Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 13P

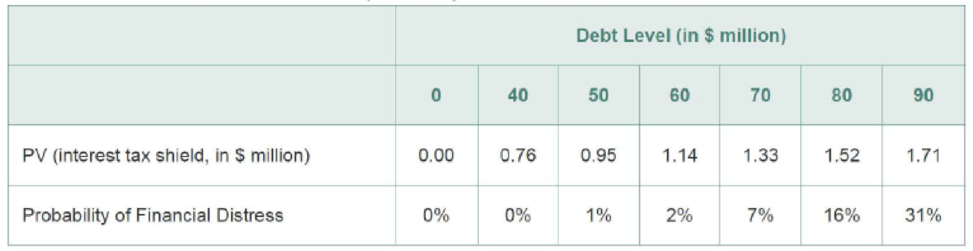

Your firm is considering issuing one-year debt, and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

Suppose the firm has a beta of zero, so that the appropriate discount rate for financial distress costs is the risk-free rate of 5%. Which level of debt above is optimal if, in the event of distress, the firm will have distress costs equal to

- a. $2 million?

- b. $5 million?

- c. $25 million?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

BBA Ltd has just issued $10 million in debt (at par or face value). The firm will pay interest only on this debt. BBA’s marginal tax rate is expected to be 30% for the foreseeable future.

a) Suppose BBA pays interest of 6% per year on its debt. What is its annual interest tax shield?

b) What is the present value of the interest tax shield, assuming the tax shield’s risk is the same as that of the loan?

c) Suppose instead that the interest rate on the debt is 5%. What is the present value of the interest tax shield in this case?

Ten years have passed since BBA issued $10 million in perpetual interest-only debt with a 6% annual coupon. Tax rates have remained the same at 30% but interest rates have dropped so BBA’s current cost of debt capital is 4%.

d) What is BBA’s annual interest tax shield now?

e) What is the present value of the interest tax shield now?

Suppose Mullens Corporation is considering three average-risk projects with the following costs and rates of return:

Project

Cost

Expected Rate of Return

1

$2,500

23.00%

2

$3,000

30.00%

3

$2,750

24.00%

Mullens estimates that it can issue debt at a rate of rd=20.00%rd=20.00% and a tax rate of T=25.00%T=25.00%. It can issue preferred stock that pays a constant dividend of Dp=$20.00Dp=$20.00 per year and at Pp=$200.00Pp=$200.00 per share.

Also, its common stock currently sells for P0=$16.00P0=$16.00 per share. The expected dividend payment of the common stock is D1=$4.00D1=$4.00 and the dividend is expected to grow at a constant annual rate of g=5.00%g=5.00% per year.

Mullens’ target capital structure consists of ws=75.00%ws=75.00% common stock, wd=15.00%wd=15.00% debt, and wp=10.00%wp=10.00% preferred stock.

1.According to the video, the after-tax cost of debt can be stated as ________________ . Plugging in the values for rdrd and (T)T yields an after-tax cost of…

Based in the U.S., Your firm faces a 25% chance of a potential loss of $20 million next year. If yourfirm implements new policies, it can reduce the chance of this loss by 10%, but these new policieshave an upfront cost of $300,000. Suppose the beta of the loss is 0, and the risk-free interest rate5%.ISa) If the firm is uninsured, what is the NPV of implementing the new policies?b) If the firm is fully insured, what is the NPV of implementing the new policies?c) Given your answer to question b), what is the actuarially fair cost of full insurance?d) What is the minimum-size deductible that would leave your firm with an incentive toimplement the new policies?e) What is the actuarially fair price of an insurance policy with the deductible in question d

Chapter 16 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 16.1 - Prob. 1CCCh. 16.1 - Does the risk of default reduce the value of the...Ch. 16.2 - If a firm files for bankruptcy under Chapter 11 of...Ch. 16.2 - Why are the losses of debt holders whose claims...Ch. 16.3 - Prob. 1CCCh. 16.3 - True or False: If bankruptcy costs are only...Ch. 16.4 - Prob. 1CCCh. 16.4 - According to the trade-off theory, all else being...Ch. 16.5 - Prob. 1CCCh. 16.5 - Why would debt holders desire covenants that...

Ch. 16.6 - Prob. 1CCCh. 16.6 - Prob. 2CCCh. 16.7 - Coca-Cola Enterprises is almost 50% debt financed...Ch. 16.7 - Why would a firm with excessive leverage not...Ch. 16.7 - Describe how management entrenchment can affect...Ch. 16.8 - How does asymmetric information explain the...Ch. 16.8 - Prob. 2CCCh. 16.9 - Prob. 1CCCh. 16.9 - Prob. 2CCCh. 16 - Gladstone Corporation is about to launch a new...Ch. 16 - Baruk Industries has no cash and a debt obligation...Ch. 16 - When a firm defaults on its debt, debt holders...Ch. 16 - Prob. 4PCh. 16 - Prob. 5PCh. 16 - Suppose Tefco Corp. has a value of 100 million if...Ch. 16 - You have received two job offers. Firm A offers to...Ch. 16 - As in Problem 1, Gladstone Corporation is about to...Ch. 16 - Kohwe Corporation plans to issue equity to raise...Ch. 16 - Prob. 10PCh. 16 - Prob. 11PCh. 16 - Hawar International is a shipping firm with a...Ch. 16 - Your firm is considering issuing one-year debt,...Ch. 16 - Marpor Industries has no debt and expects to...Ch. 16 - Real estate purchases are often financed with at...Ch. 16 - On May 14, 2008, General Motors paid a dividend of...Ch. 16 - Prob. 17PCh. 16 - Consider a firm whose only asset is a plot of...Ch. 16 - Prob. 19PCh. 16 - Prob. 20PCh. 16 - Prob. 21PCh. 16 - Consider the setting of Problem 21 , and suppose...Ch. 16 - Consider the setting of Problems 21 and 22, and...Ch. 16 - You own your own firm, and you want to raise 30...Ch. 16 - Empire Industries forecasts net income this coming...Ch. 16 - Ralston Enterprises has assets that will have a...Ch. 16 - Prob. 27PCh. 16 - If it is managed efficiently, Remel Inc. will have...Ch. 16 - Which of the following industries have low optimal...Ch. 16 - According to the managerial entrenchment theory,...Ch. 16 - Info Systems Technology (IST) manufactures...Ch. 16 - Prob. 32PCh. 16 - Prob. 33P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Adamson Corporation is considering fouraverage-risk projects with the following costs and rates of return: The company estimates that it can issue debt at a rate of rd = 10%, and its tax rate is 30%. Itcan issue preferred stock that pays a constant dividend of $5.00 per year at $50.00 per share.Also, its common stock currently sells for $38.00 per share; the next expected dividend, D1,is $4.25, and the dividend is expected to grow at a constant rate of 5% per year. The targetcapital structure consists of 75% common stock, 15% debt, and 10% preferred stock.a. What is the cost of each of the capital components?b. What is Adamson’s WACC?c. Only projects with expected returns that exceed WACC will be accepted. Whichprojects should Adamson accept?arrow_forwardIf the financial Manager of Evergreen wants to decrease its cost of capital by adding more debt to its capital structure and arrive at a debt-equity ratio of 0.60. If its debt is in the form of a 6% semiannual bond issue outstanding with 15 years to maturity. The bond currently sells for 95% of its face value of $1000. On the other hand, suppose the risk-free rate is 3% and the market portfolio has an expected return of 9% and the company has a beta of 2. If the tax rate is 40%. Question 1 Calculate the company,s after-tax cost of debt. Question 2 Calculate the company,s cost of equity. Question 3 What would be the company’s overall cost of capital (WACC) at the targeted capital structure of debt equity ratio of 0.60? Question 4 If the company achieves this new cost of capital, would your investment decision change regarding the previous two investment opportunities? Explain your answer.arrow_forwardhe Finance Manager is exploring options to further reduce the company’s weighted average cost of capital. He has suggested to the company’s CEO, that increasing the company’s debt and decreasing equity may be the best option, as the cost of equity is higher than the cost of debt. As such, the company is considering issuing a $100,000 20-year bond, with an annual coupon rate of 6%, and quarterly interest payments. Required: If the company anticipates that the bond will close at a yield to maturity of 8%, given the company’s credit ratings and current market conditions, how much would an investor be willing to pay for $1,000 face value of this bond at issue?arrow_forward

- Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. What is the aftertax cost of debt?arrow_forwardMorrison Medical Inc., an all-equity firm, has earnings before interest and taxes of $950,000, an un-levered beta of .80 and a tax rate = 35%. In the market, you observe that Government T-bills are being sold to yield 2% and the S&P/TSX Composite Index is expected to yield 9%. Assume a world with taxes and a cost for the risk of default. All general M&M assumptions apply. You have also been provided the following information: Value of Debt Cost of Debt (Rd) Beta PV of Financial Distress Costs $ 0 - .80 0 $ 5,000,000 5.5% ? $800,000 $ 7,000,000 7.0% 2 ? What is the market value of the firm? What is the market value of the firm and the market value of the equity if they issue $5,000,000 in debt with a coupon rate of 4.5% and use the proceeds to repurchase shares? What is the new cost of equity? According to CAPM, what is the new beta? What is the market value of the firm if the firm issues $7,000,000 in debt? What would be the PV of financial distress costs if…arrow_forwardMorrison Medical Inc., an all-equity firm, has earnings before interest and taxes of $950,000, an un-levered beta of .80 and a tax rate = 35%. In the market, you observe that Government T-bills are being sold to yield 2% and the S&P/TSX Composite Index is expected to yield 9%. Assume a world with taxes and a cost for the risk of default. All general M&M assumptions apply. You have also been provided the following information: Value of Debt Cost of Debt (Rd) Beta PV of Financial Distress Costs $ 0 - .80 0 $ 5,000,000 5.5% ? $800,000 $ 7,000,000 7.0% 2 ? What is the market value of the firm if the firm issues $7,000,000 in debt? What would be the PV of financial distress costs if the firm issues $7,000,000 in debt?arrow_forward

- Adamson Corporation is considering four average-risk projects with the following costs and rates of return: Project Cost Expected Rate of Return 1 $2,000 16.00% 2 3,000 15.00 3 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of rd = 10%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $6.00 per year at $56.00 per share. Also, its common stock currently sells for $43.00 per share; the next expected dividend, D1, is $3.75; and the dividend is expected to grow at a constant rate of 7% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. Cost of debt: % Cost of preferred stock: % Cost of retained earnings: % What is Adamson's WACC? Do not round intermediate calculations. Round your answer to…arrow_forwardIf company’s debt-to-equity ratio is 0.25, what is the weighted average cost of capital for the company if the required rate of return is 12. 1% and the cost of debt is 6.5%? Assume no tax rate A 7.90% B 7.62% C 10.98% D 10.70% E 9.30% Company is considering investing in a project. After consulting with their analysts, they find that the payback period for the project is 2 years and 6 months. If cash inflows are $4, 000. then the initial investment is. Answer rounded to the nearest whole dollararrow_forwardNow consider the case of another company: US Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 8%, and its tax rate is 25%. It currently has a levered beta of 1.25. The risk-free rate is 3.5%, and the risk premium on the market is 8%. US Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm’s level of debt will cause its before-tax cost of debt to increase to 10%. First, solve for US Robotics Inc.’s unlevered beta. Use US Robotics Inc.’s unlevered beta to solve for the firm’s levered beta with the new capital structure. Use US Robotics Inc.’s levered beta under the new capital structure, to solve for its cost of equity under the new capital structure. What will the firm’s weighted average cost of capital (WACC) be if it makes this change in its capital structure? 11.78% 12.40% 8.06% 9.30%arrow_forward

- Adamson Corporation is considering four average-risk projects with the following costs and rates of return: Project Cost Expected Rate of Return 1 $2,000 16.00% 2 3,000 15.00 3 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of rd = 10%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $4.00 per year at $48.00 per share. Also, its common stock currently sells for $33.00 per share; the next expected dividend, D1, is $4.25; and the dividend is expected to grow at a constant rate of 4% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. Cost of debt: % Cost of preferred stock: % Cost of retained earnings: % What is Adamson's WACC? Do not round intermediate calculations. Round your answer to two…arrow_forwardAdamson Corporation is considering four average-risk projects with the following costs and rates of return: Project Cost Expected Rate of Return 1 $2,000 16.00% 2 3,000 15.00 3 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of rd = 9%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $4.00 per year at $57.00 per share. Also, its common stock currently sells for $41.00 per share; the next expected dividend, D1, is $3.75; and the dividend is expected to grow at a constant rate of 7% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. Cost of debt: % Cost of preferred stock: % Cost of retained earnings: % What is Adamson's WACC? Do not round intermediate calculations. Round your answer to two…arrow_forwardStephens Electronics is considering a change in its target capital structure, which currently consists of 25% debt and 75% equity. The CFO believes the firm should use more debt, but the CEO is reluctant to increase the debt ratio. The risk-free rate, rRFrRF, is 5.0%, the market risk premium, RPM, is 6.0%, and the firm s tax rate is 40%. Currently, the cost of equity, rsrs, is 11.5% as determined by the CAPM. What would be the estimated cost of equity if the firm used 60% debt?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

The U.S. Treasury Markets Explained | Office Hours with Gary Gensler; Author: U.S. Securities and Exchange Commission;https://www.youtube.com/watch?v=uKXZSzY2ZbA;License: Standard Youtube License