Advanced Financial Accounting

12th Edition

ISBN: 9781259916977

Author: Christensen, Theodore E., COTTRELL, David M., Budd, Cassy

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 12.20P

Remeasurement Gain or Loss

Refer to the information given in P12−17 and your answer to part a of P12−18.

Required

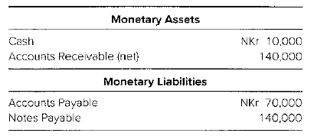

Prepare a schedule providing a proof of the remeasurement gain or loss. For this part of the problem, assume that the Norwegian subsidiary had the following monetary assets and liabilities at January 1, 20X5:

On January 1, 20X5, the Norwegian subsidiary has a net monetary liability position of NKr60,000.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The controller of Pane Co. was preparing the company's financial statements. Pane had a

wholly owned subsidiary in a foreign country that used the euro as its currency. At December

31, the exchange rate was $1 U.S. for 1.25 euro. The weighted-average exchange rate for the

year was $1 U.S. for 1.50 euro. At December 31, the subsidiary had assets of 1 million euro and

revenue for the year of 2 million euro. What amounts would assets and revenue translate for

consolidation?

Assets Revenue

A. $666,666 $1,333,333

B. $666,666 $1,600,000

C. $800,000 $1,333,333

D. $800,000 $1,600,000

Companies following international accounting standards are permitted to revalue fixed assets above the assets’ historical costs. Such revaluations are allowed under various countries’ standards and the standards issued by the IASB. Liberty International, a real estate company headquartered in the United Kingdom (U.K.), follows U.K. standards. In a recent year, Liberty disclosed the following information on revaluations of its tangible fixed assets. The revaluation reserve measures the amount by which tangible fixed assets are recorded above historical cost and is reported in Liberty’s stockholders’ equity.Liberty InternationalCompleted Investment PropertiesCompleted investment properties are professionally valued on a market value basis by external valuers at the balance sheet date. Surpluses and deficits arising during the year are reflected in the revaluation reserve.Liberty reported the following additional data. Amounts for Kimco Realty (which follows GAAP) in the same year are…

Companies following international accounting standards are permitted to revalue fixed assets above the assets’ historical costs. Such revaluations are allowed under various countries’ standards and the standards issued by the IASB. Liberty International, a real estate company headquartered in the United Kingdom (U.K.), follows U.K. standards. In a recent year, Liberty disclosed the following information on revaluations of its tangible fixed assets. The revaluation reserve measures the amount by which tangible fixed assets are recorded above historical cost and is reported in Liberty’s stockholders’ equity.Liberty InternationalCompleted Investment PropertiesCompleted investment properties are professionally valued on a market value basis by external valuers at the balance sheet date. Surpluses and deficits arising during the year are reflected in the revaluation reserve.Liberty reported the following additional data. Amounts for Kimco Realty (which follows GAAP) in the same year are…

Chapter 12 Solutions

Advanced Financial Accounting

Ch. 12 - Prob. 12.1QCh. 12 - Prob. 12.2QCh. 12 - Prob. 12.3QCh. 12 - How widely used are IFRS? Can IFRS be used for...Ch. 12 - Prob. 12.5QCh. 12 - Prob. 12.6QCh. 12 - Prob. 12.7QCh. 12 - Prob. 12.8QCh. 12 - Prob. 12.9QCh. 12 - Prob. 12.10Q

Ch. 12 - Prob. 12.11QCh. 12 - Prob. 12.12QCh. 12 - Prob. 12.13QCh. 12 - Prob. 12.14QCh. 12 - Prob. 12.15QCh. 12 - Prob. 12.16QCh. 12 - Prob. 12.17QCh. 12 - Prob. 12.18QCh. 12 - Prob. 12.19QCh. 12 - Prob. 12.20QCh. 12 - Prob. 12.4CCh. 12 - Prob. 12.5CCh. 12 - Prob. 12.6CCh. 12 - Prob. 12.7CCh. 12 - Prob. 12.1.1ECh. 12 - Prob. 12.1.2ECh. 12 - Prob. 12.1.3ECh. 12 - Prob. 12.1.4ECh. 12 - Prob. 12.1.5ECh. 12 - Prob. 12.1.6ECh. 12 - Prob. 12.1.7ECh. 12 - Prob. 12.2.1ECh. 12 - Prob. 12.2.2ECh. 12 - Prob. 12.2.3ECh. 12 - Prob. 12.2.4ECh. 12 - Prob. 12.2.5ECh. 12 - Prob. 12.2.6ECh. 12 - Prob. 12.3ECh. 12 - Prob. 12.4.1ECh. 12 - Prob. 12.4.2ECh. 12 - Prob. 12.4.3ECh. 12 - Prob. 12.4.4ECh. 12 - Prob. 12.4.5ECh. 12 - Prob. 12.4.6ECh. 12 - Prob. 12.4.7ECh. 12 - Prob. 12.5ECh. 12 - Prob. 12.6ECh. 12 - Prob. 12.7ECh. 12 - Prob. 12.8ECh. 12 - Prob. 12.9ECh. 12 - Prob. 12.10ECh. 12 - Prob. 12.11ECh. 12 - Prob. 12.12ECh. 12 - Prob. 12.13ECh. 12 - Prob. 12.14ECh. 12 - Prob. 12.15ECh. 12 - Prob. 12.16PCh. 12 - Prob. 12.17PCh. 12 - Prob. 12.18PCh. 12 - Prob. 12.19PCh. 12 - Remeasurement Gain or Loss Refer to the...Ch. 12 - Prob. 12.21PCh. 12 - Remeasurement and Proof of Remeasurement Gain or...Ch. 12 - Translation Palermo Inc. purchased 80 percent of...Ch. 12 - Prob. 12.24PCh. 12 - Prob. 12.25PCh. 12 - Prob. 12.26PCh. 12 - Prob. 12.27PCh. 12 - Prob. 12.28PCh. 12 - Prob. 12.29PCh. 12 - Prob. 12.30PCh. 12 - Prob. 12.31PCh. 12 - Prob. 12.32PCh. 12 - Prob. 12.33P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that a U.S.-based company is issuing securities to foreign investors who require financial statements prepared in accordance with IFRS. Thus, adjustments to convert from U.S. GAAP to IFRS must be made. Ignore income taxes for given problem. Trecek Corporation incurs research and development costs of $650,000 in 2017, 30 percent of which relate to development activities subsequent to IAS 36 criteria having been met that indicate an intangible asset has been created. The newly developed product is brought to market in January 2018 and is expected to generate sales revenue for 10 years.a. Determine the appropriate accounting for research and development costs for the years ending December 31, 2017, and December 31, 2018, under (1) U.S. GAAP and (2) IFRS.b. Prepare the entry(ies) that Trecek would make on the December 31, 2017, and December 31, 2018, conversion worksheets to convert U.S. GAAP balances to IFRS.arrow_forwardAssume a U.S. company decides to quantitatively test its goodwill for impairment. A division's book value exceeds its fair value by $8 million, and its goodwill has a book value of $10 million. The division's goodwill impairment loss is Select one: O O a. $10 million b. $0 c. $8 million d. $2 millionarrow_forwardA foreign subsidiary of Thun Corporation has one asset (inventory) and no liabilities. The functional currency for this subsidiary is the yuan. The inventory was acquired for 100,000 yuan when the exchange rate was $0.16 = 1 yuan. Consolidated statements are to be produced, and the current exchange rate is $0.12 = 1 yuan. Which of the following statements is true for the consolidated financial statements? A remeasurement gain must be reported. A positive translation adjustment must be reported. A negative translation adjustment must be reported. A remeasurement loss must be reported.arrow_forward

- A foreign subsidiary of Thun Corporation has one asset (inventory) and no liabilities. The functional currency for this subsidiary is the yuan. The inventory was acquired for 100,000 yuan when the exchange rate was $0.16 = 1 yuan. Consolidated statements are to be produced, and the current exchange rate is $0.12 = 1 yuan. Which of the following statements is true for the consolidated financial statements?a. A remeasurement gain must be reported.b. A positive translation adjustment must be reported.c. A negative translation adjustment must be reported.d. A remeasurement loss must be reported.arrow_forward11. The following information pertains to Nonagon Company's biological assets at December 31, 2021: Price of assets in an active market , P 5,000,000 Estimated broker's and dealer's commissions, P 50,000 Transport and other costs expected to be incurred to bring the assets to the market, P 40,000 Selling price in a binding sale agreement, P 5,100,000 At what amount should the biological assets be presented on the statement of financial position?arrow_forwardCertain balance sheet accounts of a foreign subsidiary of Paul Inc. at December 31, year 1, have been translated in US dollars as follows: Translated at Current Rates Historical Rates Note recievable, long term P 240,000 P 200,000 Prepaid rent 85,000 80,000 Patent 150,000 170,000 P 475,000 P 450,000 The subsidiary's functional currency is…arrow_forward

- Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes for given problem. Llungby AB spent 1,000,000 krone in 2017 on the development of a new product. The company determined that 25 percent of this amount was incurred after the criteria in IAS 36 for capitalization as an intangible asset had been met. The newly developed product is brought to market in January 2018 and is expected to generate sales revenue for five years.a. Determine the appropriate accounting for development costs for the years ending December 31, 2017, and December 31, 2018, under (1) IFRS and (2) U.S. GAAP. b. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2017, and December 31, 2018, conversion worksheets to convert IFRS balances to U.S. GAAP.arrow_forwardA foreign subsidiary of Thun Corporation has one asset (inventory) and no liabilities. The functional currency for this subsidiary is the yuan. The inventory was acquired for 100,000 yuan when the exchange rate was $0.16 = 1 yuan. Consolidated statements are to be produced, and the current exchange rate is $0.12 = 1 yuan. Which of the following statements is true for the consolidated financial statements? Choose the correct.a. A remeasurement gain must be reported.b. A positive translation adjustment must be reported.c. A negative translation adjustment must be reported.d. A remeasurement loss must be reported.arrow_forwardOn 1 June 20X0, an entity based in Country A with a functional currency of CUbuys an investment property in Country B with local currency FCU forFCU500,000. The fair value of the investment property is reliably measurable inFCU without undue cost or effort on an ongoing basis. Consequently, inaccordance with Section 16 Investment Property, the entity measures itsinvestment property, after initial recognition, at fair value through profit or loss.The entity has a year-end of 31 December.The spot exchange rates and fair values of the investment property (FVIP) are asfollows: 1 June 20X0: CU1 = FCU1.1 and FVIP = FCU500,000 31 December 20X0: CU1 = FCU1.05 and FVIP = FCU520,000 31 December 20X1: CU1 = FCU1.2 and FVIP = FCU540,000On 1 April 20X2 the investment property is sold for FCU570,000 when theexchange rate is CU1 = FCU1.1. Required:i. Make Journal Entries for each of these transactions recognizing the purchase ofinvestment property. ii. Show a journal entry Derecognizing it after…arrow_forward

- Question: XYZ Corporation is a global conglomerate with numerous subsidiaries operating in different countries. The company follows International Financial Reporting Standards (IFRS) for its financial reporting. During the current financial year, one of its subsidiaries experienced a significant decline in its market value due to adverse economic conditions. Which of the following statements regarding the impairment testing of assets under IFRS is correct? A) Under IFRS, impairment testing is only required for tangible assets such as property, plant, and equipment, and intangible assets like goodwill are exempt from impairment testing. B) Impairment testing under IFRS is required annually for all assets, regardless of their carrying amount and market value, to assess any potential diminution in value. C) The recoverable amount of an asset is determined as the higher of its fair value less costs to sell and its value in use, where value in use is calculated based on the…arrow_forwardOn October 1, 2020, Mud Co., a U.S. company, purchased parts from Terra, a Portuguese company, with payment due on December 1, 2020. If Mud's 2020 operating income included no foreign exchange gain or loss, the transaction could have _____. A. Been denominated in U.S. dollars. B. Generated a foreign exchange gain to be reported as a deferred charge on the balance sheet. C. Resulted in an extraordinary gain. D. Generated a foreign exchange loss to be reported as a separate component of stockholders' equity.arrow_forwardBomarks acquires an equipment from a foreign supplier on credit for $6 million on 31 March 2022, when the exchange rate was $1 = GH¢ 5. The entity incurred other direct costs of GH¢1.5 million in installing the equipment. The estimated useful life of the equipment is 10 years and the entity has obligation to restore the location to its original state after usage. The estimated cost of dismantling and restoration in 10 years is GH¢3.5 million and the entity’s cost of capital is 8%. Although the equipment was available for use from 1 May 2022, the entity did not bring it into use until 1 July, 2022. Bomarks also sold goods to a foreign customer for $3.5 million on 30 April 2022, when the exchange rate was $1 = GH¢5.75. The customer paid $1 million on 1 July when the rates were $1 = GH¢5.60. On that date, Bomarks paid half of the amount owed for the equipment. At the entity’s year-end of 31 December 2022, the closing exchange rate was $1 = GH¢5.9. The entity’s functional currency is the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Foreign Exchange Risks; Author: Kaplan UK;https://www.youtube.com/watch?v=ne1dYl3WifM;License: Standard Youtube License