College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 4E

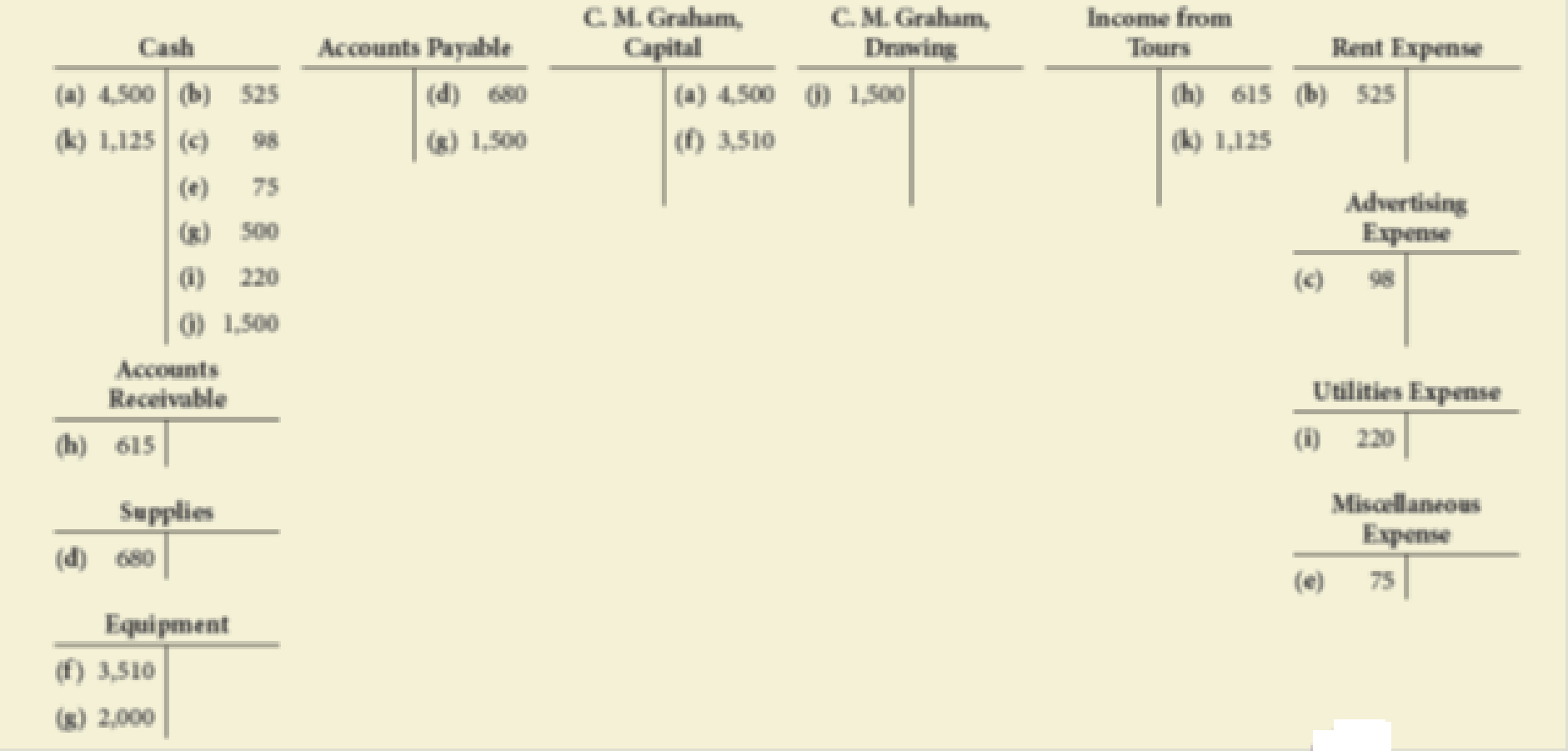

During the first month of operation, Graham Expeditions recorded the following transactions. Describe what has happened in each of the transactions (a) through (k).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

During the first month of operations, the following transactions occurred for Blossoms Inc.:

Gonzalez Engineering completed the following transactions in the month of June.Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements.

Jun.

1

Maria Gonzalez, the owner, invested $108,000 cash, office equipment with a value of $7,000, and $64,000 of drafting equipment to launch the company.

Jun.

2

The company purchased land worth $51,000 for an office by paying $9,100 cash and signing a long-term note payable for $41,900.

Jun.

3

The company purchased a portable building with $53,000 cash and moved it onto the land acquired on June 2.

Jun.

4

The company paid $4,200 cash for the premium on an 18-month insurance policy.

Jun.

5

The company completed and delivered a set of plans for a client and collected $7,800 cash.

Jun.

6

The company purchased $22,400 of additional drafting equipment by paying $11,500 cash and signing a long-term note payable for…

Turner Engineering completed the following transactions in the month of June.Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements.

Jun.

1

Tony Turner, the owner, invested $144,000 cash, office equipment with a value of $16,000, and $82,000 of drafting equipment to launch the company.

Jun.

2

The company purchased land worth $60,000 for an office by paying $21,700 cash and signing a long-term note payable for $38,300.

Jun.

3

The company purchased a portable building with $44,000 cash and moved it onto the land acquired on June 2.

Jun.

4

The company paid $9,600 cash for the premium on an 18-month insurance policy.

Jun.

5

The company completed and delivered a set of plans for a client and collected $15,000 cash.

Jun.

6

The company purchased $33,200 of additional drafting equipment by paying $20,500 cash and signing a long-term note payable for…

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - Prob. 1ECh. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - What Would You Say? A fellow accounting student...Ch. 2 - Prob. 3A

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the first month of operations, Landish Modeling Agency recorded transactions in T account form. Foot and balance the accounts. Then prepare a trial balance, an income statement, a statement of owners equity, and a balance sheet dated March 31, 20--.arrow_forwardThe financial statements at the end of Atlas Realtys first month of operations follow: Instructions By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (p).arrow_forwardThe financial statements at the end of Wolverine Realtys first month of operations are as follows: Instructions By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (p).arrow_forward

- Prepare journal entries to record the following transactions for the month of July: A. on first day of the month, paid rent for current month, $2,000 B. on tenth day of month, paid prior month balance due on accounts, $3,100 C. on twelfth day of month, collected cash for services provided, $5,500 D. on twenty-first day of month, paid salaries to employees, $3,600 E. on thirty-first day of month, paid for dividends to shareholders, $800arrow_forwardEddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--: REQUIRED 1. Prepare general journal entries for the transactions. 2. Prepare necessary adjusting entries for the notes outstanding on December 31.arrow_forwardPrepare journal entries to record the following transactions for the month of November: A. on first day of the month, issued common stock for cash, $20,000 B. on third day of month, purchased equipment for cash, $10,500 C. on tenth day of month, received cash for accounting services, $14,250 D. on fifteenth day of month, paid miscellaneous expenses, $3,200 E. on last day of month, paid employee salaries, $8,600arrow_forward

- Prepare journal entries to record the following transactions that occurred in March: A. on first day of the month, purchased building for cash, $75,000 B. on fourth day of month, purchased inventory, on account, $6,875 C. on eleventh day of month, billed customer for services provided, $8,390 D. on nineteenth day of month, paid current month utility bill, $2,000 E. on last day of month, paid suppliers for previous purchases, $2,850arrow_forwardIn July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardJournal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forward

- Turner Engineering completed the following transactions in the month of June.Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements. Jun. 1 Tony Turner, the owner, invested $144,000 cash, office equipment with a value of $16,000, and $82,000 of drafting equipment to launch the company. Jun. 2 The company purchased land worth $60,000 for an office by paying $21,700 cash and signing a long-term note payable for $38,300. Jun. 3 The company purchased a portable building with $44,000 cash and moved it onto the land acquired on June 2. Jun. 4 The company paid $9,600 cash for the premium on an 18-month insurance policy. Jun. 5 The company completed and delivered a set of plans for a client and collected $15,000 cash. Jun. 6 The company purchased $33,200 of additional drafting equipment by paying $20,500 cash and signing a long-term note payable for…arrow_forwardDuerr Engineering completed the following transactions in the month of June.Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements. Jun. 1 Melanie Duerr, the owner, invested $150,000 cash, office equipment with a value of $17,500, and $85,000 of drafting equipment to launch the company. Jun. 2 The company purchased land worth $61,500 for an office by paying $23,800 cash and signing a long-term note payable for $37,700. Jun. 3 The company purchased a portable building with $42,500 cash and moved it onto the land acquired on June 2. Jun. 4 The company paid $10,500 cash for the premium on an 18-month insurance policy. Jun. 5 The company completed and delivered a set of plans for a client and collected $16,200 cash. Jun. 6 The company purchased $35,000 of additional drafting equipment by paying $22,000 cash and signing a long-term note payable for…arrow_forwardRivera Roofing Company, owned by Reyna Rivera, began operations in July and completed these transactions during that first month of operations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Accounting for Derivatives_1.mp4; Author: DVRamanaXIMB;https://www.youtube.com/watch?v=kZky1jIiCN0;License: Standard Youtube License

Depreciation|(Concept and Methods); Author: easyCBSE commerce lectures;https://www.youtube.com/watch?v=w4lScJke6CA;License: Standard YouTube License, CC-BY