EBK CONTEMPORARY ENGINEERING ECONOMICS

6th Edition

ISBN: 8220101336736

Author: Park

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 4P

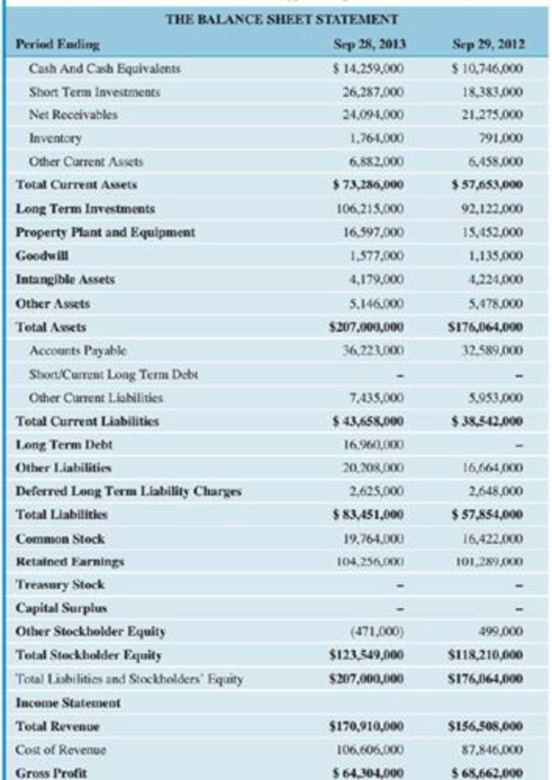

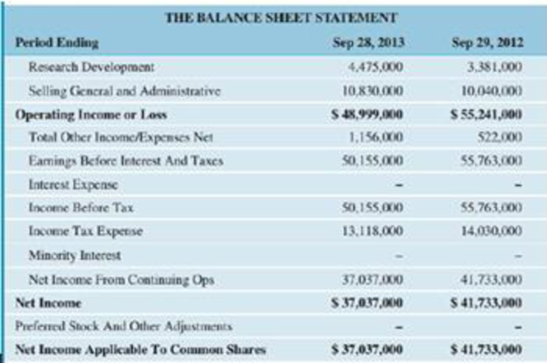

Table P2.4 shows financial statements for Apple Computer Corporation. The closing stock

- (a) Debt ratio

- (b) Times-interest-earned ratio

- (c) Current ratio

- (d) Quick (acid-test) ratio

- (e) Inventory-turnover ratio

- (f) Dav's-sales-outstandine

- (g) Total-assets turnover ratio

- (h) Profit margin on sales

- (i) Return on total assets

- (j) Return on common equity

- (k) Price/earnings ratio

- (l) Book value per share

TABLE P2.4 Financial Statements far Apple Computer (All numbers in thousands)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Questions:

Compute the expected intrinsic price of each stock in year 5. Assume that

All stocks are fairly priced such that the intrinsic and market values are equal.

Dividends are paid at the beginning of the year

How many units of each stock will Stephanie buy? Support your response with relevant computations.

What will be the total investment cost for shares? Show appropriate calculations.

Which bonds are acceptable for investment? Justify your response with suitable computations.

What will be the total cost of investment in bonds?

Do the stock and bond investments fall within Stephanie’s investment guidelines? Show appropriate computations in support of your response.

Will Stephanie have enough funds for her investment in stocks and bonds, when needed? What will be the surplus / shortfall, if any?

Given that Stephanie’s bank offers an interest rate of 6% per year, what additional amount should she have deposited as a fixed…

On the advice of your uncle, you purchased 10 shares of a well-established U.S.-based corporate stock for $21 per share. After 1 quarter, you received $0.25 per share dividends each quarter for 2 years. At that point, the stock price had gone down in a short-term recession, so you purchased 10 more shares at $18 per share. The stock continued to pay 25¢ a share on all 20 shares. After 3 years (12 quarters), you decided to sell the stock since it had increased in market value to $24 per share. Make the following assumptions: (a) no commissions for the purchase or sale of the stock, (b) no government taxes on the dividends, and (c) quarterly compounding of the rate of return. What is the effective interest rate per year?

The effective interest rate per year is %.

Membo Inc. just paid a dividend of $4.6 per share. Dividends are expected to grow at 6%, 5%, and 3% for the next three years respectively. After that the dividends are expected to grow at a constant rate of 2% indefinitely. Stockholders require a return of 9 percent to invest in Membo’s common stock. Compute the value of Membo’s common stock today. (SHOW ALL WORK IN WORD FORMAT PLEASE)

Chapter 2 Solutions

EBK CONTEMPORARY ENGINEERING ECONOMICS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 36. Assume you have placed a value of operations on Champion Inc. of $3,500,000. The firm has marketable securities of $75,000. In addition, the firm recently reported total assets of $7 million along with long-term debt of $1.5 million and preferred stock of $250,000. If Champion has 500,000 shares outstanding, what is the intrinsic value of the firm’s common stock? Only typed answerarrow_forwardThe following information is taken from Johnson & Johnson's annual reports. Its common stock is listed on the New York Stock Exchange, using the symbol JNJ. Johnson & Johnson Domestic Sales International Sales Employees Year ($ million) 2010 29,437 32,124 114.0 2011 12,907 36,107 117.9 2012 29,830 37,394 127.6 2013 31,910 39,402 128.1 2014 34,782 39,548 126.5 2015 35,687 34,387 127.1 2016 37,811 34,079 126.4 2017 39,863 36,597 134.0 2018 41,884 39,697 135.1 Using the period 2010–12 as the base period, compute a simple index of international sales for each year from 2013 to 2018. (Round your answers to 1 decimal place.)The index (2010–2012 = 100) for selected years is: Year Index 2010 2011 2012 2013 2014 2015 2016 2017 2018arrow_forwardYou’ve recently learned that the company where you work is being sold for $500,000. The company’s income statement indicates current profits of $25,000, which have yet to be paid out as dividends. Assuming the company will remain a “going concern” indefinitely and that the interest rate will remain constant at 9 percent, at what constant rate does the owner believe that profits will grow? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- A company has no preferred stock outstanding and has 15,000,000 common shares outstanding. The company’s Net income is $30,000,000 and it pays a total of $7,500,000 in common dividends. Currently the shares trade for $20 per share. For this company, what is: (Round your answer to two decimal places, if necessary) EPS? $ DPS? $ Dividend yield? % Dividend payout rate? % Retention rate? %arrow_forwardYou expect KT Industries (KTI) will have earnings per share of $4.6 this year and expect that they will pay out $1.66 of these earnings to shareholders in the form of a dividend. KTI's return on new investments is 11% and their equity cost of capital is 16%. KTI's dividend growth rate is _________ (Round to two decimal places) If KTI's dividend growth rate will remain constant, and KTI's next year dividend is $1.78, then KTI's current stock price should be ________ (Round to two decimal places)arrow_forwardCONVEX Ltd. is a new company that was established on 1st January, 2020 to oversee the production of coronavirus vaccines for Ghana. On 1st July, 2020, CONVEX Ltd. acquired 75% shares in CONCAVE Ltd., a pharmaceutical company, to speed up the vaccine production. As a new graduate from UGBS, CONVEX Ltd. has employed you as their accountant. At a management meeting held, a number of issues were raised about how CONVEX Ltd. should deal with its transactions and investment in CONCAVE Ltd. and the need to conduct financial ratio analysis to determine the profitability and sustainability of CONCAVE Ltd. In a memo to management, provide your views on how the following issues should be addressed. Issue DAssuming you have done the financial ratio analysis and you have realized that profitability is looking good but liquidity is not impressive and needs urgent attention. What do you think could be the problem with CONCAVE Ltd. that your company needs to help them address?arrow_forward

- Imagine you are the owner of a downtown Laredo building that you lease out for a yearly amount of $ 45,000 over a span of five years. Assume that the explicit expenses for maintaining the building are $ 20,000, and an additional implicit cost of $15,000 exists. All earnings and costs occur at the conclusion of each year. Suppose the interest rate is 7.5 percent, Determine the present value for both the stream of: (i) your accounting profits. Show your steps. (ii) economic profits. Show your stepsarrow_forward1. All of the following could be on a multi-step income statement except for: Group of answer choices non-operating income income from continuing operations income from discontinued operations no subtotals or intermediate calculations of income before net income. 2. Which of the following would be a current asset? Group of answer choices Investments to pay for a bond due in 10 years Accounts Receivable Building Patent 3. Which of the following would be a current liability? Group of answer choices Bonds payable Accounts Payable Mortgage payable Notes payable due in 5 years. 4. Which of the following is not an intangible? Group of answer choices Patents Trademarks Investments Copyrights 5. What must happen for goodwill to be recorded as an asset on an accounting balance sheet? Group of answer choices A company has a good reputation A company buys another company for more than the value of the…arrow_forwardIdentify the term being referred to: A process wherein new shares are offered to existing shareholders based on their current shareholdings.arrow_forward

- An owner can lease her building for $100,000 per year for three years. The explicit cost of maintaining the building is $35,000, and the implicit cost is $50,000. All revenues are received, and costs borne, at the end of each year. If the interest rate is 7 percent, determine the present value of the stream of: Accounting profits and economic profitsarrow_forwardA firm that owns and manages rental properties is considering buying a building that would cost $800,000 this year, but would yield an annual revenue stream of $50,000 per year for the foreseeable future. For what range of interest rates would this purchase increase the present value of the firm?arrow_forwardRefer to table above, a 6 percent increase in the value of assetsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

DATA GEMS: How to Access Income Data Tables and Reports From the CPS ASEC; Author: U.S. Census Bureau;https://www.youtube.com/watch?v=BWpVC-Clczw;License: Standard Youtube License