the in which the service is On December 23, Delta Airlines chartered a bus to transport its marketing group to a meeting at a resort in southern Georgia. The meeting will be held during the last week in January 2020, and Delta agrees to pay for the entire trip on the day the bus departs. At year end, none Of these arrangements have been recorded by Sentry. Required: Prepare adjusting entries at December 31 for these four activities. CONCEPTUAL CONNECTION What would be the effect on revenue if the adjusting entries were not made?arrow_forward

- Brief Exercise 1-24 The Accounting Equation Financial information for three independent cases is as follows: The liabilities of Dent Company are $82,000, and its stockholders' equity is $120,000. What is the amount of Dents total assets? The total assets of Wayne Inc. are $55,000, and its stockholders' equity is $22,500. What is the amount of Waynes total liabilities? Gordon Companys total assets increased by $60,000 during the year, and its liabilities decreased by $35,000. Did Gordons stockholders' equity increase or decrease? By how much? Required: Determine the missing amount for each case.arrow_forwardCornerstone Exercise 3-12 Accrual- and Cash-Basis Revenue McDonald Music sells used CDs for S4.00 each. During the month of April, McDonald sold 7,650 CDs for cash and 13,220 CDs on credit. McDonalds cash collections in April included $30,600 for the CDs sold for cash, $12,800 for CDs sold on credit during the previous month, and $29,850 for CDs sold on credit during April. Required: Calculate the amount of revenue recognized in April under (1) cash-basis accounting and (2) accrual-basis accounting.arrow_forwardFinancial statements We-Sell Realty, organized as a corporation on August 1, 2018, is owned and operated by Omar Farah, the sole stockholder. How many errors can you find in the following statements for We-Sell Realty, prepared after its first month of operations? We-Sell Realty Income Statement August 31, 2018 Sales commissions 140,000 Expenses: Office salaries expense 87,000 Rent expense 18,000 Automobile expense 7,500 Miscellaneous expense 2,200 Supplies expense 1,150 Total expenses 115,850 Net income 25,000 Omar Farah Retained Earnings Statement August 31, 2017 Retained earnings, August 1,2018 0 Dividends (10,000) (10,000) Issued additional common stock August 1,2018 15,000 5,000 Net income 25,000 Retained earnings, August 31, 2018 30,000 Balance Sheet For the Month Ended August 31, 2018 Cash Assets 8,900 Accounts payable 22,350 Total assets 31,250 Liabilities Accounts receivable 38,600 Supplies 4,000 Stockholders Equity Retained earnings 30,000 Total liabilities and stockholders equity 72,600arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning