College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 12SPB

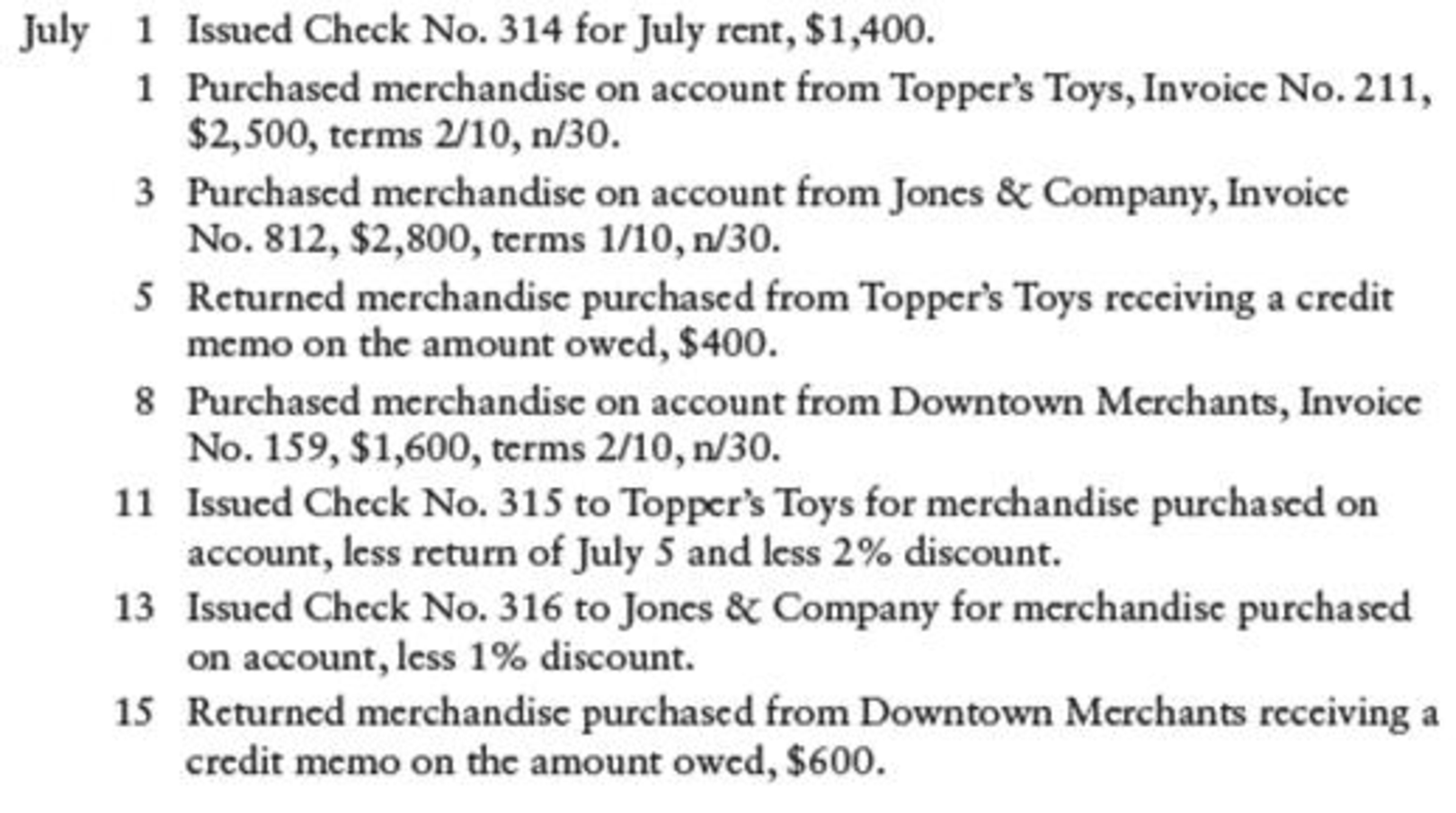

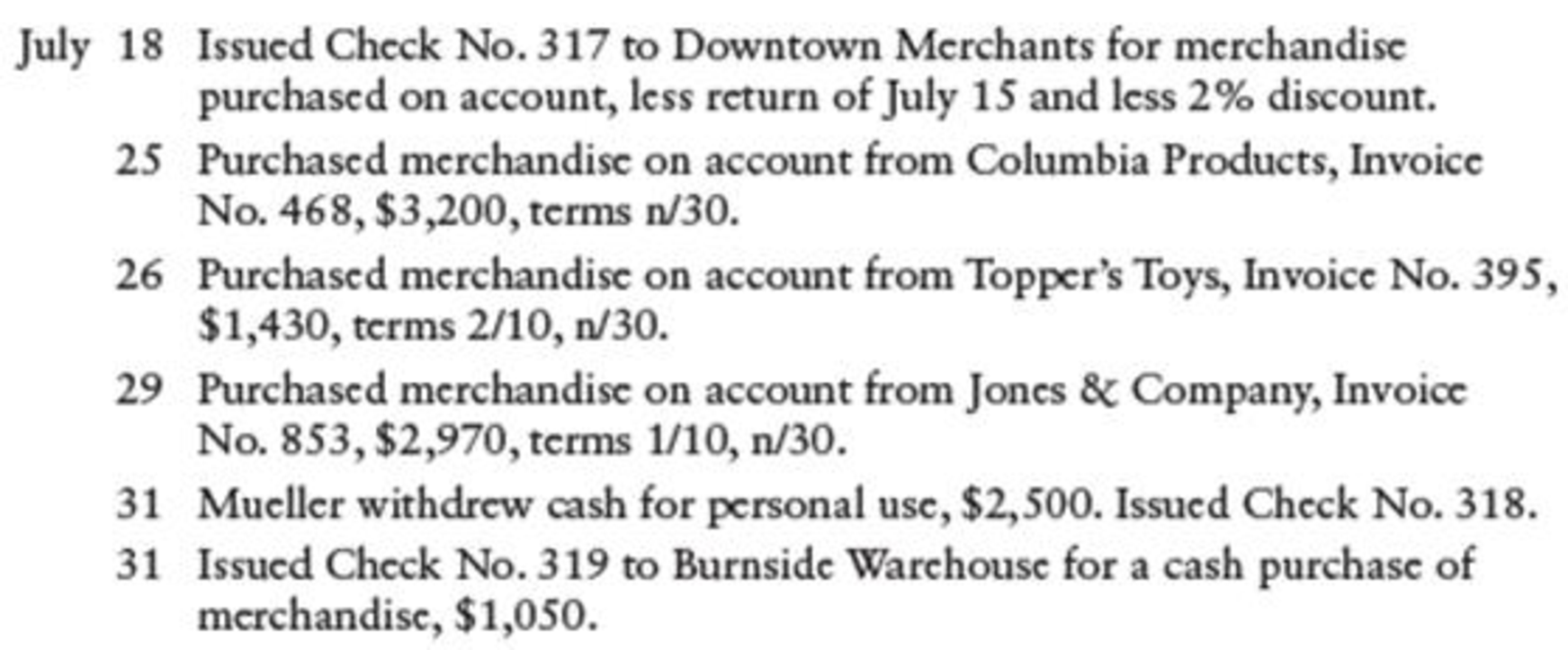

PURCHASES JOURNAL, CASH PAYMENTS JOURNAL, AND GENERAL JOURNAL Debbie Mueller owns a small retail business called Debbie’s Doll House. The cash account has a balance of $20,000 on July 1. The following transactions occurred during July:

REQUIRED

- 1. Record the transactions in the purchases journal, cash payments journal, and general journal. Total and rule the purchases and cash payments journals. Prove the cash payments journal.

- 2. Post from the journals to the general ledger and accounts payable ledger accounts. Use general ledger account numbers as shown in the chapter.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 12 Solutions

College Accounting, Chapters 1-27

Ch. 12 - LO1 The types of special journals a business uses...Ch. 12 - Prob. 2TFCh. 12 - Prob. 3TFCh. 12 - Prob. 4TFCh. 12 - LO4 Purchases returns and allowances are recorded...Ch. 12 - The first step in posting the sales journal to the...Ch. 12 - LO3 In the cash receipts journal, each amount in...Ch. 12 - The journal that should be used to record the...Ch. 12 - A purchases journal usually is used to record all...Ch. 12 - In the cash payments journal, each amount in the...

Ch. 12 - Prob. 1CECh. 12 - LO3 Enter the following transactions in a cash...Ch. 12 - LO4 Enter the following transaction in a purchases...Ch. 12 - Enter the following transactions in a cash...Ch. 12 - Prob. 1RQCh. 12 - List four items of information about each sale...Ch. 12 - Prob. 3RQCh. 12 - Prob. 4RQCh. 12 - Prob. 5RQCh. 12 - Prob. 6RQCh. 12 - Prob. 7RQCh. 12 - Prob. 8RQCh. 12 - Prob. 9RQCh. 12 - Prob. 10RQCh. 12 - Prob. 11RQCh. 12 - What steps are followed in posting from the cash...Ch. 12 - What steps are followed in posting from the cash...Ch. 12 - RECORDING TRANSACTIONS IN THE PROPER JOURNAL...Ch. 12 - Prob. 2SEACh. 12 - JOURNALIZING CASH RECEIPTS Enter the following...Ch. 12 - JOURNALIZING PURCHASES TRANSACTIONS Enter the...Ch. 12 - Prob. 5SEACh. 12 - SALES JOURNAL Futi Ishanyan owns a retail business...Ch. 12 - Prob. 7SPACh. 12 - Prob. 8SPACh. 12 - PURCHASES JOURNAL J. B. Speck, owner of Specks...Ch. 12 - PURCHASES JOURNAL, GENERAL LEDGER, AND ACCOUNTS...Ch. 12 - Prob. 11SPACh. 12 - PURCHASES JOURNAL, CASH PAYMENTS JOURNAL, AND...Ch. 12 - RECORDING TRANSACTIONS IN THE PROPER JOURNAL...Ch. 12 - Prob. 2SEBCh. 12 - Prob. 3SEBCh. 12 - JOURNALIZING PURCHASES TRANSACTIONS Enter the...Ch. 12 - JOURNALIZING CASH PAYMENTS Sandcastles Northwest...Ch. 12 - SALES JOURNAL T. M. Maxwell owns a retail business...Ch. 12 - Prob. 7SPBCh. 12 - SALES JOURNAL, CASH RECEIPTS JOURNAL, AND GENERAL...Ch. 12 - PURCHASES JOURNAL Ann Benton, owner of Bentons...Ch. 12 - PURCHASES JOURNAL, GENERAL LEDGER, AND ACCOUNTS...Ch. 12 - Prob. 11SPBCh. 12 - PURCHASES JOURNAL, CASH PAYMENTS JOURNAL, AND...Ch. 12 - Prob. 1MYWCh. 12 - Judy Baresford, the store manager of Comfort...Ch. 12 - During the month of October 20--, The Pink Petal...Ch. 12 - Screpcap Co. had the following transactions during...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CASH RECEIPTS TRANSACTIONS Color Florists, a retail business, had the following cash receipts during January 20--. The sales tax is 5%. REQUIRED 1. Record the transactions starting on page 20 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardMichelle French owns and operates Books and More, a retail book store. Selected account balances on June 1 are as follows: The following purchases and cash payments transactions took place during the month of June: June 1 Purchased books on account from Irving Publishing Company, 2,100. Invoice No. 101, terms 2/10, n/30, FOB destination. 2 Issued Cheek No. 300 to Northeastern Publishing Co. for goods purchased on May 23, terms 2/10, n/30, 1,960 (the 2,000 invoice amount less the 2% discount). 3 Purchased books on account from Broadway Publishing, Inc., 2,880. Invoice No. 711, less a 20% trade discount, and invoice terms of 3/10, n/30, FOB shipping point. 3 Issued Cheek No. 301 to Mayday Shipping for delivery from Broadway Publishing, Inc., 250. 4 Issued Cheek No. 302 for June rent, 625. 8 Purchased books on account from Northeastern Publishing Co., 5,825. Invoice No. 268, terms 2/com, n/60, FOB destination. 10 Received a credit memo from Irving Publishing Company, 550. Books had been returned because the covers were on upside down. 13 Issued Check No. 304 to Broadway Publishing, Inc., for the purchase made on June 3. (Check No. 303 was voided because an error was made in preparing it.) 28 Made the following purchases: 30 Issued Cheek No. 305 to Taylor County Utility Co. for June utilities, 325. 30 French withdrew cash for personal use, 4,500. Issued Check No. 306. 30 Issued Cheek No. 307 to Irving Publishing Company for purchase made on June 1 less returns made on June 10. 30 Issued Check No. 308 to Northeastern Publishing Co. for purchase made on June 8. 30 Issued Check No. 309 for books purchased at an auction, 1,328. REQUIRED 1. Enter the transactions in a general journal (start with page 16). 2. Post from the journal to the general ledger accounts and the accounts payable ledger. Use general ledger account numbers as indicated in the chapter. 3. Prepare a schedule of accounts payable. 4. If merchandise inventory was 35,523 on January 1 and 42,100 as of June 30, prepare the cost of goods sold section of the income statement for the six months ended June 30,20--.arrow_forwardCASH PAYMENTS TRANSACTIONS Kay Zembrowski operates a retail variety store. The books include a general journal and an accounts payable ledger. Selected account balances on May 1 are as follows: The following transactions are related to cash payments for the month of May: May 1Issued Check No. 326 in payment of May rent (Rent Expense), 2,600. 4Issued Check No. 327 to Cortez Distributors in payment of merchandise purchased on account, 4,200, less a 3% discount. Check was written for 4,074. 7Issued Check No. 328 to Indra Velga in partial payment of merchandise purchased on account, 6,200. A cash discount was not allowed. 11Issued Check No. 329 to Toy Corner for merchandise purchased on account, 4,600, less a 1% discount. Check was written for 4,554. 15Issued Check No. 330 to County Power and Light (Utilities Expense), 1,500. 19Issued Check No. 331 to Builders Warehouse for a cash purchase of merchandise, 3,500. 25Issued Check No. 332 to Troutman Outlet for merchandise purchased on account, 4,400, less a 2% discount. Check was written for 4,312. May 30Issued Check No. 333 to Rapid Transit Company for freight charges on merchandise purchased (Freight-In), 800. 31Issued Check No. 334 to City Merchants for a cash purchase of merchandise, 2,350. Required 1. Enter the transactions starting with page 9 of a general journal. 2. Post from the general journal to the general ledger and the accounts payable ledger. Use general ledger account numbers as shown in the chapter.arrow_forward

- SALES AND CASH RECEIPTS TRANSACTIONS Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax. REQUIRED 1. Record the transactions starring on page 7 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardYour company paid rent of $1,000 for the month with check number 1245. Which journal would the company use to record this? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalarrow_forwardCASH PAYMENTS TR ANS ACTIONS Sam Santiago operates a retail variety store. The books include a general journal and an accounts payable ledger. Selected account balances on May 1 are as follows: The following are the transactions related to cash payments for the month of May: May 1Issued Check No. 426 in payment of May rent (Rent Expense), 2,400. 3Issued Check No. 427 to Muellers Distributors in payment of merchandise purchased on account, 3,600, less a 3% discount. Check was written for 3,492. 7Issued Check No. 428 to Van Kooning in partial payment of merchandise purchased on account, 5,500. A cash discount was not allowed. 12Issued Check No. 429 to Fantastic Toys for merchandise purchased on account, 5,200, less a 1% discount. Check was written for 5,148. 15Issued Check No. 430 to City Power and Light (Utilities Expense), 1,720. 18Issued Check No. 431 to A-1 Warehouse for a cash purchase of merchandise, 4,800. 26Issued Check No. 432 to Goya Outlet for merchandise purchased on account, 3,800, less a 2% discount. Check was written for 3,724. 30Issued Check No. 433 to Mercury Transit Company for freight charges on merchandise purchased (Freight-In), 1,200. 31Issued Check No. 434 to Town Merchants for a cash purchase of merchandise, 3,000. Required 1. Enter the transactions starting with page 9 of a general journal. 2. Post from the general journal to the general ledger and the accounts payable ledger. Use general ledger account numbers as shown in the chapter.arrow_forward

- PURCHASES JOURNAL Ann Benton, owner of Bentons Galleria, made the following purchases of merchandise on account during the month of October: REQUIRED 1. Record the transactions in the purchases journal. Total and rule the journal. 2. Post from the purchases journal to the general ledger and accounts payable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardReceived a check for $72 from a customer, Mr. White. Mr. White owed you $124. Which journal would the company use to record this transaction? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalarrow_forwardCatherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forward

- On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. Which journal would the company use to record this transaction on the 18th? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalarrow_forwardPrepare journal entries to record the following transactions. Create a T-account for Cash, post any entries that affect the account, and calculate the ending balance for the account. Assume a Cash beginning balance of $37,400. A. May 12, collected balance due from customers on account, $16,000 B. June 10, purchased supplies for cash, $4,444arrow_forwardTransactions related to purchases and cash payments completed by Wisk Away Cleaning Services Inc. during the month of May 20Y5 are as follows: Prepare a purchases journal and a cash payments journal to record these transactions. The forms of the journals are similar to those illustrated in the text. Place a check mark () in the Post. Ref. column to indicate when the accounts payable subsidiary ledger should be posted. Wisk Away Cleaning Services Inc. uses the following accounts:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY