Concept explainers

Recording Manufacturing Costs and Analyzing Manufacturing

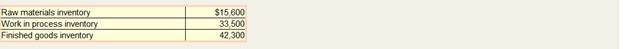

Hamilton Custom Cabinet Company uses a job order cost system with overhead applied as a percentage of direct labor costs. Inventory balance at the beginning of 2016 follow:

The following transactions occurred during January:

a. Purchased materials on account for $42,000.

b. Issued materials to production totaling $45,000, 85 percent of which was traced to specific jobs and the remainder of which was treated as indirect materials.

c. Payroll costs totaling $30,000 were recorded as follows:

$17,300 for assembly workers

8,400 for factory supervision

2,500 for administrative personnel

1,800 for sales commissions

d. Recorded

e. Recorded $9,000 of expired insurance. Sixty percent was insurance on the manufacturing facility, with the remainder classified as an administrative expense.

f. Paid $7,900 in other

g. Applied manufacturing overhead at a rate of 200 percent of direct labor cost.

h. Completed all jobs but one; the

$7,000 for direct labor, and $14,000 for applied overhead.

i. Solid jobs costing $40,000 during the period; the company adds a 25 percent markup on cost to determine the sales price.

Set up T-accounts, record the beginning balances,

a. Raw Materials Inventory.

b. Work in process Inventory.

c. Finished Goods Inventory.

d. Cost of Goods Sold.

e. Manufacturing Overhead.

f. Selling, General, and Administrative Expenses.

g. Sales Revenue.

h. Other accounts (Cash, Payables, etc.).

(a)

Recording Manufacturing Costs:

In cost accounting, various production stages of manufacturing a product are identified. Thus, manufacturing costs are recorded at such production processes to reflect appropriate apportionment of costs.

Analyzing Manufacturing Overhead:

The manufacturing overhead costs are incurred in a factory and it is related to the production process. It is attributed to the goods produced at such predetermined rate which is budgeted at the beginning of the period. Therefore, we can analyze such predetermined budgets and actual level of activity to calculate under, over or optimum utilization of the resources

To record:

The transactions in relation to Raw Materials Inventory for the month of January 2016.

Explanation of Solution

The transactions recorded in T-account of Raw Materials Inventory for the month of January 2016 of H.C.C. Co. are as follows-

| Dr | Raw Materials Inventory | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| To Opening Balance | 15,600 | By Work in Process Inventory (Direct Materials Issued) | 38,250 |

| To Purchase Payables | 42,000 | By Manufacturing Overhead (Indirect Materials Issued) | 6,750 |

| By Closing Balance | 12,600 | ||

| Total | 57,600 | Total | 57,600 |

The direct materials issued will be transferred to work in process inventory while indirect materials consumed will be considered as a manufacturing overhead respectively.

(b)

Recording Manufacturing Costs:

In cost accounting, various production stages of manufacturing a product are identified. Thus, manufacturing costs are recorded at such production processes to reflect appropriate apportionment of costs.

Analyzing Manufacturing Overhead:

The manufacturing overhead costs are incurred in a factory and it is related to the production process. It is attributed to the goods produced at such predetermined rate which is budgeted at the beginning of the period. Therefore, we can analyze such predetermined budgets and actual level of activity to calculate under, over or optimum utilization of the resources

To record:

The transactions in relation to Work in Process Inventory for the month of January 2016.

Explanation of Solution

The transactions recorded in T-account of Work in Process Inventory for the month of January 2016 of H.C.C. Co. are as follows-

| Dr | Work in Process Inventory | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| To Opening Balance | 33,500 | ||

| To Raw Materials Inventory | 38,250 | ||

| To Wages Payables (Direct Labor) | 17,300 | ||

| To Manufacturing Overhead | 34,600 | ||

| By Finished Goods | 84,650 | ||

| By Closing Balance | 39,000 | ||

| Total | 123,650 | Total | 123,650 |

All such direct costs and applied manufacturing overhead involved in the processing of materials are considered under work in process inventory. As all the jobs are not completed, the total of direct materials, direct labor and applied overhead pertaining to work in process amounts to $39,000 is considered as closing balance for such period.

(c)

Recording Manufacturing Costs:

In cost accounting, various production stages of manufacturing a product are identified. Thus, manufacturing costs are recorded at such production processes to reflect appropriate apportionment of costs.

Analyzing Manufacturing Overhead:

The manufacturing overhead costs are incurred in a factory and it is related to the production process. It is attributed to the goods produced at such predetermined rate which is budgeted at the beginning of the period. Therefore, we can analyze such predetermined budgets and actual level of activity to calculate under, over or optimum utilization of the resources

To record:

The transactions in relation to Finished Goods Inventory for the month of January 2016.

Answer to Problem 5.1GBP

The transactions recorded in T-account of Finished Goods Inventory for the month of January 2016 of H.C.C. Co. are as follows-

| Dr | Finished Goods Inventory | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| To Opening Balance | 42,300 | ||

| To Work in Process Inventory | 84,650 | ||

| By Cost of Goods Sold | 40,000 | ||

| By Closing Balance | 86,950 | ||

| Total | 126,950 | Total | 126,950 |

Explanation of Solution

The goods which are completed would be transferred to finished goods inventory. However, the total costs of such jobs which are sold during such period would be transferred as cost of such goods sold respectively.

(d)

Recording Manufacturing Costs:

In cost accounting, various production stages of manufacturing a product are identified. Thus, manufacturing costs are recorded at such production processes to reflect appropriate apportionment of costs.

Analyzing Manufacturing Overhead:

The manufacturing overhead costs are incurred in a factory and it is related to the production process. It is attributed to the goods produced at such predetermined rate which is budgeted at the beginning of the period. Therefore, we can analyze such predetermined budgets and actual level of activity to calculate under, over or optimum utilization of the resources

To record:

The transactions in relation to Cost of Goods Sold for the month of January 2016.

Explanation of Solution

The transactions recorded in T-account of Cost of Goods Sold for the month of January 2016 of H.C.C. Co. are as follows-

| Dr | Cost of Goods Sold | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| By Sales Revenue | 40,000 | ||

| To Finished Goods | 40,000 | ||

| Total | 40,000 | Total | 40,000 |

It represents the total cost of such goods sold during the period.

(e)

Recording Manufacturing Costs:

In cost accounting, various production stages of manufacturing a product are identified. Thus, manufacturing costs are recorded at such production processes to reflect appropriate apportionment of costs.

Analyzing Manufacturing Overhead:

The manufacturing overhead costs are incurred in a factory and it is related to the production process. It is attributed to the goods produced at such predetermined rate which is budgeted at the beginning of the period. Therefore, we can analyze such predetermined budgets and actual level of activity to calculate under, over or optimum utilization of the resources

To record:

The transactions in relation to Manufacturing Overhead for the month of January 2016.

Answer to Problem 5.1GBP

The transactions recorded in T-account of Manufacturing Overhead for the month of January 2016 of H.C.C. Co. are as follows-

| Dr | Manufacturing Overhead | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| To Raw Materials Inventory | 6,750 | By Work in Process Inventory (Applied Manufacturing Overhead) | 34,600 |

| To Wages Payables (Indirect Labor) | 8,400 | By Under-Applied Overhead c/f | 2,850 |

| To Accumulated Depreciation | 9,000 | ||

| To Prepaid Insurance | 5,400 | ||

| To Cash (Other Factory Costs) | 7,900 | ||

| Total | 37,450 | Total | 37,450 |

Explanation of Solution

The manufacturing overhead is the factory cost component in such production process. They are applied to work in process inventory as a result of predetermined overhead rate.The assembly workers payroll costs considered as direct labor cost. It is incurred in the manufacturing unit and directly related to such production process respectively. Thus, applied manufacturing overheads are charged at 200% of direct labor costs which is $34,600 ($17,300 * 200%).

(f)

Recording Manufacturing Costs:

In cost accounting, various production stages of manufacturing a product are identified. Thus, manufacturing costs are recorded at such production processes to reflect appropriate apportionment of costs.

Analyzing Manufacturing Overhead:

The manufacturing overhead costs are incurred in a factory and it is related to the production process. It is attributed to the goods produced at such predetermined rate which is budgeted at the beginning of the period. Therefore, we can analyze such predetermined budgets and actual level of activity to calculate under, over or optimum utilization of the resources

To record:

The transactions in relation to Selling, General and Administrative Expenses for the month of January 2016.

Explanation of Solution

The transactions recorded in T-account of Selling, General and Administrative Expenses for the month of January 2016 of H.C.C. Co. are as follows-

| Dr. | Selling, General and Administrative Expenses | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| To Salary Payable for Administrative Personnel | 2,500 | ||

| To Sales Commissions Payable | 1,800 | ||

| To Accumulated Depreciation | 25,000 | ||

| To Prepaid Insurance | 3,600 | ||

| By Closing Balance | 32,900 | ||

| Total | 32,900 | Total | 32,900 |

All such costs in relation to administration, selling and distribution of goods during the period are recorded under Selling, General and Administrative Expenses.

(g)

Recording Manufacturing Costs:

In cost accounting, various production stages of manufacturing a product are identified. Thus, manufacturing costs are recorded at such production processes to reflect appropriate apportionment of costs.

Analyzing Manufacturing Overhead:

The manufacturing overhead costs are incurred in a factory and it is related to the production process. It is attributed to the goods produced at such predetermined rate which is budgeted at the beginning of the period. Therefore, we can analyze such predetermined budgets and actual level of activity to calculate under, over or optimum utilization of the resources

To record:

The transactions in relation to Sales Revenue for the month of January 2016.

Explanation of Solution

The transactions recorded in T-account of Sales Revenue for the month of January 2016 of H.C.C. Co. are as follows-

| Dr | Sales Revenue | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| To Cost of Goods Sold | 40,000 | By Cash | 50,000 |

| To Gross Profit | 10,000 | ||

| Total | 50,000 | Total | 50,000 |

The company determines its sales price by adding 25% markup on cost of such job. The jobs costing $40,000 has been sold during such period. Thus, the sales value is $50,000 ($40,000 * 125%) for the period.The excess of sales value over the cost of such goods sold represent the gross profit for the period.

(h)

Recording Manufacturing Costs:

In cost accounting, various production stages of manufacturing a product are identified. Thus, manufacturing costs are recorded at such production processes to reflect appropriate apportionment of costs.

Analyzing Manufacturing Overhead:

The manufacturing overhead costs are incurred in a factory and it is related to the production process. It is attributed to the goods produced at such predetermined rate which is budgeted at the beginning of the period. Therefore, we can analyze such predetermined budgets and actual level of activity to calculate under, over or optimum utilization of the resources

To record:

The transactions related to other accounts for the month of January 2016.

Explanation of Solution

The transactions recorded in T-account of Cash for the month of January 2016 of H.C.C. Co. are as follows-

| Dr | Cash | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| To Sales Revenue | 50,000 | By Manufacturing Overhead | 7,900 |

| By Closing Balance | 42,100 | ||

| Total | 50,000 | Total | 50,000 |

The cash transactions during the period have been recorded to determine the cash balance.

The transactions recorded in T-account of Purchase Payables for the month of January 2016 of H.C.C. Co. are as follows-

| Dr | Purchase Payables | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| By Raw Materials Inventory | 42,000 | ||

| To Closing Balance | 42,000 | ||

| Total | 42,000 | Total | 42,000 |

It is a payables account for raw materials acquired on credit terms.

The transactions recorded in T-account of Wages Payables for the month of January 2016 of H.C.C. Co. are as follows-

| Dr | Wages Payables | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| By Work in Process Inventory (Direct Labor) | 17,300 | ||

| By Manufacturing Overhead (Indirect Labor) | 8,400 | ||

| To Closing Balance | 25,700 | ||

| Total | 25,700 | Total | 25,700 |

The direct as well as indirect labor incurred have been recorded as wages payables.

The transactions recorded in T-account of Salary Payable for the month of January 2016 of H.C.C. Co. are as follows-

| Dr | Salary Payable | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| By Selling, General and Administrative Expenses | 2,500 | ||

| To Closing Balance | 2,500 | ||

| Total | 2,500 | Total | 2,500 |

As the salary to administrative personnel is incurred but not paid, the same is represented as salary payable at the end of such period.

The transactions recorded in T-account of Sales Commissions Payable for the month of January 2016 of H.C.C. Co.are as follows-

| Dr | Sales Commissions Payable | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| By Selling, General and Administrative Expenses | 1,800 | ||

| To Closing Balance | 1,800 | ||

| Total | 1,800 | Total | 1,800 |

The sales commissions are payable at the end of such period.

The transactions recorded in T-account of Accumulated Depreciation for the month of January 2016 of H.C.C. Co.are as follows-

| Dr | Accumulated Depreciation | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| By Manufacturing Overhead | 9,000 | ||

| By Selling, General and Administrative Expenses | 25,000 | ||

| To Closing Balance | 34,000 | ||

| Total | 34,000 | Total | 34,000 |

The depreciation expense for the period is recorded in respective heads.

The transactions recorded in T-account of Prepaid Insurance for the month of January 2016 of H.C.C. Co.are as follows-

| Dr | Prepaid Insurance | Cr | |

| Particulars | Amount ($) | Particulars | Amount ($) |

| To Opening Balance | 9,000 | By Manufacturing Overhead | 5,400 |

| By Selling, General and Administrative Expenses | 3,600 | ||

| Total | 9,000 | Total | 9,000 |

The prepaid insurance which has lapsed during the current period, has been transferred as an expense to respective heads.

Want to see more full solutions like this?

Chapter 2 Solutions

MANAGERIAL ACCTNG (LL) W/CNNCT CODE

- General accountingarrow_forwardSolvearrow_forwardA local bakery sells 12,000 loaves of sourdough bread each year. The loaves are ordered from an outside supplier, and it takes 4 days for each shipment of loaves to arrive. Ordering costs are estimated at $18 per order. Carrying costs are $6 per loaf per year. Assume that the bakery is open 300 days a year. What is the maximum inventory of loaves held in a given ordering cycle? Solutionarrow_forward

- Hello tutorarrow_forwardA local bakery sells 12,000 loaves of sourdough bread each year. The loaves are ordered from an outside supplier, and it takes 4 days for each shipment of loaves to arrive. Ordering costs are estimated at $18 per order. Carrying costs are $6 per loaf per year. Assume that the bakery is open 300 days a year. What is the maximum inventory of loaves held in a given ordering cycle?arrow_forwardGiven solution for General accounting question not use aiarrow_forward

- A local bakery sells 12,000 loaves of sourdough bread each year. The loaves are ordered from an outside supplier, and it takes 4 days for each shipment of loaves to arrive. Ordering costs are estimated at $18 per order. Carrying costs are $6 per loaf per year. Assume that the bakery is open 300 days a year. What is the maximum inventory of loaves held in a given ordering cycle? need your helparrow_forwardWhat is the machine's book value at the end of 20X4?arrow_forwardAccounting solutionarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning