Zylar Industries is a manufacturer of standard and custom-designed bottling equipment. Early in December 20x0, Lyan Company asked Zylar to quote a price for a custom-designed bottling machine to be delivered in April. Lyan intends to make a decision on the purchase of such a machine by January 1, so Zylar would have the entire first quarter of 20x1 to build the equipment.

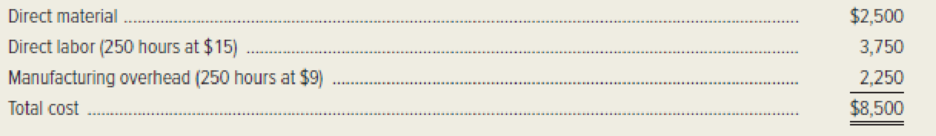

Zylar’s pricing policy for custom-designed equipment is 50 percent markup on absorption

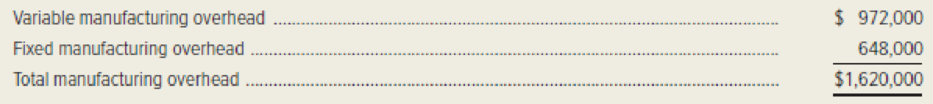

Manufacturing overhead is applied on the basis of direct-tabor hours. Zylar normally plans to run its plant at a level of 15,000 direct-labor hours per month and assigns overhead on the basis of 180,000 direct-labor hours per year. The overhead application rate for 20x1 of $9.00 per hour is based on the following budgeted manufacturing overhead costs for 20x1.

Zylar’s production schedule calls for 12,000 direct-labor hours per month during the first quarter. If Zylar is awarded the contract for the Lyan equipment, production of one of its standard products would have to be reduced. This is necessary because production levels can only be increased to 15,000 direct-labor hours each month on short notice. Furthermore, Zylar’s employees are unwilling to work overtime.

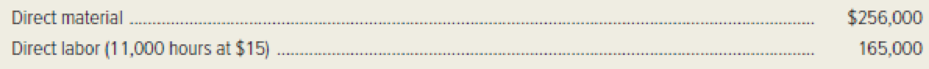

Sales of the standard product equal to the reduced production would be lost, but there would be no permanent loss of future sales or customers. The standard product for which the production schedule would be reduced has a unit sales price of $12,000 and the following cost structure.

Lyan needs the custom-designed equipment to increase its bottle-making capacity so that it will not have to buy bottles from an outside supplier. Lyan Company requires 5.000,000 bottles annually. Its present equipment has a maximum capacity of 4,500.000 bottles with a directly traceable cash outlay cost of 15 cents per bottle. Thus, Lyan has had to purchase 500,000 bottles from a supplier at 40 cents each. The new equipment would allow Lyan to manufacture its entire annual demand for bottles at a direct-material cost savings of 1 cent per bottle. Zylar estimates that Lyan’s annual bottle demand will continue to be 5,000.000 bottles over the next five years, the estimated life of the special-purpose equipment.

Required: Zylar Industries plans to submit a bid to Lyan Company for the manufacture of the special-purpose bottling equipment.

- 1. Calculate the bid Zylar would submit if it follows its standard pricing policy for special-purpose equipment.

- 2. Calculate the minimum bid Zylar would be willing to submit on the Lyan equipment that would result in the same total contribution margin as planned for the first quarter of 20x1.

- 3. Suppose Zylar Industries has submitted a bid slightly above the minimum calculated in requirement (2). Upon receiving Zylar’s bid, Lyan’s assistant purchasing manager telephoned his friend at Tygar Corporation: “Hey Joe, we just got a bid from Zylar Industries on some customized equipment. I think Tygar would stand a good chance of beating it. Stop by the house this evening, and I’ll show you the details of Zylar’s bid and the specifications on the machine.”

Is Lyan Company’s assistant purchasing manager acting ethically? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- The Cool Can Company manufactures drink koozies and has been approached by a new customer with an offer to purchase 15,000 units at a per-unit price of $7.00. The new customer is geographically separated from Cool Can's other customers, and existing sales will not be affected. Cool Can normally produces 82,000 units but plans to produce and sell only 65,000 in the coming year. The normal sales price is $12 per unit. Unit cost information is as follows: Direct materials $3.10 Direct labor Variable overhead Fixed overhead Total 1.50 1.00 1.80 $7.40 However, assume that Cool Can plans to produce and sell 70,000 units in the coming year (rather than the originally anticipated 65,000 units). Required: 1. Using Excel (or some other spreadsheet software tool), calculate the amount by which total operating income increases or decreases if the order is accepted. Decrease -84,000 X 2. Conceptual Connection: Should Cool Can accept the special order when sales at the regular price are expected to…arrow_forwardLeo Consulting enters into a contract with Highgate University to restructure Highgate's processes for purchasing goods from suppliers. The contract states that Leo will earn a fixed fee of $22,000 and earn an additional $4,000 if Highgate achieves $40,000 of cost savings. Leo estimates a 60% chance that Highgate will achieve $40,000 of cost savings. Assuming that Leo determines the transaction price as the expected value of expected consideration, what transaction price will Leo estimate for this contract?arrow_forwardB. Smash Company manufactures professional paperweights and has been approached by a new customer with an offer to purchase 15,000 units at a per-unit price of P7.00.The new customer is geographically separated from Smash’s other customers, and existing sales will not be affected. Smash normally produces 82,000 units but plans to produce and sell only 65,000 units in the coming year. The normal sales price is P12.00 per unit. Unit cost information is as follows: Direct materials P 3.10 Direct labor 2.25 Variable overhead 1.15 Fixed overhead 1.80 Total P` 8.30 If Smash accepts the order, no fixed manufacturing activities will be affected because there…arrow_forward

- Division Y has asked Division X of the same company to supply it with 6,600 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $41 per unit. Division X has the capacity to produce 26,400 units of part L763 per year. Division X expects to sell 23,760 units of part L763 to outside customers this year at a price of $43.60 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $33 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 6,600 parts this year from Division X to Division Y? Note: Round your final…arrow_forwardDivision Y has asked Division X of the same company to supply it with 5,600 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $36 per unit. Division X has the capacity to produce 22,400 units of part L763 per year. Division X expects to sell 20,160 units of part L763 to outside customers this year at a price of $37.60 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $28 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 5,600 parts this year from Division X to Division Y? (Round your final answers…arrow_forwardGrand Chocolate Inc. is a producer of premium chocolate based in Palo Alto. (Click the icon to view additional information.) Grand Chocolate Inc. decides to examine the effect of using the dual-rate method for allocating truck costs to each round-trip. (Click the icon to view the cost information for 2020.) For 2020, the trucking fleet had a practical capacity of 45 round-trips between the Palo Alto plant and the two suppliers. It recorded the following information: Read the requirements. (Click the icon to view the budget and actual data.) Requirement 1. Using the dual-rate method, what are the costs allocated to the dark chocolate division and the milk chocolate division when (a) variable costs are allocated using the budgeted rate per round-trip and actual round-trips used by each division and when (b) fixed costs are allocated based on the budgeted rate per round-trip and round-trips budgeted for each division? X Dark chocolate Milk chocolate Data table Variable costs Fixed costs A…arrow_forward

- [The following information applies to the questions displayed below.] Shadee Corporation expects to sell 610 sun shades in May and 430 in June. Each shade sells for $151. Shadee's beginning and ending finished goods inventories for May are 80 and 45 shades, respectively. Ending finished goods inventory for June will be 60 shades. Each shade requires a total of $55.00 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to have 120 in direct materials inventory on May 1, 90 poles in inventory on May 31, and 110 poles in inventory on June 30. Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $13 per hour. Additionally, Shadee's fixed manufacturing overhead is $9,000 per month, and variable manufacturing overhead is $14 per unit produced. Additional information: • Selling costs are expected to be 8 percent of sales. • Fixed administrative expenses per month total $1,200. Required: Prepare Shadee's budgeted…arrow_forwardKevian ltd Kenya soft drink manufacturer. The following information has been provided by the cost accountant of the company in relation to a new energy drink Kev-Power that the company is interested in investing in. The company plans to produce 80,000 bottles of Kev-Power and sell 80,000 bottles of Kev-Power during the first year 2021. The company plans to sell each bottle of Kev-Power at Shs.198. The Variable costs for the year in relation to production and sale of the 80,000 bottles of Kev-Power is as provided in the table below. Variable Costs Per Bottle Produced Direct Material Cost Shs 6 per Bottle Direct Labour Cost Shs 3 per Bottle Variable Production overhead cost Shs 3.8 per Bottle Variable Administration overhead cost Shs 2.5 per Bottle Variable Selling & Distribution overhead cost Shs 1.5 per Bottle 4.The Fixed costs for the year in relation to production and sale of the 80,000 bottles of Kev-Power is as provided in the…arrow_forwardDivision Y has asked Division X of the same company to supply it with 8,400 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $50 per unit. Division X has the capacity to produce 33,600 units of part L763 per year. Division X expects to sell 30,240 units of part L763 to outside customers this year at a price of $54.40 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $42 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 8,400 parts this year from Division X to Division Y? (Round your final answers…arrow_forward

- [The following information applies to the questions displayed below.] Shadee Corporation expects to sell 600 sun shades in May and 350 in June. Each shade sells for $158. Shadee's beginning and ending finished goods inventories for May are 65 and 55 shades, respectively. Ending finished goods inventory for June will be 55 shades. Each shade requires a total of $65.00 in direct materials that includes 4 adjustable poles that cost $10.00 each. Shadee expects to have 130 in direct materials inventory on May 1, 90 poles in inventory on May 31, and 110 poles in inventory on June 30. Required: Prepare Shadee's May and June purchases budget for the adjustable poles Budgeted Cost of Closures Purchased May Junearrow_forwardLawnclippers, Inc. is offering a fall promotion to new customers signing a contract within the next two weeks. For a bundled price of $99, Lawnclippers will provide fall aeration, lawn seeding and tree fertilization. The standalone price of each service sold separately is fall aeration $69, lawn seeding $20, and tree fertilization $29. Allocate the price to each of the three separate performace obligaions (rounding your final answer to the nearest whole dollar) How much is allocated to Fall Aeration? Question 24 options: a) $69 b) $82 c) $58 d) $33arrow_forwardTheta Metalwork Inc. entered into an exclusive contract with an entity involved in franchising out artisanal candy stores. It will be producing a new design for a metal commercial rack based on the latter's needs. The latter is negotiating for a fixed-price on- demand ordering of the racks over five years. Theta gathered the following data shown in the image. How much should Theta sell each rack so that it can have a product profit margin of 28%? FIXED COSTS Research and Design Manufacturing Distribution Year 1 Year 2 Year 3 Year 4 Year 5 TOTALS P 200,000 P 50,000 30,000 P P 230,000 50,000 50,000 50,000 50,000 20,000 250,000 100,000 20,000 20,000 20,000 20,000 20,000 25,000 Customer Service 80,000 50,000 30,000 30,000 210,000 25,000 25,000 375,000 P 175,000 P 125,000 P 125,000 P 115,000 P 915,000 25,000 Other incremental operating costs TOTALS 25,000 125,000 VARIABLE COSTS PER UNIT Manufacturing 500 P 450 P 450 P 450 P 450 Distribution 100 100 100 100 100 Customer Service 50 50 50 50…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning