Computing Divisional Income: Incomplete Information and Financial Ratios

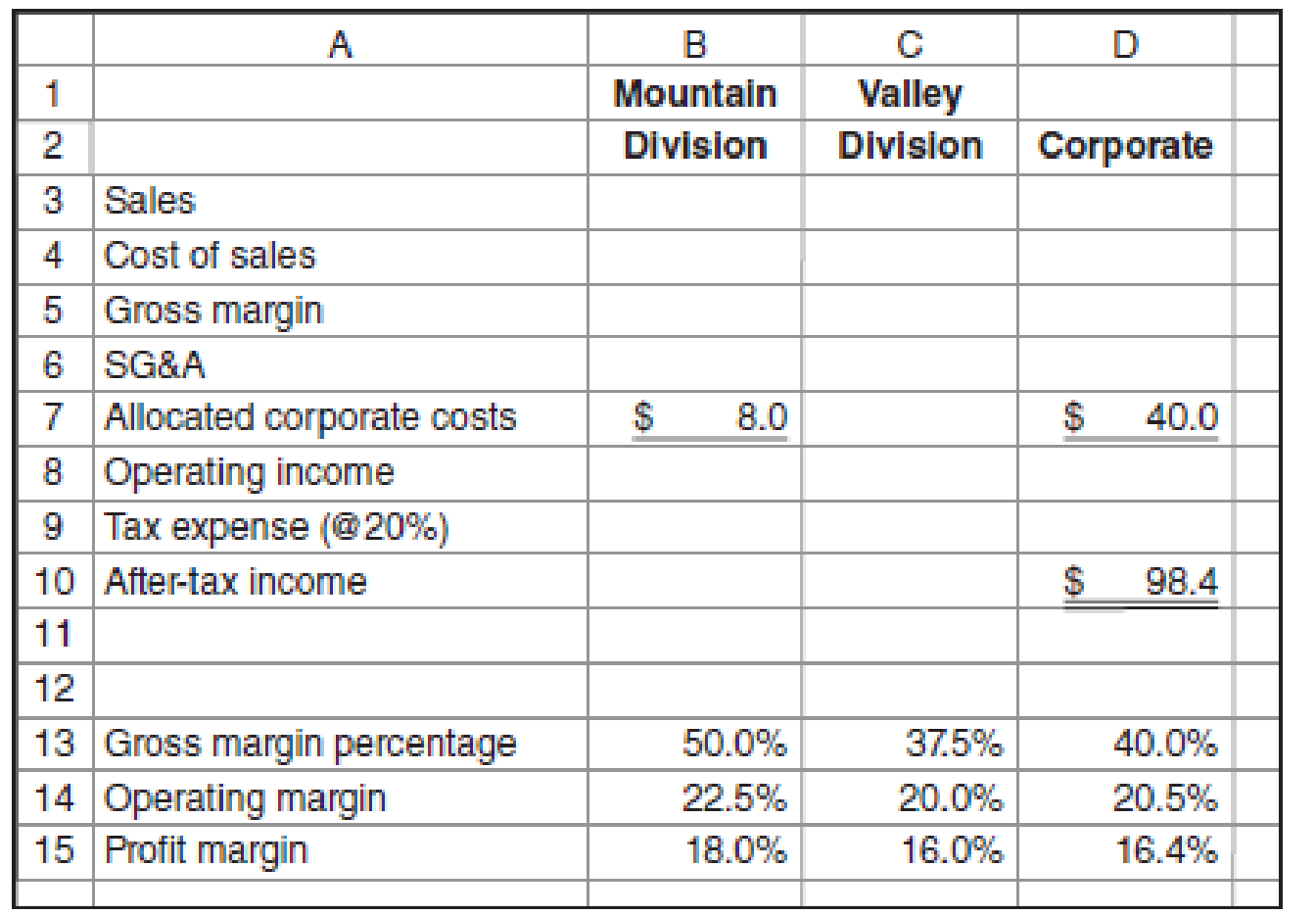

As a part of an employment interview, you are given the partial income statement and selected financial ratios shown for Sneaky Pete’s, a chain of western stores. Sneaky Pete’s is organized into two divisions: Mountain and Valley. You are told that corporate overhead costs are allocated to divisions based on relative sales.

Required

- a. Complete the income statements for both divisions and the corporation as a whole.

- b. What recommendation(s) would you make about computing divisional income for divisional performance measurement at Sneaky Pete’s?

a.

Complete the income statements for both divisions along with the corporation as a whole.

Explanation of Solution

Divisional income statement:

The divisional income statement shows the income of various divisions of the business. It calculates the operating profit of the division by subtracting the expenses of the business from the sales of the division.

Calculate the divisional income statement for mountain division, valley division and corporate:

|

Company S Divisional Income Statement | |||

| Particulars | Mountain division | Valley division | Corporate |

| Sales | $120.00(6) | $480.00(7) | $600.00(1) |

| Cost of sales | $60.00(10) | $300.00(10) | $360.00(4) |

| Gross margin | $60.00(8) | $180.00(8) | $240.00(3) |

| SG&A | $25.00(9) | $52.00(5) | $77.00(5) |

| Allocated corporate costs | $8.00 | $32.00(11) | $40.00 |

| Operating income(a) | $27.00(8) | $96.00(8) | $123.00(2) |

| Tax expenses | $5.40 | $19.20 | $24.60 |

| After tax profit | $21.60 | $76.80 | $98.40 |

Table: (1)

Working note 1:

Calculate the overall corporate sales:

Working note 2:

Calculate the operating income:

Working note 3:

Calculate the gross margin:

Working note 4:

Calculate the cost of sales:

Working note 5:

Calculate the SG&A:

Working note 6:

Calculate the sales for mountain division:

The allocated corporate costs are allocated on the basis of sales. The sales level is $600 on the costs of $40, and it will be computed as follows for the costs of $8:

Working note 7:

Calculate the sales for valley division:

Working note 8:

Calculate the gross and operating income for both the divisions:

| Particulars |

Sales (a) |

Gross margin (b) |

Operating margin (c) |

Gross margin |

Operating profit |

| Mountain division | $120 | 50% | 23% | $60 | $27 |

| Valley division | $480 | 38% | 20% | $180 | $96 |

Table: (2)

Working note 9:

Calculate the SG&A:

Working note 10:

Calculate the cost of sales:

| Particulars | Sales | Gross margin | Cost of sales |

| Mountain division | 120 | 50% | $60 |

| Valley division | 480 | 38% | $298 |

Table: (3)

Working note 11:

Calculate the allocated corporate costs:

b.

Provide recommendations to Company S.

Explanation of Solution

Recommendations to company S:

Company S should not allocate the corporate cost to the divisions. It is not a division specific cost so it should not be allocated on the basis of the revenue of the unit.

Thus, Company S should not allocate the corporate cost to the mountain division and valley division.

Want to see more full solutions like this?

Chapter 14 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Kanye Achebe just became the operations manager of Weston Transportation. Weston transports large crates for online companies and transports containers overseas. Kanye would like to evaluate each divisional manager on a basis similar to segmental reporting required by generally accepted accounting principles (GAAP) financial statements contained in annual reports. These data include a presentation of net sales, operating profit and loss before and after taxes, total identifiable assets, and depreciation for segment reported. Kanye thinks that evaluating business division managers by the same criteria as the total company is appropriate. A. Explain why you think the chief financial officer (CFO) disagrees and tells Kanye that publicly reporting information might demotivate managers. B. For better evaluation of the managers, what type of information should Kanye propose that the CFO might accept?arrow_forwardProfit center responsibility reporting for a service company Red Line Railroad Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance, using operating income as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31: The company operates three support departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department is the companys point of contact for new service, complaints, and requests for repair. The department believes that the number of customer contacts is a cost driver for this work. The Legal Department provides legal services for division management. The department believes that the number of hours billed is a cost driver for this work. The following additional information has been gathered: Instructions 1. Prepare quarterly income statements showing operating income for the three divisions. Use three column headings: East, West, and Central. 2. Identify the most successful division according to the profit margin. Round to the nearest whole percent. 3. Provide a recommendation to the CEO for a better method for evaluating the performance of the divisions. In your recommendation, identify the major weakness of the present method.arrow_forwardRocky Mountain Airlines Inc. has two divisions organized as profit centers, the Passenger Division and the Cargo Division. The following divisional income statements were prepared: The support department allocation rates for the support department costs were based on revenues. Because the revenues of the two divisions were the same, the support department allocations to each division were also the same. The following additional information is available: a.Does the operating income (loss) for the two divisions accurately measure performance? Explain. b.Correct the divisional income statements, using appropriate support department cost drivers.arrow_forward

- Corrections to service department charges Panda Airlines Inc. has two divisions organized as profit centers, the Passenger Division and the Cargo Division. The following divisional income statements were prepared The service department charge rate for the service department costs was based on revenues. The following additional information is available a.Does the operating income for the two divisions accurately measure performance? b.Using service charge rates for service department charges, correct the divisional income statements.arrow_forwardINCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT AND OPERATING INCOME Thomas and Hill Distributors has divided its business into two departments: commercial sales and industrial sales. The following information is provided for the year ended December 31, 20--: REQUIRED 1. Prepare an income statement showing departmental gross profit and total operating income. 2. Calculate departmental gross profit percentages.arrow_forwardCOMPUTING OPERATING INCOME The sales, cost of goods sold, and total operating expenses of departments A and B of Ash Company are as follows: Compute the departmental operating income for each department.arrow_forward

- Divisional income statements and return on investment analysis E.F. Lynch Company is a diversified investment company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 20Y8, are as follows: The management of E.F. Lynch Company is evaluating each division as a basis for planning a future expansion of operations. Instructions 1. Prepare condensed divisional income statements for the three divisions, assuming that there were no support department allocations. 2. Using the DuPont formula for return on investment, compute the profit margin, investment turnover, and return on investment for each division. Round percentages and the investment turnover to one decimal place. 3. If available funds permit the expansion of operations of only one division, which of the divisions would you recommend for expansion, based on parts (1) and (2)? Explain.arrow_forwardDivisional performance analysis and evaluation The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Instructions 1. Prepare condensed divisional income statements for the year ended December 31, 20Y7, assuming that there were no support department allocations. 2. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each division. Round percentages and the investment turnover to one decimal place. 3. If managements minimum acceptable return on investment is 10%, determine the residual income for each division. 4. Discuss the evaluation of the two divisions, using the performance measures determined in parts (1), (2), and (3).arrow_forwardINCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT AND OPERATING INCOME Bacon and Hand Distributors has divided its business into two departments: retail sales and wholesale sales. The following information is provided for the year ended December 31, 20--: REQUIRED 1. Prepare an income statement showing departmental gross profit and total operating income. 2. Calculate departmental gross profit percentages.arrow_forward

- Service department charges In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of 64,560, and the Purchasing Department had expenses of 40,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: A. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. B. Using the cost driver information in (A), determine the annual amount of payroll and purchasing costs allocated to the Residential, Commercial, and Government Contract divisions from payroll and purchasing services. C. Why does the Residential Division have a larger support department allocation than the other two divisions, even though its sales are lower?arrow_forwardConsider the following list of scorecard measures: a. Product profitability b. Ratings from customer surveys c. Number of patents pending d. Strategic job coverage ratio e. Revenue per employee f. Quality costs g. Percentage of market h. Employee turnover percentages i. First-pass yields j. On-time delivery percentage k. Percentage of revenues from new sources l. Economic value added Required: Classify each measure according to the following: perspective, financial or nonfinancial, subjective or objective, and external or internal. When the perspective is process, identify which type of process: innovation, operations, or post-sales service.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College