College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 6E

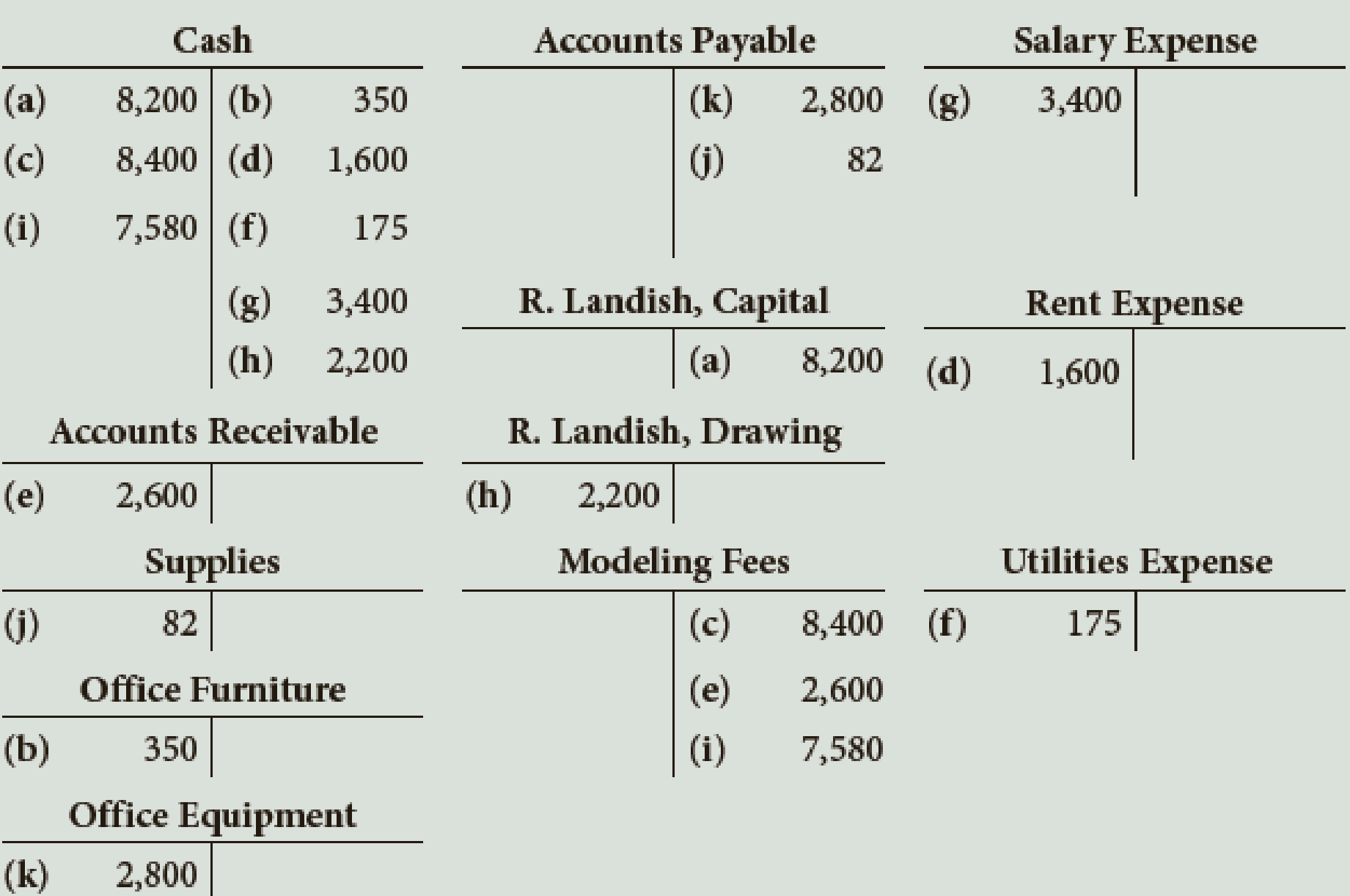

During the first month of operations, Landish Modeling Agency recorded transactions in T account form. Foot and balance the accounts. Then prepare a

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Below are account balances of Ducks Company at the end of September.Required: Prepare a trial balance by placing amounts in the appropriate debit or credit column and determining the balance of the Service Revenue account.

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - On a sheet of paper, draw the fundamental...Ch. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - A fellow accounting student has difficulty...Ch. 2 - What Would You Do? A new bookkeeper cant find the...

Additional Business Textbook Solutions

Find more solutions based on key concepts

How is activity-based costing useful for pricing decisions?

Cost Accounting (15th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

What are assets limited as to use and how do they differ from restricted assets?

Accounting for Governmental & Nonprofit Entities

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (5th Edition)

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals of Cost Accounting

Plantwide and Departmental Overhead Allocation; Activity-Based Costing; Segmented Income Statements Koontz Comp...

Introduction To Managerial Accounting

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Following is the chart of accounts of Sanchez Realty Company: Sanchez completed the following transactions during April (the first month of business): Required 1. Journalize the transactions for April in the general journal. 2. Post the entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a trial balance as of April 30, 20. 4. Prepare an income statement for the month ended April 30, 20. 5. Prepare a statement of owners equity for the month ended April 30, 20. 6. Prepare a balance sheet as of April 30, 20. If you we using CLGL, use the year 2020 when preparing all reports.arrow_forwardFollowing is the chart of accounts of Smith Financial Services: Smith completed the following transactions during June (the first month of business): Required 1. Journalize the transactions for June in the general journal. 2. Post the entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a trial balance as of June 30, 20. 4. Prepare an income statement for the month ended June 30, 20. 5. Prepare a statement of owners equity for the month ended June 30, 20. 6. Prepare a balance sheet as of June 30, 20.arrow_forwardJournal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forward

- Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6) a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardDuring the first month of operation, Graham Expeditions recorded the following transactions. Describe what has happened in each of the transactions (a) through (k).arrow_forwardLaras Landscaping Service has the following chart of accounts: The following transactions were completed by Laras Landscaping Service: Required 1. Journalize the transactions in the general journal. Provide a brief explanation for each entry. 2. If you are using working papers, write the name of the owner on the Capital and Drawing accounts. (Skip this step if you are using CLGL.) 3. Post the journal entries to the general ledger accounts. (Skip this step if you are using CLGL.) 4. Prepare a trial balance dated March 31, 20. If you are using CLGL, use the year 2020 when recording transaction! and preparing reports.arrow_forward

- Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2016, follows: The following business transactions were completed by Elite Realty during April 2016: Instructions 1. Record the April 1, 2016, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2016. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardEddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--: REQUIRED 1. Prepare general journal entries for the transactions. 2. Prepare necessary adjusting entries for the notes outstanding on December 31.arrow_forwardWyoming Tours Co. is a travel agency. The nine transactions recorded by Wyoming Tours during June 2016, its first month of operations, are indicated in the following T accounts: Indicate for each debit and each credit: (a) whether an asset, liability, owners equity, drawing, revenue, or expense account was affected and (b) whether the account was increased (+) or decreased (). Present your answers in the following form, with transaction (1) given as an example:arrow_forward

- What Do You Think? You work as an accounting clerk. You have received the following information supplied by a client, S. Winston, from the clients bank statement, the clients tax returns, and a variety of other July documents. The client wants you to prepare an income statement, a statement of owners equity, and a balance sheet for the month of July for Winston Company.arrow_forwardToms Catering Services prepared the following work sheet for the year ended December 31, 20--. Required 1. Complete the work sheet. (Skip this step if using QuickBooks or general ledger.) 2. Prepare an income statement. 3. Prepare a statement of owners equity; assume that there was an additional investment of 2,500 on December 1. (Skip this step if using QuickBooks. The additional investment assumption has already been completed in the data file.) 4. Prepare a balance sheet. 5. Journalize the closing entries with the four steps in the correct sequence. 6. Prepare a post-closing trial balance. (For QuickBooks, select the trial balance report, then modify the report name to Post-Closing Trial Balance.) Check Figure Net income, 19,567arrow_forwardWilliams Mechanic Services prepared the following work sheet for the year ended March 31,20--. Required 1. Complete the work sheet. (Skip this step if using CLGL.) 2. Prepare an income statement. 3. Prepare a statement of owners equity. Assume that there was an additional investment of 5,000 on March 13. 4. Prepare a balance sheet. 5. Journalize the closing entries using the four steps in the correct sequence. 6. Prepare a post-dosing trial balance. Check Figure Post-closing trial balance total, 31,765arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY