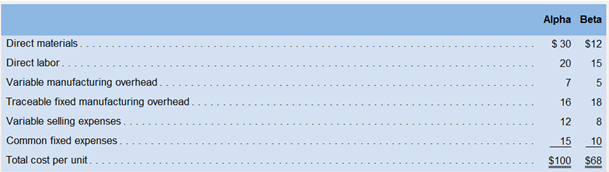

Cane Company manufactures two products called A1pia d Beta that sell for $120 and $80, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity produce 100,000 units of each product. Its average cost per unit for each product at this level of activity are given below:

The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars.

Required:

(Answer each question independently unless instructed otherwise.)

Assume that Cane expects to produce and sell 80,000 Alphas during the current year. One of Cane’s sales representatives has found a new customer who is willing to buy 10,000 additional Alphas for a price of $80 per unit. What is the financial advantage (disadvantage) of accepting the new customer’s order?

Concept Introduction:

Financial advantage (disadvantage): Financial advantage (disadvantage) refers to the incremental profit or loss, a company will earn in situations like acceptance of a special order, dropping of a business line, etc.

It is calculated by only considering the relevant costs. The incremental revenues and incremental costs are taken together to calculate financial advantage or disadvantage. Financial advantage refers to incremental net operating income and financial disadvantage refers to incremental net operating loss.

To calculate:

Financial advantage (disadvantage) of accepting the new customer’s order for Alpha

Answer to Problem 3F15

Solution:

The financial advantage of accepting the new customer’s order for Alpha is $ 110,000.

Explanation of Solution

The incremental net operating profit (loss) is the difference between incremental revenues and costs.

| Alpha - Incremental Net operating profit (Loss) (in $) | ||

| Incremental Revenue ( $ 80/ unit X 10,000 additional units) | 800,000 | |

| Less: | ||

| Incremental costs - | ||

| Direct material ( $ 30/ units X 10,000 additional units) | 300,000 | |

| Direct labor ( $ 20/ unit X 10,000 additional units) | 200,000 | |

| Variable manufacturing overhead ( $ 7/ unit X 10,000 additional units) | 70,000 | |

| Variable selling expenses ( $ 12/ unit X 10,000 additional units) | 120,000 | |

| Total incremental costs | 690,000 | |

| Alpha -Incremental net operating income | 110,000 | |

Given, the information for the product Alpha −

- Additional sales units = 10,000 units

- Selling price per unit = $ 80 per unit

- Direct Material per unit = $ 30 per unit

- Direct Labor per unit = $ 20 per unit

- Variable manufacturing overhead per unit = $ 7 per unit

- Variable selling expenses per unit = $ 12 per unit

Calculations:

- Incremental revenue

- Incremental costs

- Incremental Net operating income

Thus, the financial advantage of accepting the new customer’s order for Alpha = $ 110,000.

Want to see more full solutions like this?

Chapter 11 Solutions

Introduction To Managerial Accounting

- Oat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently. The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. Should Oat Treats make or buy the oat bars?arrow_forwardPatz Company produces two types of machine parts: Part A and Part B, with unit contribution margins of 300 and 600, respectively. Assume initially that Patz can sell all that is produced of either component. Part A requires two hours of assembly, and B requires five hours of assembly. The firm has 300 assembly hours per week. Required: 1. Express the objective of maximizing the total contribution margin subject to the assembly-hour constraint. 2. Identify the optimal amount that should be produced of each machine part and the total contribution margin associated with this mix. 3. What if market conditions are such that Patz can sell at most 75 units of Part A and 60 units of Part B? Express the objective function with its associated constraints for this case and identify the optimal mix and its associated total contribution margin.arrow_forwardOakes Inc. manufactured 40,000 gallons of Mononate and 60,000 gallons of Beracyl in a joint production process, incurring 250,000 of joint costs. Oakes allocates joint costs based on the physical volume of each product produced. Mononate and Beracyl can each be sold at the split-off point in a semifinished state or, alternatively, processed further. Additional data about the two products are as follows: An assistant in the companys cost accounting department was overheard saying ...that when both joint and separable costs are considered, the firm has no business processing either product beyond the split-off point. The extra revenue is simply not worth the effort. Which of the following strategies should be recommended for Oakes?arrow_forward

- Cool Pool has these costs associated with production of 20,000 units of accessory products: direct materials, $70; direct labor, $110; variable manufacturing overhead, $45; total fixed manufacturing overhead, $800,000. What is the cost per unit under both the variable and absorption methods?arrow_forwardHeller Manufacturing has two production facilities that manufacture baseball gloves. Production costs at the two facilities differ because of varying labor rates, local property taxes, type of equipment, capacity, and so on. The Dayton plant has weekly costs that can be expressed as a function of the number of gloves produced: TCD(X)=X2X+5, where X is the weekly production volume in thousands of units, and TCD(X) is the cost in thousands of dollars. The Hamilton plants weekly production costs are given by: TCH(Y)=Y2+2Y+3, where Y is the weekly production volume in thousands of units, and TCH(Y) is the cost in thousands of dollars. Heller Manufacturing would like to produce 8,000 gloves per week at the lowest possible cost. a. Formulate a mathematical model that can be used to determine the optimal number of gloves to produce each week at each facility. b. Solve the optimization model to determine the optimal number of gloves to produce at each facility.arrow_forwardBrees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for 66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Prior to making a decision, the companys CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups1,160 each (The setups would be avoided, and total spending could be reduced by 1,160 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is 12,300 and could be totally avoided if the part were purchased. Engineering work: 470 hours, 45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at 30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. 2. Now, using the special study data, repeat the analysis. 3. Discuss the qualitative factors that would affect the decision, including strategic implications. 4. After reviewing the special study, the controller made the following remark: This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs? Is the controller right?arrow_forward

- A company is considering a special order for 1,000 units to be priced at 8.90 (the normal price would be 11.50). The order would require specialized materials costing 4.00 per unit. Direct labor and variable factory overhead would cost 2.15 per unit. Fixed factory overhead is 1.20 per unit. However, the company has excess capacity, and acceptance of the order would not raise total fixed factory overhead. The warehouse, however, would have to add capacity costing 1,300. Which of the following is relevant to the special order? a. 11.50 b. 1.20 c. 7.35 d. 8.90arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardRose Company has a relevant range of production between 10,000 and 25.000 units. The following cost data represents average cost per unit for 15,000 units of production. Using the cost data from Rose Company, answer the following questions: If 10,000 units are produced, what is the variable cost per unit? If 18,000 units are produced, what is the variable cost per unit? If 21,000 units are produced, what are the total variable costs? If 11,000 units are produced, what are the total variable costs? If 19,000 units are produced, what are the total manufacturing overhead costs incurred? If 23,000 units are produced, what are the total manufacturing overhead costs incurred? If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred? If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forward

- Remarkable Enterprises requires four units of part A for every unit of Al that it produces. Currently, part A is made by Remarkable, with these per-unit costs in a month when 4,000 units were produced: Variable manufacturing overhead is applied at $1.60 per unit. The other $0.50 of overhead consists of allocated fixed costs. Remarkable will need 8,000 units of part A for the next years production. Altoona Corporation has offered to supply 8,000 units of part A at a price of $8.00 per unit. If Remarkable accepts the offer, all of the variable costs and $2,000 of the fixed costs will be avoided. Should Remarkable accept the offer from Altoona Corporation?arrow_forwardAlmond Treats manufactures various types of cereals that feature almonds. Acme Cereal Company has approached Almond Treats with a proposal to sell the company its top selling cereal at a price of $22,000 for 20,000 pounds. The costs shown are associated with production of 20,000 pounds of almond cereal: The manufacturing overhead consists of $2,000 of variable costs with the balance being allocated to fixed costs. Should Almond Treats make or buy the almond cereal?arrow_forwardColonels uses a traditional cost system and estimates next years overhead will be $480,000, with the estimated cost driver of 240,000 direct labor hours. It manufactures three products and estimates these costs: If the labor rate is $25 per hour, what is the per-unit cost of each product?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning