Analysis Case 19–13

Analyzing financial statements; price-earnings ratio; dividend payout ratio

• LO19–13

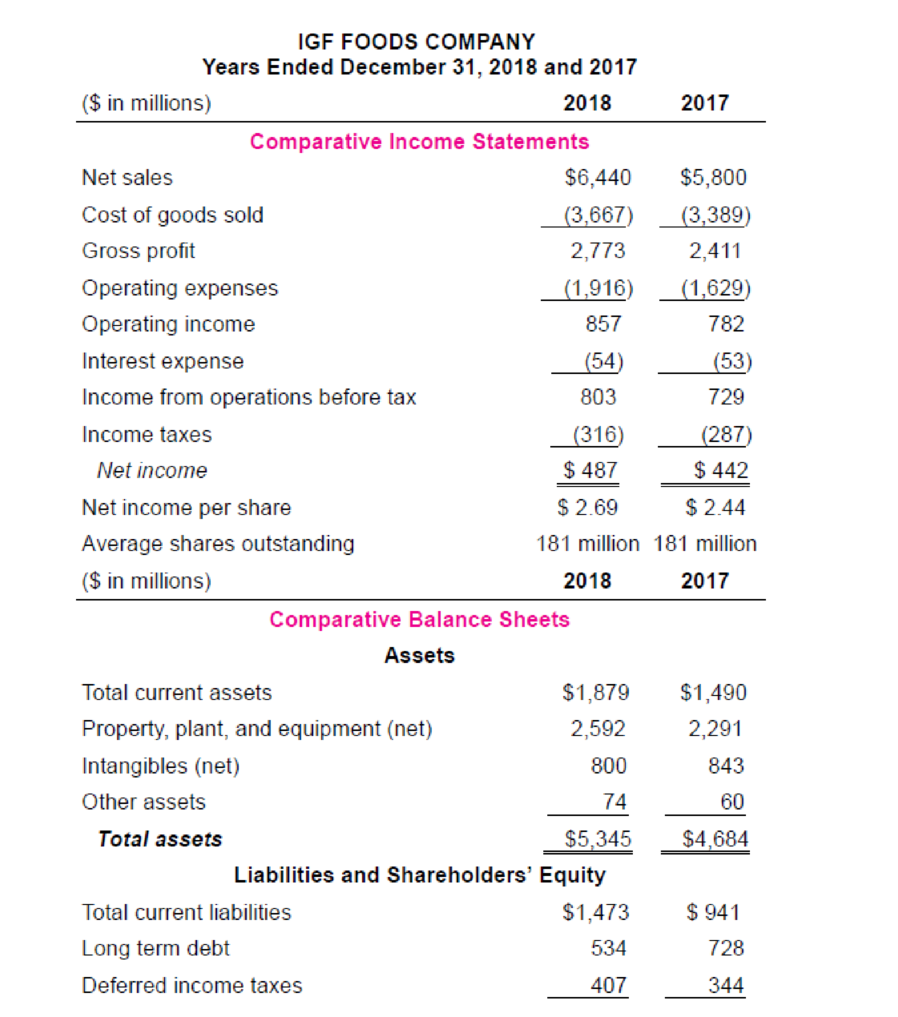

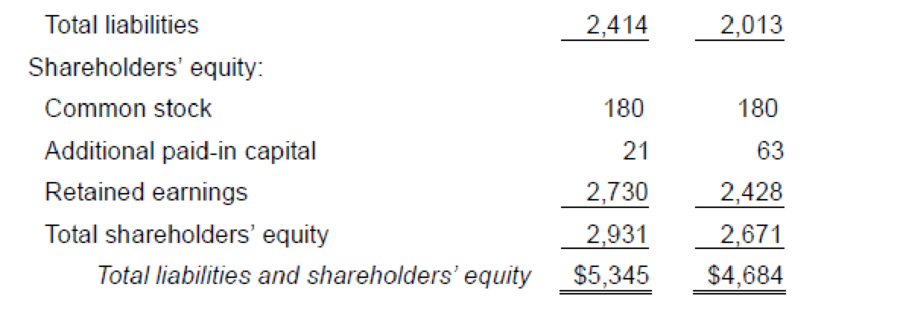

IGF Foods Company is a large, primarily domestic, consumer foods company involved in the manufacture, distribution, and sale of a variety of food products. Industry averages are derived from Troy’s The Almanac of Business and Industrial Financial Ratios and Dun and Bradstreet’s Industry Norms and Key Business Ratios. Following are the 2018 and 2017 comparative income statements and balance sheets for IGF. The market price of IGF’s common stock is $47 during 2018. (The financial data we use are from actual financial statements of a well-known corporation, but the company name used in our illustration is fictitious and the numbers and dates have been modified slightly to disguise the company’s identity.)

Some ratios express income, dividends, and market prices on a per share basis. As such, these ratios appeal primarily to common shareholders, particularly when weighing investment possibilities. These ratios focus less on the fundamental soundness of a company and more on its investment characteristics.

Required:

1. Earnings per share expresses a firm’s profitability on a per share basis. Calculate 2018 earnings per share for IGF.

2. Calculate IGF’s 2018 price-earnings ratio. The average price-earnings ratio for the stocks listed on the New York Stock Exchange in a comparable time period was 18.5. What does your calculation indicate about IGF’s earnings?

3. Calculate IGF’s 2018 dividend payout ratio. What information does the calculation provide an investor?

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

INTERMEDIATE ACCOUNTING +ACCLL

- Effect of Industry Characteristics on Financial Statement Relations: A Global Perspective. Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.24 (pages 6667) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large for the firm to disclose it. A list of the 12 companies, the country of their headquarters, and a brief description of their activities follow. A. Accor (France): Worlds largest hotel group, operating hotels under the names of Sofitel, Novotel, Motel 6, and others. Accor has grown in recent years by acquiring established hotel chains. B. Carrefour (France): Operates grocery supermarkets and hypermarkets in Europe, Latin America, and Asia. C. Deutsche Telekom (Germany): Europes largest provider of wired and wireless telecommunication services. The telecommunications industry has experienced increased deregulation in recent years. D. E.ON AG (Germany): One of the major public utility companies in Europe and the worlds largest privately owned energy service provider. E. Fortis (Netherlands): Offers insurance and banking services. Operating revenues include insurance premiums received, investment income, and interest revenue on loans. Operating expenses include amounts actually paid or amounts it expects to pay in the future on insurance coverage outstanding during the year. F. Interpublic Group (U.S.): Creates advertising copy for clients. Interpublic purchases advertising time and space from various media and sells it to clients. Operating revenues represent the commissions or fees earned for creating advertising copy and selling media time and space. Operating expenses include employee compensation. G. Marks Spencer (U.K.): Operates department stores in England and other retail stores in Europe and the United States. Offers its own credit card for customers purchases. H. Nestl (Switzerland): Worlds largest food processor, offering prepared foods, coffees, milk-based products, and mineral waters. I. Roche Holding (Switzerland): Creates, manufactures, and distributes a wide variety of prescription drugs. J. Sumitomo Metal (Japan): Manufacturer and seller of steel sheets and plates and other construction materials. K. Sun Microsystems (U.S.): Designs, manufactures, and sells workstations and servers used to maintain integrated computer networks. Sun outsources the manufacture of many of its computer components. L. Toyota Motor (Japan): Manufactures automobiles and offers financing services to its customers. REQUIRED Use the ratios to match the companies in Exhibit 1.24 with the firms listed above.arrow_forwardEffect of Industry Characteristics on Financial Statement Relations. Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.22 (pages 6061) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) Exhibit 1.22 also shows the ratio of cash flow from operations to capital expenditures. A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large enough for the firm to disclose it. Amounts that are not meaningful are shown as n.m. A list of the 12 companies and a brief description of their activities follow. A. Amazon.com: Operates websites to sell a wide variety of products online. The firm operated at a net loss in all years prior to that reported in Exhibit 1.22. B. Carnival Corporation: Owns and operates cruise ships. C. Cisco Systems: Manufactures and sells computer networking and communications products. D. Citigroup: Offers a wide range of financial services in the commercial banking, insurance, and securities business. Operating expenses represent the compensation of employees. E. eBay: Operates an online trading platform for buyers to purchase and sellers to sell a variety of goods. The firm has grown in part by acquiring other companies to enhance or support its online trading platform. F. Goldman Sachs: Offers brokerage and investment banking services. Operating expenses represent the compensation of employees. G. Johnson Johnson: Develops, manufactures, and sells pharmaceutical products, medical equipment, and branded over-the-counter consumer personal care products. H. Kelloggs: Manufactures and distributes cereal and other food products. The firm acquired other branded food companies in recent years. I. MGM Mirage: Owns and operates hotels, casinos, and golf courses. J. Molson Coors: Manufactures and distributes beer. Molson Coors has made minority ownership investments in other beer manufacturers in recent years. K. Verizon: Maintains a telecommunications network and offers telecommunications services. Operating expenses represent the compensation of employees. Verizon has made minority investments in other cellular and wireless providers. L. Yum! Brands: Operates chains of name-brand restaurants, including Taco Bell, KFC, and Pizza Hut. REQUIRED Use the ratios to match the companies in Exhibit 1.22 with the firms listed above.arrow_forwardEffect of Industry Characteristics on Financial Statement Relations. Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.23 (pages 6263) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) Exhibit 1.23 also shows the ratio of cash flow from operations to capital expenditures. A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large for the firm to disclose it. A list of the 12 companies and a brief description of their activities follow. A. Abercrombie Fitch: Sells retail apparel primarily through stores to the fashionconscious young adult and has established itself as a trendy, popular player in the specialty retailing apparel industry. B. Allstate Insurance: Sells property and casualty insurance, primarily on buildings and automobiles. Operating revenues include insurance premiums from customers and revenues earned from investments made with cash received from customers before Allstate pays customers claims. Operating expenses include amounts actually paid or expected to be paid in the future on insurance coverage outstanding during the year. C. Best Buy: Operates a chain of retail stores selling consumer electronic and entertainment equipment at competitively low prices. D. E. I. du Pont de Nemours: Manufactures chemical and electronics products. E. Hewlett-Packard: Develops, manufactures, and sells computer hardware. The firm outsources manufacturing of many of its computer components. F. HSBC Finance: Lends money to consumers for periods ranging from several months to several years. Operating expenses include provisions for estimated uncollectible loans (bad debts expense). G. Kelly Services: Provides temporary office services to businesses and other firms. Operating revenues represent amounts billed to customers for temporary help services, and operating expenses include amounts paid to the temporary help employees of Kelly. H. McDonalds: Operates fast-food restaurants worldwide. A large percentage of McDonalds restaurants are owned and operated by franchisees. McDonalds frequently owns the restaurant buildings of franchisees and leases them to franchisees under long-term leases. I. Merck: A leading research-driven pharmaceutical products and services company. Merck discovers, develops, manufactures, and markets a broad range of products to improve human and animal health directly and through its joint ventures. J. Omnicom Group: Creates advertising copy for clients and is the largest marketing services firm in the world. Omnicom purchases advertising time and space from various media and sells it to clients. Operating revenues represent commissions and fees earned by creating advertising copy and selling media time and space. Operating expenses includes employee compensation. K. Pacific Gas Electric: Generates and sells power to customers in the western United States. L. Procter Gamble: Manufactures and markets a broad line of branded consumer products. REQUIRED Use the ratios to match the companies in Exhibit 1.23 with the firms listed above.arrow_forward

- Sales transactions Using transactions listed in P4-2, indicate the effects of each transaction on the liquidity metric working capital and profitability metric gross profit percent. Indicate the gross profit percent for each sale (rounding to one decimal place) in parentheses next to the effect of the sale on the company’s ability to attain an overall gross profit percent of 30%.arrow_forwardValue Chain Analysis and Financial Statement Relations. Exhibit 1.25 (page 68) presents common-size income statements and balance sheets for seven firms that operate at various stages in the value chain for the pharmaceutical industry. These common-size statements express all amounts as a percentage of sales revenue. Exhibit 1.25 also shows the cash flow from operations to capital expenditures ratios for each firm. A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large for the firm to disclose it. A list of the seven companies and a brief description of their activities follow. A. Wyeth: Engages in the development, manufacture, and sale of ethical drugs (that is, drugs requiring a prescription). Wyeths drugs represent primarily mixtures of chemical compounds. Ethical-drug companies must obtain approval of new drugs from the U.S. Food and Drug Administration (FDA). Patents protect such drugs from competition until other drug companies develop more effective substitutes or the patent expires. B. Amgen: Engages in the development, manufacture, and sale of drugs based on biotechnology research. Biotechnology drugs must obtain approval from the FDA and enjoy patent protection similar to that for chemical-based drugs. The biotechnology segment is less mature than the ethical-drug industry, with relatively few products having received FDA approval. C. Mylan Laboratories: Engages in the development, manufacture, and sale of generic drugs. Generic drugs have the same chemical compositions as drugs that had previously benefited from patent protection but for which the patent has expired. Generic-drug companies have benefited in recent years from the patent expiration of several major ethical drugs. However, the major ethical-drug companies have increasingly offered generic versions of their ethical drugs to compete against the generic-drug companies. D. Johnson Johnson: Engages in the development, manufacture, and sale of over-thecounter health care products. Such products do not require a prescription and often benefit from brand recognition. E. Covance: Offers product development and laboratory testing services for biotechnology and pharmaceutical drugs. It also offers commercialization services and market access services. Cost of goods sold for this company represents the salaries of personnel conducting the laboratory testing and drug approval services. F. Cardinal Health: Distributes drugs as a wholesaler to drugstores, hospitals, and mass erchandisers. Also offers pharmaceutical benefit management services in which it provides customized databases designed to help customers order more efficiently, contain costs, and monitor their purchases. Cost of goods sold for Cardinal Health includes the cost of drugs sold plus the salaries of personnel providing pharmaceutical benefit management services. G. Walgreens: Operates a chain of drugstores nationwide. The data in Exhibit 1.25 for Walgreens include the recognition of operating lease commitments for retail space. REQUIRED Use the ratios to match the companies in Exhibit 1.25 with the firms listed above.arrow_forwardItem 20 of 30 Following are the selected ratios for Petron Corp. (an oil and gas exploration company) and Selecta Co. (a dairy products firm) for the year 2020. Which set of ratios belongs to Petron? Why do you think so? Company A Company B Asset turnover ratio 2.15 40 Profit margin 0.04 47arrow_forward

- 14- Gross profit of a firm for an accounting year is calculated by using __________ formula while preparing income statement. a. All of the options b. Net sales – Sales return c. Net sales – Cost of goods sold d. Net sales – Expensesarrow_forwardEvaluating Financials and Ratios From Chapter 17 1. From the data given in the following table, please construct as many of the financial ratios discussed in this chapter as you can and then indicate what dimension of a business firm's performance each ratio represents. Cash account Accounts receivable Inventories Fixed assets Miscellaneous assets Cost of goods sold Wages and salaries Interest expense Overhead expenses Depreciation expenses Selling, administrative, and other expenses 108 Before-tax net income 117* Taxes owed 325* After-tax net income 15 160 725 *Annual principal payments on bonds and notes payable total $55. The firm's marginal tax rate is 35 percent. Short-term debt: Accounts payable Notes payable Long-term debt (bonds) Equity capital A. Business Assets B. C. D. The financial ratios that could be computed given the data in this problem fall under the following categories: E. F. Liabilities and Equity G. Annual Revenue and Expense Items $60 Net sales 155 128 286 96 725…arrow_forward36 Ratio Analysis - Explain how the following ratios are calculated and what the ratio indicates. Include how these ratios provide useful information related to accounting decision making topics such as efficiency (collecting amounts owed to the firm, using the assets well, getting items to market, etc.), liquidity (ability to pay current debts), solvency (ability to pay long term or all debts) Asset Turnover Return on Assets Current Ratio Accounts Receivable Turnover Average Collection Period Debt Ratio Days’ sales in Inventory Gross Profit Percentage Return on Sales Ratioarrow_forward

- xercise 12-80Asset Efficiency Ratios Financial statements for Steele Inc. follow. Steele Inc. Consolidated Income Statements (in thousands except per share amounts) 2019 2018 2017 Net sales $7,245,088 $6,944,296 $6,149,218 Cost of goods sold (5,286,253) (4,953,556) (4,355,675) Gross margin $1,958,835 $1,990,740 $1,793,543 General and administrative expenses (1,259,896) (1,202,042) (1,080,843) Special and nonrecurring items 2,617 0 0 Operating income $701,556 $788,698 $712,700 Interest expense (63,685) (62,398) (63,927) Other income 7,308 10,080 11,529 Gain on sale of investments 0 9,117 0 Income before income taxes $645,179 $745,497 $660,302 Provision for income taxes (254,000) (290,000) (257,000) Net income $391,179 $455,497 $403,302 Steele Inc. Consolidated Balance Sheets (in thousands) ASSETS Dec. 31, 2019 Dec. 31, 2018 Current assets: Cash and equivalents…arrow_forwardQUESTION 8 P18-5A P14.5A (LO 3) are presented here (in millions). Compute selected ratios, and compare liquidity, profitability, and solvency for two сотрanies. Suppose selected financial data of Target and Wal-Mart for 2020 Wal-Mart Target Corporation Stores, Inc. Income Statement Data for Year Net sales $65,357 $408,214 Cost of goods sold 45,583 304,657 Selling and administrative expenses 15,101 79,607 L Wal-Mart Target Corporation Stores, Inc. Interest expense 707 2,065 Other income (expense) (94) (411) Income tax eхрense 1,384 7,139 $ 2,488 Balance Sheet Data (End of Year) Net income $ 14,335 Current assets $18,424 $ 48,331 Noncurrent assets 26,109 122,375 Total assets $44,533 $170,706 Current liabilities $11,327 $ 55,561 Long-term debt Total stockholders' equity 17,859 44,089 15,347 71,056 Total liabilities and stockholders' equity $44,533 $170,706 Beginning-of-Year Balances Total assets $44,106 $163,429 Total stockholders' equity 13,712 65,682 Current liabilities 10,512 55,390…arrow_forwardGIVE THE COMPARATIVE INCOME STATEMENT HORIZONTAL AND VERTICAL ANALYSIS FROM THE FOLLOWING INCOME STATEMENT BELOW JOLLIBEE INCOME STATEMENT ITEM 2016 2017 2018 2019 2020 Sales/Revenue 113.81B 133.61B 161.17B 179.63B 129.31B Sales Growth - 17.40% 20.62% 11.45% -28.01% Cost of Goods Sold (COGS) incl. D&A - - 132.96B 150.88B 115.39B COGS Growth - - - 13.47% -23.52% COGS excluding D&A 89.27B 105.39B 121.08B 137.38B 100.82B Depreciation & Amortization Expense 4B 4.75B 11.89B 13.5B 14.57B Depreciation 3.93B 4.66B 11.73B 13.34B 14.32B Amortization of Intangibles 68.99M 78.95M 151.82M 145.42M 245.23M Gross Income 20.54B 23.48B 28.21B 28.75B 13.92B Gross Income Growth - 14.30% 20.12% 1.93% -51.57% Gross Profit Margin - - - - 10.77% SG&A Expense - - 17.64B 20.21B 20.42B SGA Growth - - -…arrow_forward

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning