INTERMEDIATE ACCOUNTING(LL) W/CENGAGENO

2nd Edition

ISBN: 9781305617001

Author: WAHLEN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 10P

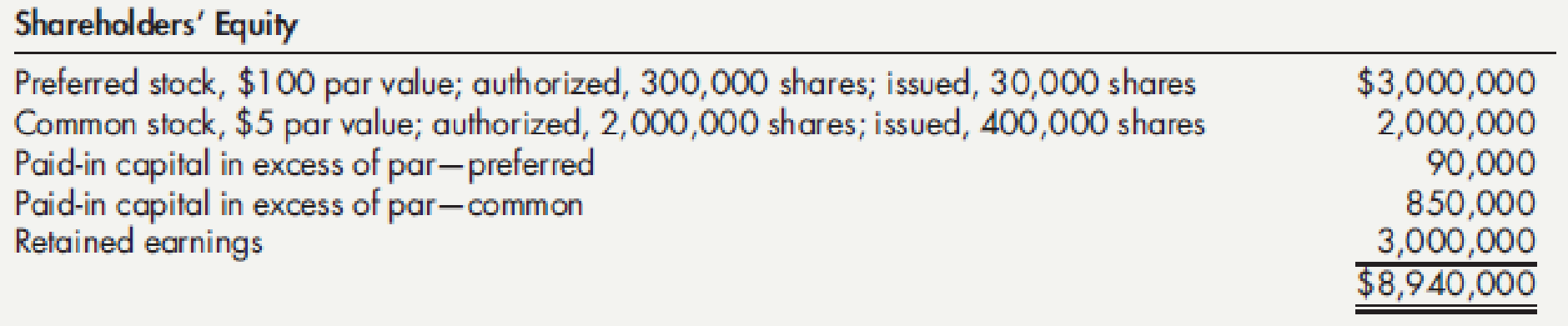

Comprehensive The shareholders’ equity section of Superior Corporation’s balance sheet as of December 31, 2015, is as follows:

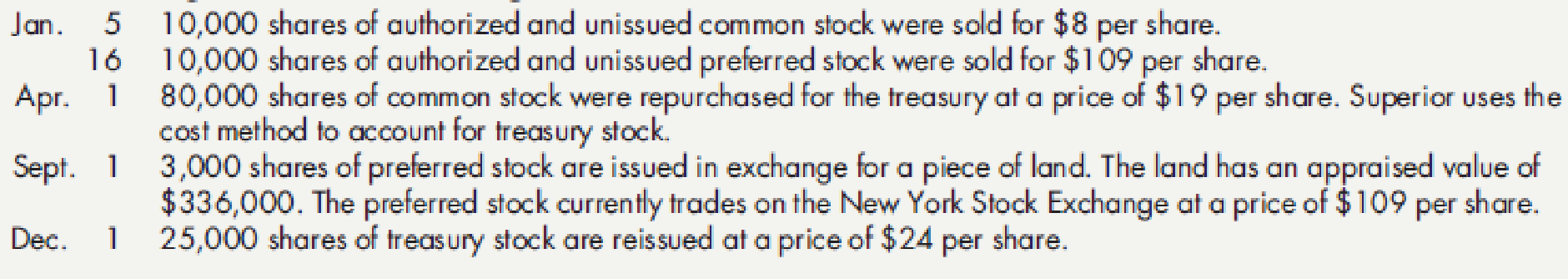

The following events occurred during 2016:

Required:

- 1. Prepare

journal entries for each of the above transactions. - 2. Calculate the number of authorized, issued, and outstanding common shares as of December 31, 2016.

- 3. Calculate Superior’s legal capital at December 31, 2016.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The shareholders’ equity section of Superior Corporation’s balance sheet as of December 31, 2018, is as follows: 1. Prepare journal entries for each of the above transactions. 2. Calculate the number of authorized, issued, and outstanding common shares as of December 31, 2019. 3. Calculate Superior’s legal capital at December 31, 2019.

Included in the December 31, 2018, Jacobi Comapany balance sheet was the following share holders’ equity section.

1. Prepare journal entries to record the preceding transactions. 2. Prepare the December 31, 2019, shareholders’ equity section (assume that 2019 net income was $270,000).

The comparative statements of shareholders' equity for Company A are shown below. They follow the fiscal years ending December 31, 2019, 2020, and 2021.Using the statements as the guide, compute earnings per share (EPS) as they would have appeared on the income statements for:December 31, 2019December 31, 2020December 31, 2021No potential common shares were outstanding during any of the periods shown above.

COMPANY A

Statements of Shareholders' Equity

For the Years Ended December 31, 2019, 2020, and 2021

($ in millions)

Total

Preferred

Common

Additional

Share-

Stock, $10

Stock, $1

Paid-in

Retained

holders'

par

par

Capital

Earnings

Equity

Balance at Jan. 1, 2019

55

495

1,878

2,428

Sale of preferred shares

10

470

480

Sale of common shares, 7/1

9

81

90…

Chapter 15 Solutions

INTERMEDIATE ACCOUNTING(LL) W/CENGAGENO

Ch. 15 - Prob. 1GICh. 15 - Prob. 2GICh. 15 - What are the three components and the basic...Ch. 15 - List the various rights of a shareholder. Which do...Ch. 15 - What is the meaning of the following terms: (a)...Ch. 15 - Prob. 6GICh. 15 - Prob. 7GICh. 15 - How does preferred stock differ from common stock?Ch. 15 - What amount of the proceeds from the issuance of...Ch. 15 - Prob. 10GI

Ch. 15 - Prob. 11GICh. 15 - Prob. 12GICh. 15 - Prob. 13GICh. 15 - Prob. 14GICh. 15 - Prob. 15GICh. 15 - Prob. 16GICh. 15 - Prob. 17GICh. 15 - Prob. 18GICh. 15 - Prob. 19GICh. 15 - How is a preferred stock similar to a long-term...Ch. 15 - Prob. 21GICh. 15 - Prob. 22GICh. 15 - Prob. 23GICh. 15 - Prob. 24GICh. 15 - Prob. 25GICh. 15 - What additional disclosures about preferred and...Ch. 15 - Prob. 1MCCh. 15 - Prob. 2MCCh. 15 - What is the most likely effect of a stock split on...Ch. 15 - Prob. 4MCCh. 15 - Prob. 5MCCh. 15 - Prob. 6MCCh. 15 - Prob. 7MCCh. 15 - When treasury stock is purchased for cash at more...Ch. 15 - Preferred stock that may be retired by the...Ch. 15 - When treasury stock accounted for by the cost...Ch. 15 - Brown Corporation issues 800 shares of its 5 par...Ch. 15 - Heart Corporation entered into a subscription...Ch. 15 - Blue Corporation issues 200 packages of securities...Ch. 15 - Sun Corporation issues 500 shares of 8 par common...Ch. 15 - Next Level Morgan Corporation issues 500 packages...Ch. 15 - Prob. 6RECh. 15 - Prob. 7RECh. 15 - Prob. 8RECh. 15 - Prob. 9RECh. 15 - Assume Cole Corporation originally issued 300...Ch. 15 - Violet Corporation issues 1,200 shares of 150 par...Ch. 15 - Assume that Lily Corporation has outstanding 1,500...Ch. 15 - Tulip Corporation uses the cost method to account...Ch. 15 - Par Value and No-Par Stock Issuance Caswell...Ch. 15 - Combined Sale of Stock Maxville Company issues 300...Ch. 15 - Sale of Stock with Bonds Pilsen Company issues 12%...Ch. 15 - Issuance of Stock for Land Putt Company issues 500...Ch. 15 - Prob. 5ECh. 15 - Prob. 6ECh. 15 - Prob. 7ECh. 15 - Prob. 8ECh. 15 - Prob. 9ECh. 15 - Prob. 10ECh. 15 - Prob. 11ECh. 15 - Prob. 12ECh. 15 - Stock Rights with Preferred Stock Nelson...Ch. 15 - Various Journal Entries Lodi Company is authorized...Ch. 15 - Treasury Stock, Cost Method On January 1, Lorain...Ch. 15 - Prob. 16ECh. 15 - Treasury Stock, Cost Method (and IFRS Revaluation)...Ch. 15 - Treasury Stock, Cost and Par Value Methods On...Ch. 15 - Treasury Stock, No Par Propst-Steele Production...Ch. 15 - Prob. 1PCh. 15 - Prob. 2PCh. 15 - Prob. 3PCh. 15 - Prob. 4PCh. 15 - Prob. 5PCh. 15 - Prob. 6PCh. 15 - Issuances of Stock Cada Corporation is authorized...Ch. 15 - Issuances of Stock Epple Corporation is authorized...Ch. 15 - Prob. 9PCh. 15 - Comprehensive The shareholders equity section of...Ch. 15 - Prob. 11PCh. 15 - Comprehensive Byrd Companys Contributed Capital...Ch. 15 - Prob. 13PCh. 15 - Prob. 14PCh. 15 - Reconstruct Journal Entries At the end of its...Ch. 15 - Prob. 16PCh. 15 - Prob. 17PCh. 15 - Prob. 1CCh. 15 - Prob. 2CCh. 15 - Prob. 3CCh. 15 - Capital Stock Capital stock is an important area...Ch. 15 - Treasury Stock A corporation sometimes engages in...Ch. 15 - Prob. 6CCh. 15 - Prob. 7CCh. 15 - Compensatory Share Option Plan Tom Twitlet,...Ch. 15 - Prob. 9CCh. 15 - Treasury Stock For numerous reasons, a corporation...Ch. 15 - Prob. 11CCh. 15 - Prob. 12CCh. 15 - Prob. 13CCh. 15 - Prob. 14C

Additional Business Textbook Solutions

Find more solutions based on key concepts

Based on your answers to the above questions, should Lockwood invest in the machinery?

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

Determine the estimated cost of the work performed each week given the tasks—with their associated costs and sc...

Construction Accounting And Financial Management (4th Edition)

Analysis of inventory errors A2 Hallam Company’s financial statements show the following. The company recently ...

FINANCIAL ACCT.FUND.(LOOSELEAF)

(a) Standard costs are the expected total cost of completing a job. Is this correct? Explain, (b) A standard im...

Managerial Accounting: Tools for Business Decision Making

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following transactions were taken from the records of Marimar Company for you to prepare a statement of changes in equity for the year ended December 31, 2019. After preparing the statement of changes in equity, provide a paragraph explaining the importance of providing this information to the varied users of financial statements. On January 1, 2019, Marimar company had 3,000,000 authorized ordinary shares of P5 par, of which 1,000,000 shares were issued and outstanding on that date. Account balances appear for the shareholders’ equity items of Marimar company on January 1, 2019:Ordinary share capital 5,000,000Share Premium 3,750,000Retained Earnings 1,625,000 The following transactions transpired during the year:January 6 Iissued at P54 per share, 50,000 shares of P50 par, 9% cumulative, convertible preference share capital. Marimar had 125,000 authorized preference shares. Feb. 3…arrow_forwardThe following information pertains to KPMJ Ltd and covers questions 11 – 21: KPMJ Ltd is a company incorporated in 2017 and has a 28 February financial year- end. The company’s accountant presented the following information to you as the accounting officer of the company: KPMJ LTD EXTRACT OF BALANCES AS AT 28 FEBRUARY 2022: Retained earnings (1 March 2021) Share capital: Ordinary shares (1 March 2021) Inventory (1 March 2021) Trade receivables control Petty cash R 200,900 600,900 34,700 244,200 5,900 Loan: PWA Bank SARS (income tax) (Dr) Land and buildings at revaluation Equipment at cost Accumulated depreciation: Equipment Revaluation surplus (1 March 2021) Income received in advance Allowance for credit losses Bank (Dr) Trade payables control Auditor's remuneration Sales Carriage on sales Settlement discount received Allowance for settlement discount granted Purchases Salaries and wages Carriage on purchases Directors’ remuneration Settlement discount granted Stationery Telephone…arrow_forwardThe information below is available for XYZ Co. . The number of shares to be used in computing earnings per ordinary share for 2019 is:arrow_forward

- Jumbo Corporation reported the following information about its stock on its December 31, 2018, balance sheet: Jumbo Corporation engaged in the following stock transactions during 2019: Required: 1. Does Jumbo Corporation have a simple or complex capital structure? 2. Calculate the number of shares that Jumbo would use to calculate basic EPS for its 2019 income statement.arrow_forwardGray Company lists the following shareholders equity items on its December 31, 2018, balance sheet: The following stock transactions occurred during 2019: Required: 1. Prepare journal entries to record the preceding transactions. 2. Prepare the December 31, 2019, shareholders equity section (assume that 2019 net income was 225,000).arrow_forwardIncluded in the December 31, 2018, Jacobi Company balance sheet was the following shareholders equity section: The company engaged in the following stock transactions during 2019: Required: 1. Prepare journal entries to record the preceding transactions. 2. Prepare the December 31, 2019, shareholders equity section (assume that 2019 net income was 270,000).arrow_forward

- The controller of Red Lake Corporation has requested assistance in determining income, basic earnings per share, and diluted earnings per share for presentation on the companys income statement for the year ended September 30, 2020. As currently calculated, Red Lakes net income is 540,000 for fiscal year 2019-2020. Your working papers disclose the following opening balances and transactions in the companys capital stock accounts during the year: 1. Common stock (at October 1, 2019, stated value 10, authorized 300,000 shares; effective December 1, 2019, stated value 5, authorized 600,000 shares): Balance, October 1, 2019issued and outstanding 60,000 shares December 1, 201960,000 shares issued in a 2-for-l stock split December 1, 2019280,000 shares (stated value 5) issued at 39 per share 2. Treasury stockcommon: March 3, 2020purchased 40,000 shares at 38 per share April 1, 2020sold 40,000 shares at 40 per share 3. Noncompensatory stock purchase warrants, Series A (initially, each warrant was exchangeable with 60 for 1 common share; effective December 1, 2019, each warrant became exchangeable for 2 common shares at 30 per share): October 1, 201925,000 warrants issued at 6 each 4. Noncompensatory stock purchase warrants, Series B (each warrant is exchangeable with 40 for 1 common share): April 1, 202020,000 warrants authorized and issued at 10 each 5. First mortgage bonds, 5%, due 2029 (nonconvertible; priced to yield 5% when issued): Balance October 1, 2019authorized, issued, and outstandingthe face value of 1,400,000 6. Convertible debentures, 7%, due 2036 (initially, each 1,000 bond was convertible at any time until maturity into 20 common shares; effective December 1, 2019, the conversion rate became 40 shares for each bond): October 1, 2019authorized and issued at their face value (no premium or discount) of 2,400,000 The following table shows the average market prices for the companys securities during 2019-2020: Adjusted for stock split Required: Prepare a schedule computing: 1. the basic earnings per share 2. the diluted earnings per share that should be presented on Red Lakes income statement for the year ended September 30, 2020 A supporting schedule computing the numbers of shares to be used in these computations should also be prepared. Assume an income tax rate of 30%.arrow_forward(Statement Presentation of Transactions—Equity Accounts) The following selected account balances are taken from the financial statements of Mandrich Inc. at its calendar year end prepared using IFRS: The following selected account balances are taken from the financial statements of Mandrich Inc. at its calendar year end prepared using IFRS: 2020 2019 Preferred shares classified as equity $145,000 $145,000 Common shares: 9,000 shares in 2020, 10,000 shares in 2019 142,000 160,000 Contributed surplus—reacquisition of common shares 3,500 –0– Cash dividends—preferred 6,250 6,250 Stock dividends—common 14,000 –0– Retained earnings (balance after closing entries) 300,000 240,000 At December 31, 2020, the following information is available: Mandrich Inc. repurchased 2,000 common shares during 2020. The repurchased shares had a weighted average cost of $32,000.During 2020, 1,000 common shares were issued as a stock dividend.Mandrich…arrow_forward6. On December 31, 2015, the shareholders' equity sections of R U B Corporation reflected the following: (see attached image for the given. Please answer it. thank you so much!) On February 1, 2016, the Board of directors declared 10% stock dividends to be issued April 30, 2016. The market value of the stock on February 1 was P18. Direction: a) Prepare the required entries for the declaration and distribution. b) Prepare the shareholders’ equity section immediately after the stock dividend was declared. c) Compare with the accounts and figures given above and explain the effects of this stock dividend on the a) assets, b) liabilities, and c) shareholders' equity. d) Prepare again the shareholders' equity immediately after the stock dividend was distributed. Compare the accounts against no 1 above and explain the effects of this distribution on the a) assets, b) liabilities, and c) shareholders' equity.arrow_forward

- Corporations and Dividends Zeus Ltd declared a final dividend to its shareholders at the Annual General Meeting on 31.12.2017 of $1,200,000. The amount was finally paid on 31.3.2018. Required: Prepare the Journal Entries for the declaration and distribution of the dividends in 2017 and 2018.arrow_forwardThe following financial information was extracted from the accounting records of Eytan Ltd for the year end 30 June 2021: Issued share capital Authorised share capital Sales (Turnover) Gross margin on sales percentage Total asset turnover Return on total assets after interest and tax Net working capital Current ratio Acid test ratio Current liabilities (including Dividends payable) Debt to equity ratio (using interest bearing debt) Retained earnings at the beginning of the year Dividends proposed and paid Notes 500 Class A (Ordinary shares of R1 each) 500 000 Class A (Ordinary shares of R1 each) R100 000 15% 1.60 : 1 11.52 % R30 000 2.5:1 1.3:1 R20 000 0.55 : 1 (55%) R22 000 R4.40 per Class A share 1. Taxation is calculated at 28 % of Net Profit before Taxation. 2. Interest expense is 27.78 % of Net Profit after Taxation. REQUIRED: Prepare the Statement of Comprehensive Income and the Statement of Financial Position as at 30 June 2021. You are required to provide only the details which…arrow_forwardThe accounts were taken from the ledger of Abante Pinoy Corporation as of December 31, 2019. (see attached image, kindly answer it based on your knowledge, thank you!) Direction: Prepare in good form the shareholders' equity section of the corporation. Identify the amount of the ff: Paid in Capital from Preferred Shares Paid in Capital from Common Shares Total Additional Paid In Capital (APIC) Total Retained Earnings Total Stockholder's Equityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License