Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 18.1E

Comprehensive income

• LO18–2

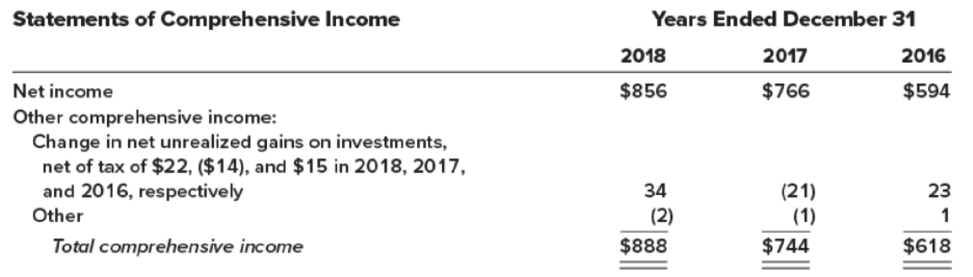

The following is from the 2018 annual report of Kaufman Chemicals, Inc.:

Kaufman reports accumulated other comprehensive income in its

| ($ in millions) | 2018 | 2017 |

| Shareholders’ equity: | ||

| Common stock | 355 | 355 |

| Additional paid-in capital | 8,567 | 8,567 |

| 6,544 | 5,988 | |

| Accumulated other comprehensive income | 107 | 75 |

| Total shareholders’ equity | $15,573 | $14,985 |

Required:

1. What is comprehensive income and how does it differ from net income?

2. How is comprehensive income reported in a balance sheet?

3. Why is Kaufman’s 2018 balance sheet amount different from the 2018 amount reported in the disclosure note? Explain.

4. From the information provided, determine how Kaufman calculated the $107 million accumulated other comprehensive income in 2018.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

E4.17 (LO 2, 3, 5) The following information was taken from the records of Roland Carlson Inc. for the year 2020:

Income tax applicable to income from continuing operations $187,000, Income tax applicable to loss on discontinued operations $25,500Gain on sale of equipment $ 95,000 Cash dividends declared $ 150,000Loss on discontinued operations 75,000 Retained earnings January 1, 2020 600,000Administrative expenses 240,000 Cost of goods sold 850,000Rent revenue 40,000 Selling expenses 300,000Loss on write-down of inventory 60,000 Sales revenue 1,900,000

Shares outstanding during 2020 were 100,000.

Prepare a multiple step income statement (including earnings per share) and a statement of…

Problem 11-5Special Deductions and Limitations (LO 11.3)

Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2021. The corporation also has $30,000 in dividends from publicly-traded domestic corporations in which the ownership percentage was 45 percent.

Below is the Dividends Received Deduction table to use for this problem.

Chapter 11 Comprehensive Problem – CP11-11

The following note appeared on the balance sheet of Sabre Rigging Limited: As of December 31, 2019, dividends on the cumulative preferred stock were in arrears for three years to the extent of $15 per stock or $15,000 in total.

Required: 1.Does the amount of the arrears appears as a liability on the December31, 2019 balance sheet? Explain your answer.

Why might the dividends be in arrears?

The comptroller of Sabre Rigging projects net income for the2020 fiscal year of $35,000. When the company last paid dividends, the directors allocated 50 per cent of current year’s net income for dividends. If dividends on shares of preferred stock are resumed at the end of 2020 and the established policy of 50 per cent is continued, how much will be available for dividends to the common stockholders if the profit projection is realized?

Chapter 18 Solutions

Intermediate Accounting

Ch. 18 - Identify and briefly describe the two primary...Ch. 18 - Prob. 18.2QCh. 18 - Prob. 18.3QCh. 18 - Prob. 18.4QCh. 18 - Prob. 18.5QCh. 18 - Prob. 18.6QCh. 18 - Prob. 18.7QCh. 18 - What is meant by a shareholders preemptive right?Ch. 18 - Terminology varies in the way companies...Ch. 18 - Most preferred shares are cumulative. Explain what...

Ch. 18 - The par value of shares historically indicated the...Ch. 18 - Prob. 18.12QCh. 18 - How do we report components of comprehensive...Ch. 18 - The balance sheet reports the balances of...Ch. 18 - At times, companies issue their shares for...Ch. 18 - Prob. 18.16QCh. 18 - The costs of legal, promotional, and accounting...Ch. 18 - When a corporation acquires its own shares, those...Ch. 18 - Discuss the conceptual basis for accounting for a...Ch. 18 - The prescribed accounting treatment for stock...Ch. 18 - Brandon Components declares a 2-for-1 stock split....Ch. 18 - What is a reverse stock split? What would be the...Ch. 18 - Suppose you own 80 shares of Facebook common stock...Ch. 18 - Prob. 18.24QCh. 18 - Comprehensive income LO181 Schaeffer Corporation...Ch. 18 - Stock issued LO184 Penne Pharmaceuticals sold 8...Ch. 18 - Prob. 18.3BECh. 18 - Prob. 18.4BECh. 18 - Prob. 18.5BECh. 18 - Retirement of shares LO185 Agee Storage issued 35...Ch. 18 - Treasury stock LO185 The Jennings Group...Ch. 18 - Prob. 18.8BECh. 18 - Prob. 18.9BECh. 18 - Cash dividend LO188 Real World Financials...Ch. 18 - Effect of preferred stock on dividends LO187 The...Ch. 18 - Property dividend LO187 Adams Moving and Storage,...Ch. 18 - Stock dividend LO188 On June 13, the board of...Ch. 18 - Prob. 18.14BECh. 18 - Stock split LO188 Refer to the situation...Ch. 18 - Prob. 18.16BECh. 18 - Comprehensive income LO182 The following is from...Ch. 18 - Prob. 18.2ECh. 18 - Earnings or OCI? LO182 Indicate by letter whether...Ch. 18 - Stock issued for cash; Wright Medical Group LO184...Ch. 18 - Issuance of shares; noncash consideration LO184...Ch. 18 - Prob. 18.6ECh. 18 - Share issue costs; issuance LO184 ICOT Industries...Ch. 18 - Reporting preferred shares LO184, LO187 Ozark...Ch. 18 - Prob. 18.9ECh. 18 - Prob. 18.10ECh. 18 - Retirement of shares LO185 In 2018, Borland...Ch. 18 - Treasury stock LO185 In 2018, Western Transport...Ch. 18 - Treasury stock; weighted-average and FIFO cost ...Ch. 18 - Prob. 18.14ECh. 18 - Prob. 18.15ECh. 18 - Prob. 18.16ECh. 18 - Transact ions affecting retained earnings LO186,...Ch. 18 - Effect of cumulative, nonparticipating preferred...Ch. 18 - Stock dividend LO188 The shareholders equity of...Ch. 18 - Prob. 18.20ECh. 18 - Cash in lieu of fractional share rights LO188...Ch. 18 - Prob. 18.22ECh. 18 - Transact ions affecting retained earnings LO186...Ch. 18 - Profitability ratio LO181 Comparative balance...Ch. 18 - Prob. 18.25ECh. 18 - Various stock transactions; correction of journal...Ch. 18 - Share buybackcomparison of retirement and treasury...Ch. 18 - Reacquired sharescomparison of retired shares and...Ch. 18 - Prob. 18.4PCh. 18 - Shareholders equity transactions; statement of...Ch. 18 - Prob. 18.6PCh. 18 - Prob. 18.7PCh. 18 - Prob. 18.8PCh. 18 - Effect o f preferred stock characteristics on...Ch. 18 - Prob. 18.10PCh. 18 - Stock dividends received on investments;...Ch. 18 - Various shareholders equity topics; comprehensive ...Ch. 18 - Prob. 18.13PCh. 18 - Prob. 18.1BYPCh. 18 - Prob. 18.2BYPCh. 18 - Research Case 184 FASB codification; comprehensive...Ch. 18 - Judgment Case 185 Treasury stock; stock split;...Ch. 18 - Prob. 18.6BYPCh. 18 - Prob. 18.7BYPCh. 18 - Prob. 18.8BYPCh. 18 - Prob. 1CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- GL1501 - Based on Problem 15-4A LO P4 Twist Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017. Apr. 16 Purchased 5,000 shares of Lafayette Co. stock at $26 per share. July 7 Purchased 3,500 shares of CVF Co. stock at $51 per share. 20 Purchased 1,600 shares of Green Co. stock at $18 per share. Aug. 15 Received an $1.20 per share cash dividend on the Lafayette Co. stock. 28 Sold 3,000 shares of Lafayette Co. stock at $29 per share. Oct. 1 Received a $3.30 per share cash dividend on the CVF Co. shares. Dec. 15 Received a $1.40 per share cash dividend on the remaining Lafayette Co. shares. 31 Received a $2.70 per share cash dividend on the CVF Co. shares.arrow_forwardNineteen measures of solvency and profitability The comparative financial statements of Bettancort Inc. are as follows. The market price of Bettancort Inc. common stock was 71.25 on December 31, 2016. Bettancort Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 2016 and 2015 2016 2015 Retained earnings. January 1......................................... 2,655,000 2,400,000 Add net income for year............................................. 300,000 280,000 Total............................................................... 2,955,000 2,680,000 Deduct dividends: On preferred stock................................................ 15,000 15,000 On common stock................................................. 10,000 10,000 Total........................................................... 25,000 25,000 Retained earnings. December 31..................................... 2,930,000 2,655,000 Bettancort Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 2016 and 2015 2016 2015 Sales...................... 1,200,000 1,000,000 Cost of goods sold............ 500,000 475,000 Gross profit............... 700,000 525,000 Selling expenses.......... 240,000 200,000 Administrative expenses...... 180,000 150,000 Total operating expenses.. 420,000 350,000 Income from operations.. 280,000 175,000 Other income............. 166,000 225,000 446,000 400,000 Other expense (Interest)... 66,000 60,000 Income before income tax 380,000 340,000 Income tax expense....... 80,000 60,000 Net income............... 300,000 280,000 Bettancort Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 2016 and 2015 Dec.31, 2016 Dec. 31, 2015 Assets Current Assets: Cash.................................... 450,000 400,000 Marketable securities.................... 300,000 260,000 Accounts receivable (net)................. 130,000 110,000 Inventories.............................. 67,000 58,000 Prepaid expenses........................ 153,000 139,000 Total current assets..................... 1,100,000 967,000 Long-term investments.................... 2,350,000 2,200,000 Property, plant and equipment (net)....... 1,320,000 1,118,000 Total assets............................... 4,770,000 4,355,000 Liabilities Current liabilities.......................... 440,000 400,000 Long-term liabilities: Mortgage note payable, 8.8%, due 2021... 100,000 0 Bonds payable, 9%, due 2017............. 1,000,000 1,000,000 Total long term liabilities............... 1,100,000 1,000,000 Total liabilities............................ 1,540,000 1,400,000 Stockholders' equity Preferred stock 0.90, 10 par.. 200,000 200,000 Common stock. 5 par..................... 100,000 100,000 Retained earnings......................... 2,930,000 2,665,000 Total stockholders equity............... 3,230,000 2,955,000 Total liabilities and stockholders' equity..... 4,770,000 4,355,000 Instructions Determine the following measures for 2016, rounding to one decimal place: 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days' sales in receivables 6. Inventory turnover 7. Number of days' sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Number of times interest charges are earned 11. Number of times preferred dividends are earned 12. Ratio of sales to assets 13. Rate earned on total assets 14. Rate earned on stockholders' equity 15. Rate earned on common stockholders' equity 16. Earnings per share on common stock 17. Price-earnings ratio 18. Dividends per share of common stock 19. Dividend yieldarrow_forwardProblem 11-5 (Algorithmic)Special Deductions and Limitations (LO 11.3) Fisafolia Corporation has gross income from operations of $423,000 and operating expenses of $359,550 for 2021. The corporation also has $42,300 in dividends from publicly-traded domestic corporations in which the ownership percentage was 45 percent. Below is the Dividends Received Deduction table to use for this problem.arrow_forward

- E10.18 (LO 5), AN Suppose the following financial data were reported by 3M Company for 2021 and 2022 (dollars in millions). 3M CompanyBalance Sheets (partial) 2022 2021 Current assets Cash and cash equivalents $ 3,040 $1,849 Accounts receivable, net 3,250 3,195 Inventories 2,639 3,013 Other current assets 1,866 1,541 Total current assets $10,795 $9,598 Current liabilities $ 4,897 $5,839 Instructions Calculate the current ratio and working capital for 3M for 2021 and 2022. Suppose that at the end of 2022, 3M management used $300 million cash to pay off $300 million of accounts payable. How would its current ratio and working capital have changed?arrow_forwardSteele Inc. Consolidated Statements of Income (in thousands except per share amounts) 2023 2022 2021 Net sales $7,245,088 $6,944,296 $6,149,218 Cost of goods sold (5,286,253) (4,953,556) (4,355,675) Gross margin $1,958,835 $1,990,740 $1,793,543 General and administrative expenses (1,259,896) (1,202,042) (1,080,843) Special and nonrecurring items 2,617 0 0 Operating income $701,556 $788,698 $712,700 Interest expense (63,685) (62,398) (63,927) Other income 7,308 10,080 11,529 Gain on sale of investments 0 9,117 0 Income before income taxes $645,179 $745,497 $660,302 Provision for income taxes 254,000 290,000 257,000 Net income $391,179 $455,497 $403,302 Steele Inc. Consolidated Balance Sheets (in thousands) ASSETS Dec. 31, 2023 Dec. 31, 2022 Current assets: Cash and equivalents $320,558 $41,235 Accounts receivable 1,056,911 837,377 Inventories 733,700…arrow_forwardE23.10B (L0 1,4) (Classification of Transactions) Following are selected balance sheet accounts of BioLazer Corp. at December 31, 2020 and 2019, and the increases or decreases in each account from 2019 to 2020. Also presented is selected income statement information for the year ended December 31, 2020, and additional information. Increase Selected balance sheet accounts 2020 2019 (Decrease)AssetsAccounts receivable $154,000 $120,000 $34,000Property, plant, and equipment 631,000 581,000 50,000Accumulated…arrow_forward

- Question 78 Using Financial Statements for 2018-2019. Net asset value per share of preferred stock for 2018 is $685.71. TRUE OR FALSE?arrow_forward7. What amount of consolidated retained earnings will be reported? A.P 295,000 C. P 232,000B. P 268,000 D. P 205,0008. What amount of stockholders; equity will be reported?A. P 355,000 C. P 419,500B. P 397,000arrow_forwardN1. Exercise 29.5 Wattle Ltd owns all the share capital of Ashgrove Ltd. The income tax rate is 30%. During the period ended 30 June 2024, the following transactions took place: (a) Ashgrove Ltd sold inventories costing $50 000 to Wattle Ltd. Ashgrove Ltd recorded a $10 000 profit before tax on these transactions. At 30 June 2024, Wattle Ltd has none of these goods still on hand. (b) Wattle Ltd sold inventories costing $15 000 to Ashgrove Ltd for $22arrow_forward

- 24. Based on Item 21, what is the amount of contributed capital that ABC Corporation should report in its May 1, 2020 statement of shareholder’s equity? a. 640,000 b. 600,000 c. 260,000 d. 900,000 25. Based on Item 21, what is the amount of legal capital that ABC Corporation should report in its May 1, 2020 statement of shareholder’s equity?arrow_forward33. On December 31, 2018, Calm Company appropriately reported P80, 000 unrealized loss in OIC for equity securities measured irrevocably at FVOCI. Security Cost Fair value at 12/31/19 X 1, 250, 000 1, 600, 000 Y 1, 000, 000 950, 000 Z 1, 750, 000 1, 250, 000 What amount of unrealized loss is recognized in the 2019 statement of changes in equity? a.280,000 b.200,000 c.120,000 d.0arrow_forwardProblem 19-4 Per-Share Ratios (LO3, CFA6) You are given the following information for Smashville, Inc. Cost of goods sold: $249,000 Investment income: $2,900 Net sales: $394,000 Operating expense: $92,000 Interest expense: $7,400 Dividends: $13,000 Tax rate: 21 % Current liabilities: $22,000 Cash: $21,000 Long-term debt: $9,000 Other assets: $37,000 Fixed assets: $139,000 Other liabilities: $5,000 Investments: $13,000 Operating assets: $49,000 During the year, Smashville, Inc., had 17,000 shares of stock outstanding and depreciation expense of $15,000. Calculate the book value per share, earnings per share, and cash flow per share. (Do not round intermediate calculations. Round your answers to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License