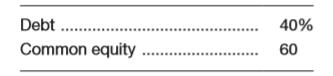

Evans Technology has the following capital structure:

The aftertax cost of debt is 6 percent, and the

a. What is the firm’s weighted average cost of capital?

b. An outside consultant has suggested that because debt is cheaper than equity, the firm should switch to a capital structure that is 50 percent debt and 50 percent equity. Under this new and more debt-oriented arrangement, the aftertax cost of debt is 7 percent, and the cost of common equity (in the form of retained earnings) is 15 percent. Recalculate the firm’s weighted average cost of capital.

c. Which plan is optimal in terms of minimizing the weighted average cost of capital?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- The Rivoli Company has no debt outstanding, and its financial position is given by the following data: What is Rivoli’s intrinsic value of operations (i.e., its unlevered value)? What is its intrinsic stock price? Its earnings per share? Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 7%. Based on the new capital structure, what is the new weighted average cost of capital? What is the levered value of the firm? What is the amount of debt? Based on the new capital structure, what is the new stock price? What is the remaining number of shares? What is the new earnings per share?arrow_forwardA company had WACC (weighted average cost of capital) equal to 8. % If the company pays off mortgage bonds with an interest rate of 4% and issues an equal amount of new stock considered to be relatively risky by the market, which of the following is true? a. residual income will increase. b. ROI will decrease. c. WACC will increase. d. WACC will decrease.arrow_forwardThe Nolan Corporation finds it is necessary to determine its marginal cost of capital. Nolan’s current capital structure calls for 35 percent debt, 25 percent preferred stock, and 40 percent common equity. Initially, common equity will be in the form of retained earnings (Ke) and then new common stock (Kn). The costs of the various sources of financing are as follows: debt (after-tax), 8.6 percent; preferred stock, 8 percent; retained earnings, 14 percent; and new common stock, 15.2 percent. a. What is the initial weighted average cost of capital? (Include debt, preferred stock, and common equity in the form of retained earnings, Ke.) (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) b. If the firm has $16 million in retained earnings, at what size capital structure will the firm run out of retained earnings? (Enter your answer in millions of dollars (e.g., $10 million should be entered as "10").) c. What will the marginal cost of…arrow_forward

- Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 26%. Debt The firm can sell for $1005 a 13-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2.5% of the par value is required. Preferred stock 7.00% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $5 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $80 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.50 ten years ago to the $4.92 dividend payment, D0, that the company just recently made. If…arrow_forwardDillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 26%. Debt The firm can sell for $1005 a 13-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2.5% of the par value is required. Preferred stock 7.00% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $5 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $80 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.50 ten years ago to the $4.92 dividend payment, D0, that the company just recently made. If…arrow_forwardThe calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm’s overall capital structure. is the symbol that represents the before-tax cost of debt in the weighted average cost of capital (WACC) equation. Wyle Co. has $1.4 million of debt, $2.5 million of preferred stock, and $3.3 million of common equity. What would be its weight on debt? 0.28 0.32 0.19 0.46arrow_forward

- The Nolan Corporation finds it is necessary to determine its marginal cost of capital. Nolan’s current capital structure calls for 40 percent debt, 10 percent preferred stock, and 50 percent common equity. Initially, common equity will be in the form of retained earnings (Ke) and then new common stock (Kn). The costs of the various sources of financing are as follows: debt (after-tax), 6.6 percent; preferred stock, 6 percent; retained earnings, 11 percent; and new common stock, 12.2 percent. a. What is the initial weighted average cost of capital? (Include debt, preferred stock, and common equity in the form of retained earnings, Ke.) (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Weighted Cost Debt % Preferred stock Common equity 5.50 Weighted average cost of capital % b. If the firm has $10 million in retained earnings, at what size capital structure will the firm run out of retained earnings? (Enter your answer in millions of…arrow_forwardThe Nolan Corporation finds it is necessary to determine its marginal cost of capital. Nolan’s current capital structure calls for 40 percent debt, 10 percent preferred stock, and 50 percent common equity. Initially, common equity will be in the form of retained earnings (Ke) and then new common stock (Kn). The costs of the various sources of financing are as follows: debt (after-tax), 6.6 percent; preferred stock, 6 percent; retained earnings, 11 percent; and new common stock, 12.2 percent. a. What is the initial weighted average cost of capital? (Include debt, preferred stock, and common equity in the form of retained earnings, Ke.) (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimalarrow_forwardDillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 20% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1030 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.5% (annual dividend) preferred stock having a par value of $100 can be sold for $90. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.75 ten years ago to the $5.41 dividend payment, D0, that the company just recently made. If the…arrow_forward

- Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 20% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1030 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.5% (annual dividend) preferred stock having a par value of $100 can be sold for $90. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.75 ten years ago to the $5.41 dividend payment, D0, that the company just recently made. If the…arrow_forwardDillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 10% preferred stock, and 60% common stock equity (retained earnings, new common�� stock, or both). The firm's tax rate is 23%. Debt : The firm can sell for $1030 a 14-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock: 9.00% (annual dividend) preferred stock having a par value of $100 can be sold for $92.An additional fee of $2 per share must be paid to the underwriters. Common stock: The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.26 dividend payment, D0, that the company just recently made.…arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning