Comparison of alternative joint-cost-allocation methods, further-processing decision, chocolate products. The Rich and Creamy Edibles Factory manufactures and distributes chocolate products. It purchases cocoa beans and processes them into two intermediate products: chocolate-powder liquor base and milk-chocolate liquor base. These two intermediate products become separately identifiable at a single splitoff point. Every 600 pounds of cocoa beans yields 20 gallons of chocolate-powder liquor base and 60 gallons of milk-chocolate liquor base.

The chocolate-powder liquor base is further processed into chocolate powder. Every 20 gallons of chocolate-powder liquor base yield 680 pounds of chocolate powder. The milk-chocolate liquor base is further processed into milk chocolate. Every 60 gallons of milk-chocolate liquor base yield 1,100 pounds of milk chocolate.

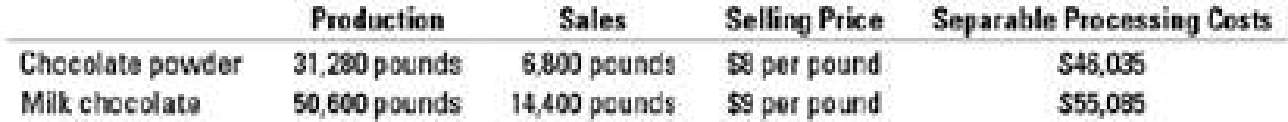

Production and sales data for August 2017 are as follows (assume no beginning inventory):

- Cocoa beans processed, 27,600 pounds

- Costs of processing cocoa beans to splitoff point (including purchase of beans), $70,000

Rich and Creamy Edibles Factory fully processes both of its intermediate products into chocolate powder or milk chocolate. There is an active market for these intermediate products. In August 2017, Rich and Creamy Edibles Factory could have sold the chocolate-powder liquor base for $21 a gallon and the milk-chocolate liquor base for $28 a gallon.

- 1. Calculate how the joint costs of $70,000 would be allocated between chocolate powder and milk chocolate under the following methods:

Required

- a. Sales value at splitoff

- b. Physical measure (gallons)

- c. NRV

- d. Constant gross-margin percentage NRV

- 2. What are the gross-margin percentages of chocolate powder and milk chocolate under each of the methods in requirement 1?

- 3. Could Rich and Creamy Edibles Factory have increased its operating income by a change in its decision to fully process both of its intermediate products? Show your computations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

HORGREN'S COST ACCOUNTING

- Stahl Inc. produces three separate products from a common process costing $100,800. Each of the products can be sold at the split-off point or can be processed further and then sold for a higher price. Shown below are cost and selling price data for a recent period. Sales Valueat Split-OffPoint Cost toProcessFurther Sales Valueafter FurtherProcessing Product 10 $60,400 $100,600 $190,000 Product 12 15,600 30,100 35,400 Product 14 55,500 150,800 214,500 Determine total net income if all products are sold at the split-off point. Net income $ eTextbook and Media Determine total net income if all products are sold after further processing. Net income $ eTextbook and Media Calculate incremental profit/(loss) and determine which products should be…arrow_forwardAlternative joint-cost-allocation methods, further process decision. The Tempura spirits Company produces two products – methanol (wood alcohol) and turpentine—by a joint process. Joint costs amount to $ 124,000 per batch of output. Each batch totals 9,500 gallons:25% methanol and 75% turpentine. Both products are processed further without gain or loss in volume. Separable processing costs are methanol,$4 per gallon, and turpentine,$2 per gallon. Methanol sells for $22 per gallon. Turpentine sells for $16 per gallon.arrow_forwardStahl Inc. produces three separate products from a common process costing $100,300. Each of the products can be sold at the split-off point or can be processed further and then sold for a higher price. Shown below are cost and selling price data for a recent period. Sales Valueat Split-OffPoint Cost toProcessFurther Sales Valueafter FurtherProcessing Product 10 $59,400 $100,900 $190,100 Product 12 15,000 30,100 34,000 Product 14 55,600 149,400 215,900arrow_forward

- Kelp Company produces three joint products from seaweed. At the split-off point, three basic products emerge: Sea Tea, Sea Paste, and Sea Powder. Each of these products can either be sold at the split-off point or be processed further. If they are processed further, the resulting products can be sold as delicacies to health food stores. Cost and revenue information is as follows. Sales Value and AdditionalCosts If Processed Further Product PoundsProduced Sales Value at Split-Off Final SalesValue AdditionalCost Sea Tea 9,000 $ 60,000 $ 90,000 $ 35,000 Sea Paste 5,300 86,900 160,000 50,000 Sea Powder 2,000 70,000 85,000 14,000 Required: a-1. Compute the incremental benefit (cost) of further processing to these products. a-2. Which products should Kelp process beyond the split-off point? b. What is the selling price per pound of Sea Paste at the split-off point at which the company is indifferent?arrow_forwardBlossom Inc. produces three separate products from a common process costing $100,300. Each of the products can be sold at the split-off point or can be processed further and then sold for a higher price. Shown below are cost and selling price data for a recent period. Sales Valueat Split-OffPoint Cost toProcessFurther Sales Valueafter FurtherProcessing Product 10 $59,400 $100,900 $190,100 Product 12 15,000 30,100 34,000 Product 14 55,600 149,400 215,900 Determine total net income if all products are sold at the split-off point. Net incomearrow_forwardOak View Chemicals produces two main products. M-10 and M-20, and one by-product, B-60, from a single input. Chem-X. Products M-10 and M-20 can either be sold at split-off or processed further and sold. A given batch begins with 1,000 gallons of Chem-X with a cost of $90,000. Additional information regarding a batch follows. Oak View Chemicals uses the net realizable at split-off approach to allocate joint costs and treats the sales value of the by-product B-60 as other income. If processed further Product Units produced Units sales value at split off Additional Cost(per unit) Sales value(per unit) M-10 20000 $ 5.00 $ 2.00 $ 6.00 M-20 14000 $ 10.00 $ 4.00 $ 16.00 B-60 5000 $ 0.50 NA NA Required The joint cost allocated to product M-10 at Oak View…arrow_forward

- Gigabody, Inc., a nutritional supplement manufacturer, produces five lines of protein supplements. Each product line is managed separately by a senior-level product engineer who is evaluated, in part, based on his or her ability to keep costs low. The five product lines are produced in a joint production process. After splitting off from the joint production process, all five lines are processed further before resale. Traditionally, joint product costs have been allocated to the five product lines using the physical units method. Recently, however, one of the line managers has complained that the supplement she oversees, the Turbo Capsule, is subsidizing the production of the Power Shake. As she puts it, "The powder for the Power Shake requires a higher temperature in the early refining process than the powder in my capsules, so it should carry more of the joint costs!" However, the line manager does not point out that in terms of the powder used, the Power Shakes sell for a fraction…arrow_forwardGigabody, Inc., a nutritional supplement manufacturer, produces five lines of protein supplements. Each product line is managed separately by a senior-level product engineer who is evaluated, in part, based on his or her ability to keep costs low. The five product lines are produced in a joint production process. After splitting off from the joint production process, all five lines are processed further before resale. Traditionally, joint product costs have been allocated to the five product lines using the physical units method. Recently, however, one of the line managers has complained that the supplement she oversees, the Turbo Capsule, is subsidizing the production of the Power Shake. As she puts it, “The powder for the Power Shake requires a higher temperature in the early refining process than the powder in my capsules, so it should carry more of the joint costs!” However, the line manager does not point out that in terms of the powder used, the Power Shakes sell for a fraction…arrow_forwardGigabody, Inc., a nutritional supplement manufacturer, produces five lines of protein supplements. Each product line is managed separately by a senior-level product engineer who is evaluated, in part, based on his or her ability to keep costs low. The five product lines are produced in a joint production process. After splitting off from the joint production process, all five lines are processed further before resale. Traditionally, joint product costs have been allocated to the five product lines using the physical units method. Recently, however, one of the line managers has complained that the supplement she oversees, the Turbo Capsule, is subsidizing the production of the Power Shake. As she puts it, “The powder for the Power Shake requires a higher temperature in the early refining process than the powder in my capsules, so it should carry more of the joint costs!” However, the line manager does not point out that in terms of the powder used, the Power Shakes sell for a fraction…arrow_forward

- Sell-or-Process-Further Decision; Product Mix Cantel Company produces cleaning compounds for both commercial and household customers. Some of these products are producedas part of a joint manufacturing process. For example, GR37, a coarse cleaning powder meantfor commercial sale, costs $1.60 a pound to make and sells for $2.00 per pound. A portion ofthe annual production of GR37 is retained for further processing in a separate department whereit is combined with several other ingredients to form SilPol, which is sold as a silver polish,at $4.00 per unit. The additional processing requires ¼ pound of GR37 per unit; additionalprocessing costs amount to $2.50 per unit of SilPol produced. Variable selling costs forSilPol average $0.30 per unit. If production of SilPol were discontinued, $5,600 of costs inthe processing department would be avoided. Cantel has, at this point, unlimited demand for,but limited capacity to produce, product GR37.Required1. Calculate the minimum number of units…arrow_forwardBreegle Company produces three products (B-40, J-60, and H-102) from a single process. Breegle uses the physical volume method to allocate joint costs of 22,500 per batch to theproducts. Based on the following information, which product(s) should Breegle continue toprocess after the split-off point in order to maximize profit? a. B-40 only b. J-60 only c. H-102 only d. B-40 and H-102 onlyarrow_forwardStrawberry Sweet Company makes a variety of jams and jellies. During June, 55,000 gallons of strawberry mash was processed at a joint cost of $40,000. This produced 42,000 gallons of preserve-grade mix and 4,000 gallons of Strawberry juice for jelly. The juice could be processed further into energy drinks, and the preserve mix could be processed further into ice cream flavoring. Information on these items is shown: A. Assume that the joint cost is allocated to the products based on the physical quantity of output of each product. How much joint cost should be assigned to each product? B. How much joint cost should be assigned to each product if the relative sales value allocation method is used? C. Which products should be processed further?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,