INTERMEDIATE ACCTG W/CONNECT HARDCOVER

9th Edition

ISBN: 9781260359466

Author: SPICELAND

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 20.1E

Change in principle; change in inventory methods

• LO20–2

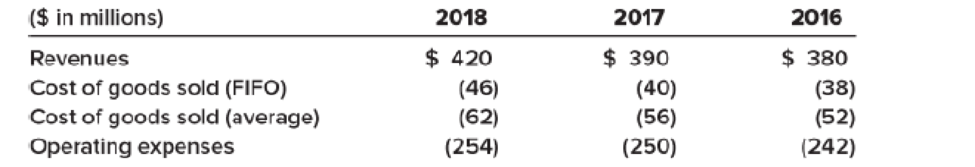

During 2016 (its first year of operations) and 2017, Batali Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2018, Batali decided to change to the average method for both financial reporting and tax purposes.

Income components before income tax for 2018, 2017, and 2016 were as follows:

Dividends of $20 million were paid each year. Batali’s fiscal year ends December 31.

Required:

- 1. Prepare the

journal entry at the beginning of 2018 to record the change in accounting principle. (Ignore income taxes.) - 2. Prepare the 2018–2017 comparative income statements.

- 3. Determine the balance in

retained earnings at January 1, 2017, as Batali reported previously using the FIFO method. - 4. Determine the adjustment to the January 1, 2017, balance in retained earnings that Batali would include in the 2018–2017 comparative statements of retained earnings or retained earnings column of the statements of shareholders’ equity to revise it to the amount it would have been if Batali had used the average method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

3. How much is the cumulative effect of this change that

should be reported in the income statement for the year

ended December 31, 2021?

On December 31, 2021, BLACK MAMBA Company appropriately changed its inventory valuation

method to average cost method from FIFO for financial statement and income tax purposes. The

change will result in a $180,000 increase in the beginning inventory at January 1, 2021. Assume

an income tax rate of 30%.

Your answer

During 2019, DGP Company decided to change from the FIFO inventory valuation to the weighted average method. The

income tax rate is 30%.

FIFO Weighted Average

January 1, inventory

P7,100,000

P7,700,000

December 31, inventory

7,900,000

8,200,000

What amount should be reported in the cumulative effect of the change in accounting policy for 2019?

A P600,000 decrease in retained earnings

B P420,000 decrease in retained earnings

P420,000 increase in retained earnings

(D) P600,000 increase in retained earnings

#54

On January 1, 2021, Frost Corp. changed its inventory method to FIFO from LIFO for both financial and income tax reporting purposes. The change resulted in a $900,000 increase in the January 1, 2021 inventory. Assume that the income tax rate for all years is 20%. The cumulative effect of the accounting change should be reported by Frost in its 2021

Question 54 options:

a

retained earnings statement as a $900,000 addition to the beginning balance.

b

income statement as a $720,000 cumulative effect of accounting change.

c

income statement as a $900,000 cumulative effect of accounting change.

d

retained earnings statement as a $720,000 addition to the beginning balance.

Chapter 20 Solutions

INTERMEDIATE ACCTG W/CONNECT HARDCOVER

Ch. 20 - Prob. 20.1QCh. 20 - There are three basic accounting approaches to...Ch. 20 - Prob. 20.3QCh. 20 - Lynch Corporation changes from the...Ch. 20 - Sugarbaker Designs Inc. changed from the FIFO...Ch. 20 - Most changes in accounting principles are recorded...Ch. 20 - Southeast Steel, Inc., changed from the FIFO...Ch. 20 - Prob. 20.8QCh. 20 - Its not easy sometimes to distinguish between a...Ch. 20 - For financial reporting, a reporting entity can be...

Ch. 20 - Prob. 20.11QCh. 20 - Describe the process of correcting an error when...Ch. 20 - Prob. 20.13QCh. 20 - If it is discovered that an extraordinary repair...Ch. 20 - Prob. 20.15QCh. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in inventory methods; average cost method...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in depreciation methods LO203 Irwin, Inc.,...Ch. 20 - Prob. 20.5BECh. 20 - Book royalties LO204 Three programmers at Feenix...Ch. 20 - Warranty expense LO204 In 2017, Quapau Products...Ch. 20 - Change in estimate; useful life of patent LO204...Ch. 20 - Prob. 20.9BECh. 20 - Error correction LO206 In 2018, internal auditors...Ch. 20 - Prob. 20.11BECh. 20 - Error correction LO206 In 2018, the internal...Ch. 20 - Change in principle; change in inventory methods ...Ch. 20 - Change in principle; change in inventory methods ...Ch. 20 - Change from the treasury stock method to retired...Ch. 20 - Change in principle; change to the equity method ...Ch. 20 - Prob. 20.5ECh. 20 - FASB codification research LO202 Access the FASB...Ch. 20 - Change in principle; change in inventory cost...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in inventory methods; FIFO method to the...Ch. 20 - Change in depreciation methods LO203 For...Ch. 20 - Change in depreciation methods LO203 The Canliss...Ch. 20 - Book royalties LO204 Dreighton Engineering Group...Ch. 20 - Loss contingency LO204 The Commonwealth of...Ch. 20 - Warranty expense LO204 Woodmier Lawn Products...Ch. 20 - Prob. 20.15ECh. 20 - Accounting change LO204 The Peridot Company...Ch. 20 - Change in estimate; useful life and residual value...Ch. 20 - Classifying accounting changes LO201 through...Ch. 20 - Error correction; inventory error LO206 During...Ch. 20 - Error corrections; investment LO206 Required: 1....Ch. 20 - Prob. 20.21ECh. 20 - Prob. 20.22ECh. 20 - Prob. 20.23ECh. 20 - Inventory errors LO206 Indicate with the...Ch. 20 - Classifying accounting changes and errors LO201...Ch. 20 - Change in inventory costing methods; comparative...Ch. 20 - P 20-2 Change in principle; change in method of...Ch. 20 - Change in inventory costing methods; comparative...Ch. 20 - Change in inventory methods LO202 The Rockwell...Ch. 20 - Change in inventory methods LO202 Fantasy...Ch. 20 - Change in principle; change in depreciation...Ch. 20 - Depletion; change in estimate LO204 In 2018, the...Ch. 20 - Accounting changes; six situations LO201, LO203,...Ch. 20 - Prob. 20.9PCh. 20 - Inventory errors LO206 You have been hired as the...Ch. 20 - Error correction; change in depreciation method ...Ch. 20 - Accounting changes and error correction; seven...Ch. 20 - Prob. 20.13PCh. 20 - Prob. 20.14PCh. 20 - Prob. 20.15PCh. 20 - Prob. 20.16PCh. 20 - Prob. 20.17PCh. 20 - Integrating Case 201 Change to dollar-value LIFO ...Ch. 20 - Prob. 20.2BYPCh. 20 - Prob. 20.3BYPCh. 20 - Analysis Case 204 Change in inventory methods;...Ch. 20 - Prob. 20.5BYPCh. 20 - Prob. 20.6BYPCh. 20 - Analysis Case 208 Various changes LO201 through...Ch. 20 - Analysis Case 209 Various changes LO201 through...Ch. 20 - Prob. 20.10BYPCh. 20 - Prob. 20.11BYPCh. 20 - Prob. 20.12BYPCh. 20 - Prob. 1CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 31, 2020 Mega Nhon Company changed its method of accounting for inventory from weighted average cost method to the FIFO method. This change caused the 2020 beginning inventory to increase by ₱630,000. The cumulative effect of this accounting change to be reported for the year ended 12/31/13, assuming a 40% tax rate, is ₱630,000 ₱252,000 ₱378,000 ₱0arrow_forwardDuring 2021, Colombo Company changed its inventory costing method from FIFO to weighted average method. Inventory balances were as follows: FIFO Weighted Ave. As of January 1 7,200,000 7,700,000 As at December 31 7,900,000 8,300,000 Ignoring income tax, what is the amount of the effect of the accounting change in the statement of changes in equity for 2021? a. 900,000 b. 600,000 c. 500,000 d. 400,000arrow_forwardAnalyzing Inventory Disclosure Comparing LIFO & FIFOThe current asset section of the 2014 and 103 fiscal year end balance sheet of The Kroger Co are presented in the accompany tables: a. At what dollar amount does Kroger report its inventory in its Jan. 31, 205 balance sheet? b. What is the cumulative effect (through Jan. 31, 2015) of the use of LIFO on Kroger’s pretax earning? c. Assuming a 35% tax rate, what is the cumulative (through Jan. 31, 2015) tax effect of the use of LIFO to determine inventory costs?d. Kroger reported net earnings of $1,728 million in its fiscal year 2014 income statement. Assuming a 35% tax rate, what amount of net earnings would Kroger report if the company is using FIFO inventory costing methods?e. Kroger reported merchandise cost of $85,512 M in fiscal year 2014. Compute the inventory turnover for the year.f. How would the inventory turnover ratio differ if the FIFO costing method had been used? Current asset (in millions) Jan.…arrow_forward

- Problem 16-4 (PHILCPA Adapted) Malampaya Company showed income before income tax of P6,500,000 on December 31, 2021. The year-end verification of the transactions revealed the following errors: * P1,000,000 worth of merchandise was purchased in 2021 and included in the ending inventory. However, the purchase was recorded only in 2022. A merchandise shipment valued at P1,500,000 was properly recorded as purchase at year-end. Since the merchandise was still at the port area, it was inadvertently omitted from the inventory on December 31, 2021. *Advertising for December 2021, amounting to P500,000, was recorded when payment was made in January 2022. * Rent of P300,000 on an equipment applicable for six months was received on November 1, 2021. The entire amount was reported as income upon receipt. Insurance premium covering the period from July 1, 2021 to July 1, 2022 amounting to P200,000 was paid and recorded as expense on July 31, 2021. The entity did not make any adjustment at the end…arrow_forwardOn December 31, 2021 Carla Vista Company changed its method of accounting for inventory from weighted average cost method to the FIFO method. This change caused the 2021 beginning inventory to increase by $935000. What the cumulative effect of this accounting change to be reported for the year ended 12/31/21, assuming a 40% tax rate? $374000. $0. $561000. $935000.arrow_forwardRefer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020. Prepare Hellers partial income statements (through gross profit) for 2019 and 2020. RE22-2 Heller Company began operations in 2019 and used the LIFO method to compute its 300,000 cost of goods sold for that year. At the beginning of 2020, Heller changed to the FIFO method. Heller determined that its cost of goods sold under FIFO would have been 250,000 in 2019. For 2020, Hellers cost of goods sold under FIFO was 360,000, while it would have been 410,000 under LIFO. Heller is subject to a 21% income tax rate. Compute the cumulative effect of the retrospective adjustment on prior years income (net of taxes) that Heller would report on its retained earnings statement for 2020.arrow_forward

- LIFO and Inventory Pools On January 1, 2016, Grover Company changed its inventory cost flow method to the LIFO cost method from the FIFO cost method for its raw materials inventory. It made the change for both financial statement and income tax reporting purposes. Grover uses the multiple-pools approach under which it groups substantially identical raw materials into LIFO inventory pools. It uses weighted average costs in valuing annual incremental layers. The composition of the December 31, 2018, inventory for the Class F inventory pool is as follows: Inventory transactions for the Class F inventory pool during 2019 were as follows: On March 2, 2019, 4,800 units were purchased at a unit cost of 13.50 for 64,800. On September 1, 2019, 7,200 units were purchased at a unit cost of 14.00 for 100,800. A total of 15,000 units were used for production during 2019. The following transactions for the Class F inventory pool took place during 2020: On January 11, 2020, 7,500 units were purchased at a unit cost of 14.50 for 108,750. On May 14, 2020, 5,500 units were purchased at a unit cost of 15.50 for 85,250. On December 29, 2020, 7,000 units were purchased at a unit cost of 16.00 for 112,000. A total of 16,000 units were used for production during 2020. Required: 1. Prepare a schedule to compute the inventory (units and dollar amounts) of the Class F inventory pool at December 31, 2019. Show supporting computations in good form. 2. Prepare a schedule to compute the cost of Class F raw materials used in production for the year ended December 31, 2019. 3. Prepare a schedule to compute the inventory (units and dollar amounts) of the Class F inventory pool at December 31, 2020. Show supporting computations in good form.arrow_forwardIn 2020, Frost Company, which began operations in 2018, decided to change from LIFO to FIFO because management believed that FIFO belter represented the flow of their inventory. Management prepared the following analysis showing the effect of this change: Frost reported net income of 2,500,000, 2,400,000, and 2,100,000 in 2018, 2019, and 2020, respectively. The tax rate is 21%. Required: 1. Prepare the journal entry necessary to record the change. 2. What amount of net income would Frost report in 2018, 2019, and 2020? 3. If Frosts employees received a bonus of 10% of income before deducting the bonus and income taxes in 2018 and 2019, what would be the effect on net income for 2018, 2019, and 2020?arrow_forwardEffects of an Inventory Error The income statements for Graul Corporation for the 3 years ending in 2019 appear below. During 2019, Graul discovered that the 2017 ending inventory had been misstated due to the following two transactions being recorded incorrectly. a. A purchase return of inventory costing $42,000 was recorded twice. b. A credit purchase of inventory' made on December 20 for $28,500 was not recorded. The goods were shipped F.O.B. shipping point and were shipped on December 22, 2017. Required: 1. Was ending inventory for 2017 overstated or understated? By how much? 2. Prepare correct income statements for all 3 years. 3. CONCEPTUAL CONNECTION Did the error in 2017 affect cumulative net income for the 3-year period? Explain your response. 4. CONCEPTUAL CONNECTION Why was the 2019 net income unaffected?arrow_forward

- Exhibit7.5 Sullivan Produce Co. switched from FIFO to LIFO on January1,2018, for external reporting and income tax purposes, while retaining FIFO for internal reports. On that date, the FIFO inventory equaled $360,000. The ensuing three-year period resulted in the following: December31,2018 Year-End Costs $438,000 Cost Index 1.05 December 31,2019 Year-End Costs $460,000 Cost Index 1.15 December 31, 2020 Year-End Costs $520,000 Cost Index 1.25 Refer to Exhibit 7-5, The ending inventory at December 31,2020, using the dollar-value LIFO method would be a. $422,000 b. $402,000 c $426,000 d. $420,400 Refer to Exhibit7-5, the ending inventory at December 31,2019, at base-year price is: a.$400,000 b. $402,000 c.$406,000 d.$424,000arrow_forwardFTC Company had used the FIFO method of inventory valuation since it began operations in 2016. The entity decided to change to the weighted average method for measuring inventory at the beginning of 2019. The income tax rate is 30%. The following schedule shows year-end inventory balances: Year FIFO Weighted Average 2016 P4,500,000 P5,400,000 2017 7,800,000 7,100,000 2018 8,300,000 7,800,000 What amount should be reported for 2019 as the cumulative effect of the change in accounting policy? (A P500,000 decrease in retained earnings B P350,000 increase in retained earnings (C P350,000 decrease in retained earnings D P500,000 increase in retained earningsarrow_forward5 of 18 Petra Company uses the average-cost inventory method. Its 2020 ending inventory was $80,000, but it would have been $120,000 if FIFO had been used. Thus, if FIFO had been used, Petra's income before income taxes would have been O $40,000 greater. O $40,000 less. O the same. not determinable without the tax rate. Assessment Navigator Questionmark Perception licensed to Yarmouk University MERT P Type here to scarch Delete ※一 F11 Insert PriSc + C F5 F7 FB F9 F10 F12 F6 F4 F2 * 23 24 Backspace 2. 3. 48 7 V 8. 9. T YlY ! u P COarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License