Compare Current Cost to Historical Cost

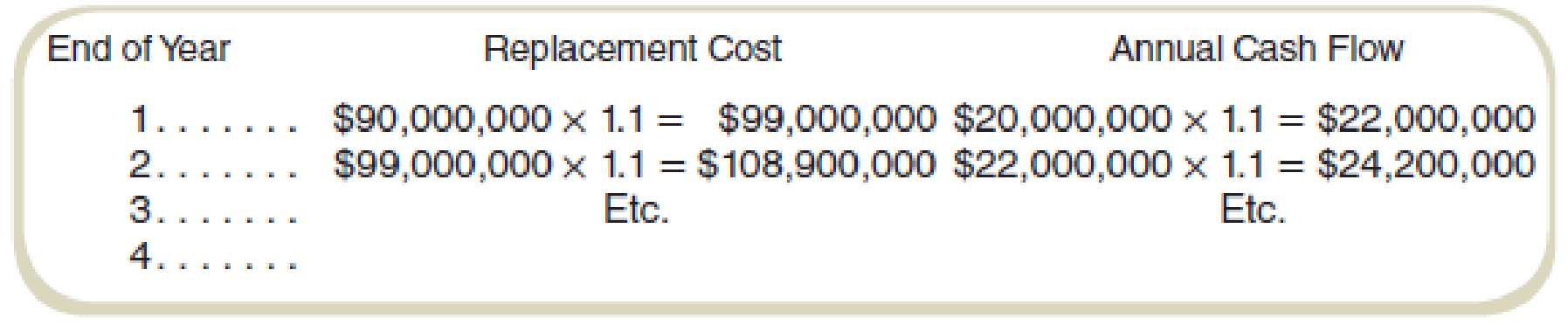

Refer to the information in Exercise 14-36. In computing

Note that “accumulated” depreciation is 10 percent of the gross book value of depreciable assets after one year, 20 percent after two years, and so forth.

Required

- a. Compute ROI using historical cost, net book value.

- b. Compute ROI using historical cost, gross book value.

- c. Compute ROI using current cost, net book value.

- d. Compute ROI using current cost, gross book value.

a.

Compute ROI by using historical cost, net book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 16.05%, 21.11%, 27.97%, and 37.56%.

Explanation of Solution

Net book value:

Net book value refers to the value of the asset after the adjustment of the depreciation. The value of the asset is calculated by deducting the cumulative depreciation from the book value of the asset.

Calculate the ROI using historical cost, net book value:

| Year |

Investment(3) (a) |

Operating profit (1) (b) |

ROI |

| 1 | $81,000,000 | $13,000,000 | 16.05% |

| 2 | $72,000,000 | $15,200,000 | 21.11% |

| 3 | $63,000,000 | $17,620,000 | 27.97% |

| 4 | $54,000,000 | $20,282,000 | 37.56% |

Table: (1)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 16.05%, 21.11%, 27.97%, and 37.56%.

Working note 1:

Calculate the operating profit over the life of the asset:

| Year |

Gross cash flow (a) |

Net cash flow |

Depreciation (1) (c) |

Operating profit |

| 1 | $20,000,000 | $22,000,000 | $9,000,000 | $13,000,000 |

| 2 | $22,000,000 | $24,200,000 | $9,000,000 | $15,200,000 |

| 3 | $24,200,000 | $26,620,000 | $9,000,000 | $17,620,000 |

| 4 | $26,620,000 | $29,282,000 | $9,000,000 | $20,282,000 |

Table: (2)

Working note 2:

Calculate the depreciation:

Working note 3:

Calculate the investment base over the life of the asset:

| Year |

Gross asset value (a) |

Annual depreciation (b) |

Depreciation |

Net asset value |

| 1 | $90,000,000 | 10% | $9,000,000 | $81,000,000 |

| 2 | $90,000,000 | 20% | $18,000,000 | $72,000,000 |

| 3 | $90,000,000 | 30% | $27,000,000 | $63,000,000 |

| 4 | $90,000,000 | 40% | $36,000,000 | $54,000,000 |

Table: (3)

The depreciation has been calculated on the historical cost in this method.

b.

Compute ROI using historical cost, gross book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 14.44%, 16.89%, 19.58%, and 22.54%.

Explanation of Solution

Gross book value:

Gross book value is the value of the asset without the adjustment of the depreciation. The asset is recorded on the book value or the cost value.

Calculate the ROI using historical cost, net book value:

| Year |

Investment (a) |

Operating profit (1) (b) |

ROI |

| 1 | $90,000,000 | $13,000,000 | 14.44% |

| 2 | $90,000,000 | $15,200,000 | 16.89% |

| 3 | $90,000,000 | $17,620,000 | 19.58% |

| 4 | $90,000,000 | $20,282,000 | 22.54% |

Table: (4)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 14.44%, 16.89%, 19.58%, and 22.54%.

c.

Compute ROI by using current cost, net book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 13.58%, 15.28%, 17.46%, and 20.37%.

Explanation of Solution

Current cost:

Current cost is the current market value of the asset. The depreciation is calculated on the current value of the asset rather than the historical cost of the asset.

Calculate the ROI using historical cost, net book value:

| Year |

Investment (7) (a) |

Operating profit (4) (b) |

ROI |

| 1 | $89,100,000 | $12,100,000 | 13.58% |

| 2 | $87,120,000 | $13,310,000 | 15.28% |

| 3 | $83,853,000 | $14,641,000 | 17.46% |

| 4 | $79,061,400 | $16,105,100 | 20.37% |

Table: (5)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 13.58%, 15.28%, 17.46%, and 20.37%.

Working note 4:

Calculate the operating profit over the life of the asset:

| Year |

Gross cash flow (a) |

Net cash flow |

Depreciation (5) (c) |

Operating profit |

| 1 | $20,000,000 | $22,000,000 | $9,900,000 | $12,100,000 |

| 2 | $22,000,000 | $24,200,000 | $10,890,000 | $13,310,000 |

| 3 | $24,200,000 | $26,620,000 | $11,979,000 | $14,641,000 |

| 4 | $26,620,000 | $29,282,000 | $13,176,900 | $16,105,100 |

Table: (2)

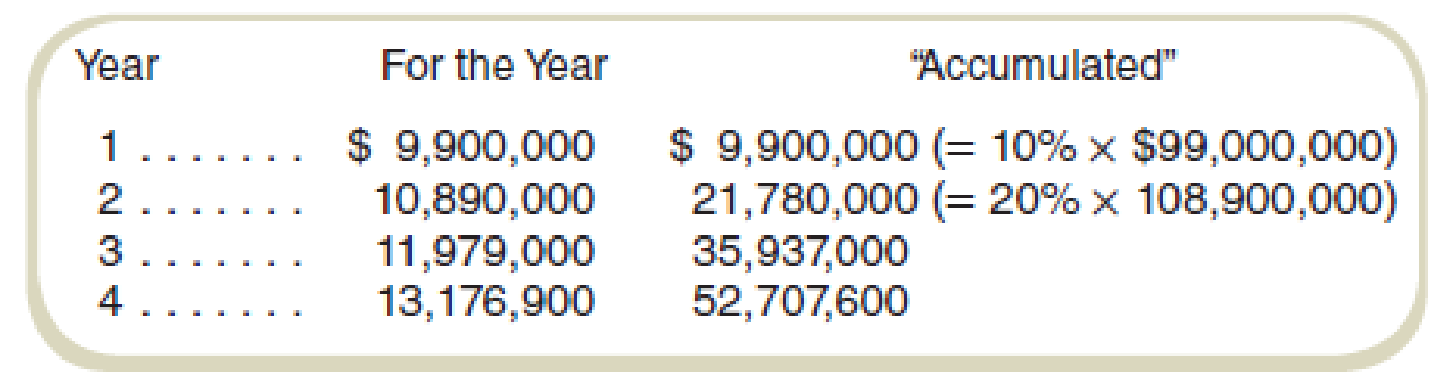

Working note 5:

Calculate the depreciation over the life of the asset:

| Year |

Asset value (a) |

Annual Increment (b) |

The gross value of the asset |

Yearly depreciation |

Total depreciation |

| 1 | $36,000,000 | 10% | $39,600,000 | $9,900,000 | $9,900,000 |

| 2 | $39,600,000 | 10% | $43,560,000 | $10,890,000 | $21,780,000 |

| 3 | $43,560,000 | 10% | $47,916,000 | $11,979,000 | $35,937,000 |

| 4 | $47,916,000 | 10% | $52,707,600 | $13,176,900 | $52,707,600 |

Table: (6)

The closing gross value of each year will be the opening asset value of the next year.

Working note 6:

Calculate the asset value for the first year:

Working note 7:

Calculate the investment base over the life of the asset:

| Year |

Gross asset value (a) |

Depreciation (5) (b) |

Net asset value |

| 1 | $9,900,000 | $9,900,000 | $89,100,000 |

| 2 | $10,890,000 | $21,780,000 | $87,120,000 |

| 3 | $11,979,000 | $35,937,000 | $83,853,000 |

| 4 | $13,176,900 | $52,707,600 | $79,061,400 |

Table: (7)

d.

Compute ROI using current cost, gross book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 12.22% each year.

Explanation of Solution

Gross book value:

Gross book value is the value of the asset without the adjustment of the depreciation. The asset is recorded on the book value or the cost value.

Calculate the ROI using historical cost, net book value:

| Year |

Investment (a) |

Operating profit (4) (b) |

ROI |

| 1 | $99,000,000 | $12,100,000 | 12.22% |

| 2 | $108,900,000 | $13,310,000 | 12.22% |

| 3 | $119,790,000 | $14,641,000 | 12.22% |

| 4 | $131,769,000 | $16,105,100 | 12.22% |

Table: (8)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 12.22% each year.

Want to see more full solutions like this?

Chapter 14 Solutions

FUNDAMENTALS OF COST....-W/CODE>CUSTOM<

- The following selected data pertain to the Argent Division for last year: Required: 1. How much is the residual income? 2. How much is the return on investment? (Rounded to four significant digits.)arrow_forwardDuring the current year, Sokowski Manufacturing earned income of $350,000 from total sales of $5,500,000 and average capital assets of $12,000,000. A. Based on this information, calculate asset turnover. B. Using the sales margin from the previous exercise, what is the total ROI for the company during the current year?arrow_forwardMargin, Turnover, Return on Investment, Average Operating Assets Elway Company provided the following income statement for the last year: At the beginning of last year, Elway had 28,300,000 in operating assets. At the end of the year, Elway had 23,700,000 in operating assets. Required: 1. Compute average operating assets. 2. Compute the margin and turnover ratios for last year. (Note: Round the answer for margin ratio to two decimal places.) 3. Compute ROI. (Note: Round answer to two decimal places.) 4. CONCEPTUAL CONNECTION Briefly explain the meaning of ROI. 5. CONCEPTUAL CONNECTION Comment on why the ROI for Elway Company is relatively high (as compared to the lower ROI of a typical manufacturing company).arrow_forward

- Use the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-32 Residual Income Refer to the information for Washington Company above. In addition, Washington Companys top management has set a minimum acceptable rate of return equal to 8%. Required: 1. Calculate the residual income for the Adams Division. 2. Calculate the residual income for the Jefferson Division.arrow_forwardThe income statement comparison for Forklift Material Handling shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the return on investment. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the residual income for each year. Explain how this compares to your findings in part C.arrow_forwardDescribe the cost formula for a strictly fixed cost such as depreciation of 15,000 per year.arrow_forward

- GGX is the general manager of the Jung Division, and his performance is measured using the residual income method. GGX is reviewing the following forecasted information for the division for next year. Category Amount (thousands) Working capital P 1,800 Revenue 30,000 Plant and equipment 17,200 To establish a standard of performance for the division’s manager using the residual income approach, four scenarios are being considered. Scenario 1 assumes an imputed interest charge of 12% and a target residual income of P1,500,000. Scenario 2 assumes an imputed interest charge of 15% and a target residual income of P2,000,000. Scenario 3 assumes an imputed interest charge of 18% and a target residual income of P1,250,000. Scenario 4 assumes an imputed interest charge of 10% and a target residual income of P2,500,000. What is the residual income for scenario 2?arrow_forwardUsing the following data, estimate the new Return on Investment if there is a 13% decrease in the average operating assets - with the new average operating assets as the base. Sales $3,516,519 Contribution margin 39% Controllable fixed costs 300,215 Average operating assets $4,964,961 Round to two decimal places. Be sure to enter the answer as a percentage but do not include the % sign.arrow_forwardThe Best Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated here. The corporate tax rate is 24 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project. Year 0 Year 1 Year 2 Year 3 Year 4 Investment $ 27,700 Sales revenue $ 14,800 $ 16,400 $ 17,800 $ 14,300 Operating costs 3,600 3,450 5,600 4,200 Depreciation 6,925 6,925 6,925 6,925 Net working capital spending 370 270 365 220 ? a. Compute the incremental net income of the investment for each year. (Do not round intermediate calculations.) b. Compute the incremental cash flows of the investment for each year. (Do not round intermediate calculations. A negative…arrow_forward

- Mitsu Division has the following results for the year: Revenues $1,080,000Variable expenses 440,000Fixed expenses 400,000Total divisional assets are $1,600,000. The company's minimum required rate of return is 14 percent. What is the residual income for Scottso?arrow_forwardCoolbrook Company has the following information available for the past year: River Division Stream Division Sales revenue $ 1,209,000 $ 1,810,000 Cost of goods sold and operating expenses 900,000 1,286,000 Net operating income $ 309,000 $ 524,000 Average invested assets $ 1,200,000 $ 1,460,000 The company’s hurdle rate is 6.26 percent. Required: 1. Calculate return on investment (ROI) and residual income for each division for last year. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.)) river steam ROI % % Residual income (loss) 2. Recalculate ROI and residual income for the division for each independent situation that follows: Operating income increases by 11 percent. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.). Loss…arrow_forwardAssume a high demand for the product and by-products that all produced goods are sold each year within the studyperiod. Calculate the: Payback period formula PP = Fixed Capital Investment / Net Annual Profitarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning