Concept explainers

Variance Computations with Missing Data

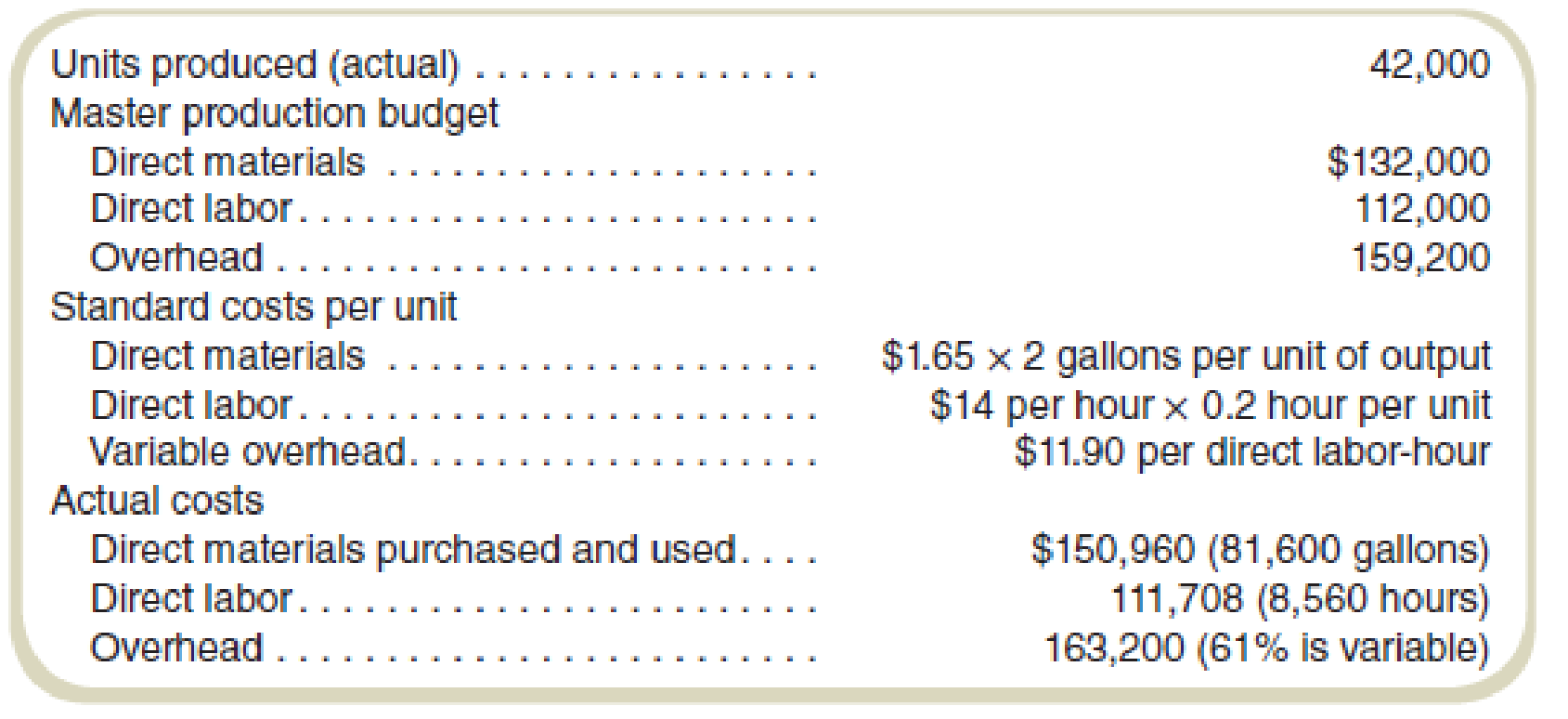

The following information is provided to assist you in evaluating the performance of the production operations of Studio Company:

Variable overhead is applied on the basis of direct labor-hours.

Required

Prepare a report that shows all variable production cost price and efficiency variances and fixed production cost price and production volume variances.

Prepare a report showing variable production cost price and efficiency variances along with fixed production cost price and production volume variances.

Explanation of Solution

Price variance:

The price variance refers to the difference of the actual unit cost and standard unit cost of the product.

Efficiency variance:

The efficiency variance refers to the difference of the actual and budgeted quantities which have been purchased for a specific price.

Variable production cost will include direct material, direct labor, and variable overhead costs so price and efficiency variances will be computed for all three components. For fixed overhead cost variances with variable cost; price and production volume variances need to be calculated.

Compute the variable production cost variances:

For preparing variable product cost variance report, following missing components needs to be calculated first.

Standard Units Produced:

Actual direct material unit cost:

Actual labor cost per unit:

Standard total labor hours:

Actual variable overhead per actual labor hour:

The report showing variable production cost price and efficiency variances:

| Direct Material Variances | Amount |

| Price Variance | $16,320 |

| Efficiency Variance | $2,6400 |

| Total Variance | $18,960F |

| Direct Labor Variances | |

| Price Variance | $8,132 |

| Efficiency Variance | $7,840 |

| Total Variance | $2,92F |

| Variable Overhead Variance: | |

| Price Variance | $2,311 |

| Efficiency Variance | $6,664 |

| Total Variance | $4,353U |

Table: (1)

Compute the fixed overhead cost variance:

For calculating fixed production cost price and production volume variances, standard fixed overhead cost and fixed overhead applied to production need to be calculated.

Standard fixed overhead cost:

Applied fixed overhead to production:

The report showing fixed overhead cost variance with price and production volume variances:

| Fixed Overhead Variance | Amount |

| Price Variance | $ 1,280 |

| Production Volume Variance | $ 3,200 |

| Total Variance | $1,920F |

Table: (2)

Fixed overhead cost price variance is unfavorable being actual is more than the standard fixed overhead whereas production volume variance is favorable as applied fixed overhead to actual production is less than the budgeted.

Want to see more full solutions like this?

Chapter 16 Solutions

FUNDAMENTALS OF COST....-W/CODE>CUSTOM<

- Performance Report for Variable Variances Humo Company provided the following information: Required: Prepare a performance report that shows the variances for each variable overhead item (inspection and power).arrow_forwardFixed Overhead Spending and Volume Variances, Columnar and Formula Approaches Branch Company provided the following information: Required: 1. Using the columnar approach, calculate the fixed overhead spending and volume variances. 2. Using the formula approach, calculate the fixed overhead spending variance. 3. Using the formula approach, calculate the fixed overhead volume variance. 4. Calculate the total fixed overhead variance.arrow_forwardFixed Overhead Spending and Volume Variances, Columnar and Formula Approaches Corey Company provided the following information: Required: 1. Using the columnar approach, calculate the fixed overhead spending and volume variances. 2. Using the formula approach, calculate the fixed overhead spending variance. 3. Using the formula approach, calculate the fixed overhead volume variance. 4. Calculate the total fixed overhead variance.arrow_forward

- (Appendix) Calculating factory overhead: three variances Using the data given in E8-17, calculate the following overhead variances: a. Spending variance. b. Production-volume variance. c. Efficiency variance. d. Was the factory overhead under- or overapplied? By what amount? In all problems involving variances, use F and U to indicate favorable and unfavorable variances, respectively.arrow_forwardVariable Overhead Spending and Efficiency Variances, Columnar and Formula Approaches Rath Company provided the following information: Required: 1. Using the columnar approach, calculate the variable overhead spending and efficiency variances. 2. Using the formula approach, calculate the variable overhead spending variance. 3. Using the formula approach, calculate the variable overhead efficiency variance. 4. Calculate the total variable overhead variance.arrow_forwardVariable Overhead Spending and Efficiency Variances, Columnar and Formula Approaches Aretha Company provided the following information: Required: 1. Using the columnar approach, calculate the variable overhead spending and efficiency variances. 2. Using the formula approach, calculate the variable overhead spending variance. 3. Using the formula approach, calculate the variable overhead efficiency variance. 4. Calculate the total variable overhead variance.arrow_forward

- Refer to the information for Cinturon Corporation on the previous page. Required: 1. Break down the total variance for labor into a rate variance and an efficiency variance using the columnar and formula approaches. 2. CONCEPTUAL CONNECTION As part of the investigation of the unfavorable variances, the plant manager interviews the production manager. The production manager complains strongly about the quality of the leather strips. He indicates that the strips are of lower quality than usual and that workers have to be more careful to avoid a belt with cracks and more time is required. Also, even with extra care, many belts have to be discarded and new ones produced to replace the rejects. This replacement work has also produced some overtime demands. What corrective action should the plant manager take?arrow_forwardThe fixed factory overhead variance is caused by the difference between which of the following? A. actual and standard allocation base B. actual and budgeted Units C. actual fixed overhead and applied fixed overhead D. actual and standard overhead ratesarrow_forwardThe worksheet you have developed will handle most simple variance analysis problems. Try the problem below for Pscheidl, Inc.: Actual production for October was 11,500 units. Compute the direct materials and direct labor variances for Pscheidl, Inc. Be careful when entering your input because this problem presents the information in a different format from the McGrade Industries data. Save the file as PRIMEVAR4. Print the worksheet when done.arrow_forward

- A. Describe the two variances between the actual costs and the standard costs for factory overhead. B. What is a factory overhead cost variance report?arrow_forwardAcme Inc. has the following information available: A. Compute the material price and quantity, and the labor rate and efficiency variances. B. Describe the possible causes for this combination of favorable and unfavorable variances.arrow_forwardComputing materials variances D-List Calendar Co. specializes in manufacturing calendars that depict obscure comedians. The company uses a standard cost system to control its costs. During one month of operations, the direct materials costs and the quantities of paper used showed the following: Calculate the following: 1. Total cost of purchases for the month 2. Materials purchase price variance 3. Materials quantity variance 4. Net materials variancearrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,