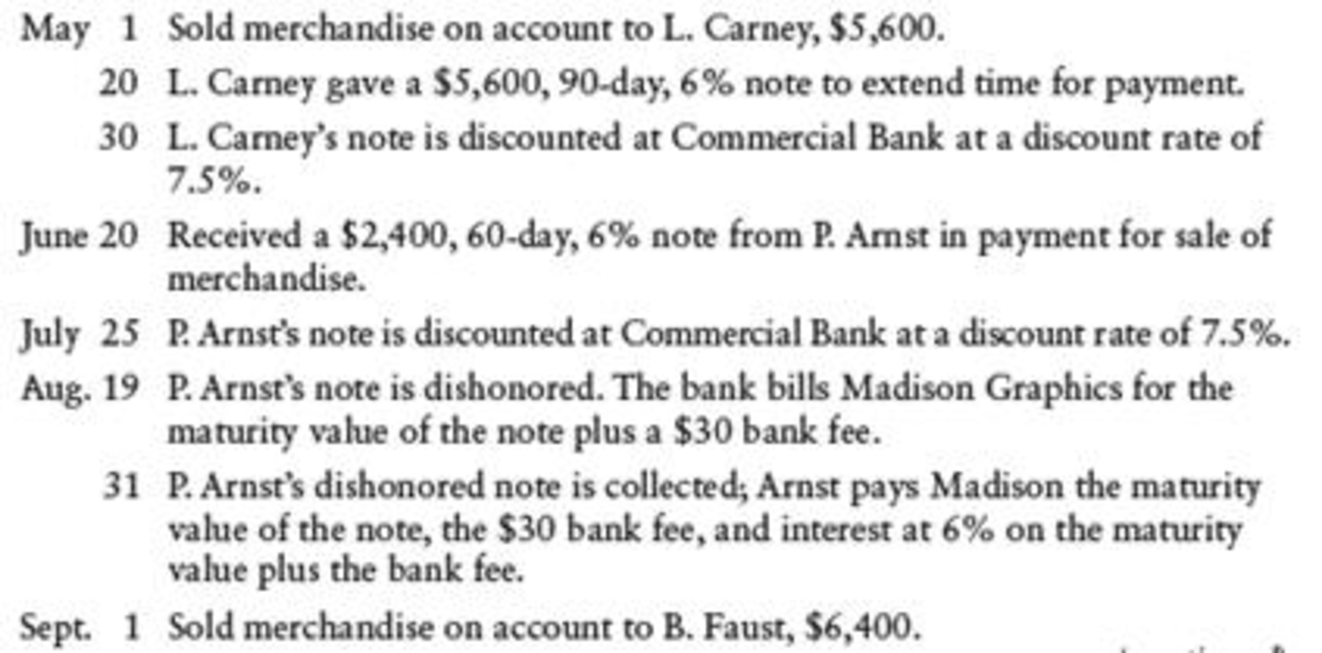

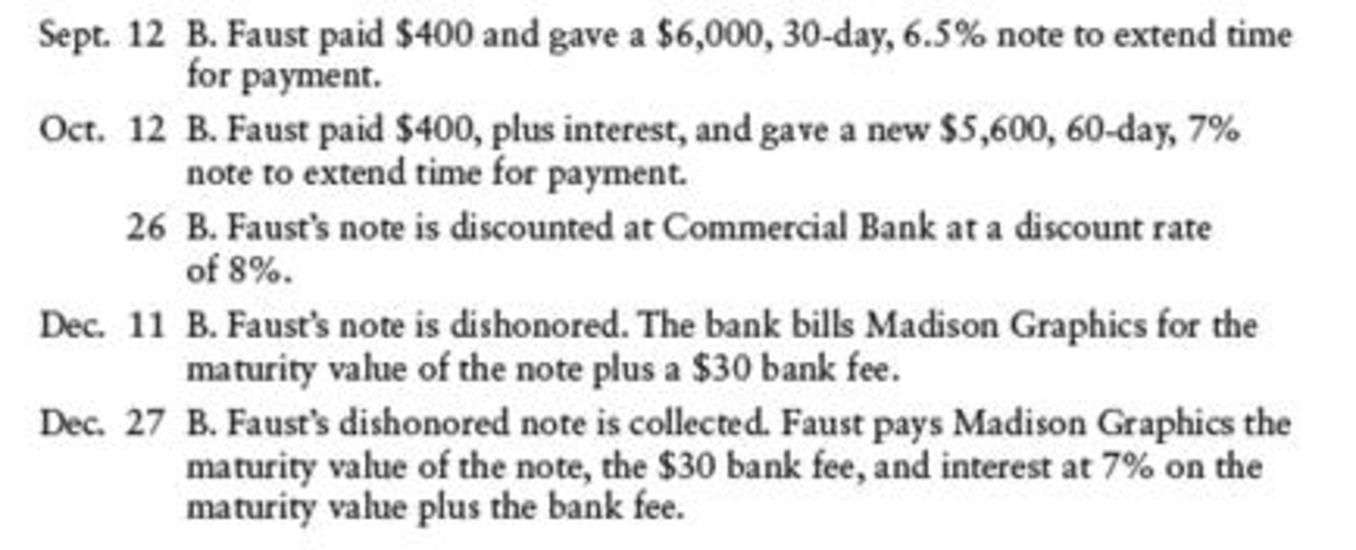

NOTES RECEIVABLE DISCOUNTING Madison Graphics had the following notes receivable transactions:

REQUIRED

Record the transactions in a general journal.

Prepare a journal entry to record Suppliers MG.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

| Date | Account titles and Explanation | Debit | Credit |

| May 1 | Accounts receivable -L.C | $5,600 | |

| Sales | $5,600 | ||

| (To record sale made on account) | |||

| May 20 | Notes receivable | $5,600 | |

| Accounts receivable - L.C | $5,600 | ||

| (To record received note to settle account) | |||

| May 30 | Cash (1) | $5,589.27 | |

| Interest expense (2) | $10.73 | ||

| Notes receivable | $5,600 | ||

| (To record discount on notes receivable) | |||

| June 20 | Notes receivable | $2,400 | |

| Sales | $2,400 | ||

| (To record received note for merchandise sale) | |||

| July 25 | Cash (3) | $2,411.37 | |

| Notes receivable | $2,400 | ||

| Interest revenue (4) | $11.37 | ||

| (To record received payment of note with interest) | |||

| August 19 | Accounts receivable - P.A | $2,454 | |

| Cash | $2,454 | ||

| (To record cash paid for dishonoured note) | |||

| August 31 | Cash | $2,458.91 | |

| Accounts receivable - D. L | $2,454 | ||

| Interest revenue (5) | $4.91 | ||

| (To record Collected dishonoured note with interest) | |||

| September 1 | Accounts receivable - B.F | $6,400 | |

| Sales | $6,400 | ||

| (To record sale made on account) | |||

| September 12 | Cash | $400 | |

| Notes receivable | $5,600 | ||

| Accounts receivable - A.B | $6,000 | ||

| (To record cash received and note to settle account) | |||

| October 12 | Cash (6) | $432.50 | |

| Notes receivable (new note) | $5,600 | ||

| Notes receivable (old note) | $6,000 | ||

| Interest revenue (7) | $32.50 | ||

| (To record received new note plus interest on old note) | |||

| October 26 | Cash | $5,607.42 | |

| Notes receivable | $5,600 | ||

| Interest revenue | $7.42 | ||

| (To record received payment of note with interest) | |||

| December 11 | Accounts receivable – B.F | $5,695.33 | |

| Cash | $5,695.33 | ||

| (To record cash paid for dishonoured note) | |||

| December 27 | Cash | $5,713.05 | |

| Accounts receivable - A.B | $5,695.33 | ||

| Interest revenue (8) | $17.72 | ||

| (To record Collected dishonoured note with interest) |

Table (1)

Working notes:

(1)Calculate cash proceeds.

(2)Calculate interest expense.

(3)Calculate cash proceeds.

(4)Calculate interest revenue.

(5)Calculate interest revenue.

(6)Calculate interest revenue.

(6)Calculate cash proceeds.

(7)Calculate interest revenue.

(8)Calculate interest revenue.

Want to see more full solutions like this?

Chapter 17 Solutions

College Accounting, Chapters 1-27

- NOTES RECEIVABLE DISCOUNTING Marienau Suppliers had the following transactions: REQUIRED Record the transactions in a general journal.arrow_forwardNOTES RECEIVABLE ENTRIES M. L. DiMaurizio had the following notes receivable transactions: REQUIRED Record the transactions in a general journal.arrow_forwardJOURNALIZING SALES RETURNS AND ALLOWANCES Enter the following transactions starting on page 60 of a general journal and post them to the appropriate general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. Beginning balance in Accounts Receivable is 3,900. Beginning balances in selected customer accounts are Adams, 850; Greene, 428; and Phillips, 1,018.arrow_forward

- Notes receivable entries The following data relate to notes receivable and interest for CGH Cable Co., a cable manufacturer and supplier. (All notes are dated as of the day they are received.) Instructions Journalize the entries to record the transactions.arrow_forwardWhat is the accounts receivable ledger? a. A record of credit customers and their balances b. A record of vendors and their balances c. Part of the sales journal d. Part of the general journal e. Part of the general ledgerarrow_forwardNOTES RECEIVABLE ENTRIES J. K. Pratt Co. had the following transactions: 20-1 REQUIRED Record the transactions in a general journal.arrow_forward

- A journal entry that requires a debit to Accounts Receivable and a credit to Sales goes in which special journal?arrow_forwardEntries for receipt and dishonor of note receivable Journalize the following transactions of Trapper Jons Productions:arrow_forwardThe journal that should be used to record the return of merchandise for credit is the (a) purchases journal. (b) cash payments journal. (c) general journal. (d) accounts payable journal.arrow_forward

- You just posted a credit to Accounts Receivable. Which special journal did it come from? A. sales journal B. cash receipts journal C. purchases journal D. cash disbursements journal E. general journalarrow_forwardAllowance method Journalize the following transactions, using the allowance method of accounting for uncollectible receivables:arrow_forwardWhat is the journal entry for recording credit sales? a. Cash Dr. and Sales Cr b. Sales Dr. and Accounts Receivable Cr c. Accounts Receivable Dr. and Sales Cr d. Sales Dr. and Accounts Payable Crarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage