Intermediate Financial Management (MindTap Course List)

12th Edition

ISBN: 9781285850030

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 20P

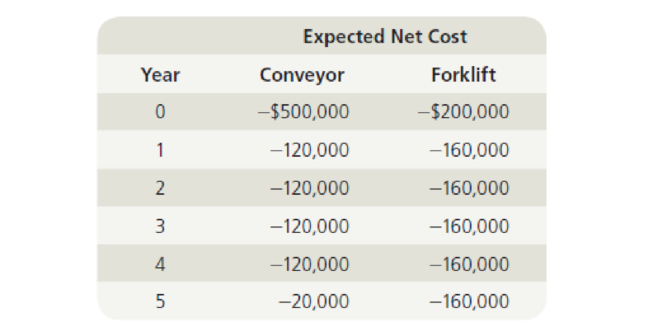

The Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are (1) a conveyor system with a high initial cost but low annual operating costs and (2) several forklift trucks, which cost less but have considerably higher operating costs. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The cost of capital for the plant is 8%, and the projects’ expected net costs are listed in the following table:

- a. What is the

IRR of each alternative? - b. What is the present value of the costs of each alternative? Which method should be chosen?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are (1) a conveyor system with a high initial cost but low annual operating costs and (2) several forklift trucks, which cost less but have considerably higher operating costs. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The cost of capital for the plant is 7%, and the projects' expected net costs are listed in the following table:

Expected Net Cost

Year

Conveyor

Forklift

0

-$500,000

-$200,000

1

-120,000

-160,000

2

-120,000

-160,000

3

-120,000

-160,000

4

-120,000

-160,000

5

-20,000

-160,000

What is the IRR of each alternative?

The IRR of alternative 1 is -Select-undefined 5% 7% 9% Item 1 .

The IRR of…

Calculate the Net present value of the replacement decision?

At times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment.

The company will need to do replacement analysis to determine which option is the best financial decision for the company.

Price Co. is considering replacing an existing piece of equipment. The project involves the following:

The new equipment will have a cost of $1,800,000, and it will be depreciated on a straight-line basis over a period of six years (years1-6).

The old machine is also being depreciated on a straight-line basis. It has a book value of $200,000 (at year O) and four more years of depreciation left ($50,000 per year).

. The new equipment will have a salvage value of $0 at the end of the project's life (year 6). The old machine has a current salvage value (at year 0) of $300,000.

Replacing the old machine will require an investment in net working capital (NWC) of $20,000…

A firm that manufactures paper is considering a project to set up a logging operation. Wood pulp generated by the project - normally an unwanted by-product of a logging operation - is an input to the paper manufacturing process. This will save the company $340,000 in wood pulp purchases, but it will cost $50,000 more to transport the wood pulp to the paper factory than it would cost to dump it as waste.

How would you describe this situation in terms of the NPV analysis for the logging operation?

Question 2Answer

a.

There is a positive externality equal to $290,000 which should be included in the NPV analysis.

b.

There is a positive externality equal to $340,000 which should be included in the NPV analysis.

c.

There is a negative externality equal to $290,000 which should be included in the NPV analysis.

d.

There is a negative externality equal to $340,000 which should be included in the NPV analysis.

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 12 - What types of projects require the least detailed...Ch. 12 - Prob. 3QCh. 12 - Prob. 4QCh. 12 - Prob. 5QCh. 12 - A project has an initial cost of 40,000, expected...Ch. 12 - IRR Refer to Problem 12-1. What is the projects...Ch. 12 - Prob. 3PCh. 12 - Prob. 4PCh. 12 - Prob. 5PCh. 12 - Prob. 6P

Ch. 12 - Your division is considering two investment...Ch. 12 - Edelman Engineering is considering including two...Ch. 12 - Prob. 9PCh. 12 - Project S has a cost of $10,000 and is expected to...Ch. 12 - Prob. 11PCh. 12 - After discovering a new gold vein in the Colorado...Ch. 12 - Prob. 13PCh. 12 - Prob. 14PCh. 12 - The Pinkerton Publishing Company is considering...Ch. 12 - Shao Airlines is considering the purchase of two...Ch. 12 - The Perez Company has the opportunity to invest in...Ch. 12 - Filkins Fabric Company is considering the...Ch. 12 - The Ulmer Uranium Company is deciding whether or...Ch. 12 - The Aubey Coffee Company is evaluating the...Ch. 12 - Your division is considering two investment...Ch. 12 - The Scampini Supplies Company recently purchased a...Ch. 12 - You have just graduated from the MBA program of a...Ch. 12 - Prob. 2MCCh. 12 - Define the term “net present value (NPV).” What is...Ch. 12 - Prob. 4MCCh. 12 - Prob. 5MCCh. 12 - What is the underlying cause of ranking conflicts...Ch. 12 - Prob. 7MCCh. 12 - Prob. 8MCCh. 12 - Prob. 9MCCh. 12 - Prob. 10MCCh. 12 - In an unrelated analysis, you have the opportunity...Ch. 12 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Hudson Corporation is considering three options for managing its data warehouse: continuing with its own staff, hiring an outside vendor to do the managing, or using a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows: If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse? What is the expected annual cost associated with that recommendation? Construct a risk profile for the optimal decision in part (a). What is the probability of the cost exceeding $700,000?arrow_forwardSouthland Corporation’s decision to produce a new line of recreational products resulted in the need to construct either a small plant or a large plant. The best selection of plant size depends on how the marketplace reacts to the new product line. To conduct an analysis, marketing management has decided to view the possible long-run demand as low, medium, or high. The following payoff table shows the projected profit in millions of dollars: What is the decision to be made, and what is the chance event for Southland’s problem? Construct a decision tree. Recommend a decision based on the use of the optimistic, conservative, and minimax regret approaches.arrow_forwardMallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.arrow_forward

- The J.R. Ryland Computer Company is considering a plant expansion to enable the company to begin production of a new computer product. The companys president must determine whether to make the expansion a medium- or large-scale project. Demand for the new product is uncertain, which for planning purposes may be low demand, medium demand, or high demand. The probability estimates for demand are 0.20, 0.50, and 0.30, respectively. Letting x and y indicate the annual profit in thousands of dollars, the firms planners developed the following profit forecasts for the medium-and large-scale expansion projects. a. Compute the expected value for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of maximizing the expected profit? b. Compute the variance for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of minimizing the risk or uncertainty?arrow_forwardFriedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.arrow_forwardNewmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at 860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of 225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%. Required: 1. Compute the NPV of the new system. 2. One year after implementation, the internal audit staff noted the following about the new system: (1) the cost of acquiring the system was 60,000 more than expected due to higher installation costs, and (2) the annual cost savings were 20,000 less than expected because more labor cost was needed than anticipated. Using the changes in expected costs and benefits, compute the NPV as if this information had been available one year ago. Did the company make the right decision? 3. CONCEPTUAL CONNECTION Upon reporting the results mentioned in the postaudit, the marketing manager responded in a memo to the internal audit department indicating that cash inflows also had increased by a net of 60,000 per year because of increased purchases by environmentally sensitive customers. Describe the effect that this has on the analysis in Requirement 2. 4. CONCEPTUAL CONNECTION Why is a postaudit beneficial to a firm?arrow_forward

- Dalrymple Inc. is considering production of a new product. In evaluating whether to go ahead with the project, which of the following items should be considered when cash flows are estimated? If the item should not be included, explain why not.A) Since the firm's director of capital budgeting spent some of her time last year to evaluate the new project, a portion of her salary for that year should be charged to the project's initial cost.B) The project will utilize some equipment the company currently owns but is not now using. A used equipment dealer has offered to buy the equipment.C) The company has spent for tax purposes $3 million on research related to the new product. These funds cannot be recovered, but the research may benefit other projects that might be proposed in the future.D) The new product will cut into sales of some of the firm's other products.E) The firm would borrow all the money used to finance the new project, and the interest on this debt would be $1.5 million…arrow_forwardAdams Corporation is considering the purchase of equipment employing advanced technology to lower production costs in a product line. At the end of the third year, management will close down the line and liquidate the remaining assets. The project will require an investment of $500,000 in plant upgrade and equipment and an additional $30,000 in working capital, which will be recovered in full at the end of year 3.Over its three-year useful life, the new equipment will reduce labor and rawmaterials usage sufficiently to cut operating costs from $9,000,000 to $8,850,000. It is estimated that the new equipment can be sold for $150,000 at the end of year 3. If the new equipment were purchased, the old machine would be sold to another company for $170,000 rather than be traded in for the new equipment. If the old equipment is kept for three more years, the salvage value would be reduced to $70,000.Adams management uses 10% to discount the cash flows. Decide whether replacement is justified…arrow_forwardThe management of Kimco is evaluating the possibility of replacing their large mainframe computer with a modern network system that requires much less office space. The network would cost $760,000 (including installation costs) and would save $150,000 per year in net cash flows (accounting for taxes and depreciation) in Year 1-2, $160,000 in year3-4, and $120,000 in year 5 due to efficiency gains. The current mainframe has a remaining book value of $160,000 and would be immediately sold for $120,000. Kimco’s discount rate is 10%, and its tax rate is 25%. Based on NPV, should management install the network system?arrow_forward

- What would the capital investment amount for pump SP240 have to be such that the firm would be indifferent as to which pump model isselected? You are a member of an engineering project team that is designing a new processing facility. Your present design task involves the portion of the catalytic system that requires pumping a hydrocarbon slurry that is corrosive and contains abrasive particles. For final analysis and comparison, you have selected two fully lined slurry pump units, of equal output capacity, from different manufacturers. Each unit has a large diameter impeller required and an integrated electric motor with solid-state controls. Both units will provide the same level of service (support) to the catalytic system but have different useful lives and costs. The new processing facility is needed by your firm at least as far into the future as the strategic plan forecasts operating requirements. The MARR is 20% per year. Based on this information, which slurry pump should you…arrow_forwardDavis Industries must choose between a gas-powered and an electric-powered forklift truck for moving materials in its factory. Because both forklifts perform the same function, the firm will choose only one. (They are mutually exclusive investments.) The electric-powered truck will cost more, but it will be less expensive to operate; it will cost $21,000, whereas the gas-powered truck will cost $17,230. The cost of capital that applies to both investments is 11%. The life for both types of truck is estimated to be 6 years, during which time the net cash flows for the electric-powered truck will be $6,100 per year, and those for the gas-powered truck will be $5,300 per year. Annual net cash flows include depreciation expenses. Calculate the NPV and IRR for each type of truck, and decide which to recommend. Do not round intermediate calculations. Round the monetary values to the nearest dollar and percentage values to two decimal places.arrow_forwardDwight Donovan, the president of Fanning Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of four years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $116,000 and for Project B are $36,000. The annual expected cash inflows are $44,810 for Project A and $12,355 for Project B. Both investments are expected to provide cash flow benefits for the next four years. Fanning Enterprises’ desired rate of return is 8 percent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License