Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 4EA

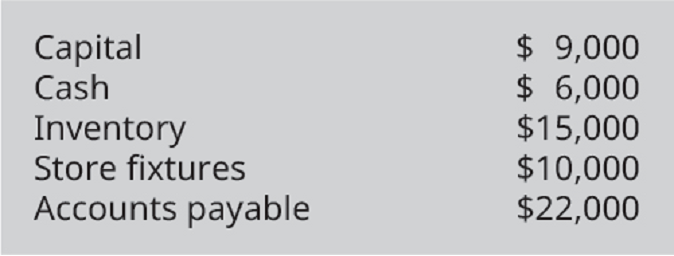

Cheese Partners has decided to close the store. At the date of closing, Cheese Partners had the following account balances:

A competitor agrees to buy the inventory and store fixtures for $20,000. Prepare the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Cheese Partners has decided to close the store. At the date of closing, Cheese Partners had the following account balances:

Capital

$8,000

Cash

8,000

Inventory

12,000

Store fixtures

8,000

Accounts payable

22,000

A competitor agrees to buy the inventory and store fixtures for $15,000.

Prepare the journal entries detailing the liquidation, assuming that partners Colette and Swarma are sharing profits on a 50:50 basis. If an amount box does not require an entry, leave it blank.

Cheese Partners has decided to close the store. At the date of closing, Cheese Partners had the following account balances:

Capital

$8,000

Cash

6,000

Inventory

12,000

Store fixtures

8,000

Accounts payable

22,000

A competitor agrees to buy the inventory and store fixtures for $15,000.

Prepare the journal entries detailing the liquidation, assuming that partners Colette and Swarma are sharing profits on a 50:50 basis. If an amount box does not require an entry, leave it blank.

Cash

Cash

Loss on Sale

Loss on Sale

Inventory

Inventory

Store Fixtures

Store Fixtures

Colette, Capital

Colette, Capital

Swarma, Capital

Swarma, Capital

Loss on Sale

Loss on Sale

Accounts Payable

Accounts Payable

Cash

Cash

Colette, Capital

Colette, Capital

Swarma, Capital

Swarma, Capital

Cash

Cash

On May 1, Soriano Co. reported the following account balances along with their estimated fair values:On that day, Zambrano paid cash to acquire all of the assets and liabilities of Soriano, which will cease to exist as a separate entity. To facilitate the merger, Zambrano also paid $100,000 to an investment banking firm.The following information was also available:• Zambrano further agreed to pay an extra $70,000 to the former owners of Soriano only if they meet certain revenue goals during the next two years. Zambrano estimated the present value of its probability adjusted expected payment for this contingency at $35,000.• Soriano has a research and development project in process with an appraised value of $200,000. However, the project has not yet reached technological feasibility and the project’s assets have no alternative future use.Prepare Zambrano’s journal entries to record the Soriano acquisition assuming its initial cash payment to the former owners wasa. $700,000.b.…

Chapter 15 Solutions

Principles of Accounting Volume 1

Ch. 15 - A partnership ________. A. has one owner B. can...Ch. 15 - Any assets invested by a particular partner in a...Ch. 15 - Which of the following is a disadvantage of the...Ch. 15 - Mutual agency is defined as: A. a mutual agreement...Ch. 15 - Chani contributes equipment to a partnership that...Ch. 15 - Juan contributes marketable securities to a...Ch. 15 - Which one of the following would not be considered...Ch. 15 - A well written partnership agreement should...Ch. 15 - What type of assets may a partner not contribute...Ch. 15 - How does a newly formed partnership handle the...

Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - When a partnership dissolves, the first step in...Ch. 15 - When a partnership dissolves, the last step in the...Ch. 15 - Prior to proceeding with the liquidation, the...Ch. 15 - Does a partnership pay income tax?Ch. 15 - Can a partners personal assets in a limited...Ch. 15 - Can a partnership assume liabilities as part of...Ch. 15 - Does each partner have to contribute an equal...Ch. 15 - What types of bases for dividing partnership net...Ch. 15 - Angela and Agatha are partners in Double A...Ch. 15 - On February 3, 2016 Sam Singh invested $90,000...Ch. 15 - Why do partnerships dissolve?Ch. 15 - What are the four steps involved in liquidating a...Ch. 15 - When a partner withdraws from the firm, which...Ch. 15 - What is the first step in a partnership...Ch. 15 - When a partnership liquidates, do partners get...Ch. 15 - Coffee Partners decides to close due to the...Ch. 15 - On May 1, 2017, BJ and Paige formed a partnership....Ch. 15 - The partnership of Chase and Chloe shares profits...Ch. 15 - The partnership of Tasha and Bill shares profits...Ch. 15 - Cheese Partners has decided to close the store. At...Ch. 15 - The partnership of Michelle, Amal, and Maureen has...Ch. 15 - The partnership of Tatum and Brook shares profits...Ch. 15 - Arun and Margot want to admit Tammy as a third...Ch. 15 - When a partnership is liquidated, any gains or...Ch. 15 - The partnership of Magda and Sue shares profits...Ch. 15 - The partnership of Arun, Margot, and Tammy has...Ch. 15 - Match each of the following descriptions with the...Ch. 15 - While sole proprietorships and corporations are...Ch. 15 - A partnership is thriving. The three partners get...

Additional Business Textbook Solutions

Find more solutions based on key concepts

In addition to the owners of a business, who are some of the other stakeholders that managers should consider w...

Principles of Management

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (4th Edition)

Ravenna Candles recently purchased candleholders for resale in its shops. Which of the following costs would be...

Financial Accounting (12th Edition) (What's New in Accounting)

Define cost object and give three examples.

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

What are some of the problems with using the CPI?

Construction Accounting And Financial Management (4th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the following account balances: Cash - $66,000 Noncash - $231,000 Liabilities - $46,000 Frick, capital (60%) - $135,000 Wilson, capital (20%) - $37,000 Clarke, capital (20%) - $79,00 Prepare journal entries to record the liquidation transactions reflected in the final statement of liquidation.arrow_forwardLester, Torres, and Hearst are members of Arcadia Sales, LLC, sharing income and losses in the ratio of 2:2:1, respectively. The members decide to liquidate the limited liability company. The members' equity prior to liquidation and asset realization on August 1 are as follows: Lester $28,800 Torres 66,600 Hearst 41,400 Total $136,800 In winding up operations during the month of August, noncash assets with a book value of $180,000 are sold for $223,200, and liabilities of $58,800 are satisfied. Prior to realization, Arcadia Sales has a cash balance of $15,600.arrow_forwardLester, Torres, and Hearst are members of Arcadia Sales, LLC, sharing income and losses in the ratio of 2:2:1, respectively. The members decide to liquidate the limited liability company. The members’ equity prior to liquidation and asset realization on August 1 are as follows: Lester $ 49,000 Torres 61,000 Hearst 27,000 Total $137,000In winding up operations during the month of August, noncash assets with a book value of $146,000 are sold for $158,000, and liabilities of $35,000 are satisfied. Prior to realization, Arcadia Sales has a cash balance of $26,000.a. Prepare a statement of LLC liquidation.b. Provide the journal entry for the final cash distribution to members.c. What is the role of the income- and loss-sharing ratio in liquidating an LLC?arrow_forward

- The partnership of Folly and Frill is in the process of liquidation. On January 1, 2021, the booksshow account balances as follows:Cash 10,000 Accounts Payable 15,000Accounts Receivable 25,000 Folly Capital 40,000Lumber Inventory 40,000 Frill Capital 20,000On January 10, 2021, the lumber inventory is sold for $25,000. During January, AccountsReceivable of $21,000 are collected. No further collections on the receivables are expected.Profits are shared 60% to Folly and 40% to Frill.1) Compute the final distribution to Folly2) Compute the final distribution to Frillarrow_forwardLester, Torres, and Hearst are members of Arcadia Sales, LLC, sharing income and losses in the ratio of 2:2:1, respectively. The members decide to liquidate the limited liability company. The members’ equity prior to liquidation and asset realization on August 1 are as follows: Lester $48,550 Torres 57,430 Hearst 29,680 Total $135,660 In winding up operations during the month of August, noncash assets with a book value of $154,940 are sold for $166,430, and liabilities of $47,780 are satisfied. Prior to realization, Arcadia Sales has a cash balance of $28,500. Required: a. Prepare a statement of LLC liquidation. For those boxes in which you must enter negative numbers (balance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of liabilities, receipt of deficiency, or cash distribution rows, the cell can be left blank. However, in the balance rows, a balance of…arrow_forwardLester, Torres, and Hearst are members of Arcadia Sales, LLC, sharing income and losses in the ratio of 2:2:1, respectively. The members decide to liquidate the limited liability company. The members’ equity prior to liquidation and asset realization on August 1 are as follows: Lester $53,120 Torres 55,790 Hearst 26,560 Total $135,470 In winding up operations during the month of August, noncash assets with a book value of $157,550 are sold for $170,590, and liabilities of $47,430 are satisfied. Prior to realization, Arcadia Sales has a cash balance of $25,350. Required: a. Prepare a statement of LLC liquidation. Refer to the list of Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter negative numbers (balance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of liabilities, receipt of deficiency,…arrow_forward

- After several years of operation, the partnership of Raimondo, Rodriguez, and Rosenfeld is being liquidated. After making closing entries on September 30, 20--, the following accounts remain open: Cash 18,000 Merchandise inventory 73,000 Other assets 157,000 Accounts payable 61,000 M. A. Raimondo, capital 50,000 M. E. Rodriguez, capital 50,000 C. R. Rosenfeld, capital 87,000 The noncash assets are sold for $275,000. Profits and losses are shared equally. Required: a. Prepare journal entries for the sale of the noncash assets on October 1. If an amount box does not require an entry, leave it blank. Page: 1 DATE DESCRIPTION POST.REF. DEBIT CREDIT 1 Oct. 1 fill in the blank 37d400fbffe4f95_2 fill in the blank 37d400fbffe4f95_3 1 2 fill in the blank 37d400fbffe4f95_5 fill in the blank 37d400fbffe4f95_6 2 3 fill in the blank 37d400fbffe4f95_8 fill in the blank 37d400fbffe4f95_9 3 4 fill in the blank…arrow_forwardOn October 01, 2019, Benny and Joey pooled their resources in a partnership with the firm taking over their business assets and assuming their business liabilities. They agreed to make the following adjustments and to make settlement among themselves to conform to the 40:60 capital and profit and loss ratio. ➢ Joey’s inventory be reduced by P3,000. ➢ Allowance for doubtful accounts be recognized in the amount of P1,500 each. ➢ P4,000 of unrecorded accounts payable to supplier be recorded in the books of Benny ➢ Accrued utilities be recognized in the books of Benny, P1,200. ➢ Store equipment in the books of Joey are under depreciated by P5,000. The individual trial balance before adjustments show the following: BennyJoey AssetsP120,000P150,000 Liabilities 25,000 35,000 Capital 95,000 115,000 The capital balances of the partners that conform with their agreement are: Benny: ___________________Joey: _____________________arrow_forwardLane Stevens is to retire from the partnership of Stevens and Associates as of March 31, the end of the current fiscal year. After closing the accounts, the capital balances of the partners are as follows: Lane Stevens, $150,000; Cherrie Ford, $70,000; and LaMarcus Rollins, $60,000. They have shared net income and net losses in the ratio of 3:2:2. The partners agree that the merchandise inventory should be increased by $22,300 and theallowance for doubtful accounts should be increased by $1,300. Stevens agrees to accept a note for $100,000 in partial settlement of his ownership equity. The remainder of his claim is to be paid in cash. Ford and Rollins are to share equally in the net income or net loss of the new partnership.Journalize the entries to record (a) the adjustment of the assets to bring them into agreement with current market prices and (b) the withdrawal of Stevens from the partnership.arrow_forward

- After several years of operations, the partnership of Arenas, Dulay and Laurente is to be liquidated. After making the closing entries on June 30, 2018, the following accounts remained open: Account Title Debit Credit Cash P 50,000 Non-cash Assets 2,350,000 Liabilities P 400,000 Arenas, Capital 900,000 Dulay, Capital 500,000 Laurente, Capital 600,000 The non-cash assets are sold for P2,650,000. Profits and losses are shared equally. Prepare a Statement of Partnership Liquidation and the entries to record the following: 1. Sale of all non-cash assets 2. Distribution of gain on realization to the partners 3. Payment of the liabilitiesarrow_forwardAfter several years of operations, the partnership of Arenas, Dulay and Laurente is to be liquidated. After making the closing entries on June 30, 2018, the following accounts remained open: Account Title Debit Credit Cash P 50,000 Non-cash Assets 2,350,000 Liabilities P 400,000 Arenas, Capital 900,000 Dulay, Capital 500,000 Laurente, Capital 600,000 The non-cash assets are sold for P2,650,000. Profits and losses are shared equally. Prepare a Statement of Partnership Liquidation and the entries to record the following: 1. Distribution of cash to the partnersarrow_forwardLane Stevens is to retire from the partnership of Stevens and Associates as of March 31, the end of the current fiscal year. After closing the accounts, the capital balances of the partners are as follows: Lane Stevens, $150,000; Cherrie Ford, $70,000; and LaMarcus Rollins, $60,000. They have shared net income and net losses in the ratio of 3:2:2. The partners agree that the merchandise inventory should be increased by $22,300 and the allowance for doubtful accounts should be increased by $1,300. Stevens agrees to accept a note for $100,000 in partial settlement of his ownership equity. The remainder of his claim is to be paid in cash. Ford and Rollins are to share equally in the net income or net loss of the new partnership.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License