Translation

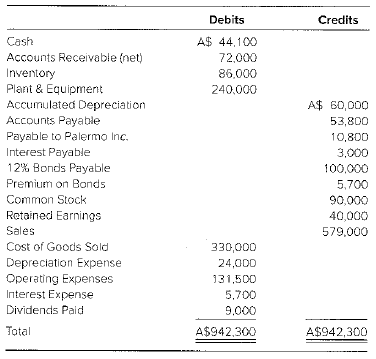

Palermo Inc. purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on January 1, 20X3. The purchase price in Australian dollars (AS) was A$200,000, and A$40,000 of the differential was allocated lo plant and equipment, which is amortized over a 10-year period. The remainder of the differential was attributable to a Patent. Palermo Inc. amortizes the patent over 10 years. Salina Ranching’s

Additional Information

1. Salina Ranching uses average cost for cost of goods sold. Inventory increased by A$20,000 during the year. Purchases were made uniformly during 20X3. The ending inventory was acquired at the average exchange rate for the year.

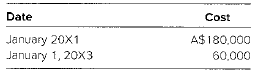

2. Plain and equipment were acquired as follows:

3. Plant and equipment are

4. The payable to Palermo is in Australian dollars. Palermo’s books show a receivable from Salina Ranching of $6,480.

5. The 10−year bonds were issued on July 1, 20X3, for A$106,000. The premium is amortized on a straight−line basis. The interest is paid on April 1 and October 1,

6. The dividends were declared arid paid on April 1.

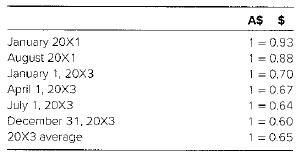

7. Exchange rates were as follows:

Required

a. Prepare a schedule translating the December 31, 20X3, trial balance of Salina Ranching from Australian dollars to U.S. dollars.

b. Prepare a schedule providing a proof of the translation adjustment.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Advanced Financial Accounting

- Panama Company acquired 60 % of Samoa Corporation on 1/2018. Fair values of Samoa's assets and liabilities approximated book values on that date. Panama uses the initial value method to account for its investment in Samoa. only answer D.) E.) F.) On 1/2019, Panama bought equipment from Samoa for $60,000 that had originally cost Samoa $120,000 and had $ 90,000 of Accumulated depreciation at the time. The equipment had a five-year remaining life and was being depreciated using the straight line method. You are preparing the worksheet for the 2020 fiscal year. a. Was this equipment sale upstream or downstream?b. How much unrealized net gain from the equipment transfer remains at the beginning of 2020? (this is the amount you will need for the *TA entry at 1/2020.)c. Which company's Retained earnings account will be adjusted in the *TA entry in part a? (Which company was the “initiator” of the transaction?)d. How much excess depreciation will there be in each of the first five years after…arrow_forwardPanama Company acquired 60 %of Samoa Corporation on 1/2018. Fair values of Samoa's assets and liabilitiesapproximated book values on that date. Panama uses the initial value methodto account for its investment in Samoa.On 1/2019, Panama bought equipment from Samoa for $60,000 that hadoriginally cost Samoa $120,000 and had $ 90,000of Accumulated depreciation at the time. The equipment had a five-yearremaining life and was being depreciated using the straight line method.You are preparing the worksheet for the 2020 fiscal year.a. Was this equipment sale upstream or downstream?b. How much unrealized net gain from the equipment transfer remains at thebeginning of 2020? (this is the amount you will need for the *TA entry at 1/2020.)c. Which company's Retained earnings account will be adjusted in the *TA entryin part a? (Which company was the “initiator” of the transaction?)d. How much excess depreciation will there be in each of the first five yearsafter the transfer?e. Panama's 2020 net…arrow_forwardPanama Company acquired 60 %of Samoa Corporation on 1/2018. Fair values of Samoa's assets and liabilitiesapproximated book values on that date. Panama uses the initial value methodto account for its investment in Samoa.On 1/2019, Panama bought equipment from Samoa for $60,000 that hadoriginally cost Samoa $120,000 and had $ 90,000of Accumulated depreciation at the time. The equipment had a five-yearremaining life and was being depreciated using the straight line method.You are preparing the worksheet for the 2020 fiscal year.d. How much excess depreciation will there be in each of the first five yearsafter the transfer?e. Panama's 2020 net income, without including any investment income, was$ 360,000 and Samoa reported net income of $ 115,000 in 2020.What consolidated income will be reported before removing the noncontrollinginterest's share of the subsidiary's net income? (This includes the effectof the ED entry.)f. What will the noncontrolling interest's share of the subsidiary's net…arrow_forward

- On January 1, 20X8, Plum Company acquired all of the outstanding stock of Snap PLC, a British Company, for $300,000. Snap's net assets on the date of acquisition were 220,000 pounds ( £ ). On January 1,2018, the book and fair values of the Snap's identifiable assets and liabilities approximated their fair values except for equipment. The remaining useful life of Snap's equipment at January 1,20×8, was 10 years. During 20X8, Snap earned 80,000 pounds in income and declared and paid 10,000 pounds in dividends. The dividends were declared and paid in pounds on November 1,20×8. Plum's income from its own operations was $160,000 for 20X8. Plum's total stockholders' equity on January 1,20×8 was $1,100,000. It declared $90,000 of dividends during 20X8. Assume Plum uses the fully adjusted equity method to account for its investment in Snap. Management has determined that the pound is Snap's appropriate functional currency. Relevant exchange rates were as follows: January 1,20×8,$1.20=1£…arrow_forwardBahrain Company acquired a trademark for P10 million from Bangkok Trading on January 2, 2022. The trademark is carried in the accounting records for Bangkok at an amortized cost of P7.6 million. Bahrain's independent consultant has estimated that the remaining useful life of the trademark is 10 years. What amount should Bahrain report as accumulated amortization in its December 31, 2022 statement of financial position?arrow_forwardOn January 1, 20x1, Entity X sells a building to Entity Y for ₱900,000 cash and simultaneously leases the building back. Additional information follows: Fair value of building 1,000,000 Carrying amount of building 800,000 Remaining useful life of building 10 years Lease term 5 years Annual rent payable at the end of each year 100,000 Implicit interest rate equal to Market rate 12% The transfer qualifies as a sale under PFRS 15. What amount of gain should Entity X recognize at lease commencement date? 0 107,904 263,244 174,904arrow_forward

- On December 18, 2020, Stephanie Corporation acquired 100 percent of a Swiss company for 4.004 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2020, the book and fair values of the subsidiary’s assets and liabilities were as follows: Cash CHF 804,000 Inventory 1,304,000 Property, plant, and equipment 4,004,000 Notes payable (2,108,000 ) Stephanie prepares consolidated financial statements on December 31, 2020. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. Determine the translation adjustment to be reported on Stephanie’s December 31, 2020, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary’s functional currency. What is the economic relevance of this translation adjustment? Determine the remeasurement gain or loss…arrow_forwardOn October 1, Takei, Inc. exchanged 8,000 shares of its ₱25 par value ordinary share for a parcel of land to be used as site for a new plant. Takei's ordinary share had a fair value of ₱80 per share on the exchange date. Takei received ₱36,000 from the sale of scrap when an existing building on the site was razed. The land should be carried at a. 200,000 b. 236,000 c. 604,000 d. 640,000 This is from Intermediate Accounting (PPE)arrow_forward15 Clegane Company had the following acquisitions of intangible assets in 2022: Franchise On January 31, 2022, Clegane signed an agreement to operate as franchisee of Clear Copy Service, Inc. for an initial franchise of P780,000. Of this amount, P300,000 was paid when the agreement was signed and the balance was payable in four annual payments of P120,000 each, beginning January 31, 2023. The agreement provides that the down payment is not refundable and no future services are required of the franchisor. The implicit rate for loan of this type is 12%. The agreement also provides the 1.5% of the revenue from the franchise must be paid to the franchisor annually. Clegane’s revenue from the franchise in 2022 was P9,500,000. Clegane estimates the useful life of the franchise to be ten years. At the end of 2022, the franchise recoverable amount was P610,000. Trademark On March 1, 2022 Clegane purchased for P400,000 a trademark for a very successful soft drink it markets under the name…arrow_forward

- In order to demonstrate the use of the remeasurement process, assume that at the beginning of the year a U.S. parent company invested 100,000 foreign currency B (FCB) to form a 100% owned subsidiary.The subsidiary immediately invested the foreign currency in land at a cost of 50,000 FCB and inventory with a cost of 50,000 FCB. At midyear, 50% of the inventory was sold for 40,000 FCB. At year-end, assume that the sale is still uncollected. Although FCB is the subsidiary’s functional currency, the subsidiary maintains its books of record in foreign currency A (FCA). Assume the following exchange rates: Beginning of Year Mid Year End of Year1 FCB equals . . . . . . 12.5 FCA 8 FCA 10 FCA1 FCA equals. . . . . . 0.08 FCB 0.125 FCB 0.10 FCB1 FCA equals. . . . . . $0.20 $0.40 $0.301 FCB equals . . . . . . $2.50…arrow_forwardQuiz Company acquired a patent on July 1, Year 1. On the date of acquisition, the patent had a remaining legal life of 12 years and a fair value of $120,000. Quiz Company made a cash payment of $20,000 and signed a 5-year, 6%, $80,000 note to acquire the patent. The note required five equal annual payments. Quiz Company believes that the product under patent was marketable for another 10 years from the date of acquisition. Determine the carrying value of the patent at December 31, Year 2.arrow_forwardKosher Pickle Company acquires all the outstanding stock of Midwest Produce for $19 million. The fair value of Midwest’s assets is $14.3 million. The fair value of Midwest’s liabilities is $2.5 million. Calculate the amount paid for goodwill.arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning