Concept explainers

Cash versus accrual accounting;

• LO2–4, LO2–5, LO2–8

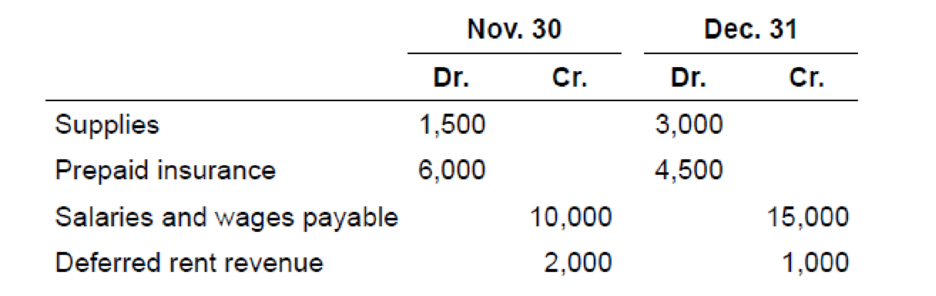

The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December 31, 2018,

The following information also is known:

a. The December income statement reported $2,000 in supplies expense.

b. No insurance payments were made in December.

c. $10,000 was paid to employees during December for salaries and wages.

d. On November 1, 2018, a tenant paid Righter $3,000 in advance rent for the period November through January. Deferred rent revenue was credited.

Required:

1. What was the cost of supplies purchased during December?

2. What was the adjusting entry recorded at the end of December for prepaid insurance?

3. What was the adjusting entry recorded at the end of December for accrued salaries and wages?

4. What was the amount of rent revenue recognized in December? What adjusting entry was recorded at the end of December for deferred rent revenue?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Intermediate Accounting

- Pls only do part D Question 3. AGM Accounting received an invoice dated Jun 4th. The invoice is for office equipment and the supplier charged AGM $14,000 less 30%, with terms 4/15, n/45, ROG. The furniture arrives on Jul 10th.a) What date is the cash discount valid until?b) How much will AGM have to pay if it takes advantage of the cash discount?c) What date is the credit period valid until?d) Suppose AGM sends a $7,000 cheque for partial payment on Jul 17th. How much does AGM still owe after this payment? Assume the cash discount period has passed and we are still within the credit period.arrow_forwardP4.4 (LO 2, 3, 4, 5 ) (Multiple- and Single-Step Statements, Retained Earnings Statement) The following account balances were included in the trial balance of Twain Corporation at June 30, 2020. Sales revenue $1,578,500 Depreciation expense (office furniture and equipment) $7,250 Sales discounts 31,150 Cost of goods sold 896,770 Property tax expense 7,320 Salaries and wages expense (sales) 56,260 Bad debt expense (selling) 4,850 Sales commissions 97,600 Maintenance and repairs expense (administration) 9,130 Travel expense (salespersons) 28,930 Delivery expense 21,400 Office expense 6,000 Entertainment expense 14,820 Sales returns and allowances 62,300 Telephone and Internet expense (sales) 9,030 Dividends received 38,000 Depreciation expense (sales equipment) 4,980 Interest expense 18,000 Maintenance and repairs expense (sales) 6,200 Income tax expense 102,000…arrow_forwardQ.2.1 Open, post to and balance the debtors control account in the general ledger of Dumbledore Magic World for May 2019. The balance brought down on 1 May 2019 was R 71 821.20arrow_forward

- Part B ( 7 marks) (Note this question IS related to Part A) SuperElectronics Limited Adjusted Trial Balance As at 30 June 2020 Debit Credit $ $ Cash 87,000 Accounts receivable 89,000 Allowance for Doubtful debts 4,300 Supplies 4,000 Plant & Equipment 218,000 Accumulated depreciation 64,000 Accounts Payable 38,000 Wages Payable 11,500 Loan payable ( not due until 2025) 50,000 Share capital 100,000 Retained Earnings 105,250 Dividends paid 10,000 Sales Revenue 368,000 Interest revenue 1,120 Doubtful debts expense 2,460 Depreciation expense 19,680 Rent & utilities expense 19,230 Wages and Salaries expense 281,000 Advertising expense 9,300 Interest expense 2,500 Totals 742,170 742,170 Required Prepare the Statement of Financial Position ( Balance…arrow_forwardEx5.22The following transactions of Larson Services Inc. occurred during August 2019, its first month ofoperations.Aug. 1 Issued common stock for $3,000 cash1 Borrowed $10,000 cash from the bank1 Paid $8,000 cash for a used truck4 Paid $600 for a one–year truck insurance policy effective August 1 (record as an asset)5 Collected $2,000 fees from a client for work to be performed at a later date7 Billed a client $5,000 for services performed today9 Paid $250 for supplies purchased and used today12 Purchased $500 of supplies on credit (record as an asset)15 Collected $1,000 of the amount billed August 716 Paid $200 for advertising in The News during the first two weeks of August20 Paid $250 of the amount owing for supplies purchased on August 1225 Paid the following expenses: rent for August, $350; salaries,$2,150; telephone, $50; truck operating, $25028 Called clients about payment of the balances owing from August 729 Billed a client $6,000 for services performed today, including $1,500…arrow_forwardQ # 3 The accounts in the ledger of Donald Brown, with the adjusted balance on Dec 30, the end of the current fiscal year, are as follows Account Title Debit Credit Cash 170,000 Account Receivable 70,000 Merchandise Inventory-Beg 60,000 Office Supplies 5,000 Land 50,000 Store Equipment 40,000 Accumulated Dep. -Store Equipment 30,000 Office Equipment 50,000 Accumulated. Dep.-Office Equipment 25,000 Account Payable 38,850 Salaries Payable 22,000 Donald Brown, Capital 125,000 Sales 500,000 Sales Discounts 6,000 Purchases 250,000 Purchase returned 18,000 Purchase Discounts 12,000 Transportation In 11,550 Advertising Expense 18,000 Bad debts expense 16,520 Dep. Exp. -Store Equipment 13,500 Allowance for bad debts…arrow_forward

- Problem 5-3A Record transactions related to accounts receivable (LO5-3, 5-4, 5-5) [The following information applies to the questions displayed below.]The following events occur for The Underwood Corporation during 2021 and 2022, its first two years of operations. June 12, 2021 Provide services to customers on account for $41,000. September 17, 2021 Receive $25,000 from customers on account. December 31, 2021 Estimate that 45% of accounts receivable at the end of the year will not be received. March 4, 2022 Provide services to customers on account for $56,000. May 20, 2022 Receive $10,000 from customers for services provided in 2021. July 2, 2022 Write off the remaining amounts owed from services provided in 2021. October 19, 2022 Receive $45,000 from customers for services provided in 2022. December 31, 2022 Estimate that 45% of accounts receivable at the end of the year will not be received. Problem 5-3A…arrow_forwardPB14. LO 3.5Post the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash, indicating the ending balance. Assume no beginning balances in these accounts. sold products to customers for cash, $7,500 sold products to customers on account, $12,650 collected cash from customer accounts, $9,500arrow_forwardQuestion 2.4 Calculate the cost (as a percentage) to Satner Limited of not accepting discounts from creditors in settlement of accounts. Notes: Inventories as at 31 December 2020 amounted to R185000 All purchases and sales are on credit Credit terms to Debtors are 30 days Credit terms of 3/10 net 90 days are granted by creditors Dividends for the year amounted to R139 503arrow_forward

- Q# 2 Pass the adjusting entries from the following data the year ended on Dec 2019.i. Prepaid insurance account has a debit balance of Rs. 17,200 actual prepaid at the end is Rs. 6,200ii. Unpaid commission Rs. 3,560iii. Mark-up receivable on Notes Receivable Rs. 270iv. Rent payable for the month Rs. 4,500v. Outstanding electric expenses Rs. 2,850vi. Supplies inventory account balance Rs. 13,500 at the end supplies consumed Rs. 11,200vii. Advertising supplies Rs. 15,000 out of which advertising supplies consumed 9,950viii. Mark-up expenses on Notes Payable Rs. 55 not paid.arrow_forwardQ#3 The following account balance were taken from the general ledger of Aslam on June 30, 1994 before adjusting the accounts Name of Accounts Debit Credit Cash 15,000 Account Receivable 19,000 Merchandise Inventory (1/1/94) 41,200 Purchases 112,000 Office Equipment 45,100 Purchase discount 31,000 Carriage in 11,800 Sales Discount 1,200 Sales Revenue 126,200 Commission Income 3,500 Utilities Expense 2,500 Advertising Expense 8,000 Postages and Telephone expense 11,600 Salaries Expense 13,000 Rent Expense 14,500 Prepaid Insurance 11,500 Account Payable 60,000 Aslam Drawings 11,200 Aslam Capital 1,27,000 348,600 348,600 Adjustments at the end of the year: Merchandise Inventory Dec 31, 1994 Rs. 6,000 Allowance for Depreciation on equipment…arrow_forwardQ#3 The following account balance were taken from the general ledger of Aslam on June 30, 1994 before adjusting the accounts Name of Accounts Debit Credit Cash 15,000 Account Receivable 19,000 Merchandise Inventory (1/1/94) 41,200 Purchases 112,000 Office Equipment 45,100 Purchase discount 31,000 Carriage in 11,800 Sales Discount 1,200 Sales Revenue 126,200 Commission Income 3,500 Utilities Expense 2,500 Advertising Expense 8,000 Postages and Telephone expense 11,600 Salaries Expense 13,000 Rent Expense 14,500 Prepaid Insurance 11,500 Account Payable 60,000 Aslam Drawings 11,200 Aslam Capital 1,27,000 348,600 348,600 Adjustments at the end of the year: Merchandise Inventory Dec 31, 1994 Rs. 6,000 Allowance for Depreciation on equipment…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education