FUND.ACCT.PRIN.(LOOSELEAF)-W/CONNECT

25th Edition

ISBN: 9781264218103

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 14E

Exercise 20-14

Production cost flow and measurement;

P4

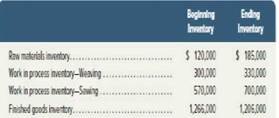

Pro-Weave manufactures stadium blankets by passing the products through a weaving department and a sewing department. The following information is

The Mowing additional information describes the company's manufacturing activities for June:

available regarding its June inventories:

Required

- Compute the (a) cost of products transferred from weaving to sewing, (b) cost of products transferred from sewing to finished goods, and (c) cost of goods sold.

- Prepare journal entries dated June 30 to record (a) goods transferred from weaving to sewing, (b) goods transferred from sewing to finished goods, and (c) sale of finished goods.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

GLO301 - Based on Problem 3-5A (Algo) LO P3, P4

Drake Company manufactures soccer balls in two sequential processes: Cutting and Stiching. All direct materlals enter

production at the beginning of the Cutting process. The following Information Is avallable regarding its May Inverntorles:

Raw materlals inventory

Work in process Inventory-Cutting

Work in process Inventory-Stitching

Finished goods Inventory

Beginning

Inventory

$ 126,000

283,500

303,300

260,100

Ending

Inventory

$ 153,250

63,500

180,500

56,250

The following additional Information describes the company's production activitles for May.

Direct naterlals

Raw materials purchased on credit

Direct naterlals used-Cutting

Direct naterials used-Stitching

$ 145,000

27,750

Direct labor

Direct labor-Cutting

Direct labor-Stitching

$ 27,6ee

110,400

Factory Overhead (Actual costs)

Indirect materlals used

Indirect labor used

Other overhead costs

$ 90,000

59, see

71,800

Factory Overhead Rates

Cutting

stitching

Sales

(15ex of direct naterlals…

S

Raw materials

Work in process

Finished goods

Beginning Inventory

$ 28,100

22,200

79,400

Raw materials purchases

Indirect materials used

Direct labor

Additional information for the month of March follows:

Manufacturing overhead applied

Selling, general, and administrative expenses

Sales revenue

Required 1 Required 2

Inventory

Required:

1. Based on the above information, prepare a cost of goods manufactured report.

2. Based on the above information, prepare an income statement for the month of March.

Complete this question by entering your answers in the tabs below.

$ 25,300

45,600

68,900

Sales Revenue

Less: Cost of Goods Sold

Beginning Finished Goods Inventory

Less: Ending Finished Goods Inventory

Cost of Goods Sold

Gross Profit

Based on the above information, prepare an income statement for the month of March.

Stor Smart Company

Income Statement

For the Month of March

Net Income (Loss) from Operations

$ 41,300

1,800

63,900

36,000

24,900

237,600

Cost of Goods Sold, Cost of Goods Manufactured

Princeton 3 Company has the following information for May:

Cost of direct materials used in production

$17,300

Direct labor

44,700

Factory overhead

28,800

Work in process inventory, May 1

72,100

Work in process inventory, May 31

76,400

Finished goods inventory, May 1

30,300

Finished goods inventory, May 31

34,600

Question Content Area

a. For May, using the data given, prepare a statement of Cost of Goods Manufactured.

Princeton 3 CompanyStatement of Cost of Goods Manufacturedblank

$- Select -

$- Select -

- Select -

- Select -

Total manufacturing costs incurred during May

fill in the blank 22653a05d041061_9

Total manufacturing costs

$fill in the blank 22653a05d041061_10

- Select -

Cost of goods manufactured

$fill in the blank 22653a05d041061_13

Question Content Area

b. For May, using the data given, prepare a statement of Cost of Goods…

Chapter 20 Solutions

FUND.ACCT.PRIN.(LOOSELEAF)-W/CONNECT

Ch. 20 - Prob. 1QSCh. 20 - Prob. 2QSCh. 20 - Process vs. job order operations C1 For each of...Ch. 20 - Physical flow reconciliation C2 Prepare a physical...Ch. 20 - Prob. 5QSCh. 20 - A FIFO: Computing equivalent units C4 Refer to QS...Ch. 20 - Prob. 7QSCh. 20 - Prob. 8QSCh. 20 - Prob. 9QSCh. 20 - Prob. 10QS

Ch. 20 - Prob. 11QSCh. 20 - Prob. 12QSCh. 20 - Prob. 13QSCh. 20 - Prob. 14QSCh. 20 - Prob. 15QSCh. 20 - Prob. 16QSCh. 20 - A FIFO: Journal entry to transfer costs P4 Refer...Ch. 20 - Prob. 18QSCh. 20 - Weighted average: Assigning costs to output C3...Ch. 20 - Prob. 20QSCh. 20 - Prob. 21QSCh. 20 - Prob. 22QSCh. 20 - Recording costs of materials P1 Hotwax mates...Ch. 20 - Prob. 24QSCh. 20 - Recording costs of factory overhead P1 P3 Prepare...Ch. 20 - Recording transfer of costs to finished goods P4...Ch. 20 - Prob. 27QSCh. 20 - Prob. 28QSCh. 20 - Prob. 29QSCh. 20 - Exercise 20-1 Process vs. job order operations C1...Ch. 20 - Exercise 20-2 Comparing process and job order...Ch. 20 - Prob. 3ECh. 20 - Prob. 4ECh. 20 - Prob. 5ECh. 20 - Prob. 6ECh. 20 - Prob. 7ECh. 20 - Exercise 20-8 Weighted average: Computing...Ch. 20 - Prob. 9ECh. 20 - Prob. 10ECh. 20 - Prob. 11ECh. 20 - Prob. 12ECh. 20 - Exercise 20-13A

FIFO: Completing a process cost...Ch. 20 - Exercise 20-14 Production cost flow and...Ch. 20 - Exercise 20-15 Recording product costs P1 P2 P3...Ch. 20 - Prob. 16ECh. 20 - Prob. 17ECh. 20 - Prob. 18ECh. 20 - Prob. 19ECh. 20 - Prob. 20ECh. 20 - Prob. 21ECh. 20 - Exercise 20-22 Recording costs of labor P2 Prepare...Ch. 20 - Prob. 23ECh. 20 - Prob. 24ECh. 20 - Exercise 20-25 Recording cost flows in a process...Ch. 20 - Exercise 20-26 Interpretation of journal entries...Ch. 20 - Prob. 27ECh. 20 - Prob. 28ECh. 20 - Prob. 29ECh. 20 - Prob. 30ECh. 20 - Prob. 1PSACh. 20 - Prob. 2PSACh. 20 - Prob. 3PSACh. 20 - Problem 20-4A Weighted average: Process cost...Ch. 20 - Problem 20-5AA FIFO: Process cost summary:...Ch. 20 - Prob. 6PSACh. 20 - Prob. 7PSACh. 20 - Prob. 1PSBCh. 20 - Prob. 2PSBCh. 20 - Prob. 3PSBCh. 20 - Prob. 4PSBCh. 20 - Problem 20-5BA FIFO: Process cost summary;...Ch. 20 - Problem 20-6BAFIFO: Costs per equivalent unit;...Ch. 20 - Problem 20-7BA FIFO: Process cost summary,...Ch. 20 - Prob. 20SPCh. 20 - Prob. 20CPCh. 20 - Prob. 1GLPCh. 20 - Apple has entered into contracts that require the...Ch. 20 - Apple and Google work to maintain high-quality and...Ch. 20 - Prob. 3AACh. 20 - Prob. 1DQCh. 20 - Prob. 2DQCh. 20 - Prob. 3DQCh. 20 - Prob. 4DQCh. 20 - Prob. 5DQCh. 20 - Explain in simple terms the notion of equivalent...Ch. 20 - Prob. 7DQCh. 20 - Prob. 8DQCh. 20 - Direct labor costs flow through what accounts in a...Ch. 20 - Prob. 10DQCh. 20 - Prob. 11DQCh. 20 - Prob. 12DQCh. 20 - Prob. 13DQCh. 20 - Companies such as Apple commonly prepare a process...Ch. 20 - Prob. 15DQCh. 20 - Prob. 16DQCh. 20 - Prob. 17DQCh. 20 - How could a company manager use a process cost...Ch. 20 - Explain a hybrid costing system. Identify' a...Ch. 20 - Prob. 1BTNCh. 20 - Prob. 2BTNCh. 20 - Many companies use technology to help them improve...Ch. 20 - Prob. 4BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Statement of Cost of Goods Manufactured for a Manufacturing Company Cost data for Firetree Manufacturing Company for the month ended March 31 are as follows: Inventories March 31 Materials Work in process Finished goods March 1 $215,250 142,070 109,780 $185,120 122,180 124,030 Direct labor Materials purchased during March Factory overhead incurred during March: Indirect labor Machinery depreciation Heat, light, and power Supplies Property taxes Miscellaneous costs Costs Type $387,450 413,280 41,330 24,970 8,610 6,890 6,030 11,190 a. Prepare a cost of goods manufactured statement for March. Firetree Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ended March 31 Amount Amount Amountarrow_forwardCost of Goods Sold, Cost of Goods Manufactured Princeton 3 Company has the following information for May: Cost of direct materials used in production $17,300 Direct labor 44,700 Factory overhead 28,800 Work in process inventory, May 1 72,100 Work in process inventory, May 31 76,400 Finished goods inventory, May 1 30,300 Finished goods inventory, May 31 34,600 Question Content Area a. For May, using the data given, prepare a statement of Cost of Goods Manufactured. Princeton 3 CompanyStatement of Cost of Goods Manufacturedblank $Factory overhead $Cost of goods manufactured Direct labor Factory overhead Total manufacturing costs incurred during May fill in the blank 4bdba303aff9f91_9 Total manufacturing costs $fill in the blank 4bdba303aff9f91_10 Less factory overhead Cost of goods manufactured $fill in the blank 4bdba303aff9f91_13 b. For May, using the data given, prepare a…arrow_forwardView Policies Current Attempt in Progress Logan's Enterprises reported the following data for May. Beginning balance, Direct Materials Inventory Beginning balance, Work in Process Inventory Beginning balance, Finished Goods Inventory Ending balance, Direct Materials Inventory Purchase of direct materials Direct labor Manufacturing overhead applied Cost of goods manufactured Cost of Goods Sold (a) Direct materials used in production $ e Textbook and Media $45,000 Save for Later 52,000 62,000 47,000 92,000 48,000 42,000 What is the cost of direct materials were used in production? 200,000 220,000 Attempts: 0 of 4 used (b) The parts of this question must be completed in order. This part will be available when you complete the part above. (c) The parts of this question must be completed in order. This part will be available when you complete the part above. Submit Answerarrow_forward

- Cost of direct materials used in production Direct labor Factory overhead Work in process inventory, June 1 Work in process inventory, June 30 Finished goods inventory, June 1 Finished goods inventory, June 30 a. For June, determine the cost of goods manufactured. Using the data given, prepare a statement of Cost of Goods Manufactured. Woodfall Company Statement of Cost of Goods Manufactured Costs Type Work in process inventory, June 1 Cost of direct materials used in production Direct labor Factory overhead Total manufacturing costs incurred in June Total manufacturing costs Work in process inventory, June 30 Cost of goods manufactured ✓ $260,000 340,000 182,300 70,200 74,000 33,300 44,100 ✓ Amount $ Amount 260,000 Xarrow_forward< Zoe Corporation has the following information for the month of March: Cost of direct materials used in production Direct labor Factory overhead Work in process inventory, March 1 Work in process inventory, March 31 Finished goods inventory, March 1 Finished goods inventory, March 31 a. Determine the cost of goods manufactured. $ b. Determine the cost of goods sold. $16,971 25,726 36,875 18,297 18,757 21,733 25,034arrow_forwardCost of Goods Sold, Cost of Goods Manufactured Princeton 3 Company has the following information for May: Cost of direct materials used in production Direct labor Factory overhead Work in process inventory, May 1 Work in process inventory, May 31 Finished goods inventory, May 1 Finished goods inventory, May 31 $33,000 38,000 a. For May, using the data given, prepare a statement of Cost of Goods Manufactured. Princeton 3 Company Statement of Cost of Goods Manufactured Total manufacturing costs incurred during May Total manufacturing costs Cost of goods manufactured 27,000 25,000 25,830 22,000 14,000 Cost of goods sold $ b. For May, using the data given, prepare a statement of Cost of Goods Sold. Princeton 3 Company Statement of Cost of Goods Soldarrow_forward

- Purchases of raw materials Indirect materials used in production Direct labor Manufacturing overhead applied to work in process Underapplied overhead Inventories Raw materials Work in process Finished goods Beginning $ 10,100 $ 55,600 $ 34,100 Ending $ 18,500 $ 66,700 $ 43,200 Required: 1. Prepare a schedule of cost of goods manufactured for the month. 2. Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold. Required 1 Required 2 Complete this question by entering your answers in the tabs below. Prepare a schedule of cost of goods manufactured for the month. Primare Corporation Schedule of Cost of Goods Manufactured Beginning work in process inventory Direct materials: $32,000 $ 4,690 $ 59,900 $ 87,300 $ 4,070 Beginning raw materials inventory Add: Purchases of raw materials Total raw materials available Less: Ending raw materials inventory Raw materials used in production Less: Indirect materials used…arrow_forwardCost of direct materials used in production Direct labor Factory overhead Work in process inventory, June 1 Work in process inventory, June 30 Finished goods inventory, June 1 Finished goods inventory, June 30 a. For June, determine the cost of goods manufactured. Using the data given, prepare a statement of Cost of Goods Manufactured. Woodfall Company Statement of Cost of Goods Manufactured Costs Type Work in process inventory, June 1 Cost of direct materials used in production Direct labor Factory overhead $63,000 77,000 28,000 47,000 52,000 30,000 18,000 Total manufacturing costs incurred in June Total manufacturing costs Work in process inventory, June 30 Cost of goods manufactured Amount Amount SAarrow_forwardCost of Goods Sold, Cost of Goods Manufactured Sandbagger Company has the following information for March: Cost of direct materials used in production $ 37,000 Direct labor 42,000 28,000 28,000 31,000 27,000 19,000 Factory overhead Work in process inventory, March 1 Work in process inventory, March 31 Finished goods inventory, March 1 Finished goods inventory, March 31 a. For March, determine the cost of goods manufactured. $ b. For March, determine the cost of goods sold. $arrow_forward

- S Activity Cost Pool Labor-related Purchase orders Product testing Template etching General factory Activity Cost Pool Labor-related (DLHS) Activity Measure Direct labor-hours Number of orders Number of tests Number of templates Machine-hours Product A Product B Product C Product D Cost $ 19,250 $ 1,820 $ 6,320 $ 960 $ 68,600 Total Overhead Cost 2. The expected activity for the year was distributed among the company's four products as follows: Expected Activity 1,375 DLHS Expected Activity Product A Product B Product C Product D 300 650 125 300 20 65 180 190 Purchase orders (orders) Product testing (tests) 65 0 80 Template etching (templates) 250 0 26 10 4 General factory (MHs) 3,800 2,000 1,200 2,800 Using the ABC data, determine the total amount of overhead cost assigned to each product. 455 orders 395 tests 40 templates S 9,800 MHsarrow_forwardProblem 2-62 (Static) Cost Concepts (LO 2-1, 6) The accountant at Roland Industries provides you with the following information for the first quarter: Direct labor costs Direct materials inventory, January 1 Direct materials inventory, March 31 Direct materials purchased during the quarter Finished goods inventory, January 1 Finished goods inventory, March 31 Manufacturing overhead for the quarter Work-in-process inventory, January 1 Work-in-process inventory, March 31 Required: a. Compute the following. 1. Total prime costs 2. Total conversion costs 3. Total manufacturing costs 4. Cost of goods manufactured 5. Cost of goods sold $ 202,000 20,700 17,100 271,500 61,000 80,400 293,000 11,700 8,900arrow_forwardJournalizing standard costs in two departments Griffin Manufacturing Inc. has two departments, Mixing and Blending. When goods are completed in Mixing, they are transferred to Blending and then to the finished goods storeroom. There was no beginning or ending work in process in either department. Listed below is information to be used in preparing journal entries at the end of October: Prepare journal entries for the following: 1. The issuance of direct materials into production and the recording of the materials variances. (Prepare separate entries for each department.) 2. The use of direct labor in production and the recording of the labor variances. (Prepare separate entries for each department.) 3. The entries to record the actual and applied factory overhead. 4. The entries to transfer the production costs from Mixing to Blending and from Blending to Finished Goods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License