College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 2E

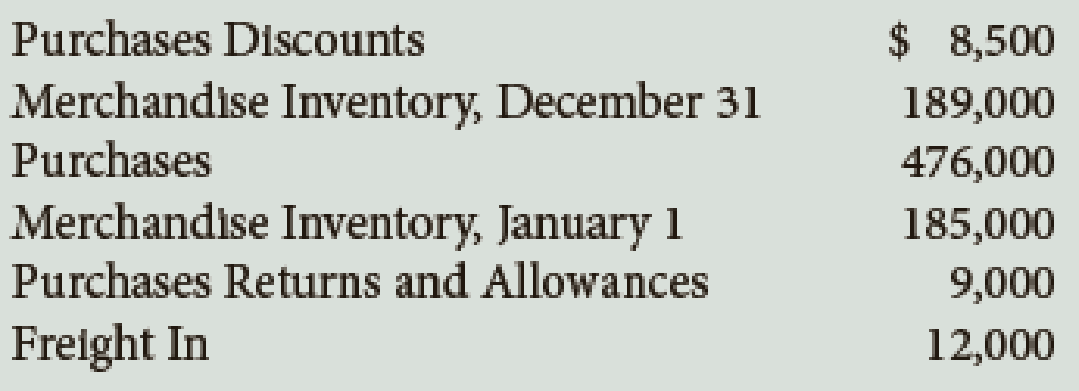

Using the following information, prepare the Cost of Goods Sold section of an income statement.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 12 Solutions

College Accounting (Book Only): A Career Approach

Ch. 12 - What is the term used for the profit on a sale...Ch. 12 - Which of the following is not an example of a...Ch. 12 - Prob. 3QYCh. 12 - What is the third entry of the closing procedure...Ch. 12 - What general journal entry is used to undo a...Ch. 12 - Prob. 1DQCh. 12 - What is the difference between the cost of goods...Ch. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - Prob. 5DQ

Ch. 12 - Explain the calculation of net sales and net...Ch. 12 - Prob. 7DQCh. 12 - What are the rules for recognizing whether an...Ch. 12 - Prob. 9DQCh. 12 - Calculate the missing items in the following:Ch. 12 - Using the following information, prepare the Cost...Ch. 12 - Identify each of the following items relating to...Ch. 12 - The Income Statement columns of the August 31...Ch. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - From the following T accounts, journalize the...Ch. 12 - From the following information, journalize the...Ch. 12 - A partial work sheet for The Fan Shop is presented...Ch. 12 - Prob. 2PACh. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - A partial work sheet for McKnight Music Store is...Ch. 12 - Here is the partial work sheet for Meyer Mountain...Ch. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - Costco is the largest chain of membership...Ch. 12 - A music store sells new instruments. The store...Ch. 12 - You are an owner/bookkeeper in a country whose...Ch. 12 - Prob. 4ACh. 12 - Prob. 5ACh. 12 - It is now August 31. You have journalized and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Calculating certain information using the direct method (Learning Objective 4) 20-25 min. Trudeaus Marine, Inc....

Financial Accounting, Student Value Edition (5th Edition)

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Dave Nelson recently retired at age 48, courtesy of the numerous stock options he had been granted while presid...

Managerial Accounting: Creating Value in a Dynamic Business Environment

Using the information from Problem 1-2B and the inventory information for the Best Bikes below, complete the re...

Managerial Accounting

For each of the following transactions, state which special journal (Sales Journal, Cash Receipts Journal, Cash...

Principles of Accounting Volume 1

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- COST OF GOODS SOLD SECTION, MULTIPLE-STEP INCOME STATEMENT Based on the information that follows, prepare the cost of goods sold section of a multiple-step income statement.arrow_forwardWhich of the following represents the components of the income statement for a merchandising business? A. Sales Revenue - Cost of Goods Sold = gross profit B. Service Revenue - Operating Expenses = gross profit C. Sales Revenue - Cost of Goods Manufactured = gross profit D. Service Revenue - Cost of Goods Purchased = gross profitarrow_forwardWhich of the following represents the components of the income statement for a service business Sales Revenue - Cost of Goods Sold = gross profit Service Revenue - Operating Expenses = operating income Sales Revenue - Cost of Goods Manufactured = gross profit Service Revenue - Cost of Goods Purchased = gross profitarrow_forward

- Identify each of the following items relating to sections of an income statement as Revenue from Sales (S), Cost of Goods Sold (CGS), Selling Expenses (SE), General Expenses (GE), Other Income (OI), or Other Expenses (OE). a. Utilities Expense b. Advertising Expense c. Purchases Discounts d. Sales Returns and Allowances e. Interest Income f. Freight In g. Depreciation Expense, Equipment h. Interest Expense i. Rent Expense j. Salesarrow_forwardHow do you calculate the markup on cost of goods sold? Is the markup pure profit? Explain.arrow_forwardA multi-step income statement ________. A. separates cost of goods sold from operating expenses B. considers interest revenue an operating activity C. is another name for a simple income statement D. combines cost of goods sold and operating expensesarrow_forward

- The difference between merchandise available for sale and the end-of-period merchandise inventory is called (a) gross profit. (b) net purchases. (c) net sales. (d) cost of goods sold.arrow_forwardUse the weighted-average (AVG) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for B75 Company, considering the following transactions.arrow_forwardExplain the difference between the flow of cost and the flow of goods as it relates to inventory.arrow_forward

- Identify items missing in determining cost of goods sold For (a) through (e), identify the items designated by X and Y. A. Purchases (X + Y) = Net purchases B. Net purchases + X = Cost of inventory purchased C. Inventory (beginning) + Cost of inventory purchased = X D. Inventory available for sale X = Cost of inventory before estimated returns E. Cost of goods sold before estimated returns X = Cost of goods soldarrow_forwardIn the income statement, Freight-In is (a) added to purchases. (b) subtracted from purchases. (c) added to sales. (d) subtracted from cost of goods.arrow_forwardDETERMINING THE BEGINNING AND ENDING INVENTORY FROM A PARTIAL SPREADSHEET: PERIODIC INVENTORY SYSTEM From the following partial spreadsheet, indicate the dollar amount of beginning and ending merchandise inventory to be used to compute cost of goods sold.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License