Bundle: Fundamentals of Financial Management, Concise, Loose-Leaf Version, 9th + LMS Integrated for MindTap Finance, 1 term (6 months) Printed Access Card

9th Edition

ISBN: 9781337148085

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 14P

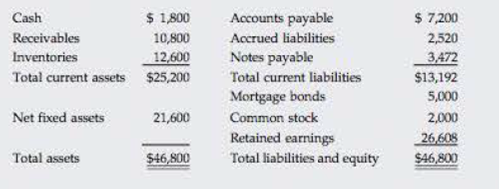

EXCESS CAPACITY Krogh Lumber’s 2016 financial statements are shown here.

Krogh Lumber Balance Sheet as of December 31, 2016 (Thousands of Dollars)

Krogh Lumben Income Statement for December 31, 2016 (Thousands of Dollars)

| Sales | $36,000 |

| Operating costs including depredation | 30,783 |

| Earnings before interest and taxes | $ 5,217 |

| Interest | 1,017 |

| Earnings before taxes | $ 4,200 |

| Taxes (40%) | 1,680 |

| Net income | $ 2,520 |

| Dividends (60%) | $ 1,512 |

| Addition to |

$ 1,008 |

- a. Assume that the company was operating at full capacity in 2016 with regard to all items except fixed assets; fixed assets in 2016 were being utilized to only 75% of capacity. By what percentage could 2017 sales increase over 2016 sales without the need for an increase in fixed assets?

- b. Now suppose 2017 sales increase by 25% over 2016 sales. Assume that Krogh cannot sell any fixed assets. All assets other than fixed assets will grow at the same rate as sales; however, after reviewing industry averages, the firm would like to reduce its operating costs/sales ratio to 82% and increase its total liabilities-to-assets ratio to 42%. The firm will maintain its 60% dividend payout ratio, and it currently has 1 million shares outstanding. The firm plans to raise 35% of its 2017 forecasted interest-bearing debt as notes payable, and it will issue bonds for the remainder. The firm

forecasts that its before-tax cost of debt (which includes both short- and longterm debt) is 11%. Any stock issuances or repurchases will be made at the firm’s current stock price of $40. Develop Krogh’s projected financial statements like those shown in Table 16.2. What are the balances of notes payable, bonds, common stock, and retained earnings?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

EXCESS CAPACITY Krogh Lumber’s 2016 financial statements are shown here.

a. Assume that the company was operating at full capacity in 2016 with regard to all itemsexcept fixed assets; fixed assets in 2016 were being utilized to only 75% of capacity. Bywhat percentage could 2017 sales increase over 2016 sales without the need for anincrease in fixed assets?b. Now suppose 2017 sales increase by 25% over 2016 sales. Assume that Krogh cannotsell any fixed assets. All assets other than fixed assets will grow at the same rate assales; however, after reviewing industry averages, the firm would like to reduce itsoperating costs/sales ratio to 82% and increase its total liabilities-to-assets ratio to42%. The firm will maintain its 60% dividend payout ratio, and it currently has1 million shares outstanding. The firm plans to raise 35% of its 2017 forecastedinterest-bearing debt as notes payable, and it will issue bonds for the remainder. Thefirm forecasts that its before-tax cost of debt (which…

Brick & StoneIncome Statement for the year ended 31 December 2016 Notes $ $Sales 2,500,000Cost of Sales 1 1,100,000Gross Profit 1,400,000ExpensesSalaries & Wages 2 760,000Employer NIS Contribution 2,400Rent and Rates 3 240,000Insurance 50,000Maintenance 120,000Depreciation 4…

Dela Rosa Company Company

The income statement for the year ended December 31, 2020, for Dela Rosa Company Company contains the following condensed information.

Dela Rosa Company Company

Income Statement

For the Year Ended December 31, 2X20

Sales revenue

P6,583,000

Cost of goods sold

P2,810,000

Operating expenses (excluding depreciation)

2,086,000

Depreciation expense

880,000

Loss on disposal of plant assets

24,000

5,800,000

Income before income taxes

783,000

Income tax expense

353,000

Net income

P430,000

The P24,000 loss resulted from selling equipment for P270,000 cash. The equipment was purchased at a cost of P750,000. The following balances are reported on Delar Rosa’s comparative balance sheets at December 31.

Dela Rosa Company Company

Comparative Balance Sheets

2X20

2X19

Cash

P672,000

P130,000

Accounts receivable

775,000

610,000…

Chapter 16 Solutions

Bundle: Fundamentals of Financial Management, Concise, Loose-Leaf Version, 9th + LMS Integrated for MindTap Finance, 1 term (6 months) Printed Access Card

Ch. 16 - Prob. 1QCh. 16 - Assume that an average firm in the office supply...Ch. 16 - Would you agree that computerized corporate...Ch. 16 - Certain liability and net worth items generally...Ch. 16 - Suppose a firm makes the following policy changes....Ch. 16 - AFN EQUATION Carlsbad Corporations sales are...Ch. 16 - AFN EQUATION Refer to problem 16-1. What...Ch. 16 - AFN EQUATION Refer to problem 16-1 and assume that...Ch. 16 - PRO FORMA INCOME STATEMENT Austin Grocers recently...Ch. 16 - EXCESS CAPACITY Williamson Industries has 7...

Ch. 16 - REGRESSION AND INVENTORIES jasper Furnishings has...Ch. 16 - PRO FORMA INCOME STATEMENT At the end of last...Ch. 16 - LONG-TERM FINANCING NEEDED At year-end 2016, total...Ch. 16 - SALES INCREASE Paladin Furnishings generated 4...Ch. 16 - REGRESSION AND RECEIVABLES Edwards Industries has...Ch. 16 - REGRESSION AND INVENTORIES Charlies Cycles Inc....Ch. 16 - EXCESS CAPACITY Earleton Manufacturing Company has...Ch. 16 - ADDITIONAL FUNDS NEEDED Morrissey Technologies...Ch. 16 - EXCESS CAPACITY Krogh Lumbers 2016 financial...Ch. 16 - INTEGRATED CASE NEW WORLD CHEMICALS INC. FINANCIAL...Ch. 16 - Prob. 1DQCh. 16 - Prob. 2DQCh. 16 - Forecast Earnings Growth Have analysts made any...Ch. 16 - Prob. 4DQCh. 16 - How has Abercrombies stock performed this year...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- EXCESS CAPACITY Krogh Lumbers 2019 financial statements are shown here. Krogh Lumber: Balance Sheet as of December 31, 2019 (thousands of dollars) Krogh Lumber: Income Statement for December 31, 2019 (thousands of dollars) a. Assume that the company was operating at full capacity in 2019 with regard to all items except fixed assets; fixed assets in 2019 were being utilized to only 75% of capacity. By what percentage could 2020 sales increase over 2019 sales without the need for an increase in fixed assets? b. Now suppose 2020 sales increase by 25% over 2019 sales. Assume that Krogh cannot sell any fixed assets. All assets other than fixed assets will grow at the same rate as sales; however, after reviewing industry averages, the firm would like to reduce its operating costs/sales ratio to 82% and increase its total liabilities-to-assets ratio to 42%. The firm will maintain its 60% dividend payout ratio, and it currently has 1 million shares outstanding. The firm plans to raise 35% of its 2020 forecasted interest-bearing debt as notes payable, and it will issue bonds for the remainder. The firm forecasts that its before-tax cost of debt (which includes both short- and long-term debt) is 11%. Any stock issuances or repurchases will be made at the firms current stock price of 40. Develop Kroghs projected financial statements like those shown in Table 16.2. What are the balances of notes payable, bonds, common stock, and retained earnings?arrow_forwardLan & Chen Technologies: Income Statements for Year Ending December 31 (Thousands of Dollars) 2018 2017 Sales $945,000 $900,000 Expenses excluding depreciation and amortization 812,700 774,000 EBITDA $132,300 $126,000 Depreciation and amortization 33,100 31,500 EBIT $99,200 $94,500 Interest Expense 10,470 8,600 EBT $88,730 $85,900 Taxes (40%) 35,492 34,360 Net income…arrow_forwardLan & Chen Technologies: Income Statements for Year Ending December 31 (Thousands of Dollars) 2018 2017 Sales $945,000 $900,000 Expenses excluding depreciation and amortization 812,700 774,000 EBITDA $132,300 $126,000 Depreciation and amortization 33,100 31,500 EBIT $99,200 $94,500 Interest Expense 10,470 8,600 EBT $88,730 $85,900 Taxes (40%) 35,492 34,360 Net income…arrow_forward

- A company recorded the following expenses at the end of the current year: Decrease in inventory P300,000Transportation out 40,000Depreciation 170,000Purchases 800,000Finance cost 20,000Salaries 130,000Freight in 30,000Purchase discount 140,000Sales 2,500,000Loss on sale of equipment 10,000Gain on sale of investment 30,000 14. What amount should be reported as cost of goods sold of the company?a. P690,000b. P990,000c. P390,000d. P970,000 15. What amount should be reported as income by the company?a. P1,170,000b. P1,190,000c. P1,770,000d. P1,470,000arrow_forwardReturn on AssetsThe following financial data is from Hi-Tech Instruments' financial statements (thousands of dollars, except earnings per share.) 2016 Sales revenue $210,000 Cost of goods sold 125,000 Net income 8,800 Dividends 3,100 Earnings per share 4.40 Hi-Tech Instruments, Inc.Balance Sheet (Thousands of Dollars) Dec. 31, 2016 Dec. 31, 2015 Assets Cash $19,300 $18,000 Accounts receivable (net) 46,000 41,000 Inventory 39,500 43,700 Total current assets 104,800 102,700 Plant assets (net) 52,600 50,500 Other assets 15,600 13,800 Total assets 173,000 $167,000 Liabilities and Stockholders' Equity Notes payable-banks $6,000 $6,000 Accounts payable 22,500 18,700 Accrued liabilities 16,500 21,000 Total current liabilities 45,000 45,700 9% Bonds payable 41,000 40,000 Total liabilities 86,000 85,700 Common stock, $25 par value (2,000,000 shares) 50,000 50,000 Retained earnings 37,000 31,300 Total stockholders'…arrow_forwardThe following transactions for Fortitude Enterprises during the second quarter of 2024: Sales amounted to P5,000,000 and related cost of goods sold was P3,000,000 Selling expenses for the given period was P250,000. Depreciation is usually recorded at annual amount of P1,200,000. Real property taxes for the year in the amount of P600,000 were paid on April 1, 2024. An inventory loss arising from a temporary market decline of P400,000 had occurred on June 30, 2024. Ignoring income taxes, net income for the second quarter ending June 30, 2024 should be?arrow_forward

- Calculating Economic Value Added East Mullett Manufacturing earned operating income last year as shown in the following income statement: Sales $630,000 Cost of goods sold 380,000 Gross margin $250,000 Selling and administrative expense 174,400 Operating income $ 75,600 Less: Income taxes (@ 40%) 30,240 Net income $ 45,360 Total capital employed equaled $399,000. East Mullett's actual cost of capital is 8 percent. Required: Calculate the EVA for East Mullett Manufacturing.$fill in the blank 1arrow_forwardWright Company reports the following information for the year ended December 31, 2016: Pretax income from continuing operations (a) $160,000 Pretax income from operations of discontinued Division M 27,000 Pretax loss on disposal of Division M (45,000) Pretax correction of error in understating depreciation in 2015 (8,000) Retained earnings, January 1, 2016 410,000 Cash dividends during 2016 48,000 Income tax payable (b) 41,000 a: Of this amount, revenues are $400,000 and expenses are $240,000. b: Of this amount, $6,750 relates to the pretax income from the operations of discontinued Division M; pretax loss on the disposal of Division M resulted in an income tax savings of $11,250; and pretax correction of the depreciation error resulted in an income tax savings of $2,000. Required: 1. Prepare the year-end journal entry necessary to record the 2016 intraperiod income tax allocation. 2. Prepare Wright’s 2016 income statement and statement of retained…arrow_forwardBrick & StoneIncome Statement for the year ended 31 December 2016Notes $ $Sales 2,500,000Cost of Sales 1 1,100,000 Gross Profit 1,400,000ExpensesSalaries & Wages 2 760,000Employer NIS Contribution 2,400 Rent and Rates 3 240,000Insurance 50,000Maintenance 120,000Depreciation 4 55,000Loss on Disposal of Vehicle 5 10,000Telephone 6 35,000Electricity 7 54,000Utilities 70,000Entertainment 8 100,000Donations 9 85,000Provision for Bad Debts 10 80,000Fines and Penalties 11 15,000Drawings 105,000 1,781,400 Net Profit/ (Loss) (381,400)Brick & StoneNotes to the Income Statement1. The Cost of Sales includes goods valuing $250,000 that were purchased for Mr. Stone’s personal use.2. Salaries and Wages include $25,000 per month, and $20,000 per month, paid to Mr. Stone and Mr. Brick respectively.3. $65,000 of the rent relates to the private dwelling of Mr. Brick’s wife.4. As at the 31 December 2021, the business recorded the following assets in its books:Assets Cost Reducing Balance…arrow_forward

- An entity reported the following information for the year ended December 31, 2020: Sales 7,750,000 Cost of goods sold 2,400,000 Administrative expenses 700,000 Loss on sale of equipment 100,000 Sales commissions 500,000 Interest revenue 450,000 Freight out 150,000 Loss on early extinguishment of long-term debt 200,000 Doubtful accounts expense 150,000 16. What is the income from continuing operations for 2020? a. 4,000,000 b. 3,800,000 c. 2,800,000 d. 2,600,000 17. What net amount of loss should be reported as results of discontinued operations for 2020? a. 1,500,000 b. 1,700,000 c. 1,050,000 d. 1,400,000 18. What is the net income for 2020? a. 2,500,000 b. 1,750,000 c. 1,400,000 d. 1,540,000arrow_forwardDuke Company’s records show the following account balances at December 31, 2018:Sales $15,000,000Cost of goods sold 9,000,000General and administrative expenses 1,000,000Selling expenses 500,000Interest expense 700,000Income tax expense has not yet been determined. The following events also occurred during 2018. All transactions are material in amount.1. $300,000 in restructuring costs were incurred in connection with plant closings.2. Inventory costing $400,000 was written off as obsolete. Material losses of this type are considered to beunusual.3. It was discovered that depreciation expense for 2017 was understated by $50,000 due to a mathematical error.4. The company experienced a negative foreign currency translation adjustment of $200,000 and had unrealizedgains on investments of $180,000.Required:Prepare a single, continuous multiple-step statement of comprehensive income for 2018. The company’s effective tax rate on all items affecting comprehensive income is 40%. Each component…arrow_forwardGiven the historical income statement of Mega Trade Inc., how much would be added to the company's retained earning for the year 2016 (in millions)? Income Statement ($ Million) Income Statement ( $ Million) Year End 2015 2016 2017 2019 Sales 1, 234,90 1,251.40 1,300.40 1,334.40 Cost of Sales -679.1 -659 -681.3 -667 Gross Operating Income Selling & Administration -339.7 -348.6 -351.2 -373.3 Depreciation -47.5 -52 -55.9 -75.2 Other Income / Expenses 11.8 7.6 7 8.2 Earnings Before Interest and Taxes Interest Income 1.3 1.4 1.7 2 Interest Expense -16.2 -15.1 -20.5 -23.7 Pre Tax Income Income Taxes -56.8 -64.2 -67.5 -72.6 Net Income Dividends -38.3 -38.7 -39.8 -40.1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Projections for Startups Basic Walkthrough; Author: Mike Lingle;https://www.youtube.com/watch?v=7avegQF4dxI;License: Standard youtube license