The Midwest Division of the Paibec Corporation manufactures subassemblies that are used in the corporation’s final products. Lynn Hardt of Midwest’s Profit Planning Department has been assigned the task of determining whether a component, MTR–2000, should continue to be manufactured by Midwest or purchased from Marley Company, an outside supplier. MTR–2000 is part of a subassembly manufactured by Midwest.

Marley has submitted a bid to manufacture and supply the 32,000 units of MTR–2000 that Paibec will need for 20x1 at a unit price of $17.30. Marley has assured Paibec that the units will be delivered according to Paibec’s production specifications and needs. While the contract price of $17.30 is only applicable in 20x1, Marley is interested in entering into a long-term arrangement beyond 20x1.

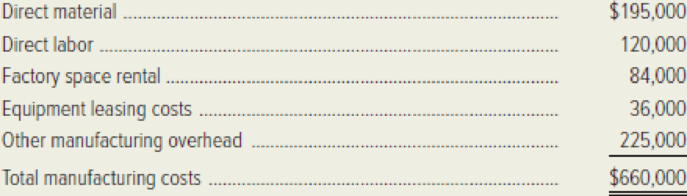

Hardt has gathered the following information regarding Midwest’s

Hardt has collected the following additional information related to manufacturing MTR–2000.

- Direct materials used in the production of MTR–2000 are expected to increase 8 percent in 20x1.

- Midwest’s direct-labor contract calls for a 5 percent increase in 20x1.

- The facilities used to manufacture MTR–2000 are rented under a month-to-month rental agreement. Thus, Midwest can withdraw from the rental agreement without any penalty. Midwest will have no need for this space if MTR–2000 is not manufactured.

- Equipment leasing costs represent special equipment that is used in the manufacture of MTR– 2000. This lease can be terminated by paying the equivalent of one month’s lease payment for each year left on the lease agreement. Midwest has two years left on the lease agreement, through the end of the year 20x2.

- Forty percent of the other manufacturing overhead is considered variable. Variable overhead changes with the number of units produced, and this rate per unit is not expected to change in 20x1. The fixed manufacturing overhead costs are expected to be the same across a relevant range of zero to 50,000 units. Equipment other than the leased equipment can be used in Midwest’s other manufacturing operations.

John Porter, divisional manager of Midwest, stopped by Hardt’s office to voice his concern regarding the outsourcing of MTR–2000. Porter commented, “I am really concerned about outsourcing MTR– 2000. I have a son-in-law and a nephew, not to mention a member of our bowling team, who work on MTR–2000. They could lose their jobs if we buy that component from Marley. I really would appreciate anything you can do to make sure the cost analysis comes out right to show we should continue making MTR–2000. Corporate is not aware of the material increases and maybe you can leave out some of those fixed costs. I just think we should continue making MTR–2000!”

Required:

- a. Prepare an analysis of relevant costs that shows whether or not the Midwest Division of Paibec Corporation should make MTR–2000 or purchase it from Marley Company for 20x1.

- b. Based solely on the financial results, recommend whether the 32,000 units of MTR–2000 for 20x1 should be made by Midwest or purchased from Marley.

- 2. Identify and briefly discuss three qualitative factors that the Midwest Division and Paibec Corporation should consider before agreeing to purchase MTR–2000 from Marley Company.

- 3. By referring to the standards of ethical conduct for

managerial accountants given in Chapter 1, explain why Lynn Hardt would consider the request of John Porter to be unethical.

1. a

Prepare an analysis of relevant costs.

Explanation of Solution

Outsourcing: Outsourcing is a process wherein, Companies choose to outsource products or service and this allows companies to concentrate on its chief function. Outsourcing decisions are generally called “make or buy decisions” since the managers must decide whether to buy a component product or service or product it in-house.

Prepare an analysis of relevant costs:

| Particulars | Amount per unit | Total for 32,000 units |

| Cost to purchase MTR-2000 from Marley: | ||

| Bid price from Marley | (1)$17.30 | $553,600 |

| Equipment lease penalty | $6,000 | |

| Total cost to purchase | $559,600 | |

| Cost for Division M to make MTR-2000: | ||

| Direct material | (2)$7.02 | $224,640 |

| Direct labor | (3)$4.20 | $134,400 |

| Variable manufacturing overhead | (4)$3.00 | $96,000 |

| Factory space rental | $84,000 | |

| Equipment leasing costs | $36,000 | |

| Total cost to make | $575,040 | |

| Cost savings if purchased from Company M | ($15,440) |

Table (1)

Working note:

(1)Calculate equipment lease penalty:

(2)Calculate direct material:

(3)Calculate direct labor:

(4)Calculate variable manufacturing overhead:

b.

Recommend whether the 32,000 units of MTR-2000 must be made or purchased Division M based on the financial results.

Explanation of Solution

The 32,000 units of MTR-2000 must be purchased from Company C, as per the financial results. Total cost from Company m would be $559,600 or $15,440 less that if the units are made by the Division M.

2.

Identify and briefly discuss three qualitative factors that Division M and corporation P must consider before agreeing to purchase MTR-2000 from Company M.

Explanation of Solution

The qualitative factors that Division M and Corporation P must consider before agreeing to purchase MTR-2000 from Company M comprise the following:

- “The quality of the Company M’s component must equalize, or must be better than, the quality of the internally made element, or else the quality of the final product might be negotiated and Corporation P’s reputation gets affected adversely”.

- “Company M’s consistency as an on-time supplier is vital, because delayed deliveries can hamper Corporation P’s production schedule and delivery dates for the final product”.

- “Layoffs can happen if the component is outsourced to Company M. This can affect Division M’s and Corporation P’s other employees and can problems related to labor or influence the position of the company in the community. Moreover, there can be end costs that are not factored into the analysis”.

3.

Explain the reason for which Person L considers the request of Person J to be unethical, by referring to the standards of ethical conduct for managerial accountants.

Explanation of Solution

Person L must consider the request of the person J to be unethical due to the following reasons that are based on the IMA statement of ethical professional practice.

Competence:

- “Maintain an appropriate level of professional expertise by continually developing knowledge and skills”.

- “Provide decision support information and recommendations that are accurate, clear, concise and timely”.

- “Perform professional duties in accordance with laws, rules and regulations”.

Integrity:

- “Mitigate actual conflicts of interest. Regularly communicate with business associates to avoid apparent conflicts of interest. Advise all parties of any potential conflicts”

- “Refrain from engaging in any conduct that would prejudice carrying out duties ethically”.

- “Abstain from engaging in or supporting any activity that might discredit the profession”.

Credibility:

- “Communicate information fairly and objectively”.

- “Disclose all relevant information that could reasonably be expected to influence an intended user’s understanding of the reports, analyses, or recommendations”.

- “Disclose delays or deficiencies in information, timeliness, processing, or internal controls in conformance with organization policy and/or applicable law”.

Want to see more full solutions like this?

Chapter 14 Solutions

Loose-Leaf for Managerial Accounting: Creating Value in a Dynamic Business Environment

- The Blair Company’s three assembly plants are located in California, Georgia, and New Jersey. Previously, the company purchased a major subassembly, which becomes part of the final product, from an outside firm. Blair has decided to manufacture the subassemblies within the company and must now consider whether to rent one centrally located facility (e.g., in Missouri, where all the subassemblies would be manufactured) or to rent three separate facilities, each located near one of the assembly plants, where each facility would manufacture only the subassemblies needed for the nearby assembly plant. A single, centrally located facility, with a production capacity of 18,000 units per year, would have fixed costs of $900,000 per year and a variable cost of $250 per unit. Three separate decentralized facilities, with production capacities of 8,000, 6,000, and 4,000 units per year, would have fixed costs of $475,000, $425,000, and $400,000, respectively, and variable costs per unit of only…arrow_forwardMSI is considering outsourcing the production of the handheld control module used with some of its products. The company has received a bid from Monte Legend Company (MLC) to produce 10,000 units of the module per year for $16 each. The following information pertains to MSI’s production of the control modules: Direct materials $ 9 Direct labor 4 Variable manufacturing overhead 2 Fixed manufacturing overhead 3 Total cost per unit $ 18 MSI has determined it could eliminate all variable costs if the control modules were produced externally, but none of the fixed overhead is avoidable. At this time, MSI has no specific use in mind for the space that is currently dedicated to the control module production. Required: 1. Compute the difference in cost between making and buying the control module. 2. Should MSI buy the modules from MLC or continue to make them? 3-a. Suppose the MSI space currently used for the modules could be utilized by a new product line that would generate…arrow_forwardMSI is considering outsourcing the production of the handheld control module used with some of its products. The company has received a bid from Monte Legend Co. (MLC) to produce 10,000 units of the module per year for $16 each. The following information pertains to MSI’s production of the control modules: Direct materials $ 9 Direct labor 4 Variable manufacturing overhead 2 Fixed manufacturing overhead 3 Total cost per unit $ 18 MSI has determined that it could eliminate all variable costs if the control modules were produced externally, but none of the fixed overhead is avoidable. At this time, MSI has no specific use in mind for the space that is currently dedicated to the control module production. Suppose that the MSI space currently used for the modules could be utilized by a new product line that would generate $35,000 in annual profit. Recompute the difference in cost between making and buying under this scenario.arrow_forward

- UTAH CORP. is a chemical manufacturer that supplies various products to industrial users. The company plans to introduce a new chemical solution called Bysap, for which it needs to develop a standard product cost. The following labor information is available on the production of Bysap. The product, which is bottled in 10-liter containers, is primarily a mixture of Byclyn, Salex, and Protet. The finished product is highly unstable, and one 10-liter batch out of six is rejected at the final inspection. Rejected batches have no commercial value and are thrown out. It takes a worker 35 minutes to process one 10-liter batch of Bysap. Employees work on eight-hour a day, including one hour per day for rest breaks and cleanup. What is the standard labor time to produce one 10-liter batch of Bysap? 2. MAINE INC.’s direct labor costs for the month of May are as follows: Standard direct labor hours allowed 12,500 Actual direct labor…arrow_forwardDivision Y has asked Division X of the same company to supply it with 5,600 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $36 per unit. Division X has the capacity to produce 22,400 units of part L763 per year. Division X expects to sell 20,160 units of part L763 to outside customers this year at a price of $37.60 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $28 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 5,600 parts this year from Division X to Division Y? (Round your final answers…arrow_forwardThe James Company manufactures widgets that sell for $120 each. The company's unit cost for each widget is as follows: A company in another state has offered to purchase 1,000 widgets from James Company at a cost of $90 each. If James were to accept this special order, no additional Fixed Manufacturing Overhead costs would be incurred. Should James accept this special order? Show relevant calculations.arrow_forward

- Corrigan Enterprises is studying the acquisition of two electrical component insertion systems for producing its sole product, the universal gismo. Data relevant to the systems follow. Model no. 6754: Variable costs, $16.00 per unit Annual fixed costs, $985,900 Model no. 4399: Variable costs, $11.80 per unit Annual fixed costs, $1,113,700 Corrigan’s selling price is $64 per unit for the universal gismo, which is subject to a 15 percent sales commission. (In the following requirements, ignore income taxes.) 2A. Calculate the net income of the two systems if sales and production are expected to average 46,000 units per year. 3. Assume Model 4399 requires the purchase of additional equipment that is not reflected in the preceding figures. The equipment will cost $440,000 and will be depreciated over a five-year life by the straight-line method. How many units must Corrigan sell to earn $965,000 of income if Model 4399 is selected? As in requirement 2,…arrow_forwardDivision Y has asked Division X of the same company to supply it with 8,400 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $50 per unit. Division X has the capacity to produce 33,600 units of part L763 per year. Division X expects to sell 30,240 units of part L763 to outside customers this year at a price of $54.40 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $42 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 8,400 parts this year from Division X to Division Y? (Round your final answers…arrow_forwardDivision G has asked Division F of the same company to supply it with 5,000 units of part WD26 this year to use in one of its products. Division G has received a bid from an outside supplier for the parts at a price of $19.00 per unit. Division F has the capacity to produce 25,000 units of part WD26 per year. Division F expects to sell 21,000 units of part WD26 to outside customers this year at a price of $18.00 per unit. To fill the order from Division G, Division F would have to cut back its sales to outside customers. Division F produces part WD26 at a variable cost of $12.00 per unit. The cost of packing and shipping the parts for outside customers is $2.00 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division G. 1.What is the lowest price the F Division should charge for the internal transfers of its goods? 2.What is the highest price the G Division should charge for the internal transfers of its goods?arrow_forward

- The composting division has identified a source of additional compostable waste at a price of $205 per ton. What would be the impact on the company as a whole if the 400 tons of material is purchased from the outside supplier? As a decentralized unit, what decision would the composting division make regarding the additional material?arrow_forwardVelstrom Ltd is considering outsourcing one of its products rather than producing it in its factory. The business allocates part of the total rental charge of the factory, based on floor area, on the section responsible for making the product. The section bears a charge of £20,000 per year. If the section were closed, the floor space released would be used for warehousing and, as a result, the business would give up the tenancy of an existing warehouse for which it is paying £25,000 a year. SO what is the answerarrow_forwardVelstrom Ltd is considering outsourcing one of its products rather than producing it in its factory. The business allocates part of the total rental charge of the factory, based on floor area, on the section responsible for making the product. The section bears a charge of £20,000 per year. If the section were closed, the floor space released would be used for warehousing and, as a result, the business would give up the tenancy of an existing warehouse for which it is paying £25,000 a year. A business has approached Velstrom Ltd to offer £22,000 a year to sublet the released factory space. What will be the relevant benefit of releasing the factory space?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College