Concept explainers

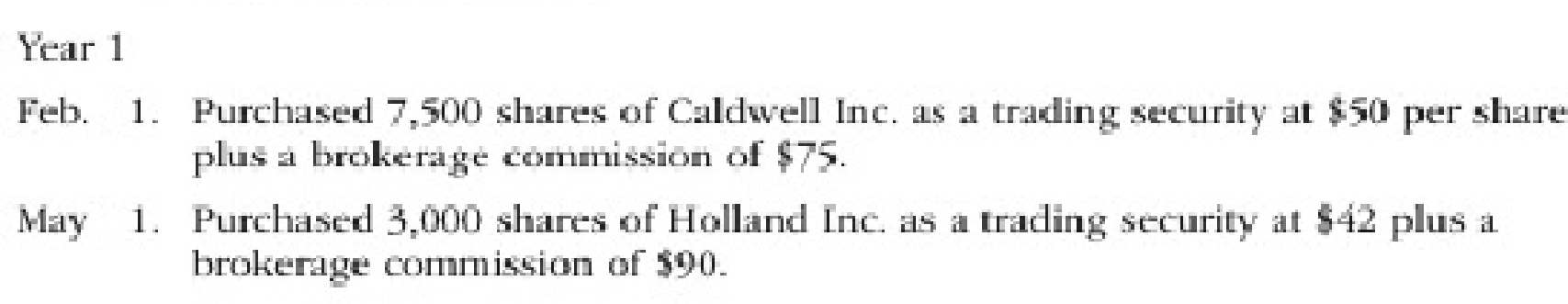

Rios Financial Co. is a regional insurance company that began operations on January 1, Year 1. The following transactions relate to trading securities acquired by Rios Financial Co., which has a fiscal year ending on December 31:

Instructions

- 1.

Journalize the entries to record these transactions. - 2. Prepare the investment-related current asset balance sheet presentation for Rios Financial Co. on December 31, Year 2.

- 3. How are unrealized gains or losses on trading investments presented in the financial statements of Rios Financial Co.?

(1)

Journalize the stock investment transactions in the books of Company RF.

Explanation of Solution

Trading securities: These are short-term investments in debt and equity securities with an intention of trading and earning profits due to changes in market prices.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entry for the purchase of 7,500 shares of Company C, at $50 per share, and a brokerage commission of $75.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| February | 1 | Investments–Company C Stock | 375,075 | ||

| Cash | 375,075 | ||||

| (To record purchase of shares for cash) | |||||

Table (1)

- Investments–Company R Stock is an asset account. Since stock investments are purchased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Compute amount of cash paid to purchase Company C’s stock.

Prepare journal entry for the purchase of 3,000 shares of Company H, at $42 per share, and a brokerage commission of $90.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| May | 1 | Investments–Company H Stock | 126,090 | ||

| Cash | 126,090 | ||||

| (To record purchase of shares for cash) | |||||

Table (2)

- Investments–Company H Stock is an asset account. Since stock investments are purchased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Compute amount of cash paid to purchase Company H’s stock.

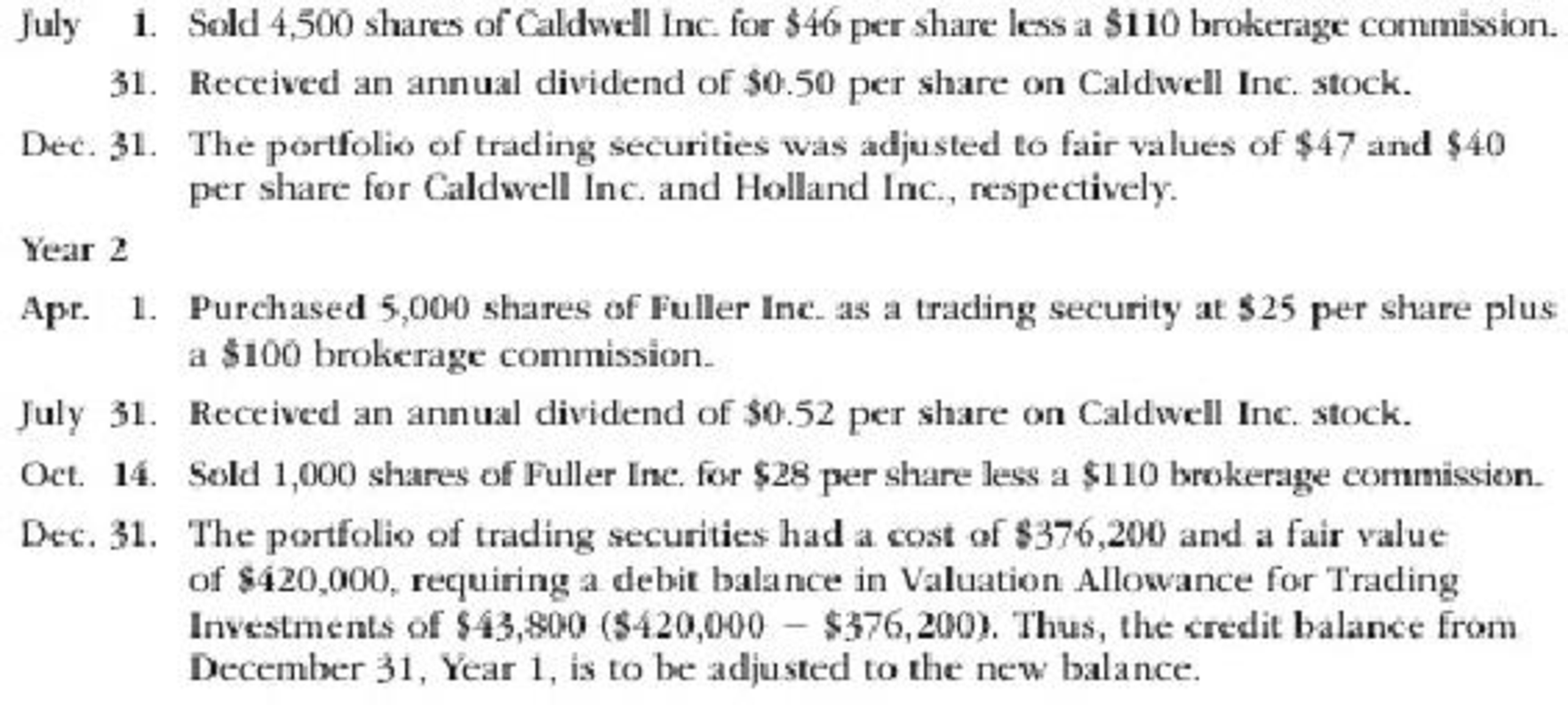

Prepare journal entry for sale of 4,500 shares of Company C, at $46, with a brokerage of $110.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| July | 1 | Cash | 206,890 | ||

| Loss on Sale of Investments | 18,155 | ||||

| Investments–Company C Stock | 225,045 | ||||

| (To record sale of shares) | |||||

Table (3)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Loss on Sale of Investments is a loss or expense account. Since losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Investments–Company C Stock is an asset account. Since stock investments are sold, asset value decreased, and a decrease in asset is credited.

Working Notes:

Calculate the realized gain (loss) on sale of stock.

Step 1: Compute cash received from sale proceeds.

Step 2: Compute cost of stock investment sold.

Step 3: Compute realized gain (loss) on sale of stock.

Note: Refer to Steps 1 and 2 for value and computation of cash received and cost of stock investment sold.

Prepare journal entry for the dividend received from Company C for 3,000 shares.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| July | 31 | Cash | 1,500 | ||

| Dividend Revenue | 1,500 | ||||

| (To record receipt of dividend revenue) | |||||

Table (4)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Dividend Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of dividend received on Company C’s stock.

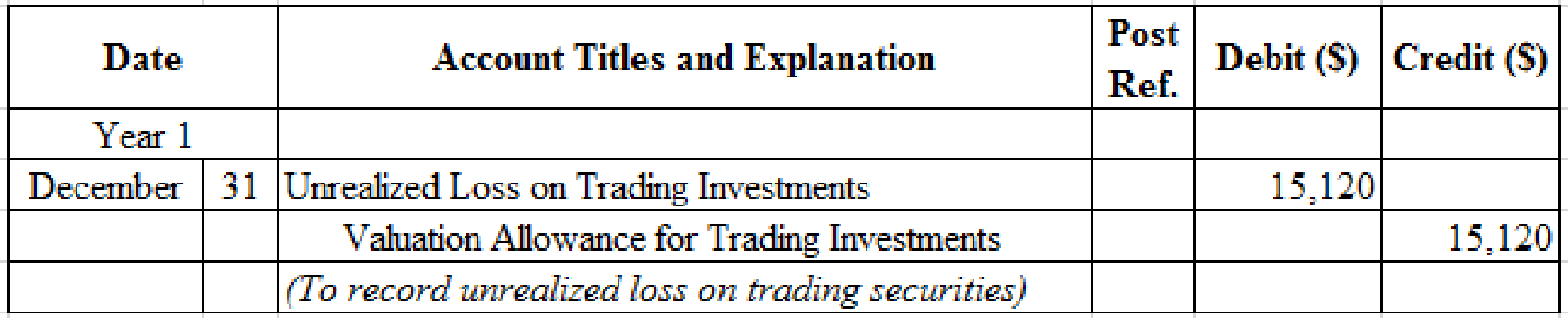

Prepare adjusting entry for valuation of trading securities transaction.

Table (5)

- Unrealized Loss on Trading Investments is an adjustment account used to report gain or loss on adjusting cost of investment at fair market value. Since loss has occurred and losses reduce stockholders’ equity value, and a decrease in stockholders’ equity value is debited.

- Valuation Allowance for Trading Investments is a contra-asset account. The account is credited because the market price was decreased (loss) to $276,120 from the cost of $261,000.

Working Notes:

Compute the unrealized gain (loss) as on December 31.

Step 1: Compute the fair value of the portfolio of the trading investment.

| Security | Number of Shares | Fair Market Value | = | Fair Market Value of Investment | |

| Company C | 3,000 shares | $47 | = | $141,000 | |

| Company H | 3,000 shares | 40 | = | 120,000 | |

| Total | $261,000 | ||||

Table (6)

Step 2: Compute the cost per share of Company C.

Step 3: Compute the cost per share of Company H.

Step 4: Compute the cost of the portfolio of the trading investment, as on December 31.

| Security | Number of Shares | Cost per Share | = | Cost of Investment | |

| Company C | 3,000 shares | $50.01 | = | $150,030 | |

| Company H | 3,000 shares | 42.03 | = | 126,090 | |

| Total | $276,120 | ||||

Table (7)

Note: Refer to Steps 3 and 4 for cost per share of Company C and Company H.

Step 5: Compute the unrealized gain (loss) as on December 31.

| Details | Amount ($) |

| Trading investments at fair value, December 31 (From Table-6) | $261,000 |

| Less: Trading investments at cost, December 31 (From Table-7) | (276,120) |

| Unrealized loss on trading investments | $(15,120) |

Table (8)

Prepare journal entry for the purchase of 5,000 shares of Company F, at $25 per share, and a brokerage commission of $100.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 2 | |||||

| April | 1 | Investments–Company F Stock | 125,100 | ||

| Cash | 125,100 | ||||

| (To record purchase of shares for cash) | |||||

Table (9)

- Investments–Company F Stock is an asset account. Since stock investments are purchased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Compute amount of cash paid to purchase Company F’s stock.

Prepare journal entry for the dividend received from Company C for 3,000 shares.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 2 | |||||

| July | 31 | Cash | 1,560 | ||

| Dividend Revenue | 1,560 | ||||

| (To record receipt of dividend revenue) | |||||

Table (10)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Dividend Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of dividend received on Company C’s stock.

Prepare journal entry for sale of 1,000 shares of Company F at $28, with a brokerage of $110.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 2 | |||||

| October | 14 | Cash | 27,890 | ||

| Gain on Sale of Investments | 2,870 | ||||

| Investments–Company F Stock | 25,020 | ||||

| (To record sale of shares) | |||||

Table (11)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Gain on Sale of Investments is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

- Investments–Corporation E Stock is an asset account. Since stock investments are sold, asset value decreased, and a decrease in asset is credited.

Working Notes:

Calculate the realized gain (loss) on sale of stock.

Step 1: Compute cash received from sale proceeds.

Step 2: Compute cost of stock investment sold.

Step 3: Compute realized gain (loss) on sale of stock.

Note: Refer to Steps 1 and 2 for value and computation of cash received and cost of stock investment sold.

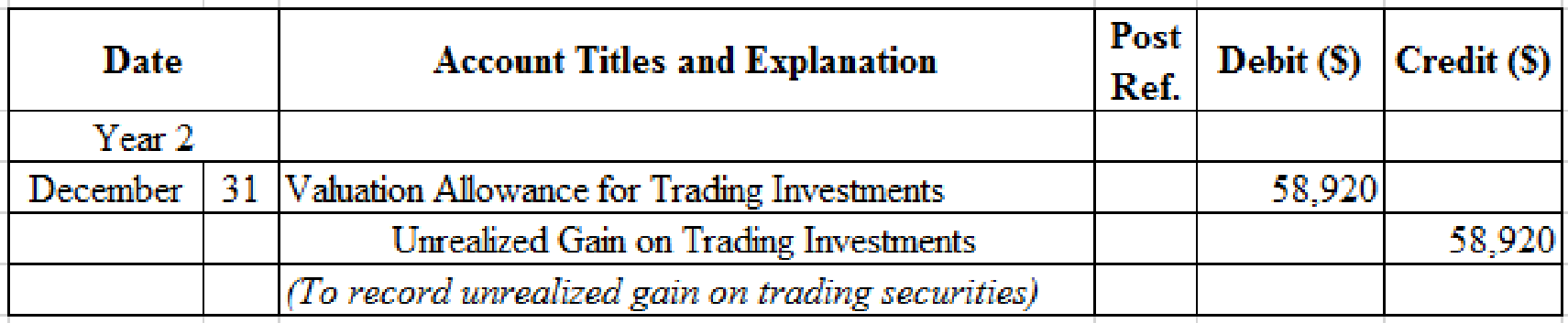

Prepare adjusting entry for valuation of trading securities transaction.

Table (12)

- Valuation Allowance for Trading Investments is a contra-asset account. The account is debited because the market price was increased (gain).

- Unrealized Gain on Trading Investments is an adjustment account used to report gain or loss on adjusting cost of investment at fair market value. Since gain has occurred and gains increase stockholders’ equity value, and an increase in stockholders’ equity value is credited.

Working Notes:

Compute the unrealized gain (loss) as on December 31.

| Details | Amount ($) |

| Unrealized gain as on December 31, Year 2 | $43,800 |

| Less: Unrealized loss as on December 31, Year 1 (From Table-8) | (15,120) |

| Unrealized loss on trading investments | $58,920 |

Table (13)

(2)

Indicate the presentation of trading investments on the current assets section of the balance sheet.

Explanation of Solution

Balance sheet presentation:

| Company R | ||

| Balance Sheet (Partial) | ||

| December 31, Year 2 | ||

| Assets | ||

| Current assets: | ||

| Trading investments (at cost) | $376,200 | |

| Add valuation allowance for trading investments | 43,800 | |

| Trading investments (at fair value) | $420,000 | |

Table (14)

(3)

Discuss the reporting of trading investments on the financial statements.

Explanation of Solution

Unrealized gain or loss is the result of change in trading investments cost and fair values, and reported as Other Revenues (Losses) on the income statement. The unrealized gain will be added to the net income and unrealized loss will be deducted from the net income. In the Year 1, Company R would report $15,120 of unrealized loss as Other Losses on the income statement. In the Year 2, Company R would report $58,920 of unrealized gain as Other Income on the income statement.

Want to see more full solutions like this?

Chapter 15 Solutions

Bundle: Financial Accounting, Loose-Leaf Version, 15th + LMS Integrated CengageNOWv2, 1 term Printed Access Card

- Glacier Products Inc. is a wholesaler of rock climbing gear. The company began operations on January 1, Year 1. The following transactions relate to securities acquired by Glacier Products Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record the preceding transactions. 2. Prepare the investment-related asset and stockholders equity balance sheet presentation for Glacier Products Inc. on December 31, Year 2, assuming that the Retained Earnings balance on December 31, Year 2, is 700,000.arrow_forwardForte Inc. produces and sells theater set designs and costumes. The company began operations on January 1, Year 1. The following transactions relate to securities acquired by Forte Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. Prepare the investment-related asset and stockholders equity balance sheet presentation for Forte Inc. on December 31, Year 2, assuming that the Retained Earnings balance on December 31, Year 2, is 389,000.arrow_forwardSoto Industries Inc. is an athletic footware company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Soto Industries Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?arrow_forward

- Rekya Mart Inc. is a general merchandise retail company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Rekya Mart Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?arrow_forwardAmalgamated General Corporation is a consulting firm that also offers financial services through its credit division. From time to time the company buys and sells securities. The following selected transactions relate to Amalgamated’s investment activities during the last quarter of 2021 and the first month of 2022. The only securities held by Amalgamated at October 1, 2021 were $56 million of 10% bonds of Kansas Abstractors, Inc., purchased on May 1, 2021 at face value and held in Amalgamated’s trading securities portfolio. The company’s fiscal year ends on December 31. 2021 Oct. 18 Purchased 2 million shares of Millwork Ventures Company common stock for $77 million. Millwork has a total of 56 million shares issued. 31 Received semiannual interest of $2.8 million from the Kansas Abstractors bonds. Nov. 1 Purchased 10% bonds of Holistic Entertainment Enterprises at their $18 million face value, to be held until they mature in 2031. Semiannual interest is…arrow_forwardPresented below are the captions of Faulk Company’s balance sheet. a. Current assets. b. Investments. c. Property, plant, and equipment. d. Intangible assets. e. Other assets. f. Current liabilities. g. Noncurrent liabilities. h. Capital stock. i. Additional paid-in capital. j. Retained earnings. Instructions Indicate by letter where each of the following items would be classified. 1. Preferred stock. 2. Goodwill. 3. Salaries and wages payable. 4. Accounts payable. 5. Buildings. 6. Equity investments (to be sold within one year). 7. Current maturity of long-term debt. 8. Premium on bonds payable. 9. Allowance for doubtful accounts. 10. Accounts receivable. 11. Cash surrender value of life insurance. 12. Notes payable (due next year). 13. Supplies. 14. Common stock. 15. Land. 16. Bond sinking fund. 17. Inventory. 18. Prepaid insurance. 19. Bonds payable. 20. Income taxes payable.arrow_forward

- Amalgamated General Corporation is a consulting firm that also offers financial services through its credit division. From time to time the company buys and sells securities. The following selected transactions relate to Amalgamated’s investment activities during the last quarter of 2021 and the first month of 2022. The only securities held by Amalgamated at October 1, 2021 were $40 million of 10% bonds of Kansas Abstractors, Inc., purchased on May 1, 2021 at face value and held in Amalgamated’s trading securities portfolio. The company’s fiscal year ends on December 31. 2021 Oct. 18 Purchased 2 million shares of Millwork Ventures Company common stock for $58 million. Millwork has a total of 34 million shares issued. 31 Received semiannual interest of $1.6 million from the Kansas Abstractors bonds. Nov. 1 Sold the Kansas Abstractors bonds for $36 million because rising interest rates are expected to cause their fair…arrow_forwardA. Select a publicly-traded company that is traded on U.S. exchange. Locate the annual report for at least the last three fiscal years. Analyze the financial statements for the company and review for large movements in specific accounts from one year to the next. In addition, review the notes to the financial statements as these are an integral part of the financial reporting package. Evaluate the balance sheet to determine if there are large changes in the company's assets, liabilities, or equity accounts. In addition, analyze the income statement and statement of cash flows.B. At a minimum, calculate the following ratios for two years, the debt-to-equity ratio, current ratio, quick ratio, return on equity, and net profit margin. For each ratio, explain what the ratio tells you about the company.arrow_forwardOn January 1, Valuation Allowance for Trading Investments had a zero balance. On December 31, the cost of the trading securities portfolio was $379,600, and the fair value was $358,900. Prepare the December 31 adjusting journal entry to record the unrealized gain or loss on trading investments. Refer to the Chart of Accounts for exact wording of account titles.arrow_forward

- The accounts and balances shown below were gathered from Primer Corporation's trial balance on December 31, 2014. All adjusting entries have been made. Wages Payable ............................................$ 25,600Cash .................................................................17,700Mortgage Payable ....................................... 151,600Dividends Payable ......................................... 14,000Prepaid Rent ...................................................13,600Inventory ........................................................ 81,800Sinking Fund Assets ...................................... 52,400Short-Term Investments ................................15,200Premium on Bonds Payable ............................4,600Stock Investment in Subsidiary ..................102,400Taxes Payable ................................................ 22,800Accounts Payable ......................................... 24,800Accounts Receivable ....................................…arrow_forwardThe following is a December 31, 2024, post-closing trial balance for Almway Corporation. Additional information: The investment in equity securities account includes an investment in common stock of another corporation of $31,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year. The land account includes land which cost $26,000 that the company has not used and is currently listed for sale. The cash account includes $16,000 restricted in a fund to pay bonds payable that mature in 2027 and $24,000 restricted in a three-month Treasury bill. The notes payable account consists of the following: a $31,000 note due in six months. a $51,000 note due in six years. a $51,000 note due in five annual installments of $10,200 each, with the next installment due February 15, 2025. The $61,000 balance in accounts receivable is net of an allowance for uncollectible accounts of $9,000. The common stock account…arrow_forwardPresented below are the captions of Faulk Company’s balance sheet. Indicate where each of the following items would be classified. Balance Sheet Accounts Balance Sheet Classification 1. Preferred stock. 2. Goodwill. 3. Salaries and wages payable 4. Accounts payable. 5. Buildings. 6. Equity investments (to be sold within one year). 7. Current maturity of long-term debt. 8. Premium on bonds payable. 9. Allowance for doubtful accounts. 10. Accounts receivable. 11. Cash surrender value of life insurance. 12. Notes payable (due next year). 13. Supplies. 14. Common stock. 15. Land. 16. Bond sinking fund. 17. Inventory. 18. Prepaid insurance. 19. Bonds payable. 20. Income taxes payable.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning