Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.9P

Basic Elements of Financial Reports

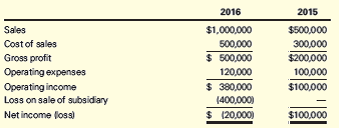

Comparative income statements for Grammar Inc. are as follows:

Required

The president and management believe that the company performed better in 2016 than it did in 2015. Write the president’s letter to be included in the 2016 annual report. Explain why the company is financially sound and why shareholders should not be alarmed by the $20,000 loss in a year when operating revenues increased significantly.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

This problem is based on the 2017 annual report of Campbell Soup Company. Answer the following questions. Refer to the Selected Financial Data for parts (a) to (d).Required:

Find the net sales in 2014. (Enter your answer in millions.)

Calculate the operating income (earnings before interest and taxes) in 2013. (Enter your answer in millions.)

Calculate the difference between operating income (earnings before interest and taxes) and net income (net earnings) in 2015. (Enter your answer in millions.)

Find the year(s) in which net income (net earnings) decreased compared to the previous year.

attatched are the charts needed for the following questions, I have tried to figure these out but I come up with incorrect answers. Thank You

You are the management accountant of AISHA Company Ltd. MARIAM Limited is a major competitor in the same industry and it has been operating for 20 years. Summary of MARIAM Limited's statements of profit or loss and financial position for the previous three years are given below. SUMMARISED STATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED 31 DEC. 2016 2017 2018 GHSm GHSm GHSm Revenue 840 981 913 Cost of sales 554 645 590 286 336 323 Gross profit Selling, distribution and admin. expenses 186 214 219 Profit before interest 100 122 104 Interest 6 15 19 Profit before taxation 94 107 85 Taxation 45 52 45 Profit after taxation 49 55 40 Dividends 24 24 24 SUMMARISED STATEMENTS OF FINANCIAL POSITION AS AT 31 DECEMBER 2016 2007 2008 GHSm GHSm GHSm ASSETSASSETS Non-current assets: 36 40 48 Intangible assets Tangible assets at net book value 176 206 216 212 246 264 Current assets: Inventories 237 303 294 Receivables 105 141 160 4 Bank 52 58 52 606 748 770 EQUITY AND LIABILITIES 2016 2017 2018 100…

(Disclosure of Estimates) Nancy Tercek, the financial vice president, and Margaret Lilly, the controller, of Romine Manufacturing Company are reviewing the financial ratios of the company for the years 2017 and 2018. The financial vice president notes that the profit margin on sales ratio has increased from 6% to 12%, a hefty gain for the 2-year period. Tercek is in the process of issuing a media release that emphasizes the efficiency of Romine Manufacturing in controlling cost. Margaret Lilly knows that the difference in ratios is due primarily to an earlier company decision to reduce the estimates of warranty and bad debt expense for 2018. The controller, not sure of her supervisor’s motives, hesitates to suggest to Tercek that the company’s improvement is unrelated to efficiency in controlling cost. To complicate matters, the media release is scheduledin a few days.Instructions(a) What, if any, is the ethical dilemma in this situation?(b) Should Lilly, the controller, remain silent?…

Chapter 2 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 2 - Read each definition below and write the number of...Ch. 2 - Prob. 2.1ECh. 2 - The Operating Cycle Two Wheeler Cycle Shop buys...Ch. 2 - Classification of Financial Statement Items Regal...Ch. 2 - Current Ratio Baldwin Corp. reported the following...Ch. 2 - Classification of Assets and Liabilities Indicate...Ch. 2 - Selling Expenses and General and Administrative...Ch. 2 - Prob. 2.7ECh. 2 - Income Statement Ratio The income statement of...Ch. 2 - Statement of Retained Earnings Landon Corporation...

Ch. 2 - Components of the Statement of Cash Flows Identify...Ch. 2 - Prob. 2.11ECh. 2 - Prob. 2.12MCECh. 2 - Prob. 2.13MCECh. 2 - Prob. 2.14MCECh. 2 - Materiality Joseph Knapp, a newly hired accountant...Ch. 2 - Costs and Expenses The following costs are...Ch. 2 - Prob. 2.3PCh. 2 - Prob. 2.4PCh. 2 - Working Capital and Current Ratio The balance...Ch. 2 - Single-Step Income Statement The following income...Ch. 2 - Multiple-Step Income Statement and Profit Margin...Ch. 2 - Statement of Cash Flows Colorado Corporation was...Ch. 2 - Basic Elements of Financial Reports Comparative...Ch. 2 - Prob. 2.10MCPCh. 2 - Prob. 2.11MCPCh. 2 - Prob. 2.12MCPCh. 2 - Prob. 2.1APCh. 2 - Prob. 2.2APCh. 2 - Prob. 2.3APCh. 2 - Prob. 2.4APCh. 2 - Working Capital and Current Ratio The balance...Ch. 2 - Single-Step Income Statement The following income...Ch. 2 - Prob. 2.7APCh. 2 - Prob. 2.8APCh. 2 - Prob. 2.9APCh. 2 - Comparability and Consistency in Income Statements...Ch. 2 - Prob. 2.12AMCPCh. 2 - Prob. 2.1DCCh. 2 - Prob. 2.2DCCh. 2 - Analysis of Cash Flow for a Small Business...Ch. 2 - Prob. 2.4DCCh. 2 - The Expenditure Approval Process Roberto is the...Ch. 2 - Prob. 2.6DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial statement data for years ending December 31 for Latchkey Company follows: a. Determine the ratio of sales to assets for 2016 and 2015. b. Does the change in the ratio of sales to assets from 2015 to 2016 indicate a favorable or an unfavorable trend?arrow_forwardLucas Hunter, president of Simmons Industries Inc., believes that reporting operating cash flow per share on the income statement would be a useful addition to the companys just completed financial statements. The following discussion took place between Lucas Hunter and Simmons controller, John Jameson, in January, after the close of the fiscal year: Lucas: Ive been reviewing our financial statements for the last year. I am disappointed that our net income per share has dropped by 10% from last year. This wont look good to our shareholders. Is there anything we can do about this? John: What do you mean? The past is the past, and the numbers are in. There isnt much that can be done about it. Our financial statements were prepared according to generally accepted accounting principles, and I dont see much leeway for significant change at this point. Lucas: No, no. Im not suggesting that we cook the books. But look at the cash flow from operating activities on the statement of cash flows. The cash flow from operating activities has increased by 20%. This is very good newsand, I might add, useful information. The higher cash flow from operating activities will give our creditors comfort. John: Well, the cash flow from operating activities is on the statement of cash flows, so I guess users will be able to see the improved cash flow figures there. Lucas: This is true, but somehow I think this information should be given a much higher profile. I dont like this information being buried in the statement of cash flows. You know as well as I do that many users will focus on the income statement. Therefore, I think we ought to include an operating cash flow per share number on the face of the income statementsomeplace under the earnings per share number. In this way, users will get the complete picture of our operating performance. Yes, our earnings per share dropped this year, but our cash flow from operating activities improved! And all the information is in one place where users can see and compare the figures. What do you think? John: Ive never really thought about it like that before. I guess we could put the operating cash flow per share on the income statement, underneath the earnings per share amount. Users would really benefit from this disclosure. Thanks for the ideaIll start working on it. Lucas: Glad to be of service. How would you interpret this situation? Is John behaving in an ethical and professional manner?arrow_forwardThe financial statements for Tyler Toys, Inc. are shown in the popup window: LOADING... . Calculate the profit margin, return on assets, and return on equity for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $14,147,690 $13,566,481 Cost of goods sold $-8,447,054 $-8,131,319 Selling, general, and administrative expenses $-998,405 $-981,658 Depreciation $-1,498,619 $-1,472,478 EBIT $3,203,612 $2,981,026 Interest expense $-376,184 $-355,975 Taxes $-1,074,423 $-997,519 Net income $1,753,005 $1,627,532 Right-click on the table and select Copy to Clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its…arrow_forward

- The financial statements for Tyler Toys, Inc. are shown in the popup window: LOADING... . Calculate the profit margin, return on assets, and return on equity for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $14,146,094 $13,567,551 Cost of goods sold $-8,448,688 $-8,131,338 Selling, general, and administrative expenses $-998,878 $-980,620 Depreciation $-1,497,580 $-1,472,740 EBIT $3,200,948 $2,982,853 Interest expense $-376,634 $-354,060 Taxes $-1,073,239 $-998,941 Net income $1,751,075 $1,629,852 Right-click on the table and select Copy to Clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its…arrow_forwardOriole Corporation recently filed the following financial statements with the SEC. Look at the image for the balance sheet and more! Oriole CorporationIncome Statement for the FiscalYear Ended July 31, 2017 Net sales $77,630 Cost of products sold 55,218 Gross profit $22,412 Selling, general, and administrative expenses 9,893 Depreciation 1,124 Operating income (loss) $11,395 Interest expense 688 Earnings (loss) before income taxes $10,707 Income taxes 3,748 Net earnings (loss) $6,959 Use the DuPont identity to calculate the return on equity (ROE). In the process, calculate the following ratios: net profit margin, total asset turnover, equity multiplier, EBIT return on assets (EROA), and return on assets. (Do not round intermediate calculations. Round answers to 2 decimal places, e.g. 52.75 or 52.75%.) Net profit margin % Total asset turnover Equity multiplier EBIT return on assets % Return on assets %…arrow_forward(Analysis of Given Ratios) Picasso Company is a wholesale distributor of packaging equipment and supplies. The company’s sales have averaged about $900,000 annually for the 3-year period 2015–2017. The firm’s total assets at the end of 2017 amounted to $850,000.The president of Picasso Company has asked the controller to prepare a report that summarizes the financial aspects of the company’s operations for the past 3 years. This report will be presented to the board of directors at their next meeting.In addition to comparative financial statements, the controller has decided to present a number of relevant financial ratios which can assist in the identification and interpretation of trends. At the request of the controller, the accounting staff has calculated the following ratios for the 3-year period 2015–2017. Check the below image for following ratios. In preparation of the report, the controller has decided first to examine the financial ratios independent of any other data to…arrow_forward

- During its first four years of operation, Vaughn Co. reported the following net income. 2015 $82,800 2016 139,700 2017 166,600 2018 239,400 Vaughn is undergoing its first financial statement audit. The external auditors noted the following:1. In early 2018, Vaughn Co. changed its estimate of bad debt expense from 2.5% of sales to 2.0% of sales. The company therefore adjusted its net income upward for 2015 through 2017 by the following amounts. 2015 $1,800 2016 4,300 2017 5,700 2. The auditor discovered that ending inventory was misstated as indicated below for the years ending 2015 and 2017: Year Amount ofmisstatement Direction ofmisstatement 2015 $20,400 Overstatement 2017 $17,700 Understatement Calculate net income to be reported in Vaughn’s comparative income statements for the years 2015 to 2018.arrow_forwardWrite report on liquidity, profitability, growth, solvency, Leverage and operational performance of National Company. Comment on overall financial position and financial health of the business. Identify problems and recommend possible solutions, if historical ratios of company are Ratios 2017 2018 2019 Current Ratio 1.4 1.5 1.6 Acid Test Ratio 0.85 0.74 0.63 Asset Turnover Ratio 4 times 3.2 2.5 Inventory Turnover Ratio 6 times 5.5 5 Collection Period 6 times 5.5 5 Account payable turnover 8 times 10 times 12 times Total Debt to equity Ratio 1.38 1.61 1.91 Interest cover 5 4 3.5 Gross Profit Ratio 20% 22% 23% Net Profit Margin 8.5% 6.7% 3.8% Return on Equity 20% 21% 24% Sales Growth Rate 8% 5% 2% P/E Ratio 10 9 8 Fixed Asset Utilization Ratio 2 1.7 1.4arrow_forwardCece Company has provided the following data (ignore income taxes): 2016 revenues were $77,500.2016 net income was $33,900.Dividends declared and paid during 2016 totaled $5,700.Total assets at December 31, 2016 were $217,000.Total stockholders' equity at December 31, 2016 was $123,000. Retained earnings at December 31, 2016 were $83,000. Which of the following is correct? 2016 expenses were $37,900 Total liabilities at December 31, 2016 were $11,000. Retained earnings increased $28,200 during 2016. Common stock at December 31, 2016 was $206,000.arrow_forward

- Kingbird Inc. reported income from continuing operations before taxes during 2017 of $2,250,000. Additional transactions occurring in 2017 but not considered in the $2,250,000 are as follows. 1. A gain of $125,000 (pretax) as a result of selling securities from its investment portfolio. 2. A $27,000 loss before taxes as a result of operating the discontinued clothing division during 2017. 3. A loss of $78,000 before taxes as a result of disposing of its clothing division. Assume that this transaction meets the criteria for discontinued operations. 4. An uninsured $122,000 loss due to a fire. 5. At the beginning of 2015, the corporation purchased a machine for $260,000 (salvage value of $20,000) that had a useful life of 10 years. The bookkeeper used straight-line depreciation for 2015, 2016, and 2017, but failed to deduct the salvage value in computing the depreciation base. 6. The corporation decided to change its method of inventory pricing from average-cost…arrow_forwardPlease find below Financial Statement extracts of Nestle from year 2017 and 2018. Based on this information please answer following question from a perspective of Financial Analyst (justify your answers with data as well the reason for choosing your ratios for your analysis) .The company’s total assets at year-end 2016 were CHF 131,900 million. What reasonable conclusions an analyst might make about the companies efficiency, Companies solvency, Liquidity and Profitability? In millions of CHF Notes 2018 2017 * Sales 3 91,439 89,590 Cost of goods sold (46,070) (45,571) Trading operating profit 3 13,789 13,277 Operating profit 13,752 10,156 Profit before taxes, associates and joint ventures 12,991 9,460 Taxes 13 (3,439) (2,773) Profit for the year 10,468 7,511 Notes 2018 2017 * Assets Current assets Cash and cash equivalents 12/16…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Consolidated financial statements; Author: The Finance Storyteller;https://www.youtube.com/watch?v=DTFD912ZJQg;License: Standard Youtube License