Concept explainers

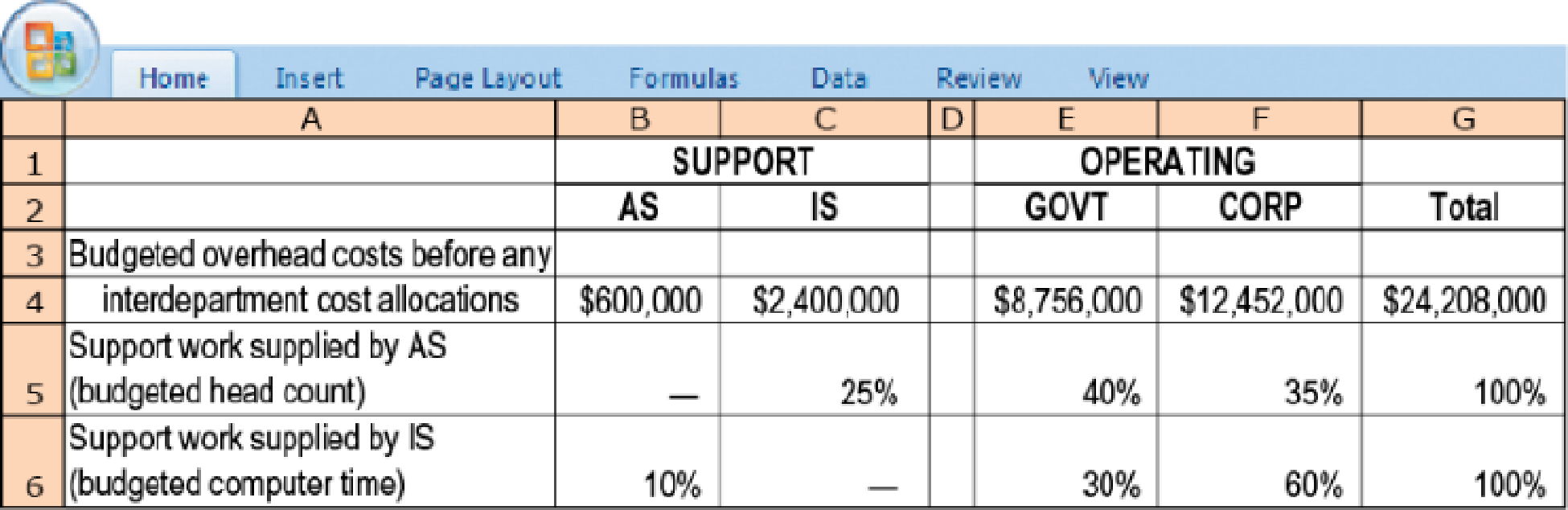

Support-department cost allocation; direct and step-down methods. Phoenix Partners provides management consulting services to government and corporate clients. Phoenix has two support departments—administrative services (AS) and information systems (IS)—and two operating departments—government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2017, Phoenix’s cost records indicate the following:

- 1. Allocate the two support departments’ costs to the two operating departments using the following methods:

Required

- a. Direct method

- b. Step-down method (allocate AS first)

- c. Step-down method (allocate IS first)

- 2. Compare and explain differences in the support-department costs allocated to each operating department.

- 3. What approaches might be used to decide the sequence in which to allocate support departments when using the step-down method?

Learn your wayIncludes step-by-step video

Chapter 15 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Principles of Accounting Volume 1

Financial Accounting (11th Edition)

Intermediate Accounting (2nd Edition)

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Cost Accounting (15th Edition)

- How could you have ranked the support departments differently?arrow_forwardPhoenix Partners provides management consulting services to government and corporate clients. Phoenix has two support departments administrative services (AS) and information systems (IS) and two operating departments-government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2020, Phoenix's cost records indicate the following: (Click the icon to view the cost records.) Read the requirements. Requirement 1a. Allocate the two support departments' costs to the two operating departments using the direct method. (Do not round intermediary calculations and round your final answers to the nearest whole dollar. Use parentheses or a minus sign when decreasing departments by allocating costs. Enter a "0" for any zero balances.) Operating Departments Support Departments AS GOVT CORP Direct Method Budgeted overhead costs before interdepartment cost allocations Allocation of AS costs Allocation of IS costs Total budgeted overhead of operating departments …………. IS Totalarrow_forwardWhich method would you recommend that Ballantine Corporation use to allocate service-department costs? Why?arrow_forward

- Phoenix Partners provides management consulting services to government and corporate clients. Phoenix has two support departments administrative services (AS) and information systems (IS) and two operating departments-government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2020, Phoenix's cost records indicate the following: (Click the icon to view the cost records.) Read the requirements. Requirement 1c. Allocate the two support departments' costs to the two operating departments using the step-down method (Allocate IS first). (Do not round intermediary calculations and round your final answers to the nearest whole dollar. Use parentheses or a minus sign when decreasing departments by allocating costs. Enter a "0" for any zero balances.) Support Departments AS Operating Departments CORP Step-down Method IS GOVT Total Budgeted overhead costs 690,000 $2,100,000 $8,675,000 $12,490,000 $23,955,000 before interdepartment cost allocations Allocation of IS…arrow_forwardHoustin Partners provides management consulting services to government and corporate clients. Houstin has two support departments-administrative services (AS) and information systems (IS)-and two operating departments-government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2017, Houstin's cost records indicate the following: E (Click the icon to view the cost records.) Read the requirements. ..... intermediary calculations and round your final answers balances.) Data table SUPPORT OPERATING AS IS GOVT CORP Total Budgeted overhead costs before any interdepartment cost allocations Support work supplied by AS (budgeted head count) Support work supplied by IS (budgeted computer time) $ 390,000 $ 2,100,000 $ 7,500,000 $ 12,420,000 $ 22,410,000 25% 45% 30% 100% 10% 36% 54% 100% Requirements Print Done 1. Allocate the two support departments' costs to the two operating departments using the following methods: а. Direct method b. Step-down method (Allocate AS…arrow_forwardWhat approaches might be used to decide the sequence in which to allocate support departments when using the step-down method?arrow_forward

- Darrow_forwardComprehensive support department allocations (Need answers for parts C, D, and E please. Thank you!) Management at C. Pier Press has decided to allocate costs of the paper’s two support departments (administration and human resources) to the two revenue-generating departments (advertising and circulation). Administration costs are to be allocated on the basis of dollars of assets employed; human resources costs are to be allocated on the basis of number of employees. The following costs and allocation bases are available: Department Direct Costs Number of Employees Assets Employed Administration $390,750 5 $193,550 Human resources 246,350 4 145,850 Advertising 478,900 6 381,200 Circulation 676,300 13 935,150 Totals $1,792,300 28 $1,655,750 a. Using the direct method, allocate the support department costs to the revenue-generating departments.Note: Round percentages in your calculation to the nearest whole percent (for example, round 34.5% to 35%).Note:…arrow_forwardBaldwin Enterprises has two service departments, Personnel and Legal, and two operating divisions, Eastern and Western. Personnel costs are allocated on the basis of employees and Legal costs are allocated on the basis of hours. A summary of Baldwin operations follows: Employees Hours Department direct costs Costs Personnel Legal Complete this question by entering your answers in the tabs below. Total Personnel $ Personnel $ 10,800 $ 320,000 Required: a. Allocate the cost of the service departments to the operating divisions using the direct method. b. Allocate the cost of the service departments to the operating divisions using the step method. Start with Legal. c. Allocate the cost of the service departments to the operating divisions using the reciprocal method. 320,000 $ 320,000 $ Required A Required B Required C Allocate the cost of the service departments to the operating divisions using the reciprocal method. Note: Do not round intermediate calculations. Round your final answers…arrow_forward

- Management at C. Pier Press has decided to allocate costs of the paper’s two support departments (administration and human resources) to the two revenue-generating departments (advertising and circulation). Administration costs are to be allocated on the basis of dollars of assets employed; human resources costs are to be allocated on the basis of number of employees. The following costs and allocation bases are available: Department Direct Costs Number of Employees Assets Employeed Administration $1,094,100 14 $541,940 Human resources 689,780 11 408,380 Advertising 1,340,920 17 1,067,360 Circulation 1,893,640 36 2,618,420 Totals $5,018,440 78 $4,636,100 a. Using the direct method, allocate the support department costs to the revenue-generating departments. Amount allocated to Advertising: $______ Amount allocated to Circulation: $______ b. Using your answer to (a), what are the total costs of the revenue-generating departments after the allocations? Advertising total…arrow_forwardWoodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT tickets Employees Department direct costs Service department costs IT allocation HR allocation Total costs allocated IT $ IT 0 27 $ 151,000 0 $ HR Required: Use the direct method to allocate these service department costs to the operating departments. 1,400 0 Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. Round "Publishing" and "Binding" answers to 2 decimal places. HR $247,500 Publishing 1,400 35 $430,000 0 Publishing 0 $ Binding 4,200 51 $ 390,000 0.00 $ Binding 0.00arrow_forwardAllocate 2017 fixed corporate-overhead costs to the three divisions using division margin as the allocation base. What is each division’s operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,