MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Cost Accounting

16th Edition

ISBN: 9780134476384

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 11.46P

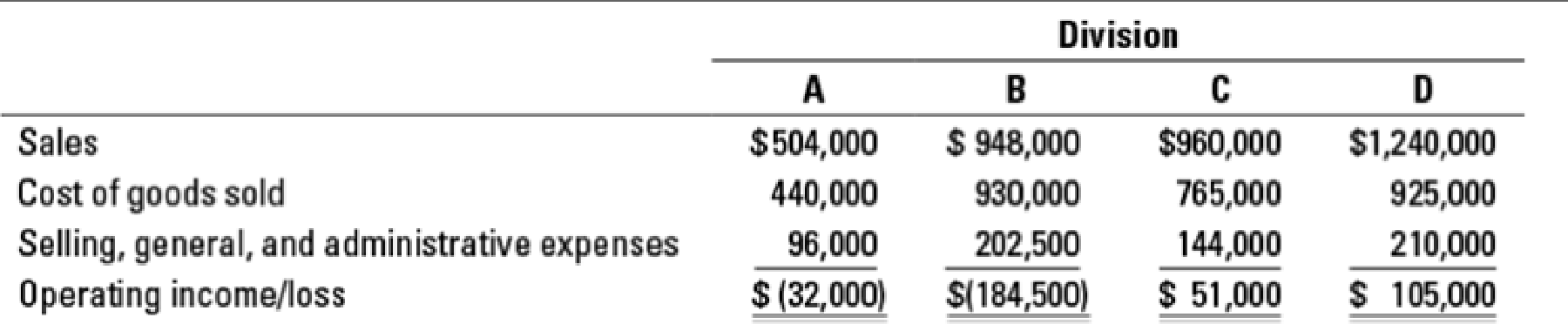

Closing down divisions. Ainsley Corporation has four operating divisions. The budgeted revenues and expenses for each division for 2017 follows:

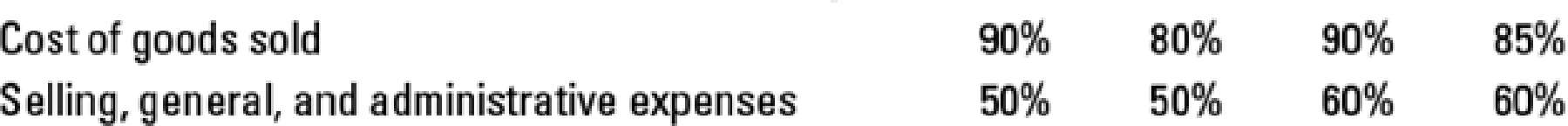

Further analysis of costs reveals the following percentages of variable costs in each division:

Closing down any division would result in savings of 40% of the fixed costs of that division.

Top management is very concerned about the unprofitable divisions (A and B) and is considering closing them for the year.

- 1. Calculate the increase or decrease in operating income if Ainsley closes division A.

Required

- 2. Calculate the increase or decrease in operating income if Ainsley closes division B.

- 3. What other factors should the top management of Ainsley consider before making a decision?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Give a detailed explanation of the question below;

“Alisha May, division manager of Shotgun Inc., was debating the merits of launching a new product.

The budgeted income of the division was £885,000 with operating assets of £2,950,000. The proposed investment would add income of £781,250 and would require an additional investment in equipment of £3,125,000. The minimum required return on investment for the company is 15%.”

Required:

“Compute the ROI of the:

division if the new product is not undertaken.

new product alone.

division if the new product is undertaken.”

“Compute the Residual Income of the:

division if the new product is not undertaken.

new product alone.

division if the new product is undertaken.”

“Do you suppose that Alisha will decide to invest in the new product? Why or why not?”

Lucas is the X Division manager and his performance is evaluated by executive management based on Division ROI. The current controllable margin for X Division is P46,000. Its current operating assets total P210,000. The division is considering purchasing equipment for P40,000 that will increase sales by an estimated P10,000, with annual depreciation of P10,000. If the equipment is purchased, what is the new ROI (round-off the final answer to one decimal places)?

Granfield company is considering eliminating its backpack division, which reported an operating loss for the recent year of $42700. The division sales for the year were $973300 and the variable costs were $482000. The fixed costs of the division were $534000. If the backpack division dropped, 40% of the fixed costs allocated to that division could be eliminated. The impact on granfield operating income for eliminating this business segment would be?

Chapter 11 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Cost Accounting

Ch. 11 - Prob. 11.1QCh. 11 - Define relevant costs. Why are historical costs...Ch. 11 - All future costs are relevant. Do you agree? Why?Ch. 11 - Distinguish between quantitative and qualitative...Ch. 11 - Describe two potential problems that should be...Ch. 11 - Variable costs are always relevant, and fixed...Ch. 11 - A component part should be purchased whenever the...Ch. 11 - Prob. 11.8QCh. 11 - Managers should always buy inventory in quantities...Ch. 11 - Management should always maximize sales of the...

Ch. 11 - Prob. 11.11QCh. 11 - Cost written off as depreciation on equipment...Ch. 11 - Managers will always choose the alternative that...Ch. 11 - Prob. 11.14QCh. 11 - Prob. 11.15QCh. 11 - Qualitative and quantitative factors. Which of the...Ch. 11 - Special order, opportunity cost. Chade Corp. is...Ch. 11 - Prob. 11.18MCQCh. 11 - Keep or drop a business segment. Lees Corp. is...Ch. 11 - Relevant costs. Ace Cleaning Service is...Ch. 11 - Disposal of assets. Answer the following...Ch. 11 - Relevant and irrelevant costs. Answer the...Ch. 11 - Multiple choice. (CPA) Choose the best answer. 1....Ch. 11 - Special order, activity-based costing. (CMA,...Ch. 11 - Make versus buy, activity-based costing. The...Ch. 11 - Inventory decision, opportunity costs. Best Trim,...Ch. 11 - Relevant costs, contribution margin, product...Ch. 11 - Selection of most profitable product. Body Image,...Ch. 11 - Theory of constraints, throughput margin, relevant...Ch. 11 - Closing and opening stores. Sanchez Corporation...Ch. 11 - Prob. 11.31ECh. 11 - Relevance of equipment costs. Janets Bakery is...Ch. 11 - Equipment upgrade versus replacement. (A. Spero,...Ch. 11 - Special order, short-run pricing. Diamond...Ch. 11 - Short-run pricing, capacity constraints. Fashion...Ch. 11 - International outsourcing. Riverside Clippers Corp...Ch. 11 - Relevant costs, opportunity costs. Gavin Martin,...Ch. 11 - Opportunity costs and relevant costs. Jason Wu...Ch. 11 - Opportunity costs. (H. Schaefer, adapted) The Wild...Ch. 11 - Make or buy, unknown level of volume. (A....Ch. 11 - Make versus buy, activity-based costing,...Ch. 11 - Prob. 11.42PCh. 11 - Product mix, special order. (N. Melumad, adapted)...Ch. 11 - Theory of constraints, throughput margin, and...Ch. 11 - Theory of constraints, contribution margin,...Ch. 11 - Closing down divisions. Ainsley Corporation has...Ch. 11 - Dropping a product line, selling more tours....Ch. 11 - Prob. 11.48PCh. 11 - Dropping a customer, activity-based costing,...Ch. 11 - Equipment replacement decisions and performance...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A study has been conducted to determine if one of the departments in Your Company should be discontinued. The contribution margin in the department is $50,000 per year. Fixed expenses charged to the department are $65,000 per year. It is estimated that $40,000 of these fixed expenses could be eliminated if the department is discontinued. Discontinuing this product would result in a $120,000 increase in the contribution margin of other product lines. If the department is discontinued, what would be the annual change in the company's overall net operating?arrow_forwardA study has been conducted to determine if one of the departments in Your Company should be discontinued. The contribution margin in the department is $50,000 per year. Fixed expenses charged to the department are $65,000 per year. It is estimated that $40,000 of these fixed expenses could be eliminated if the department is discontinued. Discontinuing this product would result in a $120,000 increase in the contribution margin of other product lines. If the department is discontinued, what would be the annual change in the company's overall net operating? It the change is a decrease, enter your number with a – in front. Otherwise, just enter the number. ENTER YOUR ANSWER WITHOUT DOLLAR SIGNS OR OTHER DISCRIPTIONSarrow_forwardBetsy Union is the Pika Division manager and her performance is evaluated by executive management based on Division ROI. The current controllable margin for Pika Division is $46,000. Its current operating assets total $210,000. The division is considering purchasing equipment for $40,000 that will increase sales by an estimated $10,000, with annual depreciation of $10,000. If the equipment is purchased, what will happen to the return on investment for the division?arrow_forward

- Following increased competition and customer expectations, ABC company has been forced to revisit its operational strategy and its quality standards. The following budgeted data for 2022 are available:Number of Trainees 4,500, Operating Income $54,000Budgeted Variable Cost per Trainee: Trainee's Support Service $36 Training Materials $12 Foods $20Miscellaneous Products & Services $20 Budgeted Fixed Cost per Training: Facilities 14,500 Salaries 15,500 Based on the customer survey it conducted, ABC company has learned that several improvements to its products and services are required. The improvements would provide the following impacts:Increase in the Number of Trainees 60%Increase in the Total Variable Costs 55%Increase in the Total Fixed Costs 85%You are required to:(i) Calculate the budgeted revenue per trainee based on the available data. (ii) Assuming that budgeted revenue per trainee remains unchanged, explain (with numerical justifications) whether ABC company should…arrow_forwardCalculate the Margin Of Safety in units and in sales dollars? The President of Benoit is under pressure from shareholders to increase operating income by 50% in 2020. Management expects per unit data and total fixed costs to remain the same in 2020. Compute the number of units that would have to be sold in 2020 to reach the shareholders desired profit level. Is this a realistic goal? Assume that as a result of reorganizing the production process, the management of Benoit Manufacturing was able to reduce direct material cost per unit by $5 due to a change in the supplier of the raw material used in the production process. Variable manufacturing overhead per unit would also decrease by $3. The business is also considering paying additional annual commission of $36,400 to its sales team as part of the sales expansion effort, which should result in an increase in sales revenue. The head of the marketing department has indicated that the effort of the sales team should result in a…arrow_forwardA study has been conducted to determine if one of the departments in Your Company should be discontinued. The contribution margin in the department is $50,000 per year. Fixed expenses charged to the department are $65,000 per year. It is estimated that $40,000 of these fixed expenses could be eliminated if the department is discontinued. If the department is discontinued, what would be the annual change in the company's overall net operating? It the change is a decrease, enter your number with a – in front. Otherwise, just enter the number. ENTER YOUR ANSWER WITHOUT DOLLAR SIGNS OR OTHER DISCRIPTIONS.arrow_forward

- Company A reported the following results for 2021: Sales $4,000,000 Variable costs 3,200,000 Controllable fixed costs 300,000 Average operating assets 2,500,000 Management is considering the following independent alternative courses of action in 2022 in order to maximize the return on investment for the division. Reduce controllable fixed costs by 10% with no change in sales or variable Reduce average operating assets by 10% with no change in controllable Increase sales $500,000 with no change in the contribution margin Instructions Compute the return on investment for 2021 Compute the expected return on investment for each of the alternative courses of actionarrow_forwardAssume that as a result of reorganizing the production process, the management of Benoit Manufacturing was able to reduce direct material cost per unit by $5 due to a change in the supplier of the raw material used in the production process. Variable manufacturing overhead per unit would also decrease by $3. The business is also considering paying additional annual commission of $36,400 to its sales team as part of the sales expansion effort, which should result in an increase in sales revenue.The head of the marketing department has indicated that the effort of the sales team should result in a 5% increase in sales volume. What must the new selling price per unit be if the company wishes to meet the shareholder's desired profit level for 2020? Is this a viable option? Consider B/E units & dollars The margin of Safety and Operating Income due to the changed variablesarrow_forwardAssume that as a result of reorganizing the production process, the management of Benoit Manufacturing was able to reduce direct material cost per unit by $5 due to a change in the supplier of the raw material used in the production process. Variable manufacturing overhead per unit would also decrease by $3. The business is also considering paying additional annual commission of $36,400 to its sales team as part of the sales expansion effort, which should result in an increase in sales revenue.The head of the marketing department has indicated that the effort of the sales team should result in a 5% increase in sales volume. What must the new selling price per unit be if the company wishes to meet the shareholder's desired profit level for 2020? Is this a viable option?arrow_forward

- he Pacific Division of Cullumber Industries reported the following data for the current year. Sales $4,179,930 Variable costs 2,625,000 Controllable fixed costs 825,000 Average operating assets 5,034,000 Top management is unhappy with the investment center’s return on investment. It asks the manager of the Pacific Division to submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of action. 1. Increase sales by $425,000 with no change in the contribution margin percentage. 2. Reduce variable costs by $145,986. 3. Reduce average operating assets by 4% (a) Compute the return on investment for the current year. (Round answers to 1 decimal place, e.g. 52.7%.) Return on investment enter the return on investment in percentages %arrow_forwardValero Company had sales in 2016 of $1,800,000 on 60,000 units. Variable costs totaled $720,000, and fixed costs totaled $570,000. A new raw material is available that will decrease the variable costs per unit by 20% (or $2.40). However, to process the new raw material, fixed operating costs will increase by $50,000. Management feels that one-half of the decline in the variable costs per unit should be passed on to customers in the form of a sales price reduction. The marketing depart ment expects that this sales price reduction will result in a 10% increase in the number of units sold. Instructions a) Prepare a CVP income statement for 2017, assuming the changes are made as described.arrow_forwardThe South Division of Novak Company reported the following data for the current year. Sales $3,050,000 Variable costs 2,013,000 Controllable fixed costs 610,000 Average operating assets 5,000,000 Top management is unhappy with the investment center’s return on investment (ROI). It asks the manager of the South Division to submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of action. 1. Increase sales by $300,000 with no change in the contribution margin percentage. 2. Reduce variable costs by $150,000. 3. Reduce average operating assets by 4.00%. (a) Compute the return on investment (ROI) for the current year. (Round ROI to 2 decimal places, e.g. 1.57%.) Return on Investment enter the return on investment in percentages % (b) Using the ROI equation, compute the ROI under each of the proposed courses of action. (Round ROI to 2 decimal places, e.g. 1.57%.)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License