Concept explainers

a.

Interpretation: Initial capital outlay, cash flows after tax and terminal cash flow of this project needs to be computed.

Concept introduction:Capital Budgeting technique is the most useful tool for

b.

Interpretation:

Concept introduction: Capital Budgeting technique is the most useful tool for financial management which helps to understand the investment in project is financially viable or not.

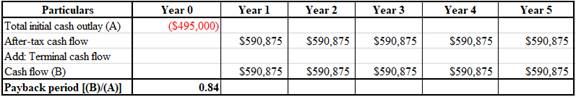

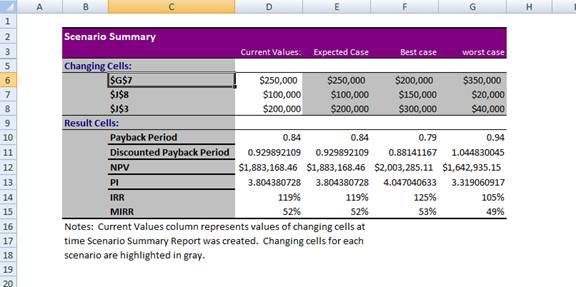

Payback period 0.84

Discounted Payback period 0.9299

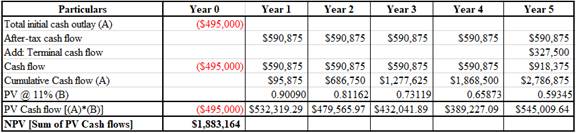

NPV $1,883,164

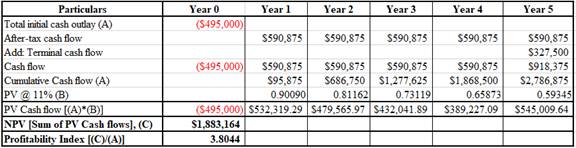

PI 3.8044

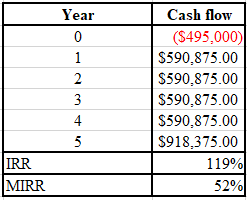

IRR 119%

MIRR 52%

Payback period: It is the period in which cash flow of investment covers the initial investment. It can be computed shown below:

Discounted payback period: It is the period in which discounted cash flow of investment covers the initial investment. It can be computed shown below:

Net present value: NPV is the sum of present value of the cash flows and initial investment when discounted at 11%. It can be computed as:

Profitability Index: It is used to analyze the profitability of an investment wherein its cash flow is divided by the initial investment It can be computed as:

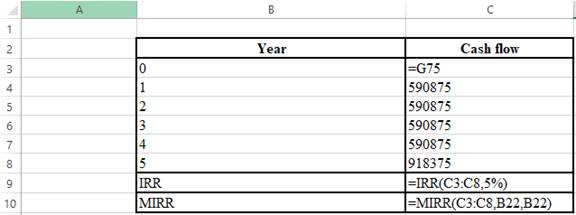

IRR& MIRR:

The formula used to compute IRR and MIRR is as follows:

c.

Interpretation: A scenario analysis is required.

Concept introduction: Capital Budgeting technique is the most useful tool for financial management which helps to understand the investment in project is financially viable or not.

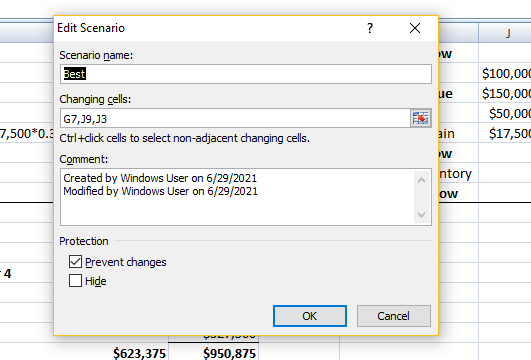

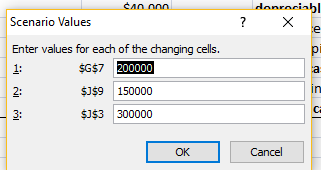

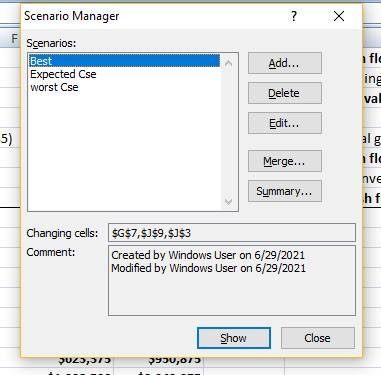

1. Click on “Data” menu and select “scenario Manager” under “what if Analysis” option, then click on “add” option.Then rename the scenario name and select changing cells which need to replace.

2. Enter values which need to be resulted in that scenario, accordingly.

3. Then click on “summary” option to get the various scenario analysis.

4. Scenario Analysis will represent the final output in given scenario.

c.

Interpretation: A scenario analysis is required.

Concept introduction: Capital Budgeting technique is the most useful tool for financial management which helps to understand the investment in project is financially viable or not.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

EBK FINANCIAL ANALYSIS WITH MICROSOFT E

- Global Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell Moore, controller for Global Reach, has been reading about the advantages of foreign trade zones. He wonders if locating in one would be of benefit to his company, which imports about 90 percent of its merchandise (e.g., chess sets from the Philippines, jewelry from Thailand, pottery from Mexico, etc.). Darnell estimates that the new warehouse will store imported merchandise costing about 16.78 million per year. Inventory shrinkage at the warehouse (due to breakage and mishandling) is about 8 percent of the total. The average tariff rate on these imports is 5.5 percent. Required: 1. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in tariffs? Why? (Round your answer to the nearest dollar.) 2. Suppose that, on average, the merchandise stays in a Global Reach warehouse for nine months before shipment to retailers. Carrying cost for Global Reach is 6 percent per year. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.) 3. Suppose that the shifting economic situation leads to a new tariff rate of 13 percent, and a new carrying cost of 6.5 percent per year. To combat these increases, Global Reach has instituted a total quality program emphasizing reducing shrinkage. The new shrinkage rate is 7 percent. Given this new information, if Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)arrow_forwardJansen Crafters has the capacity to produce 50,000 oak shelves per year and is currently selling 44,000 shelves for $32 each. Cutrate Furniture approached Jansen about buying 1,200 shelves for bookcases it is building and is willing to pay $26 for each shelf. No packaging will be required for the bulk order. Jansen usually packages shelves for Home Depot at a price of $1.50 per shell. The $1.50 per-shelf cost is included in the unit variable cost of $27, with annual fixed costs of $320.000. However, the $130 packaging cost will not apply in this case. The fixed costs will be unaffected by the special order and the company has the capacity to accept the order. Based on this information, what would be the profit if Jansen accepts the special order? A. Profits will decrease by $1,200. B. Profits will increase by $31,200. C. Profits will increase by $600. D. Profits will increase by $7,200.arrow_forwardArtisan Metalworks has a bottleneck in their production that occurs within the engraving department. Jamal Moore, the COO, is considering hiring an extra worker, whose salary will be $55,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,000 more units per year. Currently, the selling price per unit is $25 and the cost per unit is $7.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forward

- Bienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.arrow_forwardAt Stardust Gems, a faux gem and jewelry company, the setting department is a bottleneck. The company is considering hiring an extra worker, whose salary will be $67,000 per year, to ease the problem. Using the extra worker, the company will be able to produce and sell 9,000 more units per year. The selling price per unit is $20. The cost per unit currently is $15.85 as shown: What is the annual financial impact of hiring the extra worker for the bottleneck process?arrow_forwardVariety Artisans has a bottleneck in their production that occurs within the engraving department. Arjun Naipul, the COO, is considering hiring an extra worker, whose salary will be $45,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,500 more units per year. Currently, the selling price per unit is $18 and the cost per unit is $5.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forward

- Brahma Industries sells vinyl replacement windows to home improvement retailers nationwide. The national sales manager believes that if they invest an additional $25,000 in advertising, they would increase sales volume by 10,000 units. Prepare a forecasted contribution margin income statement for Brahma if they incur the additional advertising costs, using this information:arrow_forwardCountry Diner currently makes cookies for its boxed lunches. It uses 40,000 cookies annually in the production of the boxed lunches. The costs to make the cookies are: A potential supplier has offered to sell Country Diner the cookies for $0.85 each. If the cookies are purchased, 10% of the fixed overhead could be avoided. If Jason accepts the offer, what will the effect on profit be?arrow_forwardDimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all 30,000 for $240 each. Country Enterprises has approached Dimitri to buy 800 chairs for $210 each. Dimitris normal variable cost is $165 per chair, including $50 per unit in direct labor per chair. Dimitri can produce the special order on an overtime shift, which means that direct labor would be paid overtime at 150% of the normal pay rate. The annual fixed costs will be unaffected by the special order and the contract will not disrupt any of Dimitris other operations. What will be the impact on profits of accepting the order?arrow_forward

- Nico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that post-purchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 200,000 units (for the two-year period). The proposed selling price was 130 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be 120 per unit. Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded: BRIAN: Mark, as you know, we agreed that a profit of 15 per unit is needed for this new product. Also, as I look at the projected market share, 25 percent isnt acceptable. Total profits need to be increased. Cathy, what suggestions do you have? CATHY: Simple. Decrease the selling price to 125 and we expand our market share to 35 percent. To increase total profits, however, we need some cost reductions as well. BRIAN: Youre right. However, keep in mind that I do not want to earn a profit that is less than 15 per unit. MARK: Does that 15 per unit factor in preproduction costs? You know we have already spent 100,000 on developing this product. To lower costs will require more expenditure on development. BRIAN: Good point. No, the projected cost of 120 does not include the 100,000 we have already spent. I do want a design that will provide a 15-per-unit profit, including consideration of preproduction costs. CATHY: I might mention that post-purchase costs are important as well. The current design will impose about 10 per unit for using, maintaining, and disposing our product. Thats about the same as our competitors. If we can reduce that cost to about 5 per unit by designing a better product, we could probably capture about 50 percent of the market. I have just completed a marketing survey at Marks request and have found out that the current design has two features not valued by potential customers. These two features have a projected cost of 6 per unit. However, the price consumers are willing to pay for the product is the same with or without the features. Required: 1. Calculate the target cost associated with the initial 25 percent market share. Does the initial design meet this target? Now calculate the total life-cycle profit that the current (initial) design offers (including preproduction costs). 2. Assume that the two features that are apparently not valued by consumers will be eliminated. Also assume that the selling price is lowered to 125. a. Calculate the target cost for the 125 price and 35 percent market share. b. How much more cost reduction is needed? c. What are the total life-cycle profits now projected for the new product? d. Describe the three general approaches that Nico can take to reduce the projected cost to this new target. Of the three approaches, which is likely to produce the most reduction? 3. Suppose that the Engineering Department has two new designs: Design A and Design B. Both designs eliminate the two nonvalued features. Both designs also reduce production and logistics costs by an additional 8 per unit. Design A, however, leaves post-purchase costs at 10 per unit, while Design B reduces post-purchase costs to 4 per unit. Developing and testing Design A costs an additional 150,000, while Design B costs an additional 300,000. Assuming a price of 125, calculate the total life-cycle profits under each design. Which would you choose? Explain. What if the design you chose cost an additional 500,000 instead of 150,000 or 300,000? Would this have changed your decision? 4. Refer to Requirement 3. For every extra dollar spent on preproduction activities, how much benefit was generated? What does this say about the importance of knowing the linkages between preproduction activities and later activities?arrow_forwardMallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.arrow_forwardSyntech makes digital cameras for drones. Their basic digital camera uses $80 in variable costs and requires $1,500 per month in fixed costs. Syntech sells 100 cameras per month. If they process the camera further to enhance its functionality, it will require an additional $45 per unit of variable costs, plus an increase in fixed costs of $1,000 per month. The current price of the camera is $160. The marketing manager is positive that they can sell more and charge a higher price for the improved version. At what price level would the upgraded camera begin to improve operational earnings?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning