Research Case 18–4

FASB codification; comprehensive income; locate and extract relevant information and authoritative support for a financial reporting issue; integrative; Cisco Systems

• LO18–2

Real World Financials

Required:

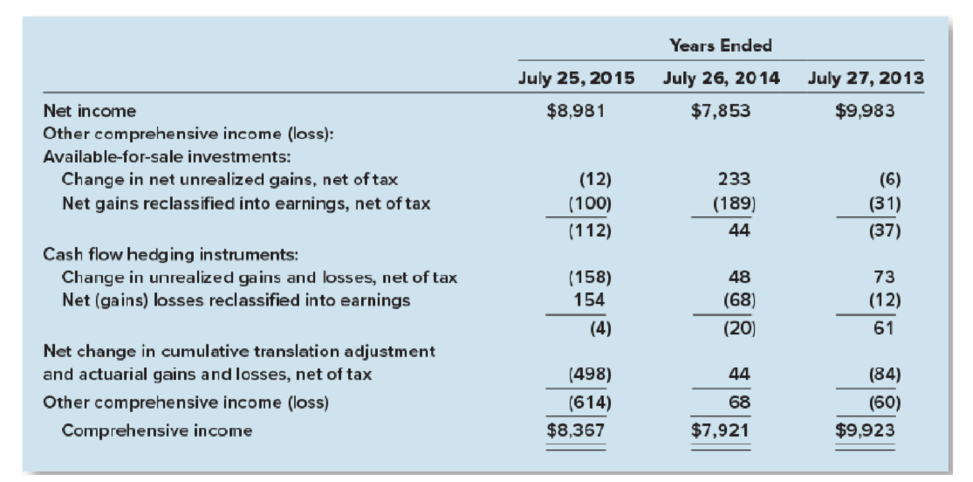

1. Locate the financial statements of Cisco at www.sec.gov or Cisco’s website. Search the 2015 annual report for information about how Cisco accounts for comprehensive income. What does Cisco report in its

2. Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Identify the specific citation from the authoritative literature that describes the two alternative formats for reporting comprehensive income.

3. What is comprehensive income? How does it differ from net income? Where is it reported in a balance sheet?

4. One component of Other comprehensive income for Cisco is “net unrealized gains on investments.” What does this mean? From the information Cisco’s financial statements provide, determine how the company calculated the $61 million accumulated other comprehensive income at the end of fiscal 2015.

5. What might be possible causes for the “Other” component of Cisco’s Other comprehensive income? Alcoa is the world’s leading producer of primary aluminum, fabricated aluminum, and alumina. The following is a press release from the company:

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Intermediate Accounting

- D3 Finance A Business Incubator may also provide marketing assistance to startup companies. Question 30 options: True The SEC does not permit business incubators to provide marketing assistance. false The above statement is true only if the articles of association demand it.arrow_forwardfinancial management ch 18 hw please show work, thank you. question 8arrow_forwardMcqs 11. There are ________________ basic decisions are involved while performing the financial management responsibilities. a. 1b. 2c. 3d. 512. The company’s management has been planning to launch a new project to get the competitive advantage over their competitors. According to the forecasts of their finance and budgeting department total cost they will be required for that project will be approximately Rs. 3.5 Millions. In their annual general meeting, they have decided to utilize their undistributed profits which are available. Which of the financial management the company’s management has taken in annual general meeting?a. Investment Decisionb. Financing Decisionc. Assets Management Decisiond. Both (a) and (b) 13. The company’s cash flows in project A for the accounting year 2013 was not showing positive results. For that the management has conducted a survey to find out the possible reasons for that bad performance. The survey results show that the major reason behind the…arrow_forward

- IAS 8 Accounting Policies, Changes in Accounting Estimates and Errorspermits a company to change an accounting policy for limited reasons. Which of the following reasons are permitted under the standard?1) The IASB has issued a standard or interpretation that requires thecompany to make the change2) The Finance Director believes a change would improve the amountof profit shown3) There is a change in the useful economic life of an asset thatrequires a greater depreciation charge4) The new policy would improve the reliability and relevance of thefinancial statements Which is the correct option? a) All of the aboveb) 1 and 4 onlyc) 3 and 4 onlyd) 1 onlyarrow_forwardfinancial management ch 17 hw please show work and explain. thank you. question 1arrow_forwardA65. The “due process” system in developing financial reporting standards A. is an efficient system for collecting dues from members.B. identifies the accounting issues that are the most important.C. enables interested parties to express their views on issues under consideration.D. requires that all accountants must receive a copy of financial accounting standards.arrow_forward

- MULTIPLE CHOICE QUESTIONS: (A1&D3) General-purpose financial statements are the product of financial accounting. managerial accounting. both financial and managerial accounting. neither financial nor managerial accounting. Users of financial reports include all of the following except creditors. government agencies. unions. All of these are users. The purpose of the International Accounting Standards Board is to issue enforceable standards which regulate the financial accounting and reporting of multinational corporations. develop a uniform currency in which the financial transactions of companies through-out the world would be measured. promote uniform accounting standards among countries of the world. arbitrate accounting disputes between auditors and international companiesarrow_forwardhd.10. Question 1 Loftus et al (2023) Exercise 13.5 Amended The following information was extracted from records of Nawa Ltd for the year ended 30 June 2024. NAWA LTD Statement of financial position (extract) as at 30 June 2024 Assets Accounts receivable $ 50 000 Allowance for doubtful debts (5 000 ) $ 45 000 Motor vehicles 250 000 Accumulated depreciation — motor vehicles (50 000 ) 200 000 Liabilities Interest payable 5 000 Additional information • The accumulated tax depreciation for motor vehicles at 30 June 2024 was $100 000. • As at 30 June 2023, the balance in the deferred tax asset was $2,000 and the balance in the deferred tax liability was $8,000. • The income tax rate is 30%. Required: Prepare a deferred tax worksheet for Nawa Ltd and the end of year deferred tax journal entry required to bring the deferred tax accounts to their ending balances as at 30 June 2024.arrow_forwardQuestion 27 Which of the following accounting standard setting body in the United States existed for the longest time period? A. CAP B. FASB C. APB D. NYSEarrow_forward

- Q39 Statement I: The objective of financial reporting is to provide insider information about the reporting entity. Statement II: The insider information provided about the reporting entity is useful only to international investors and lenders in making decisions about providing resources to the entity. a. Neither statement I is true nor statement II is true b. Only statement I is true c. Only statement II is true d. Statement I only false but statement II is truearrow_forwardAcc 202 Finance reporting Tutorial A conceptual framework can be defined as a system of ideas and objectives that lead to the creation of a consistent set of rules and standards. Specifically in accounting, the rule and standards set the nature, function and limits of financial accounting and financial statements. Question I. What is conceptual framework in accounting? II. Discuss whether a conceptual framework is necessary. III. Outline the advantages and disadvantages of a conceptual framework. IV. Summarize the finance reporting af the chapter 1 - chapter 8 of the conceptual framework.arrow_forwardQ 2 (12 marks) Gideon Corp. is a reinsurance and financial services company. Gideonstrongly believes in evaluating the performance of its stand-alone divisions using financialmetrics such as ROI and residual income. For the year ended December 31, 2019, Gideon’sCFO received the following information about the performance of the property/casualtydivision:Sales Revenues $ 900 000Operating Income 225 000Total Assets 1 500 000Page 2 of 3Current Liabilities 300 000Debt (Interest rate: 5%) 400 000Common Equity (book value) 500 000For the purposes of divisional performance evaluation, Gideon defines investment as totalassets, and income as operating income (that is, income before interest and taxes). The firmpays a flat rate of 25% in taxes on its income.Required:1. What was the net income after taxes of the property/casualty division? (4 marks)2. What was the division’s ROI for the year? (4 marks)3. Based on Gideon’s required rate of return of 8%, what was the property/casualtydivision’s…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning