Concept explainers

Payback methods, even and uneven cash flows. Sage Laundromat is trying to enhance the services it provides to customers, mostly college students. It is looking into the purchase of new high-efficiency washing machines that will allow for the laundry’s status to be checked via smartphone.

Sage estimates the cost of the new equipment at $159,000. The equipment has a useful life of 9 years. Sage expects cash fixed costs of $80,000 per year to operate the new machines, as well as cash variable costs in the amount of 5% of revenues. Sage evaluates investments using a cost of capital of 10%.

- 1. Calculate the payback period and the discounted payback period for this investment, assuming Sage expects to generate $140,000 in incremental revenues every year from the new machines.

Required

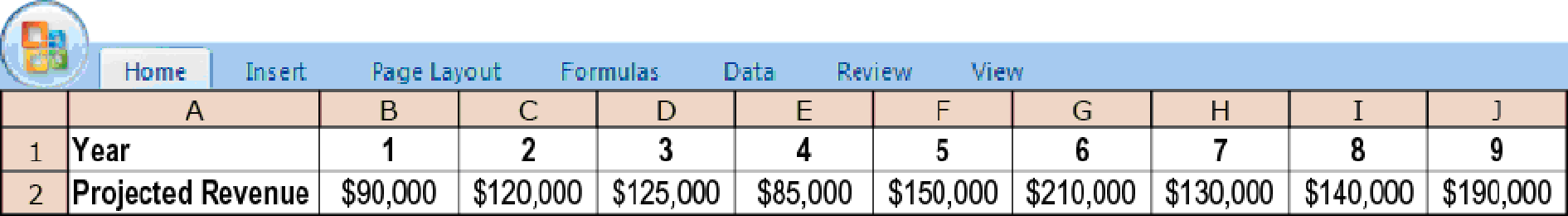

- 2. Assume instead that Sage expects the following uneven stream of incremental cash revenues from installing the new washing machines:

Based on this estimated revenue stream, what are the payback and discounted payback periods for the investment?

Trending nowThis is a popular solution!

Chapter 21 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

- A bookstore is planning to purchase an automated inventory/remote marketing system, which includes an upgrade to a more sophisticated cash register system. The package has an initial investment cost of $360,000. It is expected to generate $144,000 of annual cash flows, reduce costs and provide incremental cash revenues of $326,000, and incur incremental cash expenses of $200,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forwardGina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forwardShonda & Shonda is a company that does land surveys and engineering consulting. They have an opportunity to purchase new computer equipment that will allow them to render their drawings and surveys much more quickly. The new equipment will cost them an additional $1.200 per month, but they will be able to increase their sales by 10% per year. Their current annual cost and break-even figures are as follows: A. What will be the impact on the break-even point if Shonda & Shonda purchases the new computer? B. What will be the impact on net operating income if Shonda & Shonda purchases the new computer? C. What would be your recommendation to Shonda & Shonda regarding this purchase?arrow_forward

- Your company is planning to purchase a new log splitter for is lawn and garden business. The new splitter has an initial investment of $180,000. It is expected to generate $25,000 of annual cash flows, provide incremental cash revenues of $150,000, and incur incremental cash expenses of $100,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forwardTalbot Industries is considering launching a new product. The new manufacturing equipment will cost 17 million, and production and sales will require an initial 5 million investment in net operating working capital. The companys tax rate is 40%. a. What is the initial investment outlay? b. The company spent and expensed 150,000 on research related to the new product last year. Would this change your answer? Explain. c. Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for 1.5 million after taxes and real estate commissions. How would this affect your answer?arrow_forwardAn auto repair company needs a new machine that will check for defective sensors. The machine has an Initial investment of $224,000. Incremental revenues, including cost savings, are $120,000, and Incremental expenses, including depreciation, are $50,000. There is no salvage value. What is the accounting rate of return (ARR)?arrow_forward

- A mini-mart needs a new freezer and the initial Investment will cost $300,000. Incremental revenues, including cost savings, are $200,000, and incremental expenses, including depreciation, are $125,000. There is no salvage value. What is the accounting rate of return (ARR)?arrow_forwardTalbot Industries is considering launching a new product. The new manufacturing equipment will cost $17 million, and production and sales will require an initial $5 million investment in net operating working capital. The company’s tax rate is 25%. What is the initial investment outlay? The company spent and expensed $150,000 on research related to the new product last year. What is the initial investment outlay? Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for $1.5 million after taxes and real estate commissions. What is the initial investment outlay?arrow_forwardFriedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.arrow_forward

- The management of Ryland International Is considering Investing in a new facility and the following cash flows are expected to result from the investment: A. What Is the payback period of this uneven cash flow? B. Does your answer change if year 6s cash inflow changes to $920,000?arrow_forwardMallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.arrow_forwardKennywood Amusement Park spends $75,000 each year in consulting services for ride inspection and maintenance recommendations. New actuator element technology enables engineers to simulate complex computer-controlled movements in any direction. Construct a cash flow diagram for determining how much the park could afford to spend now on the new technology if the cost of annual consulting services will be reduced to $30,000 per year? Assume the park uses an interest rate of 15% per year and it wants to recover its investment in 5 years.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning