HORNGREN COST ACCT NON-MAJORS W/ACCESS

17th Edition

ISBN: 9781323703748

Author: Datar

Publisher: Pearson Custom Publishing

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 21.27E

Payback and

- 1. Because the company’s cash is limited, Andrews thinks the payback method should be used to choose between the capital budgeting projects.

Required

- a. What are the benefits and limitations of using the payback method to choose between projects?

- b. Calculate the payback period for each of the three projects. Ignore income taxes. Using the payback method, which projects should Andrews choose?

- 2. Bart thinks that projects should be selected based on their NPVs. Assume all cash flows occur at the end of the year except for initial investment amounts. Calculate the NPV for each project. Ignore income taxes.

- 3. Which projects, if any, would you recommend funding? Briefly explain why.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

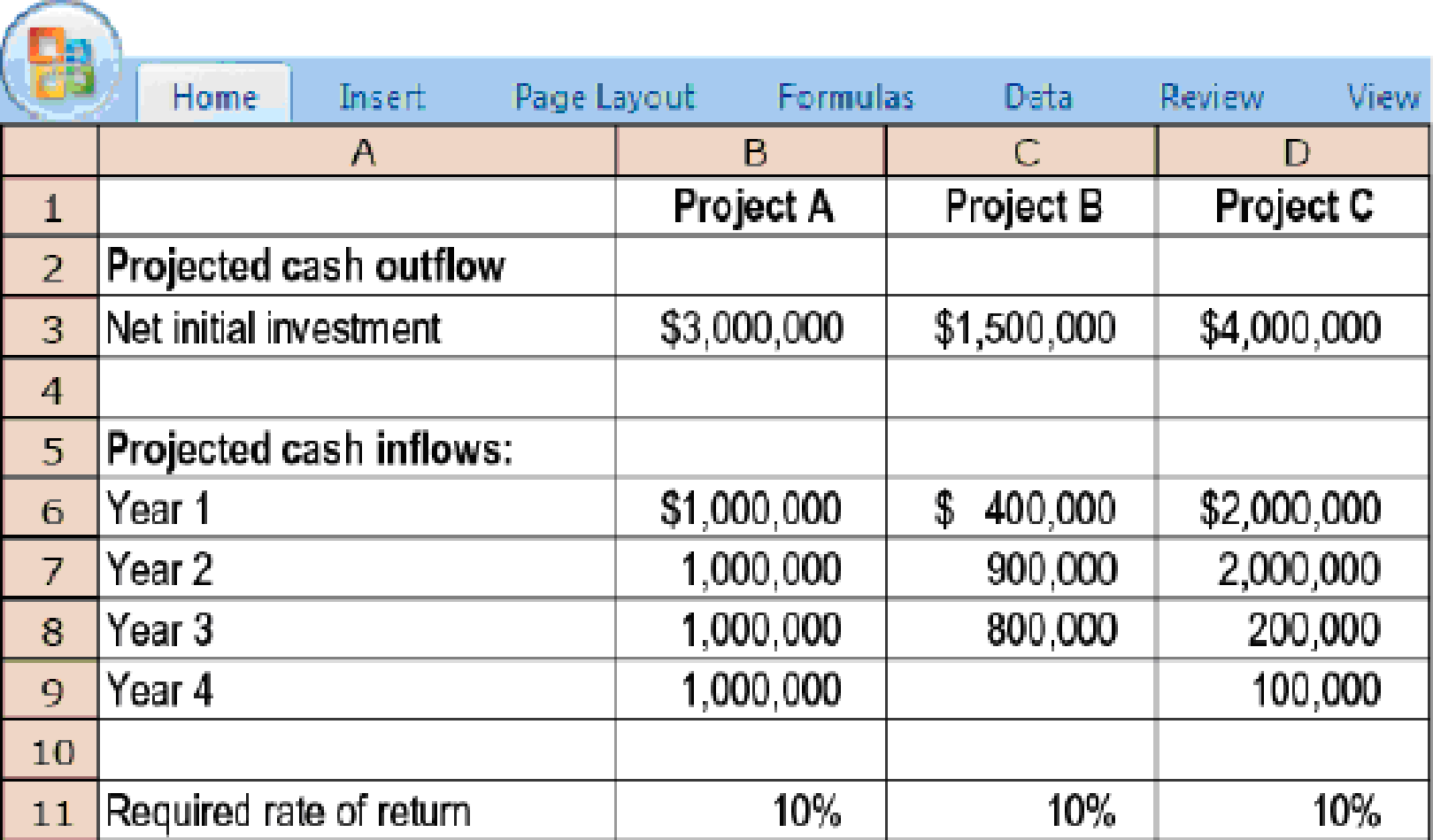

Payback and NPV methods, no income taxes. (CMA, adapted) Andrews Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited to $5,000,000 for the year. Lori Bart, staff analyst at Andrews, is preparing an analysis of the three projects under consideration by Corey Andrews, the company’s owner.

Required:

Because the company’s cash is limited, Andrews thinks the payback method should be used to choose between the capital budgeting projects.

What are the benefits and limitations of using the payback method to choose between projects?

Calculate the payback period for each of the three projects. Ignore income taxes. Using the payback method, which projects should Andrews choose?

Bart thinks that projects should be selected based on their NPVs. Assume all cash flows occur at the end of the year except for initial investment amounts. Calculate the NPV for each project. Ignore income taxes.

Which projects,…

NPVs, IRRs, and MIRRs for Independent Projects

Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year's capital budget. The projects are independent. The cash outlay for the truck is $15,000, and that for the pulley system is $21,000. The firm's cost of capital is 11%. After-tax cash flows, including depreciation, are as follows:

Year

Truck

Pulley

1

$5,100

$7,500

2

5,100

7,500

3

5,100

7,500

4

5,100

7,500

5

5,100

7,500

Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each. Do not round intermediate calculations. Round the monetary values to the nearest dollar and percentage values to two decimal places. Use a minus sign to enter negative values, if any.

NPVs, IRRs, and MIRRs for Independent Projects

Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year's capital budget. The projects are independent. The cash outlay for the truck is $18,000, and that for the pulley system is $22,000. The firm's cost of capital is 14%. After-tax cash flows, including depreciation, are as follows:

Year

Truck

Pulley

1

$5,100

$7,500

2

5,100

7,500

3

5,100

7,500

4

5,100

7,500

5

5,100

7,500

Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each. Do not round intermediate calculations. Round the monetary values to the nearest dollar and percentage values to two decimal places. Use a minus sign to enter negative values, if any.

Truck

Pulley

Value

Decision

Value

Decision

IRR

%

-Select-AcceptRejectItem 2

%

-Select-AcceptRejectItem 4

NPV

$

-Select-AcceptRejectItem 6…

Chapter 21 Solutions

HORNGREN COST ACCT NON-MAJORS W/ACCESS

Ch. 21 - Capital budgeting has the same focus as accrual...Ch. 21 - List and briefly describe each of the five stages...Ch. 21 - Prob. 21.3QCh. 21 - Only quantitative outcomes are relevant in capital...Ch. 21 - How can sensitivity analysis be incorporated in...Ch. 21 - Prob. 21.6QCh. 21 - Describe the accrual accounting rate-of-return...Ch. 21 - Prob. 21.8QCh. 21 - Lets be more practical. DCF is not the gospel....Ch. 21 - All overhead costs are relevant in NPV analysis....

Ch. 21 - Prob. 21.11QCh. 21 - Distinguish different categories of cash flows to...Ch. 21 - Prob. 21.13QCh. 21 - How can capital budgeting tools assist in...Ch. 21 - Distinguish the nominal rate of return from the...Ch. 21 - A company should accept for investment all...Ch. 21 - Prob. 21.17MCQCh. 21 - Which of the following statements is true if the...Ch. 21 - Prob. 21.19MCQCh. 21 - Nicks Enterprises has purchased a new machine tool...Ch. 21 - Prob. 21.21ECh. 21 - Capital budgeting methods, no income taxes. Yummy...Ch. 21 - Capital budgeting methods, no income taxes. City...Ch. 21 - Prob. 21.24ECh. 21 - Capital budgeting with uneven cash flows, no...Ch. 21 - Comparison of projects, no income taxes. (CMA,...Ch. 21 - Payback and NPV methods, no income taxes. (CMA,...Ch. 21 - DCF, accrual accounting rate of return, working...Ch. 21 - Prob. 21.29ECh. 21 - Prob. 21.30ECh. 21 - Project choice, taxes. Klein Dermatology is...Ch. 21 - Prob. 21.32ECh. 21 - Selling a plant, income taxes. (CMA, adapted) The...Ch. 21 - Prob. 21.36PCh. 21 - NPV and AARR, goal-congruence issues. Liam...Ch. 21 - Payback methods, even and uneven cash flows. Sage...Ch. 21 - Replacement of a machine, income taxes,...Ch. 21 - Recognizing cash flows for capital investment...Ch. 21 - NPV, inflation and taxes. Fancy Foods is...Ch. 21 - NPV of information system, income taxes. Saina...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $17,100, and that for the pulley system is $22,430. The firm’s cost of capital is 14%. After-tax cash flows, including depreciation, are as follows: Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each.arrow_forwardPostman Company is considering two independent projects. One project involves a new product line, and the other involves the acquisition of forklifts for the Materials Handling Department. The projected annual operating revenues and expenses are as follows: Required: Compute the after-tax cash flows of each project. The tax rate is 40 percent and includes federal and state assessments.arrow_forwardNPVs, IRRs, and MIRRs for Independent Projects Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year's capital budget. The projects are independent. The cash outlay for the truck is $19,000, and that for the pulley system is $20,000. The firm's cost of capital is 12%. After-tax cash flows, including depreciation, are as follows: Year Truck Pulley 1 $5,100 $7,500 2 5,100 7,500 3 5,100 7,500 4 5,100 7,500 5 5,100 7,500 Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each. Do not round intermediate calculations. Round the monetary values to the nearest dollar and percentage values to two decimal places. Use a minus sign to enter negative values, if any. Truck Pulley Value Decision Value Decision IRR % -Select-AcceptRejectItem 2 % -Select-AcceptRejectItem 4 NPV $ -Select-AcceptRejectItem 6…arrow_forward

- As a member of UA Corporation's financial staff, you must estimate the Year 1 cash flow for a proposed project with the following data. Under the new tax law, the equipment used in the project is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0. What is the Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number. Sales revenues, each year $45,500 Other operating costs $22,522 Interest expense $4,000 Tax rate 25.0%arrow_forwardThe management of Osborn Corporation is investigating an investment in equipment that would have a useful life of 5 years. The company uses a discount rate of 12% in its capital budgeting. The net present value of the investment, excluding the annual cash inflow, is −$408,614. How large would the annual cash inflow have to be to make the investment in the equipment financially attractive? (Ignore income taxes.) Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided.arrow_forwardNPV and AARR, goal-congruence issues. Liam Mitchell, a manager of the Plate Division for the Harvest Manufacturing company, has the opportunity to expand the division by investing in additional machinery costing $495,000. He would depreciate the equipment using the straight-line method and expects it to have no residual value. It has a useful life of 9 years. The rm mandates a required after-tax rate of return of 14% on investments. Liam estimates annual net cash inows for this investment of $130,000 before taxes and an investment in working capital of $5,000 that will be returned at the project’s end. Harvest’s tax rate is 30%.arrow_forward

- Sub-Prime Loan Company is thinking of opening a new office, and the key data are shown below. The company owns the building that would be used, and it could sell it for $100,000 after taxes if it decides not to open the new office. Under the new tax law, the equipment used in the project is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0. At the end of the project’s life, the equipment would have zero salvage value. No change in net operating working capital (NOWC) would be required for the project. Revenues and operating costs would be constant over the project's 3-year life. What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.) Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Opportunity cost $100,000 Equipment cost) $65,000 Annual sales revenues $116,000 Annual operating costs $25,000 Tax rate 25.0% Question options: $20,978…arrow_forwardCroce, Incorporated, is investigating an investment in equipment that would have a useful life of 7 years. The company uses a discount rate of 15% in its capital budgeting. The net present value of the investment, excluding the salvage value, is −$578,977. (Ignore income taxes.) Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. How large would the salvage value of the equipment have to be to make the investment in the equipment financially attractive? (Round your intermediate calculations and final answer to the nearest whole dollar amount.)arrow_forwardBau Long-Haul, Inc., is considering the purchase of a tractor-trailer that would cost $432,605, would have a useful life of 7 years, and would have no salvage value. The tractor-trailer would be used in the company's hauling business, resulting in additional net cash inflows of $77,500 per year. The internal rate of return on the investment in the tractor-trailer is closest to (Ignore income taxes.): Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.arrow_forward

- Techno Lab, a taxpaying entity, estimates that it can save $30,000 a year in cash operating costs for the next 10 years if it buys a special-purpose eye-testing machine at a cost of $135,000. No terminal disposal value is expected. Techno Labs' required rate of return is 10%. Assume all cash flows occur at year-end except for initial investment amounts. Techno Labs uses straight-line depreciation. The income tax rate is 34% for all transactions that affect income taxes. . Requirement 1. Calculate the following for the special-purpose eye-testing machine: Net present value (NPR) (Round interim calculations and your final answers to the nearest whole dollar. Use a minus sign or parentheses for a negative net present value.) 1. Calculate the following for the special-purpose eye-testing machine: a. Net present value b. Payback period c. Internal rate of return d. Accrual accounting rate of return based on net initial…arrow_forwardAs assistant to the CFO of Boulder Inc., you must estimate the Year 1 cash flow for a project with the following data. What is the Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number. Sales revenues $11,900 Operating costs $5,430 Tax rate 20.0%arrow_forwardCallaloo Collaborators, Inc. has been considering several capital investment proposals for the year beginning in 2019. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. New assets will be depreciated under the MACRS system rather than being fully expensed right away. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent. Table 1. Callaloo Collaborators, Inc. Project Information ______________________________________________________________________ *Not applicable Project 1 Questions: 1) For Proposal 1, the cash flow pattern for the expansion project is ________. 2) For Proposal 1, the initial outlay equals __$1,500,000______. 3) For Proposal 1, the depreciation expense for year 1 is…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License