Allocate the service department costs of company R using the reciprocal-services method in combination with the dual-allocation approach.

Explanation of Solution

Reciprocal-services method: The term reciprocal service refers to the circumstances under which two or more service departments provide services to each other. Under this method, in order to reflect the reciprocal provision of services among all other service departments, a system of simultaneous equations is established. When once it is established, “all other service departments’ costs are allocated among the departments that use the various service departments’ output of services”. Moreover, this is the only cost allocation method that fully accounts for the reciprocal provision of services among departments.

Allocate the service department costs of company R using the reciprocal-services method in combination with the dual-allocation approach as follows:

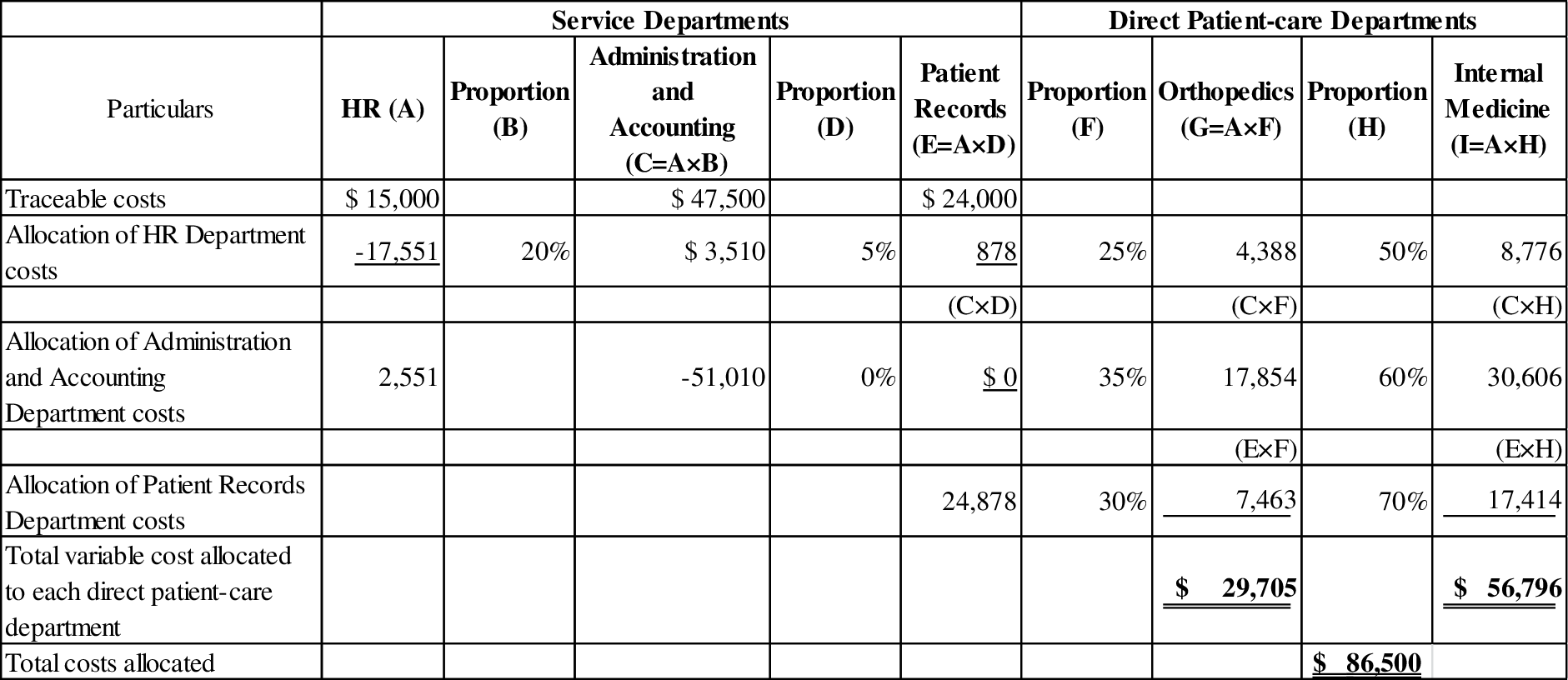

Variable costs under short-run proportions:

Table (1)

Working note (1):

Assume that:

- The total variable cost of Human resources is denoted as H.

- The total variable cost of Administration and Accounting is denoted as A, and

- The total variable cost of patient records is denoted as R.

The equations are as follows:

Now, Substitute equation (3) in equation (2).

Then, Substitute the computed value of H in equation (1) and (3):

Equation (1):

Equation (3):

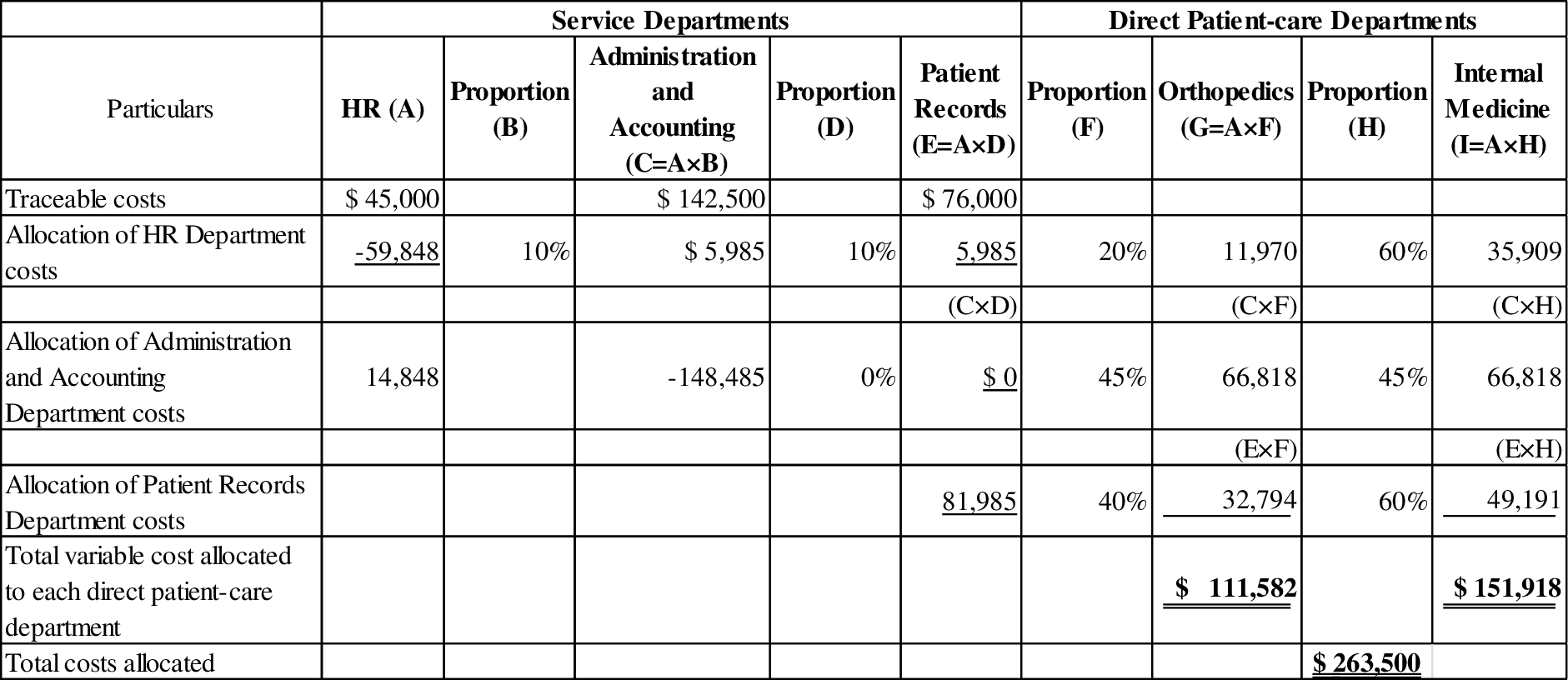

Fixed costs under long-run proportions:

Table (2)

Working note (2):

Assume that:

- The total variable cost of Human resources is denoted as H.

- The total variable cost of Administration and Accounting is denoted as A, and

- The total variable cost of patient records is denoted as R.

The equations are as follows:

Now, Substitute equation (6) in equation (5).

Then, Substitute the computed value of H in equation (4) and (6):

Equation (4):

Equation (6):

Total cost allocated:

| Particulars | Orthopedics | Internal Medicine |

| Variable costs | $ 29,705 | $ 56,796 |

| Add: Fixed costs | $ 111,582 | $ 151,918 |

| Total costs | $ 141,286 | $ 208,714 |

| Grand total | $350,000 | |

Table (3)

Want to see more full solutions like this?

Chapter 17 Solutions

MANAGERIAL ACCOUNTING-ACCESS

- Using the dual-rate method, compute the amount allocated to each department when (a) the fixedcost rate is calculated using budgeted fixed costs and the practical gift-wrapping capacity, (b) fixed costs are allocated based on budgeted fixed costs and budgeted usage of gift-wrapping services, and (c) variable costs are allocated using the budgeted variable-cost rate and actual usage.arrow_forwardDirect Method Seattle Western University has provided the following data to be used in its service department cost allocations: Required: Using the direct method, allocate the costs of the service departments to the two operating departments. Allocate the Administration cost on the basis of student credit-hours and the Facility Services cost on the basis of space occupied.arrow_forwardComprehensive Care Nursing Home is required by statute and regulation to maintain a minimum 3 to 1 ratio of direct service staff to residents to maintain the licensure associated with the Nursing Home beds. The salary expense associated with direct service staff for the Comprehensive Care Nursing Home would most likely be classified as: Variable cost. Fixed cost. Overhead costs. Inventoriable costs.arrow_forward

- Troglodyte University uses activity-based costing to assign indirect costs to academic departments, using three activities. The activity base, budgeted activity cost, and estimated activity-base usage for each activity are identified as follows: Activity Activity Base BudgetedActivity Cost Activity-BaseUsageFacilities Square feet $800,000 80,000 square feetInstruction Number of course sections 1,200,000 600 sectionsStudent services Number of students 290,000 2,500 studentsThe activity-base usage associated with the Archaeology and Geology departments is as follows:Department Facilities Instruction Student ServicesArchaeology 8,000 square feet 8 sections 150 studentsGeology 5,200 square feet 15 sections 200 studentsa. Determine the activity rate for each activity.Activity Activity RateFacilities $ per sq. ft.Instruction $ per sectionarrow_forwardRefer to Exhibit 3–12, which portrays the three types of allocation procedures used in two-stage allocation. Give an example of each of these allocation procedures in a hospital setting. The ultimate cost object is a patient-day of hospital care. This is one day of care for one patient. (Hint: First think about the various departments in a hospital. Which departments deal directly with patients; which ones are service departments and do not deal directly with patients? What kinds of costs does a hospital incur that should be distributed among all of the hospital’s departments? Correct hospital terminology is not important here. Focus on the concepts of cost allocation portrayed in Exhibit 3–12.)arrow_forwardTroglodyte University uses activity-based costing to assign indirect costs to academic departments, using three activities. The activity base, budgeted activity cost, and estimated activity-base usage for each activity are identified as follows: Activity Activity Base BudgetedActivity Cost Activity-BaseUsage Facilities Square feet $800,000 80,000 square feet Instruction Number of course sections 1,200,000 600 sections Student services Number of students 290,000 2,500 students The activity-base usage associated with the Archaeology and Geology departments is as follows: Department Facilities Instruction Student Services Archaeology 8,000 square feet 8 sections 150 students Geology 5,200 square feet 15 sections 200 students Determine the activity rate for each activity. Activity Activity Rate Facilities per sq. ft. Instruction per section Student services per…arrow_forward

- Troglodyte University uses activity-based costing to assign indirect costs to academic departments, using three activities. The activity base, budgeted activity cost, and estimated activity-base usage for each activity are identified as follows: Activity Activity Base BudgetedActivity Cost Activity-BaseUsage Facilities Square feet $800,000 80,000 square feet Instruction Number of course sections 1,200,000 600 sections Student services Number of students 290,000 2,500 students The activity-base usage associated with the Archaeology and Geology departments is as follows: Department Facilities Instruction Student Services Archaeology 8,000 square feet 8 sections 150 students Geology 5,200 square feet 15 sections 200 students a. Determine the activity rate for each activity. Activity Activity Rate Facilities $fill in the blank 1 per sq. ft. Instruction $fill in the blank 2 per section Student services $fill in the blank 3 per student b. Determine the…arrow_forwardJamison Company uses the reciprocal services method to allocate support department costs and has gathered the following information: Janitorial Department Usage Cafeteria 50% Cutting 10% Assembly 40% Cafeteria Department Usage Janitorial 20% Cutting 60% Assembly 20% Janitorial Department costs are $450,000. Cafeteria Department costs are $250,000. What are the correct equations to represent (a) the total Janitorial (J) costs, (b) the total Cafeteria (C) costs, and (c) the rewritten equation substituting C into J? a. J = $fill in the blank 1 + (fill in the blank 2% × ) b. C = $fill in the blank 4 + (fill in the blank 5% × ) c. J = $fill in the blank 7 + {fill in the blank 8% × [$fill in the blank 9 + (fill in the blank 10% × )]}arrow_forwardThe Audiology Department at Randall Clinic offers many services to the clinic’s patients. The three most common, along with cost and utilization data, are as follows: Service Variable cost per service Annual Direct fixed Cost Annual number of visits Basic examination $5 $50,000 30,000 Advanced examination 7 30,000 1,500 Therapy section 10 40,000 500 What is the fee schedule for these services, assuming that the goal is to cover only variable and direct fixed costs? Assume that the Audiology Department is allocated $100,000 in total overhead by the clinic, and the department director has allocated $50,000 of this amount to the three services listed above. What is the fee schedule assuming that these overhead costs must be covered? (To answer this question, assume that the allocation of overhead costs to each service is made on the basis of number of visits.) Assume that these services must make a combined profit of $25,000. Now, what is the…arrow_forward

- Yolksbaggin has one cost pool (General Plant), one service department (Sanitation), and two production departments (Collection and Packaging), plus it uses the STEP (sequential) method of cost allocation to allocate costs (in the order that they are mentioned above) to the two production departments. General plant, Sanitation, Collection, and Packaging, have departmental costs before allocation of $80,000, $192,000, $600,000, and $900,000 respectively. General plant costs are allocated on the basis of number of direct labor hours worked. Sanitation, Collection, and Packaging worked 2000, 8000, and 10,000 direct labor hours respectively this period. Sanitation costs are allocated on the basis of square footage occupied by a department. The entire factory is 220,000 square feet with Sanitation occupying the first 20,000 square feet of that total, while Collection and Packaging each occupy half of the remaining square footage.1. How much of the General Plant cost should be allocated to…arrow_forwardPart 1: Allocate the costs of the 3 service departments using the direct method. Part 2: Allocate the costs of the 3 service departments using the step method, with the order determined by the greater percentage usage. Part 3: Allocate the costs of the 3 service departments using the reciprical method. Part 4:What is one strength and one drawback of each of the methods?arrow_forwardIdentifying Direct and Indirect Costs Northwest Hospital is a full-service hospital that provides everything from major surgery and emergency room care to outpatient clinics. Required: For each cost incurred at Northwest Hospital, indicate whether it would most likely be a direct cost or an indirect cost of the specified cost object by placing anarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning