Concept explainers

Customer profitability and ethics. KC Corporation manufactures an air-freshening device called GoodAir, which it sells to six merchandising firms. The list price of a GoodAir is $30, and the full

KC Corporation makes products based on anticipated demand. KC carries an inventory of GoodAir, so rush orders do not result in any extra manufacturing costs over and above the $18 per unit. KC ships finished product to the customer at no additional charge for either regular or expedited delivery. KC incurs significantly higher costs for expedited deliveries than for regular deliveries. Customers occasionally return shipments to KC, and the company subtracts these returns from gross revenue. The customers are not charged a restocking fee for returns.

Budgeted (expected) customer-level cost driver rates are:

| Order taking (excluding sales commission) | $15 per order |

| Product handling | $1 per unit |

| Delivery | $1.20 per mile driven |

| Expedited (rush) delivery | $175 per shipment |

| Restocking | $50 per returned shipment |

| Visits to customers | $125 per customer |

Because salespeople are paid $10 per order, they often break up large orders into multiple smaller orders. This practice reduces the actual order-taking cost by $7 per smaller order (from $15 per order to $8 per order) because the smaller orders are all written at the same time. This lower cost rate is not included in budgeted rates because salespeople create smaller orders without telling management or the accounting department. All other actual costs are the same as budgeted costs.

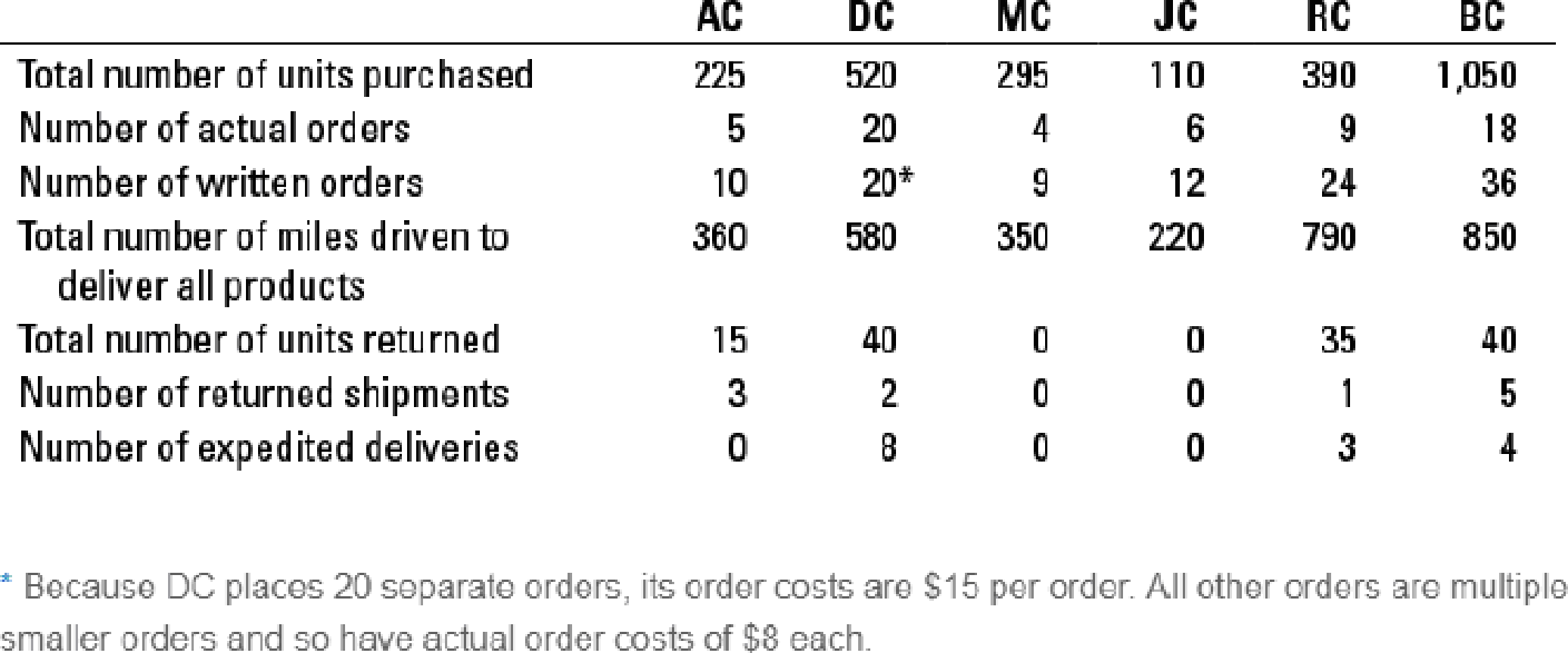

Information about KC’s clients follows:

- 1. Classify each of the customer-level operating costs as a customer output unit–level, customer batch-level, or customer-sustaining cost.

Required

- 2. Using the preceding information, calculate the expected customer-level operating income for the six customers of KC Corporation. Use the number of written orders at $15 each to calculate expected order costs.

- 3. Recalculate the customer-level operating income using the number of written orders but at their actual $8 cost per order instead of $15 (except for DC, whose actual cost is $15 per order). How will KC Corporation evaluate customer-level operating cost performance this period?

- 4. Recalculate the customer-level operating income if salespeople had not broken up actual orders into multiple smaller orders. Don’t forget to also adjust sales commissions.

- 5. How is the behavior of the salespeople affecting the profit of KC Corporation? Is their behavior ethical? What could KC Corporation do to change the behavior of the salespeople?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

COST ACCOUNTING

- Corazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?arrow_forwardBrahma Industries sells vinyl replacement windows to home improvement retailers nationwide. The national sales manager believes that if they invest an additional $25,000 in advertising, they would increase sales volume by 10,000 units. Prepare a forecasted contribution margin income statement for Brahma if they incur the additional advertising costs, using this information:arrow_forwardMany different businesses employ markup on cost to arrive at a price. For each of the following situations, explain what the markup covers and why it is the amount that it is. a. Department stores have a markup of 100 percent of purchase cost. b. Jewelry stores charge anywhere from 100 percent to 300 percent of the cost of the jewelry. (The 300 percent markup is referred to as keystone.) c. Johnson Construction Company charges 12 percent on direct materials, direct labor, and subcontracting costs. d. Hamilton Auto Repair charges customers for direct materials and direct labor. Customers are charged 45 per direct labor hour worked on their job; however, the employees actually cost Hamilton 15 per hour.arrow_forward

- How can I resolve this problem? Marwick’s Pianos, Inc., purchases pianos from a large manufacturer for an average cost of $1,481 per unit and then sells them to retail customers for an average price of $3,400 each. The company’s selling and administrative costs for a typical month are presented below: Costs Cost Formula Selling: Advertising $ 930 per month Sales salaries and commissions $ 4,803 per month, plus 4% of sales Delivery of pianos to customers $ 63 per piano sold Utilities $ 649 per month Depreciation of sales facilities $ 4,913 per month Administrative: Executive salaries $ 13,575 per month Insurance $ 711 per month Clerical $ 2,516 per month, plus $37 per piano sold Depreciation of office equipment $ 885 per month During August, Marwick’s Pianos, Inc., sold and delivered 63 pianos. Required: 1. Prepare a traditional format income statement for August.2. Prepare a contribution format income statement for August. Show costs and…arrow_forwardCarmel Company has a frequent buyer program for its customers, where the customers can attain an "elite" level based on the number of orders and the total revenue of the orders. There are twoelite levels: Platinum and Titanium. The benefits of elite membership include discounts and access to special customer service representatives who can resolve problems. The company has one full time customer representative per 200 Titanium customers and one full-time customer representa tive per 2,000 Platinum customers. Customer representatives receive salaries plus bonuses of 2 percent of customer gross margin. Carmel spends 70 percent of its promotion costs on Titanium customers to encourage their loyaltyarrow_forwardCAN SOMEONE HELP ME WITH THIS QUESTION? Pretty Lady Cosmetic Products has an average production process time of 40 days. Finished goods are kept on hand for an average of 15 days before they are sold. Accounts receivable are outstanding an average of 35 days, and the firm receives 40 days of credit on its purchases from suppliers. Assume net sales of $1,200,000 and cost of goods sold of $900,000. Determine the average investment in accounts receivable, inventories, and accounts payable. What would be the net financing need considering only these three accounts? *Note: To solve this problem, you will need to first find the Inventory Period, the Receivables Period, and the Payment Period. A. $153,054.79 B. $154,054.79 C. $152,054.79 D. $152,154.80arrow_forward

- The Fashion Shoe Company operates a chain of women’s shoe shops that carry many styles of shoes that are all sold at the same price. Sales personnel in the shops are paid a sales commission on each pair of shoes sold plus a small base salary. The following data pertains to Shop 48 and is typical of the company’s many outlets: Per Pair of Shoes Selling price $ 25.00 Variable expenses: Invoice cost $ 11.50 Sales commission 3.50 Total variable expenses $ 15.00 Annual Fixed expenses: Advertising $ 32,000 Rent 17,000 Salaries 110,000 Total fixed expenses $ 159,000 5. Refer to the original data. As an alternative to (4) above, the company is considering paying the Shop 48 store manager 50 cents commission on each pair of shoes sold in excess of the break-even point. If this change is made, what will be Shop 48's net operating income (loss) if 18,600 pairs of shoes are sold? (Do not round intermediate calculations.)arrow_forwardThe Fashion Shoe Company operates a chain of women’s shoe shops that carry many styles of shoes that are all sold at the same price. Sales personnel in the shops are paid a sales commission on each pair of shoes sold plus a small base salary. The following data pertains to Shop 48 and is typical of the company’s many outlets: Per Pair of Shoes Selling price $ 25.00 Variable expenses: Invoice cost $ 11.50 Sales commission 3.50 Total variable expenses $ 15.00 Annual Fixed expenses: Advertising $ 32,000 Rent 17,000 Salaries 110,000 Total fixed expenses $ 159,000 4. The company is considering paying the Shop 48 store manager an incentive commission of 75 cents per pair of shoes (in addition to the salesperson’s commission). If this change is made, what will be the new break-even point in unit sales and dollar sales? (Do not round intermediate calculations. Round "New break-even point in unit sales" up to the nearest whole unit and…arrow_forwardMirabella Beauty manufactures and sells a face cream to small specialty stores in the greater Los Angeles area. It presents the monthly operating income statement shown here to George Lupe, a potential investor in the business. Help Mr. Lupe understand Mirabella Beauty's cost structure. Mirabella Beauty Operating Income Statement, June 2020 Units sold $10,000 Revenues $200,000 Cost of goods sold Variable manufacturing costs $70,000 Fixed manufacturing costs $32,900 Total 102,900 Gross margin 97,100 Operating costs Variable marketing costs $58,000 Fixed marketing and administrative costs 17,500 Total operating costs 75,500 Operating income $21,600 Recast the income statement to emphasize contribution margin. Calculate the contribution margin percentage and breakeven point in units and revenues for June2020. What is the margin of safety (in units) for June 2020? If sales in June were only 8,500 units and Mirabella's tax rate is 30%, calculate its net income.arrow_forward

- [The following information applies to the questions displayed below.] The Fashion Shoe Company operates a chain of women’s shoe shops that carry many styles of shoes that are all sold at the same price. Sales personnel in the shops are paid a sales commission on each pair of shoes sold plus a small base salary. The following data pertains to Shop 48 and is typical of the company’s many outlets: Per Pair of Shoes Selling price $ 25.00 Variable expenses: Invoice cost $ 11.50 Sales commission 3.50 Total variable expenses $ 15.00 Annual Fixed expenses: Advertising $ 32,000 Rent 17,000 Salaries 110,000 Total fixed expenses $ 159,000 Required: 1. What is Shop 48's annual break-even point in unit sales and dollar sales? (Do not round intermediate calculations.) Break-even point in unit sales pairs Break-even point in dollar salesarrow_forwardHARDA Fashion sells ready-to-wear fashion clothes to teenagers. The company has a 20-store chain concentrated in the north-eastern part of the United States of America. Each store has the experienced full-time staff consist of a manager and an assistant manager. The full-time staff is paid a fixed salary. The full-time staff is assisted with a cashier and a sales assistant who have comparatively less experience. The cashier and sales assistant are paid hourly wages plus the commission based on the volume of sales. HARDA Fashion uses unsophisticated cash registered with four-parts sales invoice to record each financial transaction. These sales invoices for the sales transaction irrespective of the payment type.The record-keeping starts with the sales assistant on the sales floor. The sales assistant fills the sales invoices manually by providing the following information: Records his or her employee number.2. Enters the transaction details including clothes item number, description,…arrow_forwardHARDA Fashion sells ready-to-wear fashion clothes to teenagers. The company has a 20-store chain concentrated in the north-eastern part of the United States of America. Each store has the experienced full-time staff consist of a manager and an assistant manager. The full-time staff is paid a fixed salary. The full-time staff is assisted with a cashier and a sales assistant who have comparatively less experience. The cashier and sales assistant are paid hourly wages plus the commission based on the volume of sales. HARDA Fashion uses unsophisticated cash registered with four-parts sales invoice to record each financial transaction. These sales invoices for the sales transaction irrespective of the payment type. The record-keeping starts with the sales assistant on the sales floor. The sales assistant fills the sales invoices manually by providing the following information: 1. Records his or her employee number. 2. Enters the transaction details including clothes item number,…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College